Have you ever wondered about the best way to trade the news (trading earnings)?

Most traders who attempt to trade stocks based on earnings or news have certainly been on the wrong side of a stocks movement due to the news, but what if you could be intentional about trading the news and get positioned ahead of a known news item.

One of the ways Ive been finding great looking stocks for event based trading, as we move into another stock earnings cycle, is to look at Implied Volatility Rank. (IVR)

This is a measure of implied volatility (IV) compared to itself in the last 12 months.

So, if the IV is is near the lowest it has been in the last 12 months then the stock options could be considered inexpensive compared to how they have been priced in the last 12 months.

As such it would be said to have a low IRV.

Combine this with an earning announcement inside the option’s expiration that I typically like to trade (inside around 45 days)

This was the case with several recent premium stock alerts and make for an interesting talking point on how to trade the news simply and effectively without having to be glued to the charts all day every day.

Technically speaking the stock in the chart below is in a well defined range and is starting to break out.

However, my awareness was raised to this set up because of a low IVR (implied volatility rank) meaning that the stocks options are priced inexpensively AND there is an earnings announcement in 13 days days.

The stocks earning announcement adds a wild card that might make price jump one way or the other.

To break out or return to inside the range….

As you might imagine this creates some uncertainty around the expectation of what might happen next.

The low IVR PLUS the earnings announcement makes for an interesting new driven situation in that I can buy options cheep and creatively set up a long strangle in my preferred and unique way.

This means I can trade the news while not having to worry about the directional uncertainty.

As I write this (Jan 2018) there are to be a lot of low IVR stocks this time coming into another potentially good earnings season which make for great candidates to trading and profiting from the news

Can anyone say multi bagger?

I’ll will most certainly be adding this scan into my regular routine to look for more news event trading opportunities with this set up for myself and The AntiVestor™ premium members.

Trading News – example 2

In another recent example I am going to show you this news trading strategy which was sent out in real time to The AntiVestor™ members

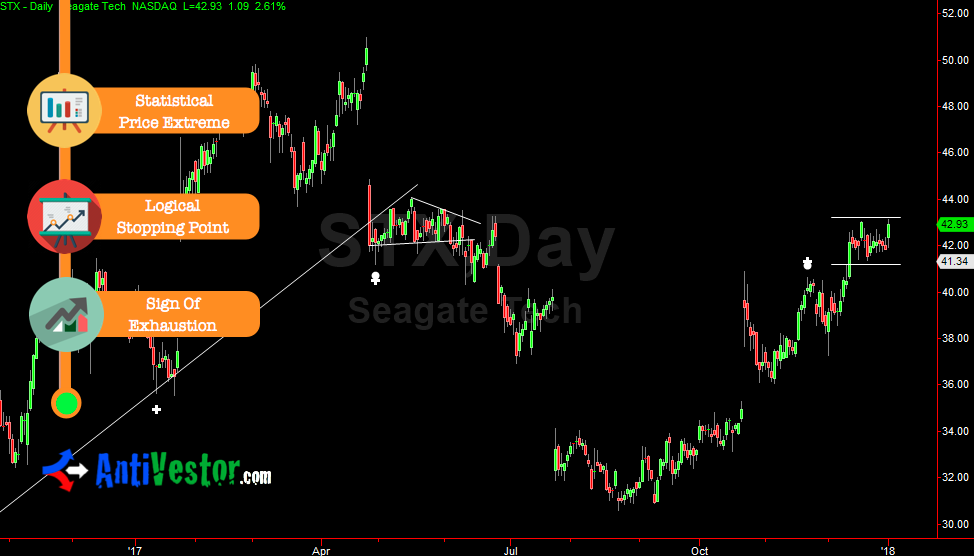

On the chart blow you can see the stock STX – Seagate Tech

Technically speaking, price was back to a logical stopping point and developing a small consolidation.

Price had pushed away from this level from this level and it was my assumption that price would push away from this level again.

Additionally, there was a news event (earnings) in the expiration cycle that I like to trade (inside the next 45 days) AND the IVR was near the lowest it had been in the last 12 months.

As such this was a great candidate to trade the news event with a long strangle which is set up in a very specific and unique way to ensure maximum success should the stock move OR volatility expand.

This removes the directional uncertainty and as long as the stock moves then I get paid and The Antivestor™ members get paid.

Easy!

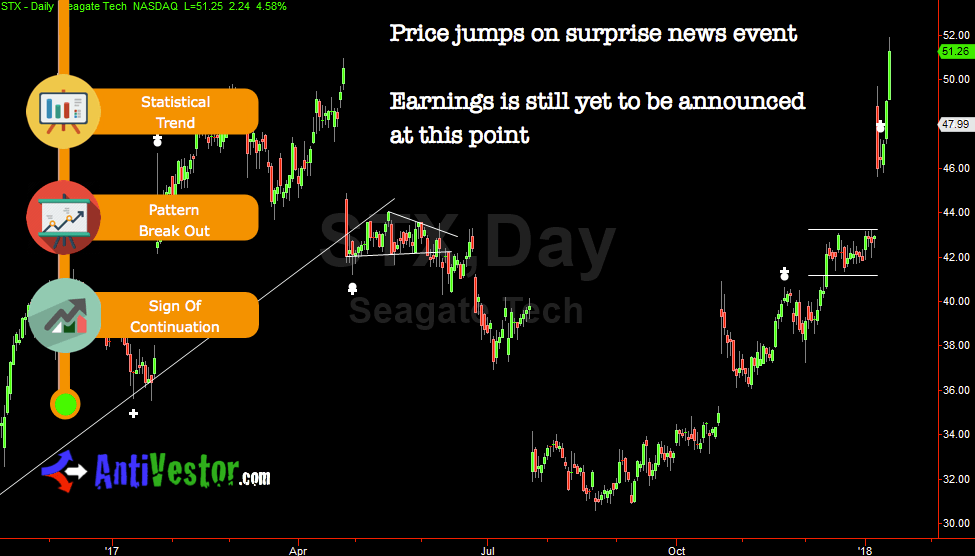

What you can see on this next chart is that just a few days later there was indeed a news announcement but at this point was unrelated to earnings which is still yet to be released as I typed this.

As is my usual practice the news event will always be a reason to get out of my position while the ill informed fall over themselves to get in and chase price around like a headless chicken.

The stock was tipped when the stock price was hovering around $43.

With price jumping higher the long strangle was closed just a few days later for 146.9% ROC.

Nice!

Have with with this news trading strategy and remember to let me know how your doing with it