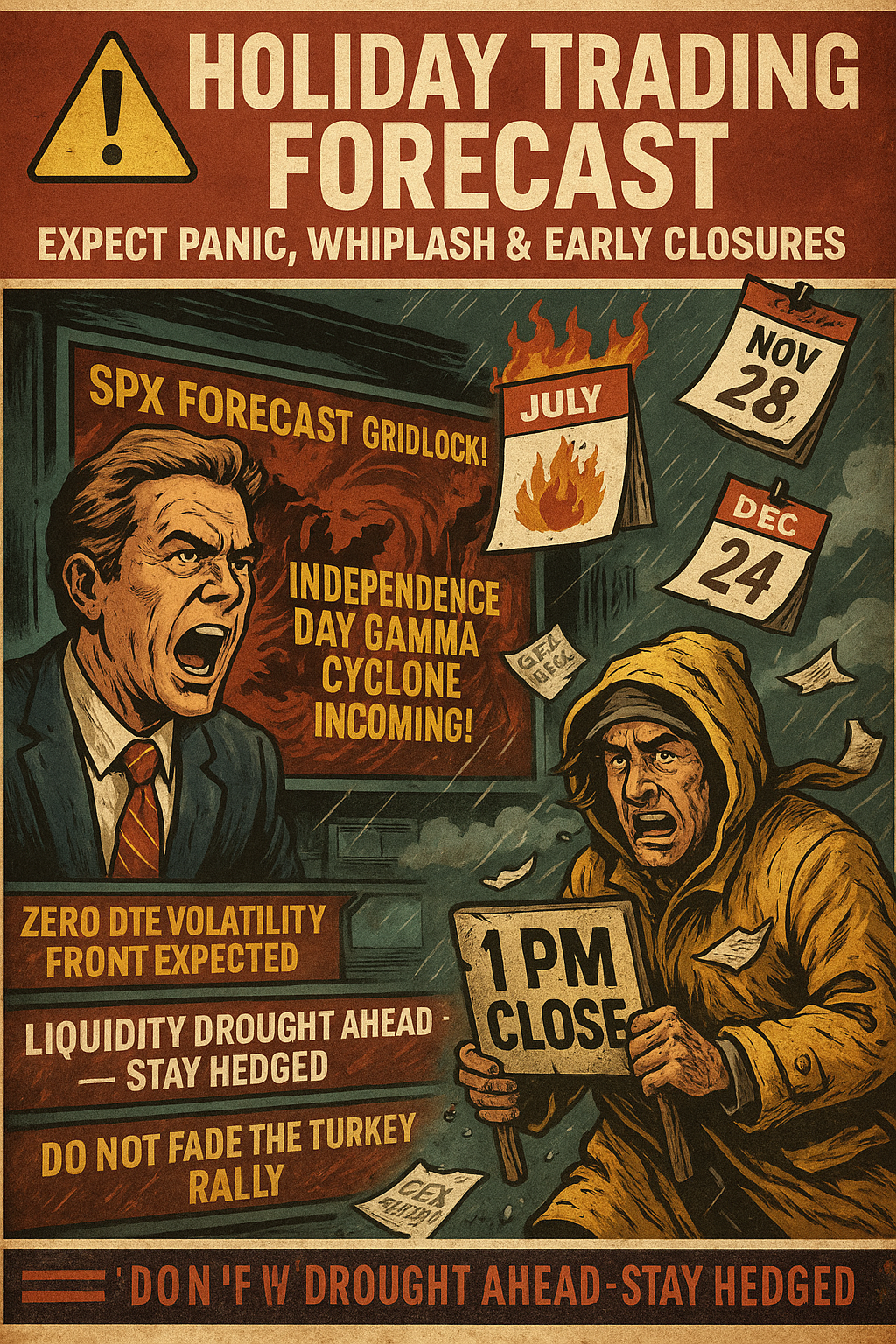

⚠️ Holiday Trading Forecast: Expect Panic, Whiplash & Early Closures

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

| Holiday | 2025 | 2026 | 2027 |

|---|---|---|---|

| New Year’s Day | Thu, Jan 1 | Fri, Jan 1 | |

| Martin Luther King Jr. Day | Mon, Jan 19 | Mon, Jan 18 | |

| Washington’s Birthday | Mon, Feb 16 | Mon, Feb 15 | |

| Good Friday | Fri, Apr 3 | Fri, Mar 26 | |

| Memorial Day | Mon, May 25 | Mon, May 31 | |

| Juneteenth | Fri, Jun 19 | Fri, Jun 18 (Observed) | |

| Independence Day | Fri, Jul 3 * (Obs) | Mon, Jul 5 * (Obs) | |

| Labor Day | Mon, Sep 1 | Mon, Sep 7 | Mon, Sep 6 |

| Thanksgiving Day | Thu, Nov 27 ** | Thu, Nov 26 ** | Thu, Nov 25 ** |

| Christmas Day | Thu, Dec 25 *** | Fri, Dec 25 *** | Fri, Dec 24 (Obs) *** |

= Closed

= Early close 1PM

* = Jul 3/5 early close

** = Day after Thanksgiving early close

*** = Christmas Eve early close

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.