The Perfect Trading Strategy that new and experienced traders can replicate with ease.

This is the exact process that I used when I first got started trading full time (back in the day) to take a small $1,000 trading account all the way to $100,000;

- WITHOUT betting the farm on every trade – Just 0.5% per trade entry.

- WITHOUT spending all day looking at charts – Pick a direction and check in a few times per day – via mobile phone if you choose to.

All with the aim to take $1,000 and grow it to $100,000 in the shortest possible time.

Waaaay back when I first started trading full time, I took my tiny $1,000 trading account,

…and in the next 8 months, multiplied it into $92,549 (and change)

I’ve since done this several times over the years, just to know that I could still [air fingers] “do it”.

In the first month of the year’s trading challenge, my, again, little $1k Trading Challenge account is already up 31%

Which, I’m sure you will agree, is an amazing start and sparked a lot of interest as I talked about it publicly.

This is when I was encouraged to open up the door to a public “ride-along” version of the trading challenge which is why you’re reading this and I will shortly outline the exact process I’m using.

What is even better is that in the first month of the public $1k to $100k challenge that as a member you are able to replicate and create your very own version of the $1k to $100k challenge, just like Jared who hit the ground running at full speed with a 37% gain on his test account.

The process is simple and getting fast results for traders, just like you.

The big question is;

How do you do it?

The answer is as simple as these 5 steps.

- Pick a direction.

- Trade in that direction.

- Set achievable targets.

- Risk really small position size.

- Always put the next trade on.

Simple, right?

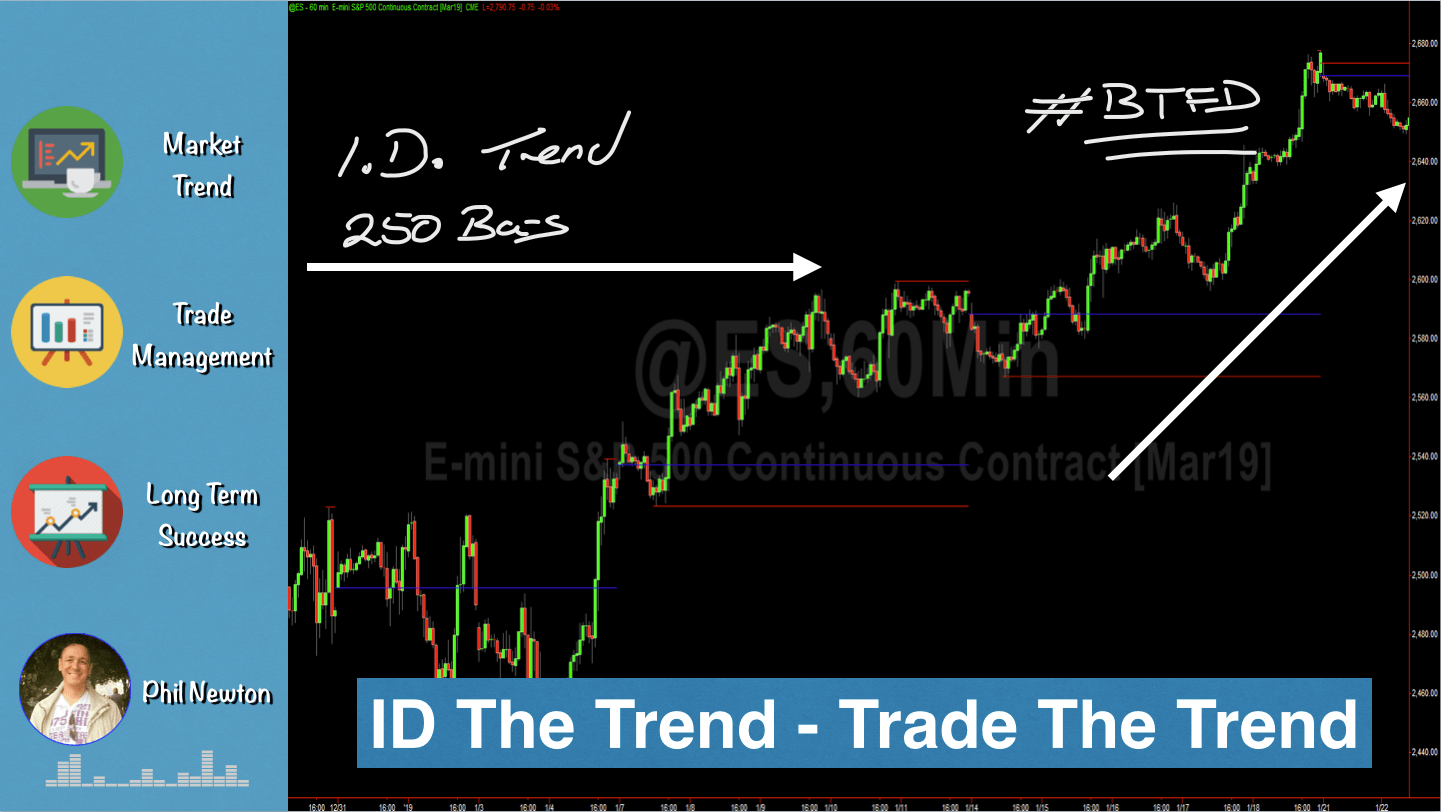

1 – Pick a direction.

I’m sure you have heard the popular phrases such as;

“…Trade the trend…” or “…The trend is your friend (until the bend at the end)…”

My personal favourite is #BTFD which stands for “…buy the F* dip…”

The problem is that many new and old traders alike do not first figure out which way the trend is or if there is a trend in the first place.

This is so important and it is the single biggest step that is dropped or left out.

Consider that if you are a trend trader, just like me, and if you’re planning to buy the dip in an uptrend, then knowing that there is a trend and which way that trend is pointing is going to be really important.

The logic holds true if you’re a counter-trend trader or a range trader or a breakout trader or one of those pesky perma-bear short only sellers.

Whatever your preferred style of trading is you really need to know this. If you know which way the trend is, that will dictate what to do next.

The trend is always relative to the time frame you’re assessing, so don’t get caught up with all that multiple time frame nonsense. These days I prefer to assess and trade from 1 single time frame and have don’t for almost the entirety of my 20+ year trading career.

One way to simply assess direction is to make sure you have at least 250-300 candles/bars in view on your chart.

Look at the entire chart.

There are only 3 things that can be interpreted on a price chart;

- Trend up

- Trend Down

- Trend Sideways

There is also a not so secret number 4 which is that the trend is undetermined or a little bit of everything.

I always want to see the entire chart and I’m looking to see one thing…

Up, Down or sideways.

If you can’t tell, leave it alone.

No matter what tools you use or trading philosophy this is the one thing everyone agrees with and as we have established, the direction is important to know for long term trading success.

A question I get asked a lot about determining the trend is;

“Can I use tools or indicators to help recognise the trend?”

The simple answer is yes.

We use a simple tool in the $1k to $100k trading challenge to make the interpretation less discretionary and easy to assess for everyone regardless of skill level.

In fact, the way we do it in the $100k challenge is 100% mechanical.

There are quite literally hundreds of tools that you can use to help you consistently determine what the trend is and as a result what you should be doing next in your trading routine.

I truly believe that it does not matter which tool as there is no such thing as “the best tool for trend trading”.

They all do approximately the same thing around the same time and it makes no difference to the philosophy that I am describing here. Trade the trend.

The tool you use is simply a tactic to consistently apply the strategy I’ve described, trade the trend. This is how you determine the trend.

Pick a tool you like or have heard of but most of all have confidence in using this on a regular basis.

The full description of exactly what tools are being used and what the precise settings are in explicit detail as a part of the $1k to $100k trading challenge training.

2 – Trade in that direction.

Once you have the challenge trend method, you can now set your sights on trading the trend.

This does not have to be complicated and In all my years of trading, I have used a simple price pattern called a pullback to enter into my positions as well as a means to add into positions.

A pullback is made up of a push in the same direction as the trend you have identified followed by a smaller retracement (or correction) in the opposite direction.

In real-time, the size or depth of that pullback will always be unknown until the price starts to resume the trend direction. My point is that you do not need to know that to get the trade set up and ready.

Let’s assume that the trend is up for a moment which means that I now know I will be buying the dips in an uptrend (conversely I could be selling the rallies in a downtrend).

Price then needs to be pushing higher and the individual bars/candles will be making a series of higher bar highs.

The pullback is confirmed on the first bar not to make a new individual bar high.

At that point, I can place my entry.

The full description of exactly what is involved in a pullback including the entries and stop loss placements for risk management are in explicit detail as a part of the $1k to $100k trading challenge training.

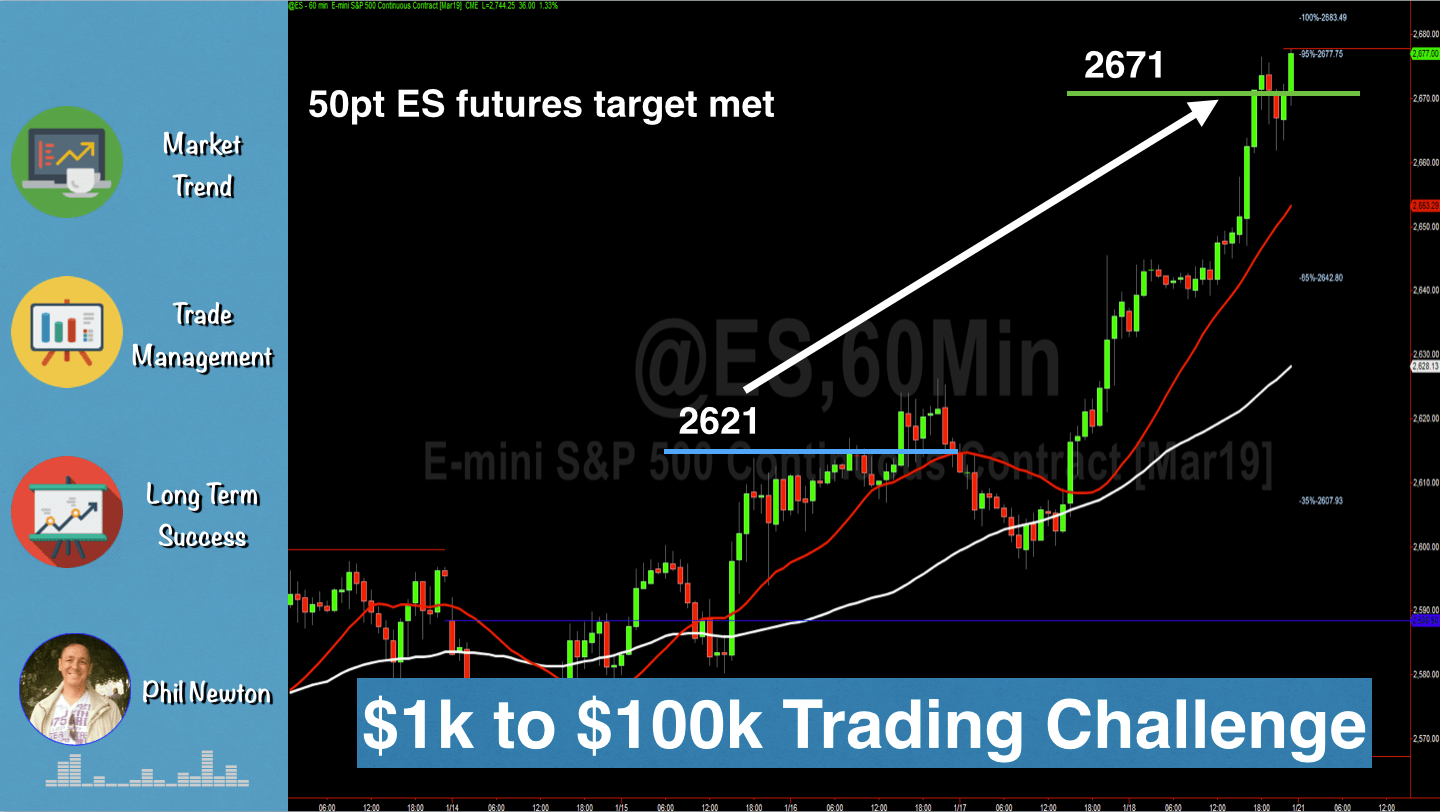

3 – Set achievable targets.

Setting targets is something that most traders get wrong either from not having any idea of what to expect and where to get out of a position.

Going to the other extreme a trader will try and “swing for the fence” and have a massive and unrealistic target expectation.

As with everything in the $1k to $100k trading challenge that is done and taught, it is simple.

This is something so simple that once you have been told it you can easily apply it. The only thing you then need to do is to do it.

Consider for a moment the $1k to $100k challenge strategy has a goal to get paid on positions at the end of every week.

It is then really important to know what a typical move looks like during an average week.

Interesting and simple isn’t it?

Let us take it one step further because the problem with averages is that it is an average and sometimes price moves more than the average and sometimes it moves less than the average.

Additionally, the average of the period you measure, albeit very slowly, is always expanding and contracting.

Rather than aim for all of the average every week, the $100k challenge strategy aims to capture just a portion of it.

This way it ensures that, at least for the majority of the time, the challenge expectations are achieved every week.

For example, If the weekly average on the Dow futures is 1,000 points (it is as I type this) and aim for at least 50% of that average. There is a high probability that the goal of 500 points can be met each and every week, maybe even twice per week.

I can almost hear the forehead-slapping going on as you re-read that last explanation.

The full description of exactly what is involved in setting targets as well as which markets or individual stocks/ETFs are worth trading in explicit detail as a part of the $1k to $100k trading challenge training.

4 – Risk really small position size.

Entire books have been written on the subject of risk and they are all correct to a point. They mainly talk about what is an acceptable risk for maximising the profits of your position relative to your account equity.

Which on face value sounds great, if you risk x your going to get the maximum $ returned.

What they don’t talk about is being able to put the next trade on or weathering the storm of a bad period in your trading strategy because that is the one thing that is certain you will have them and most won’t ever consider, so let me say it…

You will experience losses.

As such stop focusing on how much money you could make and start protecting against the downside when things don’t work out.

This is the main difference between a novice retail trader versus a professional and successful market trader;

- The novice trader focuses on how much money they will make.

- The professional trader focuses on how little they can lose.

Do you want to continue doing what everyone else does and continue to fail at it?

Or do you want to be like professional traders?

Trade small. Protect against bad market conditions and drawdown cycles in your strategy.

Always be in a position to be in business tomorrow and ready to place the next trade on as per your strategy rules.

Profits are a by-product of successful strategy implementation and protective risk management.

Ultimately, trade small. Really small.

The full description of exactly what is involved in how to set up my risk management and position size in explicit detail as a part of the $1k to $100k trading challenge training.

5 – Always put the next trade on.

The mind is a funny and fickle thing or at least the conscious mind is. We often think we know better because emotions get in the way and take over.

The reality is this, nothing is better than evidence-based decisions. The great thing about the $100k challenge strategy being used is that, at its most basic, it is mechanical in its application.

The hardest thing for traders new and experienced alike is the emotional need to be right on every trade.

The evidence in the results of the strategy is proving to put the next trade on and that you do not need to be right on every trade.

Just like a real-world business, you just need to be right on average to make a successful business and profit from trading.

Trading a really small position size helps with this and the long term application of any trading strategy.

The textbooks advocate the use of 2% of your account equity to be used on individual trades. The same textbooks often say to increase your position size as soon as you can because you can.

I personally think this is way too big and way too soon.

After all, if you cant put the next trade on from fear or take the current position off from greed only to see whatever profits you could have had disappeared without you, then what is the point of all of this.

I practice and teach the use of 0.5% of account equity to be allocated to a single entry. I only increase my position size once I can handle the drawdown phases of my strategy so that I never have to reduce my position size.

This way I will always get the best of account protection and account growth at the same time.

As a $1k to $100k challenge member, you receive daily support in the slack member’s group to help you master yourself so that you can follow your trading plans and see success as a part of your unique $100k trading challenge journey.

In conclusion…

You can now see that trading does not have to be complicated. All you need is this simple to apply a strategy that has a positive expectancy, which is just the fancy way of saying that it makes money on average.

All you need to do is make sure you have these 5 elements in your trading strategy.

- Pick a direction.

- Trade in that direction.

- Set achievable targets.

- Risk really small position size.

- Always put the next trade on.

And if you need a strategy to call your own I explain what I am doing in full detail in my $1,000 to $100,000 trading challenge.

It is the same strategy I am using myself to take a small $1,000 account to $100,000 in the next 12-months.

It is also the same strategy that the challenge members are using for their own trading challenge.

I’ve used this same strategy to manage a small trading fund where I had $10-million in assets under management.

Every trader has their own trading challenge.

Some are starting with $5,000 and want to aim for $25,000 while one member is starting with a little over $90,000 in his IRA account.

The point is you can start where it makes the most sense for you and your situation.

When you’re ready, come and join us. Start your own successful trading challenge.