Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

After a well-earned extra-long weekend, I’m playing a little game of catch-up.

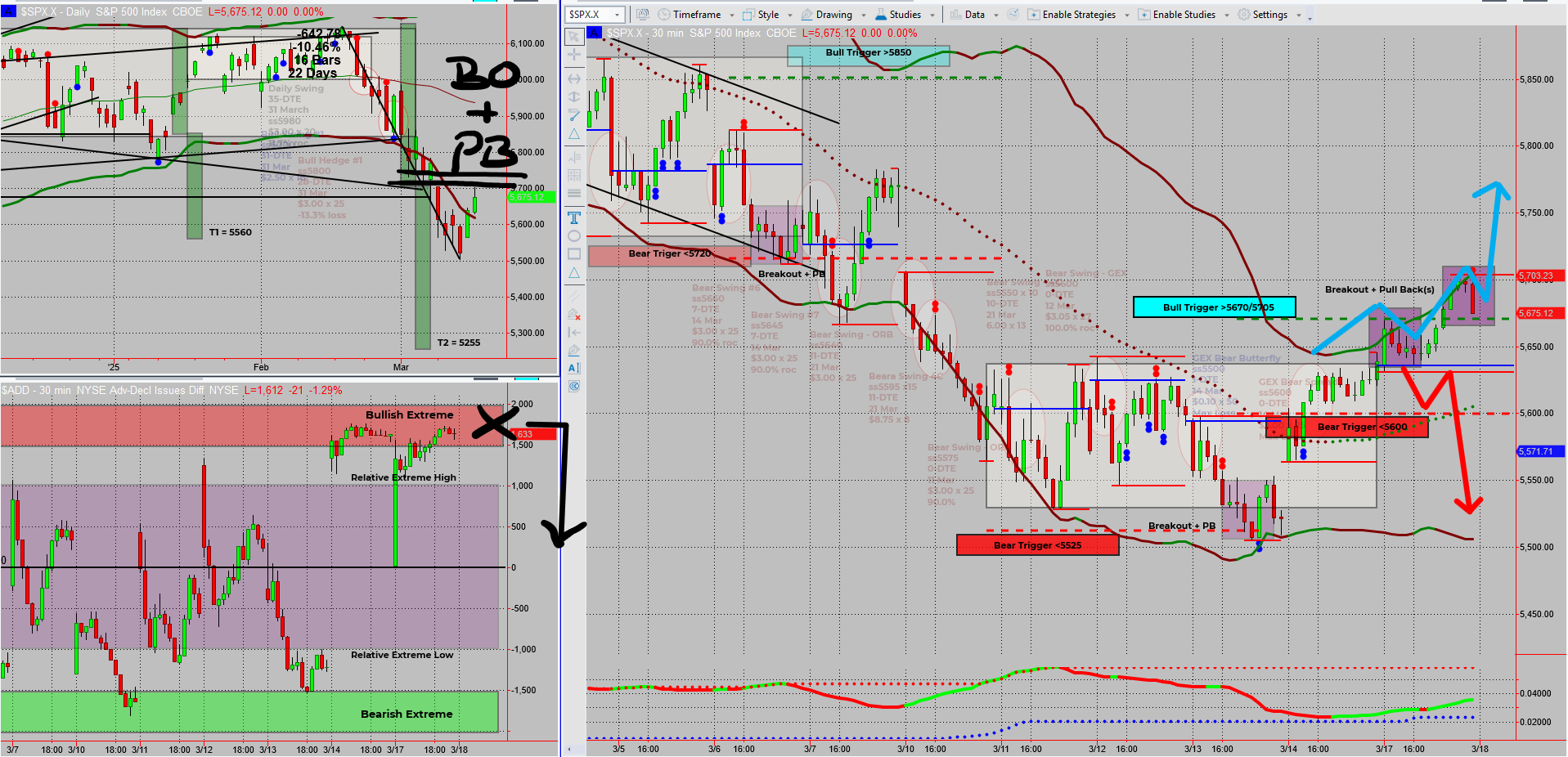

SPX has broken out of the range, now making a strong 2-day rally—but is it the start of something bigger, or just another fakeout before the next drop?

- My bull trigger is locked in above 5705.

- My bear trigger is waiting below 5625.

- Larger timeframe suggests we could still see 5255 if the move fails.

With my levels set and my triggers waiting, it’s all about execution now.

Time to let the market make the first move—then I’ll strike.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

Taking a day off from the markets always makes me itch to get back in—but it also means I have to play catch-up.

Yesterday’s price action unfolded pretty much as expected, so now it’s all about execution.

The Setup – Is This Breakout the Real Deal?

SPX has broken out of the recent range and rallied for two straight days—but we’ve seen this trick before.

- If this move has real momentum, I’ll enter in above 5705.

- If it’s another fakeout, my bear trigger at 5625 will come into play.

- On the daily chart, a failure here could send us as low as 5255.

The Trade Plan – Let the Market Make the First Move

- ✅ I’m not rushing in—I’m waiting for my levels to get hit.

- ✅ If we stay above 5705, I’ll take the bullish entry.

- ✅ If we roll back under 5625, I’m flipping back to bearish.

Bigger Picture – What Happens Next?

- If the breakout holds, we could see a larger trend shift.

- If it fails, 5500 becomes the next major level to watch.

- Either way, I’m positioned to react—not predict.

Bottom Line – The Market Makes the First Move

I’ve marked my levels, I’ve set my triggers, and now it’s just a waiting game.

Time to see what unfolds.

Fun Fact

Did you know? In 1987, before circuit breakers were introduced, the Dow plunged 22% in a single day—the largest one-day drop in history.

The Lesson? Sometimes, playing catch-up in the markets means waking up to absolute chaos. Luckily, I only missed a Monday.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece