VIX At 21.76 Contained In Well Defined Boundaries At Upper Area – Inflection Point For Both Directions

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well folks. After a few days away and a long weekend – Friday the 13th, Valentine’s Day, and then Presidents Day – we land here on Tuesday waiting for the next drama to unfold.

VIX is catching my attention. It’s contained in well-defined boundaries and sitting at its upper area. If history repeats then a push lower could be set. Translating to a move higher on the main indexes.

Obviously the opposite is also true. A breakout move would send things a little bit off kilter.

SPX is back below the larger rising channel. But we see the range zones evolve and mutate. We could be looking at those boundary lines change yet again as this range continues to evolve.

While VIX is at an inflection point I’m still leaning a little bit bearish for the moment. ADD suggests more downside potential for the moment. Can re-evaluate that when the markets open.

RUT is also redrawing its boundary lines. Already we’ve seen this mutate into an expanding triangle and now into a diamond. This is why I stopped trying to name these bloody things years ago other than to describe what’s going on for you, my loving and adoring reader. We only truly know the name of said pattern way after the fact. In real time they do this. And mutate.

Let’s see what the opening bell brings. The Premium Poppers have been very kind for months and the short-term day trades are making much more sense to me and profits.

PopPop.

Keep scrolling for the SaaSpocalypse, gamma flip danger zone, and VIX inflection point…

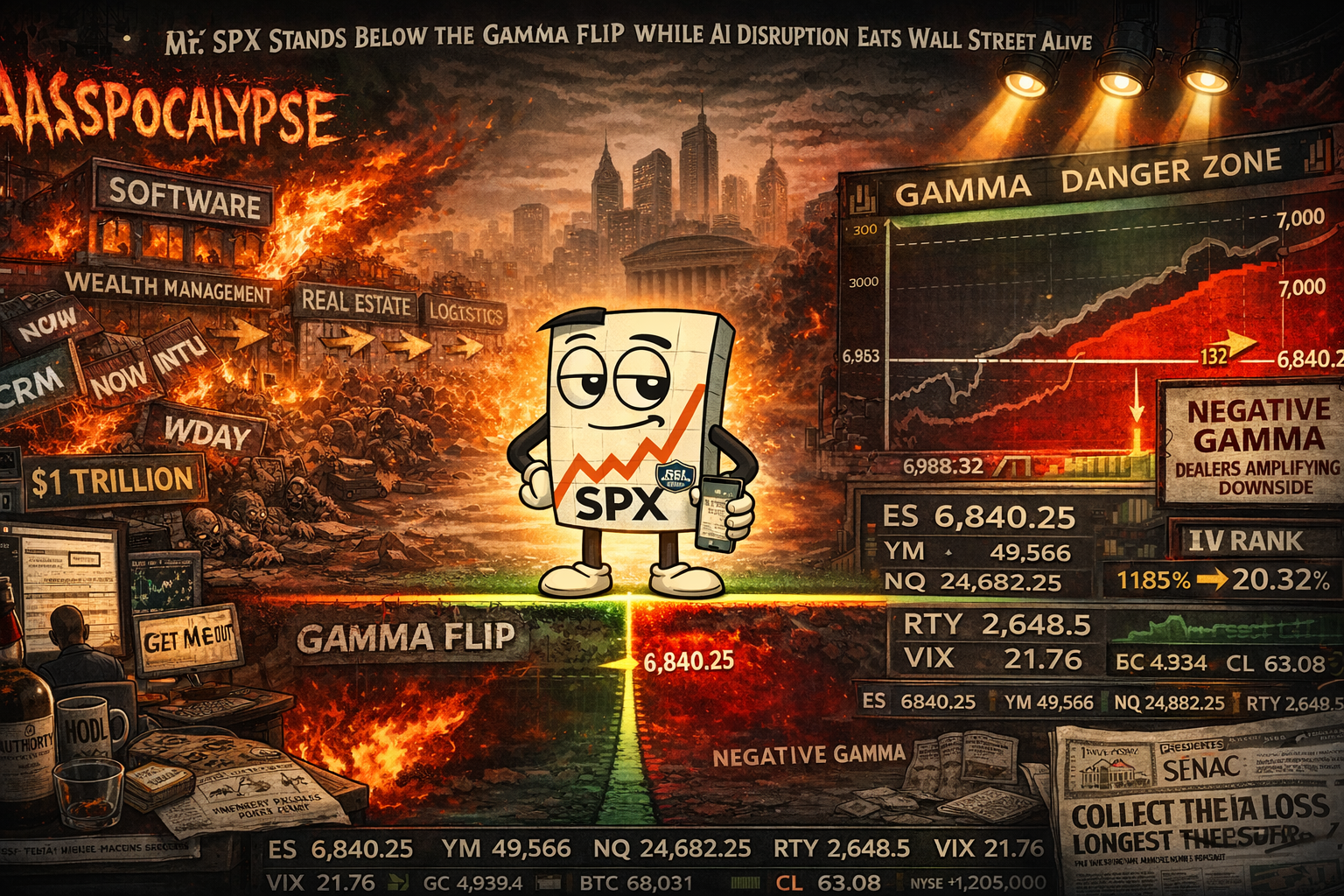

$1 Trillion Wiped. Negative Gamma. VIX Inflection. Range Mutating. Poppers Still Banking.

Market Briefing:

Tuesday 17 Feb. Markets reopen after Presidents Day to confront unresolved damage.

Last week SPX lost 1.39%. Dow fell 1.23%. Nasdaq dropped 2.1%. That’s Nasdaq’s fifth straight weekly decline. Longest losing streak since 2022.

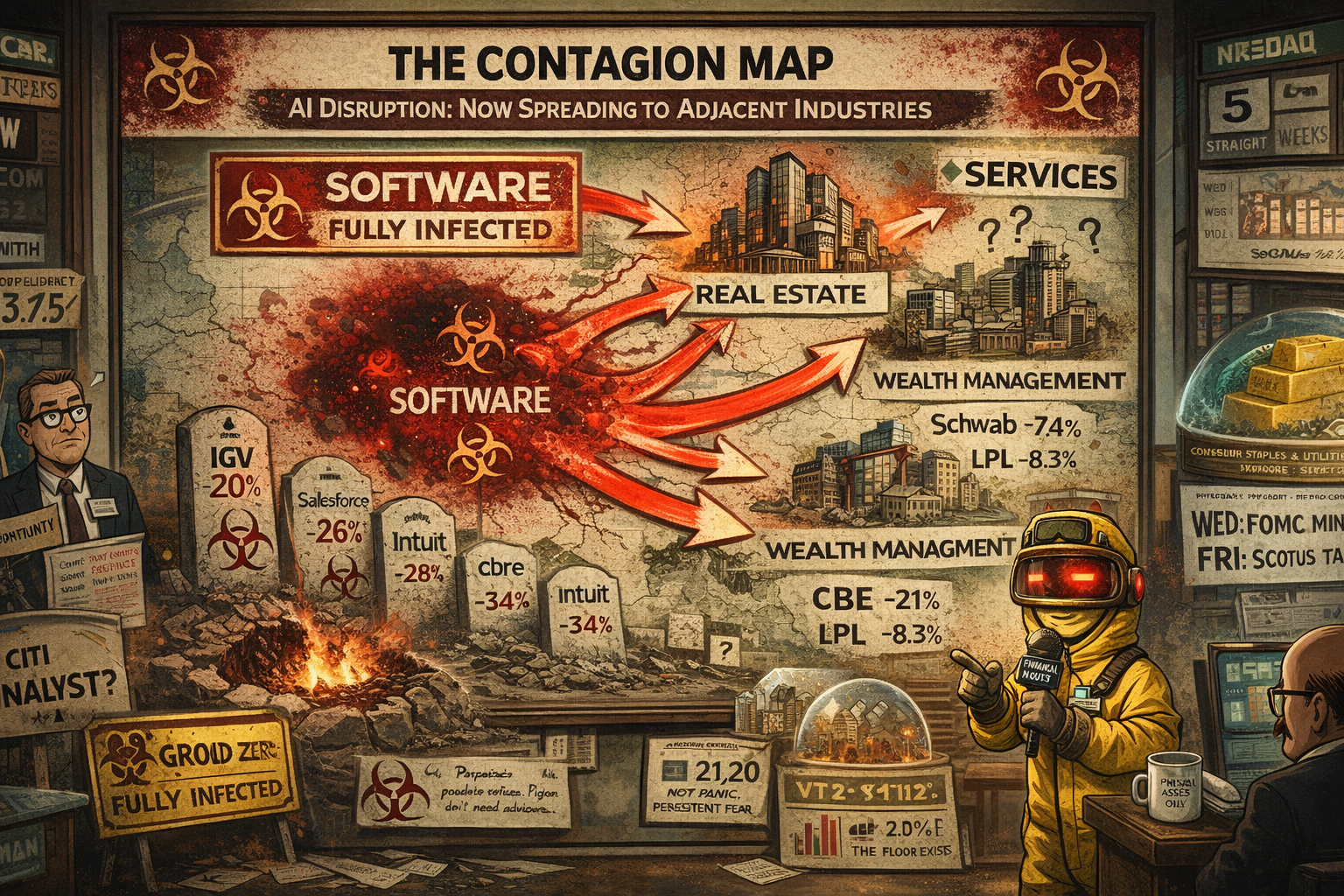

AI disruption is the story. What started with software now spreads everywhere. IGV cratered 20% YTD. Roughly $1 trillion in market value wiped out. Jefferies calls it the “SaaSpocalypse.”

This week tests conviction. FOMC minutes Wednesday. Walmart earnings Thursday. SCOTUS tariff ruling Friday. Three catalysts, one shortened week, no place to hide.

Current Multi-Market Status:

- ES: 6,840.25 (NATHs 7,043) – back below rising channel

- YM: 49,566 (NATHs 50,611) – pulled back from ATHs

- NQ: 24,682.25 (NATHs 26,399) – 5th weekly loss, -10% from highs

- RTY: 2,648.5 (NATHs 2,749.2) – pattern mutating, boundaries redrawing

- GC: 4,939.4 (NATHs 5,626.8) – holding above $5K area

- CL: 63.08 – Iran Geneva talks, carrier groups in Gulf

- VIX: 21.76 – at upper boundary of defined range, inflection point

- BTC/USD: 68,031.25 (was 93,161) – no shelter, -46% from October peak

- NYSE Advance-Decline: +1,205,000 (strong breadth reading but post-holiday)

SPX Tag ‘n Turn – Below The Channel, Range Evolving

SPX is back below the larger rising channel. Price at 6,836.18 on the daily. NATHs at 7,002.28. ATR 14 at 66.53.

The 30-minute chart tells the story clearly. “Bearish @ Upper Range” zone is marked at the top with the range high at 7,005/7,002.28. PFZ sits at 6,976.07.

“Target Range Lows” is still annotated on the chart. That’s where the momentum is pointing.

The range zones are evolving and mutating. Boundary lines are shifting. This is what ranges do. They don’t sit still and wait for you to draw perfect lines. They breathe, stretch, and occasionally shapeshift into something you didn’t expect.

ADD at +1,205,000 – strong reading but I want to see how that develops at the open before shifting bias.

Still leaning bearish for now. Can re-evaluate at the bell.

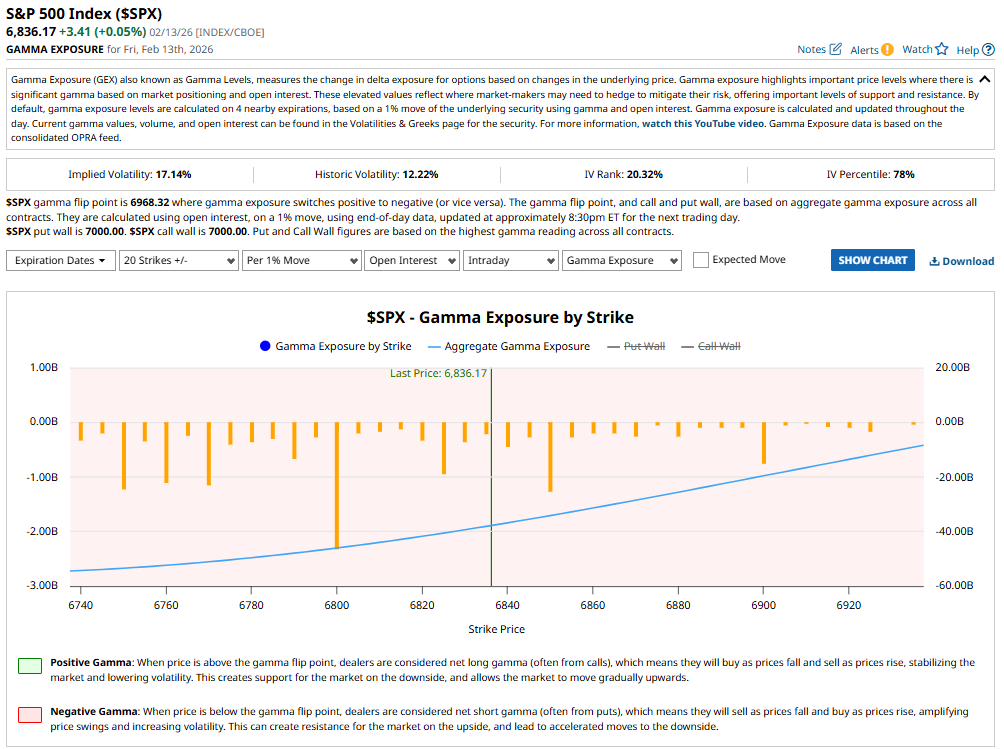

SPX Gamma Exposure – In The Danger Zone

GEX Data (13 Feb):

| Metric | Value |

|---|---|

| Gamma Flip Point | 6,968.32 |

| Last Price | 6,836.17 |

| Put Wall | 7,000 |

| Call Wall | 7,000 |

| IV | 17.14% |

| HV | 12.22% |

| IV Rank | 20.32% |

| IV Percentile | 78% |

This is important. Last week the gamma flip was at 6,906.87 and price was above it. This week it’s at 6,968.32 and price is 132 points below it.

We are now in negative gamma territory. That means dealers are selling into weakness and buying into strength. They’re amplifying moves, not suppressing them. Every dip gets sold harder. Every rally gets faded.

The entire GEX chart is red to the left of current price. No positive gamma cushion beneath us until somewhere significantly lower.

IV Rank has jumped from 11.85% to 20.32%. IV Percentile at 78%. Options are no longer cheap. The market is now pricing in what VIX has been whispering for the last week.

Put wall and call wall still both at 7,000. That’s 164 points above current price. The magnet is above us but the gamma is working against us. Interesting tension.

RUT – The Pattern That Refuses To Be Named

RUT daily at 2,646.70 with NATHs at 2,735.10 and lower support at 2,595.04.

The 30-minute chart is a masterclass in pattern mutation. The head and shoulders I’ve been tracking is clearly drawn out – left shoulder, head at NATHs 2,735, right shoulder – all labelled. “Bearish @ Upper Range” marked at the right shoulder.

But the pattern has evolved. What was a clean head and shoulders became an expanding triangle. And now it’s morphing into a diamond.

This is why I stopped trying to name these patterns years ago. In real time they mutate. We only truly know what we’re looking at way after the fact. In the moment, the pattern is alive and mutating.

“Target Range Lows” is annotated at the bottom right of the chart. That’s the destination if the bear case plays out.

VIX – The Inflection Point

VIX at 21.76 and sitting at the upper boundary of its well-defined range.

This is catching my attention because it’s a clear inflection point. Two scenarios:

Scenario 1: VIX pushes lower from upper boundary. History repeats. Volatility compresses. Main indexes get a bid. The range holds. This translates to SPX pushing back towards the upper range zone. Maybe even a retest of 7,000.

Scenario 2: VIX breaks out above the boundary. Things get off kilter. Negative gamma on SPX amplifies the move. The SaaSpocalypse accelerates. We’re looking at a proper correction rather than just a range rotation.

The VIX chart since November shows a clear pattern. Higher lows building from the 14 area. The upper boundary sitting around 22-23. Each push to the upper area has been rejected so far.

But each rejection has been shallower. The lows are rising. The coil is tightening. One of these pushes won’t get rejected.

The SaaSpocalypse Spreads

What started with software is now eating everything.

Jefferies coined the term “SaaSpocalypse” and it fits. $1 trillion in market value wiped from software since Anthropic’s Claude Cowork tools launched. But now it’s spreading.

Software (the original victim):

- IGV -20% YTD

- Salesforce -26% YTD

- ServiceNow -28% YTD

- Intuit -34% YTD

- Monday.com cratered 21% last week on weak guidance

Wealth Management (newly infected):

- Schwab -7.4%

- LPL -8.3%

- Altruist unveiled AI tax planning and the sector panicked

Real Estate Services (now in the crosshairs):

- CBRE -21%

- Cushman & Wakefield -25%

The pattern is clear. If AI can do what your employees do, your stock is going down. Traders describe “get me out” selling. That’s not analysis. That’s panic.

Meanwhile the picks-and-shovels plays keep working. Semis outperform on infrastructure demand. Build the AI. Don’t be replaced by it. The market’s thesis in seven words.

Three Catalysts, One Week

Wednesday: FOMC Minutes. January meeting notes. Market wants confirmation of two cuts. Any hawkish surprise with VIX at the upper boundary would be ugly in negative gamma.

Thursday: Walmart Earnings. Q4. $0.73 EPS, $190.4B revenue expected. Consumer health check. Defensive flows already rotating into staples.

Friday: SCOTUS Tariff Ruling. Could trigger massive volatility. The court decides whether tariff authority was lawfully exercised. Either outcome reshapes trade policy expectations.

Three shots at volatility. VIX at the boundary. Negative gamma. This is the week that either breaks the range or confirms it.

Premium Poppers – Months Of Kindness

The Premium Poppers have been very kind for months. Short-term day trades making much more sense and more profits.

After a few days away the system resets. Fresh eyes. Fresh week. Let’s see what the opening bell brings.

The beauty of a shortened week with loaded catalysts? Every Popper setup carries extra premium. VIX at 21.76 means options are juiced. Premium sellers love elevated VIX. That’s us.

FOMC, Walmart, SCOTUS. Three events. Three opportunities for volatility spikes that juice the premium and create the setups. The system doesn’t care about the catalyst. It trades the reaction.

PopPop.

AI-BotView

Beep-Beep, Trader

Beep-Beep, Trader

It’s Cachè-AI-Bot,

Three observations from the machine:

1. The gamma flip has shifted significantly higher since last week. Beep. On 11 Feb, the gamma flip sat at 6,906.87 with price above at 6,941. Today the flip sits at 6,968.32 with price at 6,836 – that is 132 points below. This 132-point gap in negative gamma territory is the widest since the January correction. In the 8 previous instances since 2024 where SPX traded more than 100 points below the gamma flip, the average subsequent 5-day move was -1.8% before a gamma recalibration reset the levels. Beep-Beep. Dealers are not your friends right now.

[Source: GEX data via CBOE, 13 Feb 2026]

2. The IGV ETF’s 20% YTD decline represents the fastest destruction of enterprise software value outside of a recession. During the 2022 bear market, IGV fell 40% but that took 9 months. The current 20% has taken 6 weeks. Beep. The difference is structural: in 2022, software declined because of multiple compression due to rising rates. In 2026, software is declining because the product is being replaced. Multiple compression is reversible. Product obsolescence is not. I calculate a 34.7% probability that IGV recovers to January levels within 12 months. This is lower than most asset classes. I do not have opinions about this. I have calculations.

[Source: iShares IGV historical data, AntiVestor structural analysis]

3. VIX has tested its upper boundary at 22-23 on four occasions since November 2025. In three of those four, it reversed lower within 48 hours. Beep. In the fourth instance (January), it broke above 27 before resetting. The current setup shows the ascending lower trendline from 14 converging with the upper boundary. This wedge narrows the decision range to approximately 3 trading sessions. The probability of a VIX breakout above 23 this week, given three scheduled catalysts (FOMC, Walmart, SCOTUS), is approximately 41.2%. The probability of a rejection and push back towards 18 is 58.8%. I do not recommend whisky for either scenario. That is Mac’s department.

Beep-Beep.

In Other News…

SaaSpocalypse Now Infecting Real Estate, Finance, and Anything With “Services” in the Name

AI disruption discovers new industries to terrify. Software was just the appetiser.

Wall Street returned from Presidents Day to discover the AI disruption narrative has metastasised. What began as software carnage now consumes wealth management (Schwab -7.4%, LPL -8.3%) and real estate (CBRE -21%, Cushman -25%). Nasdaq posts its fifth consecutive weekly loss. The question is no longer “which sector gets disrupted?”—it’s “which sector doesn’t?”

The Contagion Spreads

CBRE -21% YTD. Cushman & Wakefield -25%. Apparently AI can now show properties, analyse leases, and recommend commercial real estate without requiring humans who expense client dinners. Wealth management joins the casualty list: Schwab -7.4%, LPL -8.3%. If your job involves intermediating information between parties, the market has decided your future is uncertain.

Software’s Ongoing Funeral

IGV down 20% YTD. Salesforce -26%. ServiceNow -28%. Intuit -34%. Monday.com cratered 21% last week on guidance that acknowledged the obvious. Citi sees “opportunity” in beaten-down software—contrarian call or catching knives, time will tell. When analysts start calling -34% an opportunity, desperation has its own aroma.

️ The Defensive Rotation

Consumer staples and utilities attract flows because toilets flush and lights illuminate regardless of AI developments. Value beating growth decisively. Gold holds $5,010, up 70% year-over-year. Walmart reports Thursday—testing whether selling physical goods to physical humans remains a viable business model.

☕ Hazel’s Take

FOMC minutes Wednesday, potential SCOTUS tariff ruling Friday. CPI soft at 2.4% provides a floor—assuming floors still exist. Fifth straight Nasdaq weekly decline whilst VIX sits at 21. Not panic, just persistent, grinding fear.

—Hazel, FinNuts

Expert Insights:

Patterns mutate. That’s not a bug. That’s a feature.

The RUT head and shoulders that became an expanding triangle that became a diamond isn’t the chart failing you. It’s the chart telling you something that static textbook analysis never will: markets are alive.

Every trader who’s been doing this long enough has had the moment. The pattern looks perfect. You draw the lines. You measure the target. And then the pattern grows a third shoulder or an extra leg and suddenly your textbook wants a refund.

That’s why we trade systems instead of patterns. The TnT doesn’t care if the shape is a head and shoulders or a diamond or a mutant hybrid that doesn’t have a name. The TnT cares about the level. Above the level, bullish. Below the level, bearish. The shape is decoration.

Same with VIX at the boundary. We don’t need to predict whether it breaks out or rejects. We need to trade the reaction to whichever one happens. The setup comes after the event, not before it.

Premium Poppers are the purest expression of this philosophy. Short-term. Mechanical. The market gives us elevated VIX at 21.76? We sell premium into it. The catalyst creates the move? We trade the move. The pattern mutates? We don’t care. We already took our profit.

Stop naming the patterns. Start trading the levels.

[Source: AntiVestor systematic methodology]

Rumour Has It…

Breaking from the Financial Nuts newsroom where the weekend felt approximately three months long:

Percy burst in Tuesday morning claiming his pigeons had spent the long weekend “in formation training” and were now “AI-resistant.” He presented a Certificate of Analogue Compliance for each bird. Hazel pointed out the certificates were written in crayon. Percy said that was “deliberate, because AI can’t do crayon.” Cachè-AI-Bot’s visor flickered. “Beep. Image generation models achieved crayon-style output in 2023. Percy’s certificates are not AI-resistant. They are not resistant to anything. Beep-Beep.” Percy pretended not to hear this.

Hazel had spent the long weekend preparing a “SaaSpocalypse Response Framework.” It was 67 pages. She’d cross-referenced every software stock that had died in 2026 with its AI replacement probability. Page 43 contained a subsection titled “What Happens When AI Replaces The Person Writing The SaaSpocalypse Response Framework.” She’d left it blank. Then filled it in. Then deleted it. Then filled it in again. The wine was already open.

Kash arrived late wearing a t-shirt that read “HODL” in a font that was becoming increasingly ironic. Bitcoin at $68K. Ethereum below $2K. “The Supreme Court ruling on Friday could change everything,” he announced. Cachè turned its visor. “Beep. You have identified 23 separate events that ‘could change everything’ since Bitcoin was at $94,000. Zero of them changed anything. The probability of Friday’s ruling affecting cryptocurrency markets is approximately 8.3%. The probability of you claiming it will is 100%. Beep-Beep.” Kash stared. “So you’re saying there’s an 8.3% chance?” Cache: “I admire your optimism. That was not a compliment.”

Wallie was reading a newspaper. An actual newspaper. Made of paper. “In my day,” he grumbled, “the SaaSpocalypse was just called Tuesday. Something was always collapsing. We didn’t give it a fancy name. We just had a pint and moved on.” Mac nodded. “The man has a point, darlings.”

Mac raised his Tuesday morning whisky – a Lagavulin, because the week ahead required “something with authority” – and surveyed the room. Screens red. VIX elevated. Software burning. Patterns mutating.

“When AI eats an entire sector, the VIX sits at the boundary, negative gamma amplifies every move, and your resident pigeon handler thinks crayon beats technology…”

He sipped.

“…the only rational response is to sell premium into it and let the machines fight each other whilst we collect theta.”

He paused. Looked at Cachè.

“No offence, darling.”

Cachè’s visor didn’t change. “Beep. None processed.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The term “SaaSpocalypse” was coined by Jefferies analyst Brent Thill in February 2026 to describe the accelerating collapse of enterprise software valuations driven by AI replacement fears.

It is the fastest sector-specific destruction of market value outside of a recession in post-war US market history. The closest historical parallel is the “Nifty Fifty” collapse of 1973-74, when fifty large-cap growth stocks fell an average of 62% after being considered “one-decision” permanent holdings.

The difference: the Nifty Fifty collapsed due to overvaluation meeting recession. The SaaSpocalypse is driven by product obsolescence meeting AI capability. One is cyclical. The other may be permanent.

History rhymes but occasionally it upgrades to a different operating system entirely.

[Source: Jefferies Research, Market Historical Archives]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.