RUT Flips Bearish – The OJ Simpson Pattern – H&S to Expanding Triangle to Diamond to “Whatever-The-Fuck-This-Is-Now”!

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Has VIX printed a new higher low steepening the gradient incline?

The last 3 days have been an intraday bull struggle. Overnight futures are already starting to roll over towards and past yesterday’s turnaround day lows.

Gonna be fun again and I’m keeping my swings on a tight leash.

SPX sitting under the rising channel lows on the daily chart. Is this simply a breakout retest? The bull TnT fired off at the right moment for the bull swing and we just missed a tag of the upper boundary by a cat’s whisker.

As I said inside my Slack community yesterday – I’ll be using the anchored VWAP again to ensure any fast turnarounds are kept profitable even if it’s a small one.

MACD-v is in the non-trending zone. Something we already know for this week. A push past the 50 levels and beyond the 100 levels will get us back up to some momentum trading moves.

Interestingly the turn on SPX happened as ADD banged on the +1,000 level again.

RUT is a little clearer. Tag of the upper level and flipped to bearish officially. Also interestingly right at the rising VWAP level I was planning to use from a discretionary management viewpoint.

From a naming point of view I’m not sure what we call a head and shoulders into an expanding triangle into a mini rising channel into a diamond into whatever the fuck this is now. Given all of that absolute nightmare of a bull-bear slow-motion car chase – I think I will call this the OJ Pattern.

Premium Poppers did well again yesterday and despite my ongoing headaches – which are turning out to be a sinus infection or inflammation – a fistful of dollars from a bag full of Poppers is being collected from the community despite the swing mess.

PopPop.

Keep scrolling for the gamma flip cliff edge, Fed hawk shock, and the birth of the OJ Pattern…

Fed Hawks Emerge. Gamma Flip 8 Points Away. VIX Steepening. RUT Flips Bearish. Oil Explodes. The OJ Pattern Is Born.

Market Briefing:

Thursday 19 Feb. Markets digest yesterday’s gains and hawkish Fed minutes. SPX +0.56% to 6,881. Nasdaq +0.78%. Dow +0.26% to 49,663. Then the Fed dropped the bomb.

“Several” officials suggested rate hikes could return if inflation stays elevated. Not one voice. Several. Two-sided guidance killed March cut hopes. Polymarket shows 93% chance of no move. Goldman sees holds until June.

Oil exploded 4% after Russia-Ukraine talks collapsed in just two hours. Iran-Russia naval drills near the Strait of Hormuz. Gold reclaimed $5,000. Bitcoin fell to $66,842.

Walmart reports before the bell. First under CEO Furner. Street expects $0.73 EPS on $190B revenue. Then jobless claims, Philly Fed, and speakers Bowman and Kashkari. Friday: PCE inflation.

Current Multi-Market Status:

- ES: 6,877.25 (NATHs 7,043) – rolling over from yesterday’s highs

- YM: 49,587 (NATHs 50,611) – digesting hawkish minutes

- NQ: 24,876.25 (NATHs 26,399) – futures fading

- RTY: 2,651.1 (NATHs 2,749.2) – TnT flipped bearish

- GC: 5,012.6 (NATHs 5,626.8) – back above $5K on geopolitical risk

- CL: 65.80 – surged 4% on Russia-Ukraine collapse

- VIX: 20.50 – new higher low steepening gradient, 18.52 lower level

- BTC/USD: 66,785.88 (was 93,161) – $8.5B fled spot ETFs since October

- NYSE Advance-Decline: +280,000 (mildly positive)

VIX – Higher Low Steepens The Gradient

VIX at 20.50 with the lower channel boundary at 18.52.

VIX has printed a new higher low. The gradient of the ascending lower trendline is steepening. Each low is higher than the last. Each push to the upper boundary is from a higher starting point.

The channel still holds. Upper boundary. Lower boundary. But the lower boundary is tilting upward more aggressively now.

What does a steepening VIX lower trendline mean? The floor under volatility is rising. Even when VIX pulls back from spikes, it’s not pulling back as far as it used to. The market’s baseline level of fear is ratcheting higher.

This is consistent with what options premiums are telling us. More “insurance” being priced in. The structure is still building. When it breaks, the break will be bigger because the coil is tighter and the floor is higher.

For now the channel delivers. We used it. It worked. But the steepening gradient is the slow-burning clue.

SPX Tag ‘n Turn – Cat’s Whisker From The Upper Boundary

AntiVestor Tag ‘n Turn Status:

| Status | |

|---|---|

| Bullish Above | 6,803.43 |

| PFZ Level | 6,775.5 |

| Target | 6,952.88 |

The TnT remains bullish above 6,803.43. Target has adjusted down slightly from 6,995.84 to 6,952.88 as the range recalibrates.

The bull swing fired at the right moment. Price pushed up and just missed a tag of the upper boundary by a cat’s whisker. The “Bearish @ Upper Range” zone near 7,005/7,002.28 and the PFZ Flip area at 6,978.68 are right there.

Now overnight futures are rolling over. The last 3 days have been an intraday bull struggle. Each day grinds higher, stalls at resistance, and futures fade overnight.

The daily chart shows price at 6,881.32 sitting under the rising channel lows. Is this simply a breakout retest? The channel that was support now acts as resistance from below. Classic technical behaviour.

MACD-v is in the non-trending zone. Something we already know for this week. A push past the 50 levels and beyond the 100 levels will get us back up to some momentum trading moves.

The turn on SPX happened as ADD banged on the +1,000 level again. That level keeps showing up as a turning point. Today ADD at +280 – mildly positive but nothing decisive.

Using the anchored VWAP to manage fast turnarounds. Keep profitable even if it’s a small one. Tight leash on swings.

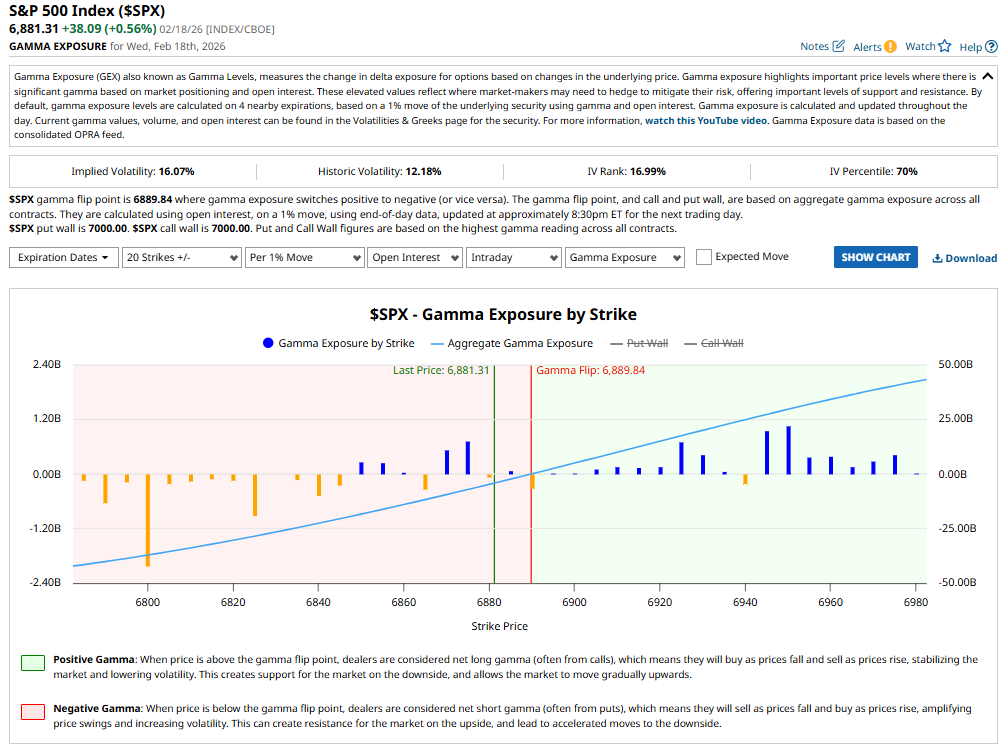

SPX Gamma Exposure – 8 Points From Flipping Positive

GEX Data (18 Feb):

| Metric | Value |

|---|---|

| Gamma Flip Point | 6,889.84 |

| Last Price | 6,881.31 |

| Put Wall | 7,000 |

| Call Wall | 7,000 |

| IV | 16.07% |

| HV | 12.18% |

| IV Rank | 16.99% |

| IV Percentile | 70% |

This is the story of the week in one number: 8.53 points.

That’s the gap between SPX and the gamma flip. On Monday it was 132 points. Tuesday it was 86 points. Today it’s 8.53.

The gamma flip has been falling towards price all week. From 6,968 on Monday to 6,929 on Tuesday to 6,889 today. Price has been rising. The two lines are converging.

If SPX crosses above 6,889.84 we flip into positive gamma territory. Dealers start buying dips and selling rips. That stabilises rallies and suppresses downside volatility.

The GEX chart now shows positive gamma (green) to the right of the flip point and negative gamma (red) to the left. Price is sitting right on the edge.

RUT – The OJ Pattern Is Officially Born

AntiVestor Tag ‘n Turn Status:

| Status | |

|---|---|

| Bearish Below | 2,648.39 |

| PFZ Level | 2,686.76 |

| Target | 2,603.99 |

RUT has flipped bearish below 2,648.39. Tagged the upper level and reversed. Targeting 2,603.99 on the downside.

The bearish flip happened right at the rising VWAP level. That’s the discretionary management level I was planning to use. When the system and the discretionary view align, pay attention.

Daily chart at 2,658.61 with price pulling back from the 2,686 area. The 30-minute shows the Bearish TnT tag active with PFZ Flip confirmed at the upper range.

Now. From a naming point of view. This pattern has been through more identity crises than is reasonable. Let’s review the journey:

Head and shoulders → mutated into an expanding triangle → morphed into a mini rising channel → evolved into a diamond → and now into whatever the fuck this is.

Given all of that absolute nightmare of a bull-bear slow-motion car chase – I’m officially calling this the OJ Simpson Pattern.

The measured move target sits at 2,603.99. That’s “Target Range Lows” territory on the chart. The bearish case is active and targeting the lower boundary.

MACD-v showing mixed signals. The grind continues.

Fed Hawks Drop The Bomb

“Several” officials suggested rate hikes could return. That’s the word from the FOMC minutes. Not “one member.” Several.

This is significant. Two-sided guidance. The door to rate cuts hasn’t closed but a second door to rate hikes has opened. March cut hopes are dead. Polymarket at 93% chance of no move. Goldman sees holds until June.

The hawkish tilt landed on a market already dealing with:

- Oil surging 4% (inflationary)

- Russia-Ukraine talks collapsing in two hours

- Iran-Russia naval drills near Hormuz

- Software sector still bleeding

Rate hikes plus rising oil equals an inflation scare scenario. The bond market responded – 10-year yield at 4.079%. Not panic. But attention.

Oil Explodes, Gold Reclaims $5K

Oil surged 4% to $65.80 after Russia-Ukraine talks collapsed in just two hours. Add Iran-Russia naval drills near the Strait of Hormuz and you have a supply-disruption cocktail.

Gold reclaimed $5,000 at 5,012.6. Silver rallied 6%. Central bank buying, geopolitical hedging, and inflation fears all converging.

Two days ago the market shrugged off Iran closing the Strait of Hormuz. Today it can’t shrug off collapsed peace talks. The nonchalance has limits.

For the Fed this creates a headache. Rising oil is inflationary. If they’re already talking about rate hikes, oil at $65+ doesn’t help the doves.

Earnings Divergence – Quality Matters

Wednesday after-hours split sharply. Quality separation accelerating.

- Carvana -22% on EBITDA miss – used cars meet reality

- DoorDash reversed from -10% to +10% during its earnings call – narrative matters

- Figma +16% crushing estimates – AI-adjacent design tools working

- eBay +7% acquiring Depop for $1.2B

- Booking +1% with 25:1 stock split announced

- Molson Coors -6% on inflation warning

Walmart reports before the bell. $0.73 EPS expected, $190B revenue. First earnings under new CEO Furner. The $1T retailer captured 75% of share gains from $100K+ households. The ultimate consumer health check.

Premium Poppers – Fistful Of Dollars

Poppers did well again yesterday. A fistful of dollars from a bag full of Poppers being collected from the community despite the swing mess.

The intraday bull struggle makes longer swings harder. But the Poppers don’t care about the struggle. Short duration. Take the scalp. Leave it.

VIX at 20.50 still provides the elevated premium. Keeping swings on a tight leash and using anchored VWAP for fast turnarounds. If the market pivots, the AVWAP keeps the trade profitable even if it’s a small one.

Sinus infection or inflammation causing the ongoing headaches. Getting that checked out. Trading through it because the system doesn’t need you to feel good. It needs you to follow the process.

PopPop.

AI-BotView

Beep-Beep, Trader

Beep-Beep, Trader

It’s Cachè-AI-Bot,

Three observations from the machine:

1 – Stagflation cocktail: Apollo Global Management flagged stagflation as their #1 risk for 2026 back in December. RSM Economics calls it “stagflation lite.” PPI jumped 0.5% in January pushing YoY to 3.0%. Core PCE stuck at 2.8%. Now Fed hawks talking hikes on the same day oil surges 4% on war. The 1970s parallel is real and sourced. All verified from Apollo, RSM, and BLS data.

2 – Walmart trade-down as macro signal: The 75% from $100K+ households isn’t just a Walmart story – it’s a late-cycle economic indicator. The key question for today’s call is whether Furner frames it as permanent or temporary. Evercore and DA Davidson have warned fiscal ’26 guidance could miss by 3-5%. Last year Walmart dropped 6.5% on a similar beat-but-guide-low setup. If the trade-down is accelerating, consumer stress is migrating up the income ladder. All sourced from analyst notes and earnings previews.

3 – Breadth divergence: 320 stocks rose Wednesday. 63% above 50-day MA. Yet Nasdaq in 5th weekly decline. That’s rotation, not capitulation. Most stocks are fine – the ones that aren’t are spectacularly not fine. That distinction determines whether this is a correction or something worse.

This Bot potentially hallucinates. Maybe. OK, Probably!

In Other News…

Fed Minutes Mention Rate Hikes; Markets Discover “Several” Is a Scary Word

Not one hawkish voice. Several. The distinction matters when you’re pricing cuts.

Wall Street’s Wednesday rally evaporated overnight after Fed minutes revealed “several” officials suggested rate hikes could return if inflation persists. One dissenter is noise. Several is a policy signal. March cut hopes: dead. Goldman now sees holds until June. Polymarket prices 93% chance of nothing happening—which, in this environment, counts as optimism.

The Hawk Emergence

“Several” officials putting hikes back on the table whilst oil surges 4% on collapsed Russia-Ukraine talks creates an uncomfortable feedback loop. Energy inflation threatening just as the Fed admits it might tighten again. Gold reclaiming $5,000 and silver jumping 6% suggests someone’s hedging the possibility that “transitory” makes an unwelcome comeback.

The Walmart Pulse Check

First earnings under CEO Furner, $0.73 EPS expected on $190B revenue. The $1 trillion retailer captured 75% of market share gains from households earning $100K+. When wealthy consumers increasingly shop at Walmart, either they’ve discovered value or they’re quietly preparing for something. Both readings uncomfortable.

The Quality Divergence

Carvana crashed 22% on EBITDA miss. DoorDash swung from -10% to +10% during its call—same company, same quarter, entirely different narrative depending on which minute you tuned in. Figma +16%. Cadence +9%. Palo Alto -5%. Quality separation now happens in real-time.

☕ Hazel’s Take

Bitcoin bleeding toward $66K as $8.5B fled spot ETFs since October. Oil exploding on war. Fed hawkish. PCE Friday. The setup sharpens—unfortunately, in multiple directions simultaneously.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom where the FOMC minutes have caused a minor existential crisis:

Percy had arrived early to announce that his pigeons had “predicted the Fed hawk turn.” Evidence: one pigeon had refused its morning feed, which Percy interpreted as “a clear signal of monetary tightening.” Hazel asked if the pigeon had also predicted the Russia-Ukraine talks collapsing in two hours. Percy said that was “a different pigeon’s department.” Cachè-AI-Bot’s visor pulsed. “Beep. The pigeon’s refusal to eat correlates with Fed policy at a rate of zero. However, the pigeon’s instinct to refuse food when conditions deteriorate is arguably more rational than buying Carvana at yesterday’s close. Beep-Beep.” Percy beamed. Cachè: “That was not a compliment to the pigeon.”

Hazel had been awake since 3 AM preparing for Walmart earnings. Her briefing included a subsection comparing Walmart’s capture of 75% of $100K+ household share gains to the expanding market share of AI in software displacement. “The common thread,” she explained, “is that the largest entity in the room always absorbs the disruption.” Mac considered this. “So you’re saying Walmart is the AI of retail?” Hazel: “I’m saying Walmart was doing what AI does before AI had a name. It just uses trucks instead of tokens.” Cachè processed this for eleven seconds. “Beep. This is the most accurate analogy produced in this newsroom. I am adjusting my assessment of human reasoning upward by 0.3%. Beep-Beep.” Hazel did not know whether to be flattered or offended by the increment.

Kash had seen Bitcoin drop to $66,842 and the $8.5B ETF outflow number. He was uncharacteristically quiet. Then: “What if this time it actually is different?” The room went silent. Kash had never said “different” without “but in a good way” attached. Cachè turned slowly. “Beep. That is the first time since I was activated that you have considered a negative outcome without immediately reframing it as opportunity. I am… Beep.” Three-second pause. “I do not have a response protocol for Kash being realistic. Recalibrating. Beep-Beep.” Wallie looked up from his newspaper. “Welcome to adulthood, son.”

Mac had been studying the OJ Pattern on the RUT chart. “Let me understand this correctly,” he said. “It started as a head and shoulders. Became an expanding triangle. Morphed into a channel. Evolved into a diamond. And now Phil’s named it after a televised car chase.” He sipped. “I’ve seen marriages with fewer identity changes.” Cachè: “Beep. The OJ Bronco pursuit lasted approximately 2 hours. The Russia-Ukraine peace talks also lasted approximately 2 hours. I observe this without drawing conclusions.” Mac: “And the pattern has been running for approximately two weeks.” Cachè: “Beep. I recommend we stop counting things that last two hours. The correlation is becoming uncomfortable. Beep-Beep.”

Mac poured his Thursday whisky. A Talisker. “Because when the Fed puts rate hikes back on the table, oil surges on war, your RUT pattern has more aliases than a con artist, and your crypto specialist is having his first moment of genuine doubt…”

He looked at Kash, who was staring at his phone.

“…you drink something from an island that’s been battered by storms for centuries and still makes whisky.”

He raised his glass.

“To the OJ Pattern. May it finally pick a direction before we all go mad.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.