Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

What do you do when a trade gets tricky? The latest bullish move unfolded just as expected—until the market turned quickly.

My usual break-even exit wasn’t possible, but instead of taking a hit, I managed my trades strategically.

The result? A profitable outcome instead of a loss. Let’s break it down…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

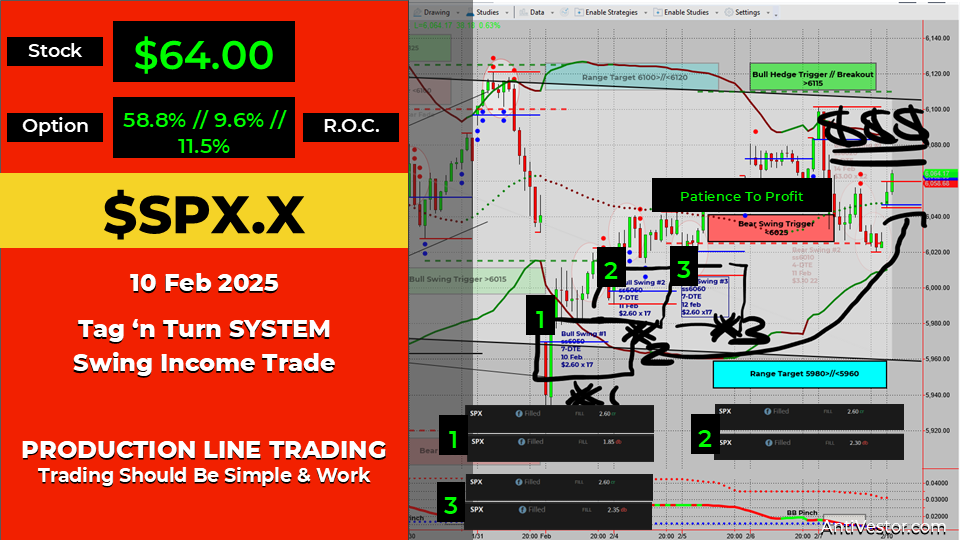

The Setup – Aiming for Range Highs

As we discussed in daily analysis and Fast Forward Live Calls, the plan was simple:

- Buy at range lows

- Target the range highs

This worked… mostly. But then, things got interesting.

The Quick Turnaround – A Challenge

- The bearish setup came in fast

- My usual break-even or better exit wasn’t available ❌

- With time still on the clock, I adjusted my approach

The Solution – Playing It Smart

Instead of rushing out of the trade, I:

✅ Placed a bearish trade to hedge risk

✅ Waited for a better exit on my bullish positions – Theta decay is my friend!

✅ Used the flexibility of income trading to let the trade breathe

The Results – Turning a Tricky Trade into Profits

- Collected $2.60 x 3 (for each entry)

- Trade 1 closed at $1.85 → 58.8% gain

- Trade 2 closed at $2.35 → 9.6% gain

- Trade 3 closed at $2.30 → 11.5% gain

⚖ Why This Works in Income Trading (But Not Futures)

With SPX income trading, I only needed:

✅ 1 cent past the short strike to hit max gains

✅ No reliance on a big directional move

✅ Time to let the trade work in my favour – Theta burn baby!

Compare this to futures or long calls/puts—where you need big price moves or you’re out of luck. With income trading, I was able to adapt and still profit—even in a tricky situation.

Bottom Line?

This is why I love income trading—it gives me more control, more flexibility, and better ways to manage risk.

Fun Fact:

Did you know? In 2010, Apple’s stock price was under $30. Today, even after multiple stock splits, it’s worth well over $180 per share.

The Lesson? The right strategy matters more than just picking the right stock. Apple boomed, but timing and market conditions dictate whether you profit or not—just like in trading.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece