Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

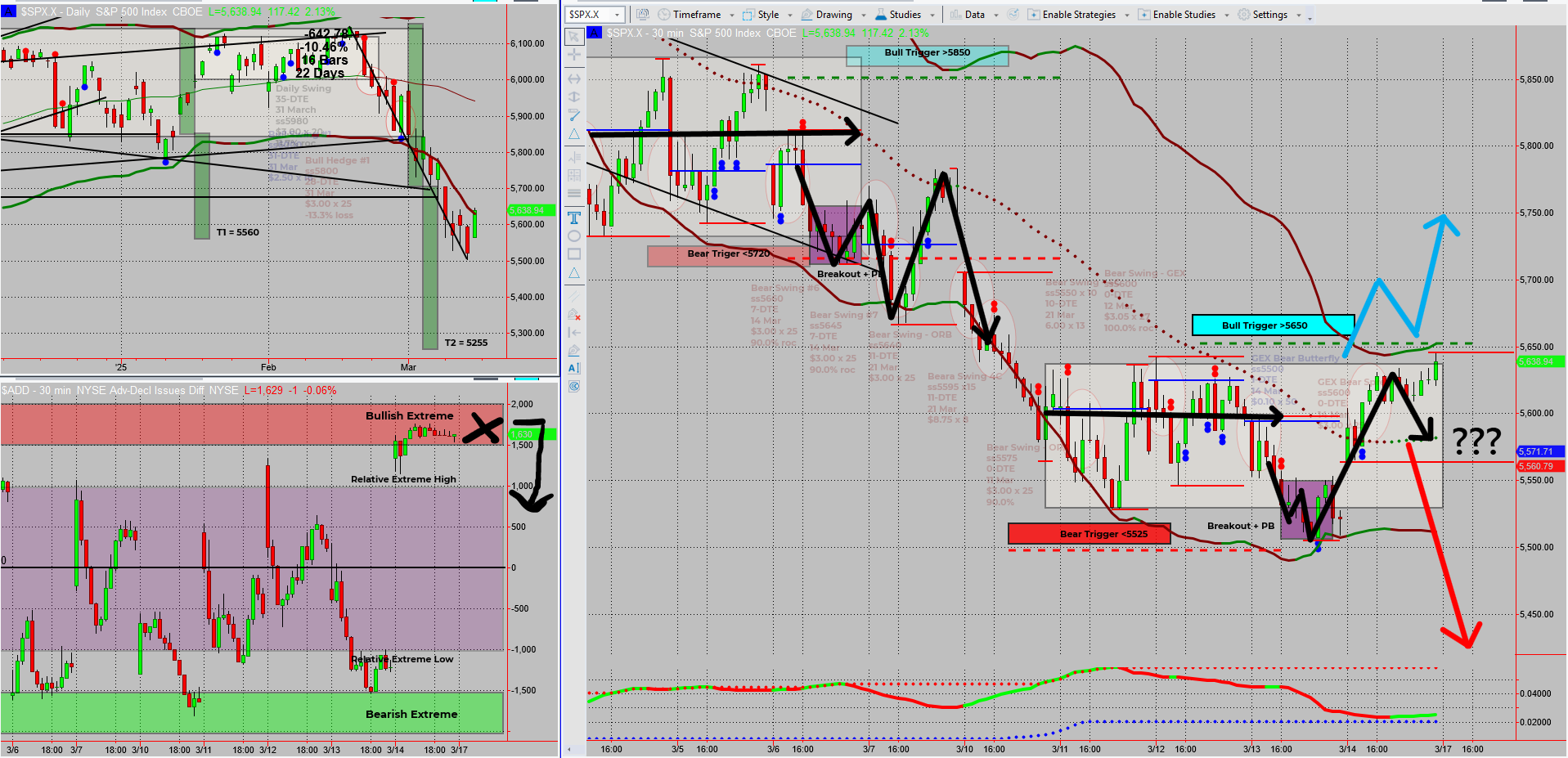

SPX feels like it’s stuck on a broken record—a little up, a little down, an occasional intraday yo-yo… and then back to square one. But this time, history might repeat itself—again.

- A bullish breakout isn’t off the table, but it needs to clear 5650.

- Until then, I’m riding the bear swing lower, watching for a final push.

- Friday’s rally took us to the upper range, but futures are hinting at weakness.

I’ve rolled some experimental GEX trades since I’ll be away from the desk Monday, checking in from St. Paddy’s Day festivities.

And if we get one last bearish flush while I’m raising a pint anf splitting the G? Even better.

Let’s break it down…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

SPX feels like it’s stuck in a never-ending soap opera—dramatic moves, wild swings, but ultimately going nowhere fast.

And just like a terrible plot twist you see coming a mile away, this setup looks eerily familiar.

Last time we saw this, SPX faked a move higher, sucked in the bulls… and then pulled the rug.

Will it happen again?

Well, I’ve seen this market dance to the same tune more times than I can count—so I wouldn’t be surprised if we get another short-term pop before the next move lower.

The Setup – A Repeating Pattern?

SPX continues to grind, teasing both bullish and bearish setups:

- Price is stair-stepping lower, but slowly—like a bear on NyQuil.

- Last time, a similar move faked higher, then dropped.

- Gamma Exposure levels point to 5500/5520 as price magnets.

- 5550 could act as resistance before another move down.

I like when history rhymes—it means I already have a plan.

The Trade Plan – Waiting for the Right Entry

I’m not rushing to flip bullish just yet—even though the temptation is always there when price hovers at the upper range.

✅ Bullish Breakout? Not touching it unless we see a strong breakout above 5650 AND a clean pullback entry.

✅ Bearish Reversal? Preferably near 5550, ideally with a pulse bar confirmation.

✅ Targeting the range lows at 5500/5520 if the move follows through.

And before you ask—yes, my bear swing is still open and nicely in the money.

My “Out of Office” Trading Plan

Because let’s be honest—I won’t be glued to the screens all day.

- I’ve rolled some Friday GEX trades since I’ll be away from the desk.

- The bear swing stays in place with exit orders set.

- Bullish moves likely won’t need my attention until Tuesday anyway.

- If the market dumps while I’m mid-pint, even better.

Oh, and just so we’re clear—it’s not a morning Guinness! My afternoon starts here in the UK just as the opening bell rings on the markets.

Looking Ahead – The Next Move

So, what’s next?

- If SPX dumps lower, I lock in my exits.

- If we rally, I wait for 5650 to break before considering bullish moves.

- If it continues the “Up a Day, Down a Day” grind… well, that’s what Guinness is for.

This market owes me nothing at this point—I’ve already stacked my wins.

For now, I’m letting the trades work, the charts breathe, and the St. Paddy’s pints flow.

Because markets move, profits compound, but Guinness waits for no trader.

Fun Fact

Did you know? The New York Stock Exchange was once closed every St. Patrick’s Day—until 1953, when they decided traders probably shouldn’t get an official day off for drinking.

The Lesson? Markets may evolve, but traders will always find a reason to take a break when they can.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece