Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

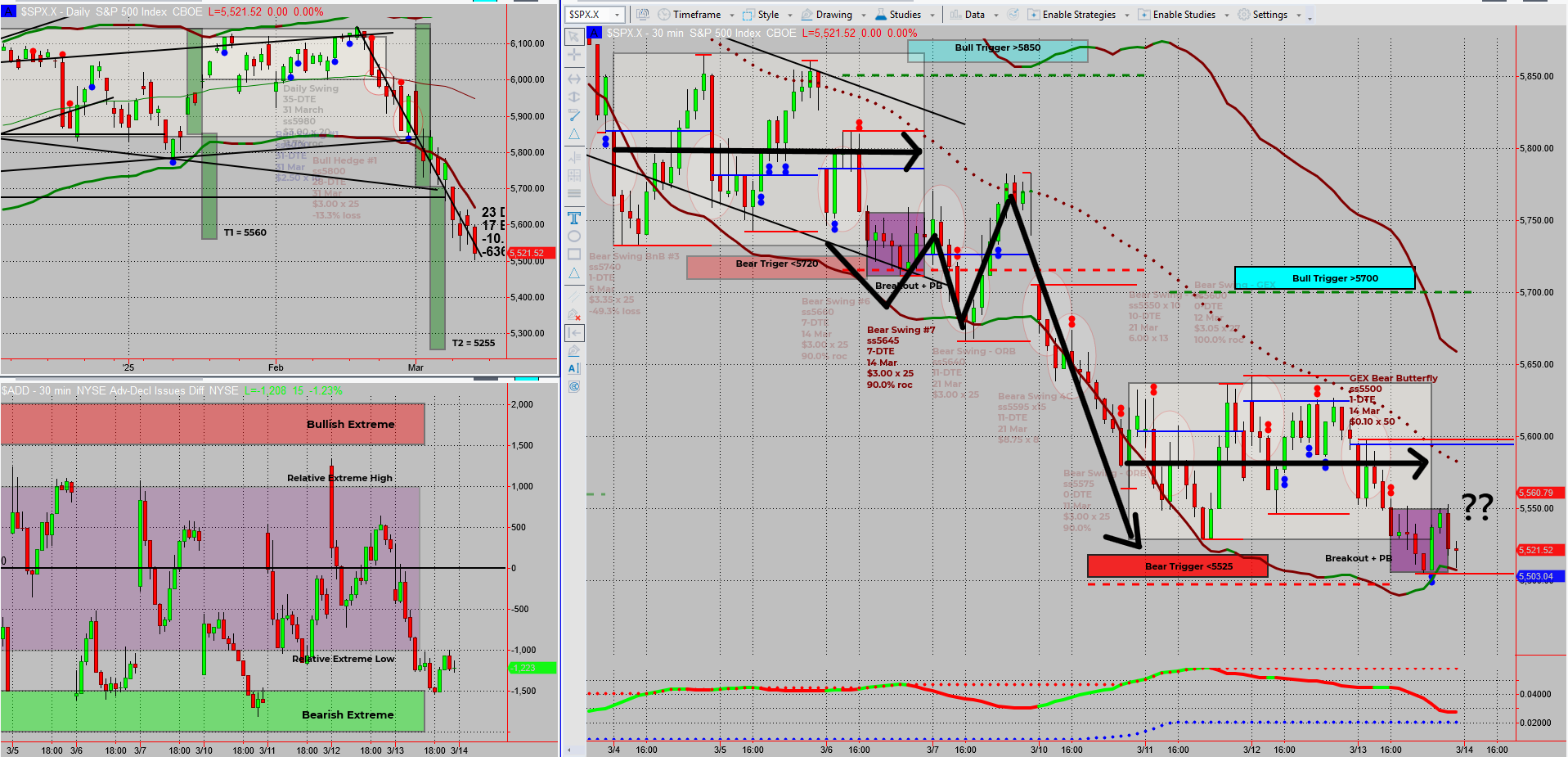

The lazy bear keeps rolling downhill, but if history has anything to say about it, it might just wake up for a quick stretch before heading lower again.

- Last time, SPX pushed down, bounced, then continued lower.

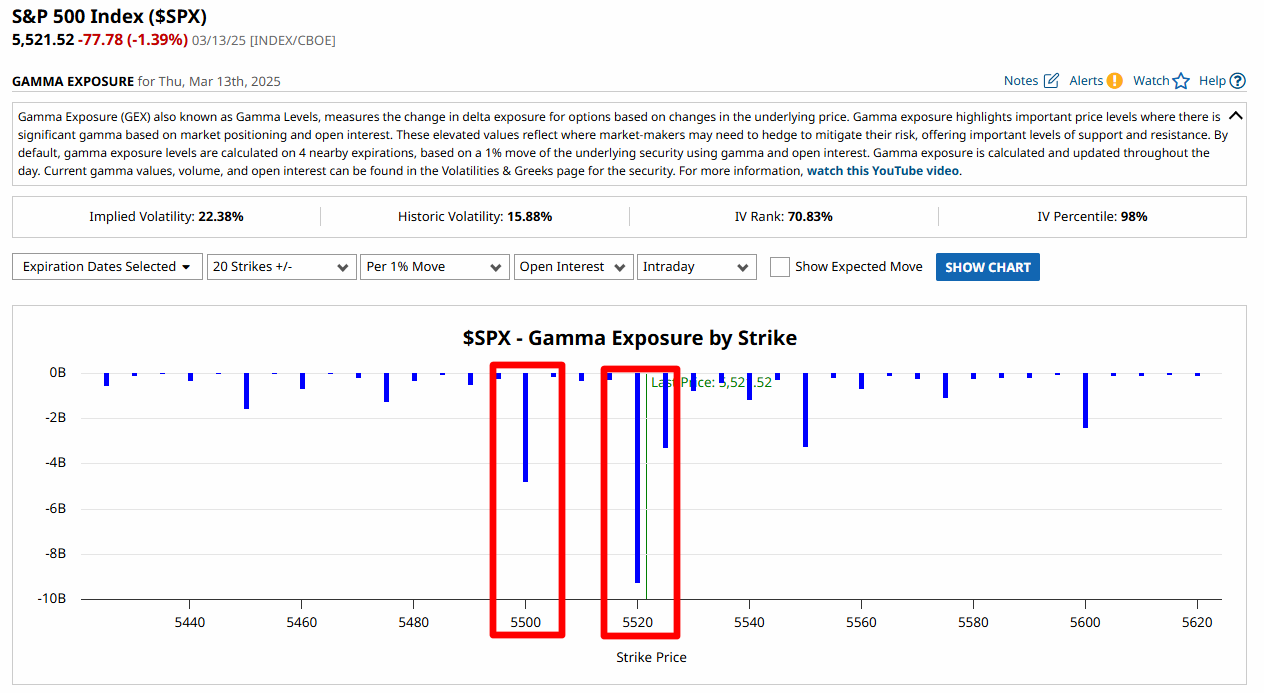

- Gamma Exposure suggests 5500/5520 are price magnets, with 5550 acting as resistance.

- A short-term pop before another drop wouldn’t be surprising.

With bear swings already unloading, profits are stacking up, but there’s still plenty of juice left in the move.

I’ll be watching for one more push higher before looking for the next bearish entry—unless the market decides to hand me a clean setup first.

Otherwise? I’m calling it early for some live music, a zoo visit, and a St. Paddy’s pint.

Let’s break it down…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

The market continues to stair-step lower, but like any good trend, nothing moves in a straight line forever.

The Setup – Is a Bounce Before the Next Drop Coming?

If you look at past price action, the last time SPX broke down, it:

- Pushed lower.

- Briefly popped back up.

- Then continued the descent.

Now, we’re seeing a similar structure forming.

GEX Levels Are Painting a Clear Picture

Using my new toy, Gamma Exposure, I’m watching:

- 5500/5520 acting as magnets—price is likely drawn to them.

- 5550 as a possible resistance level before rolling back down.

- If price rallies into these levels, I’ll be hunting bearish entries.

Trade Execution Plan – Stick With What Works

- Delaying bullish trade ideas until we clear 5700.

- Looking for reversal setups and pulse bars around 5550.

- Targeting 5500/5520 for a possible low-of-day move.

Profits Locked In—Time for a Break?

Bear swings are paying out, and I’m sitting in a good position with my exposure.

- Some tranches have already hit profit targets.

- If more reach exit targets, I’ll reposition if the setup aligns.

- Otherwise, it’s time to enjoy a well-earned long weekend.

The market can move without me for a couple of days—but if the setup is there, I’ll be ready to strike.

Saxophones, zoo visits, and a St. Patrick’s pint are calling.

Fun Fact

Did you know? The first recorded stock market crash happened in 1637—and it wasn’t stocks that crashed, it was… tulips.

The Lesson? Markets have been overreacting to hype for centuries. Whether it’s tulips, tech stocks, or meme trades, human nature never changes—only the assets do.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece