Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

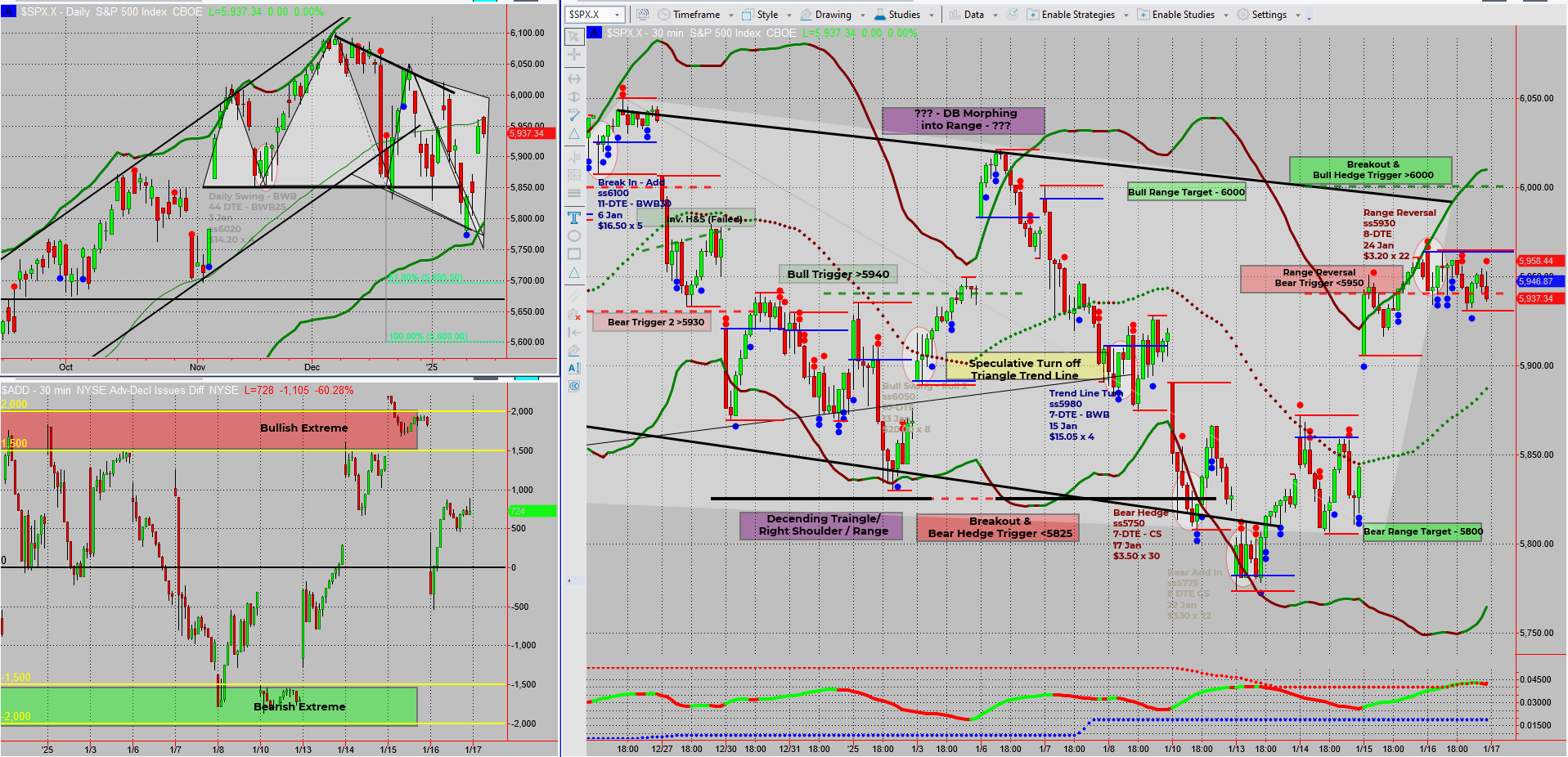

SPX is dancing to the beat of short-term swings, and the Tag ‘n Turn system is leading the charge. With a well-defined range emerging amidst evolving consolidation, the focus now shifts to simple setups off range highs and lows. Let’s break down why clarity in this market means more opportunities to profit!

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

The SPX Tag ‘n Turn system is all about embracing the chaos of short-term swings. When prices yo-yo within a defined range, it’s like a game of ping-pong, offering repeated trade setups.

- Shifting Focus: Instead of relying solely on Bollinger bands, the system now pivots to range highs and lows for new trade opportunities.

- A Clearer Picture: Recent market movements, though volatile, have settled into an identifiable range, making trade setups simpler to assess.

- Volatility’s Role: Typically, bandwidth contraction aids in identifying consolidations. This time, volatility widened, creating a dynamic yet evolving consolidation pattern.

Why This Matters

Now that the market has calmed into a structured range, trading setups are less murky. It’s a shift from unpredictability to clarity, making it easier to capitalise on opportunities.

- Watch for reversals at range highs and lows.

- Look for breakouts as price tests boundaries.

- Stick to the plan – no need to chase trades or force entries.

The beauty of Tag ‘n Turn? It thrives on these yo-yo movements. With defined boundaries, it’s all about letting the system do its thing.

Fun Fact

Bollinger Bands: A Volatility Secret Weapon

Bollinger bands adapt to market conditions, but did you know they were inspired by statistical standard deviation? They’re like a dynamic ruler for measuring volatility!

Bollinger bands adjust to price volatility by expanding and contracting, using statistical standard deviation to calculate upper and lower bounds. Developed by John Bollinger in the 1980s, they’ve since become a staple tool for traders. When the bands pinch tight, expect a big move – it’s like coiling a spring!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece