Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

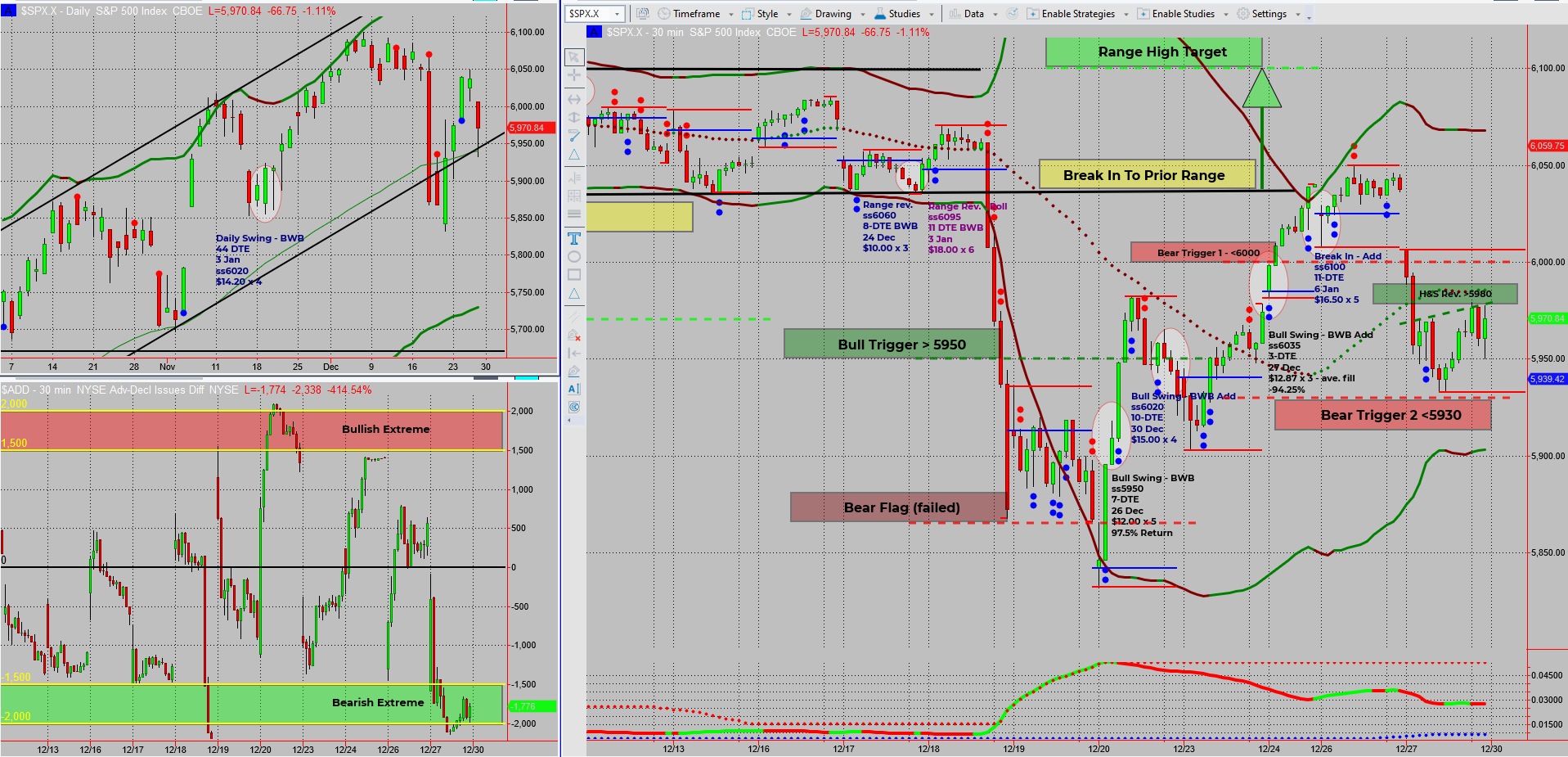

The SPX keeps traders on their toes, bouncing back from Friday’s dip with a bullish reversal pattern. A potential inverted head-and-shoulders pattern and the absence of bearish triggers have kept my bullish bias. But could the last week of the year bring surprises? Let’s dive in!

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Thursday’s sell-off seemed ominous but rebounded intraday, forming what could resemble an inverted head-and-shoulders pattern on the 30-minute chart. This recovery left a large lower wick on the daily candle, a classic signal, for me, of a potential narrow-ranging day ahead. We’ve seen this setup before, just a few days back, when a similar pattern led to bullish follow-through.

Key points from Friday:

- SPX pushed through the initial bear trigger but lacked bearish pulse bars for entry.

- The daily chart is still retesting the daily rising channel’s lower boundary.

- $ADD reached a bearish extreme, hinting at a short-term bullish move early this week.

With no bearish confirmations in sight, the bullish outlook remains. My plan? Stick with the bullish bias unless SPX breaks below Friday’s low—a new bear trigger level.

A Shortened Trading Week

It’s a start-stop week with half-day trading on Tuesday (New Year’s Eve) and markets closed on Wednesday (New Year’s Day). Unless we see dramatic changes, income swings should continue to thrive in this sideways-to-bullish environment.

What to Watch For:

- Bullish moves fueled by $ADD extremes and inverted head and shoulder triggers.

- Bear triggers activating if SPX price dips below Friday’s low.

- Opportunities for bullish income swings as price grinds upward.

Fun Fact

The New York Stock Exchange (NYSE) first closed for a holiday on July 4, 1834, long before market-wide regulations existed. Why? To honor Independence Day while traders enjoyed a rare break from the chaos of hand-signaled trades and ticker tapes.

Back then, trading was conducted in open-air venues and relied heavily on physical exchanges of stock certificates. Taking a day off wasn’t just for patriotism—it was essential to keep traders from burning out during the frenzied pre-electronic era. Today, holiday closures are part of market regulations, ensuring everyone gets a break—even the bulls and bears.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece