Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

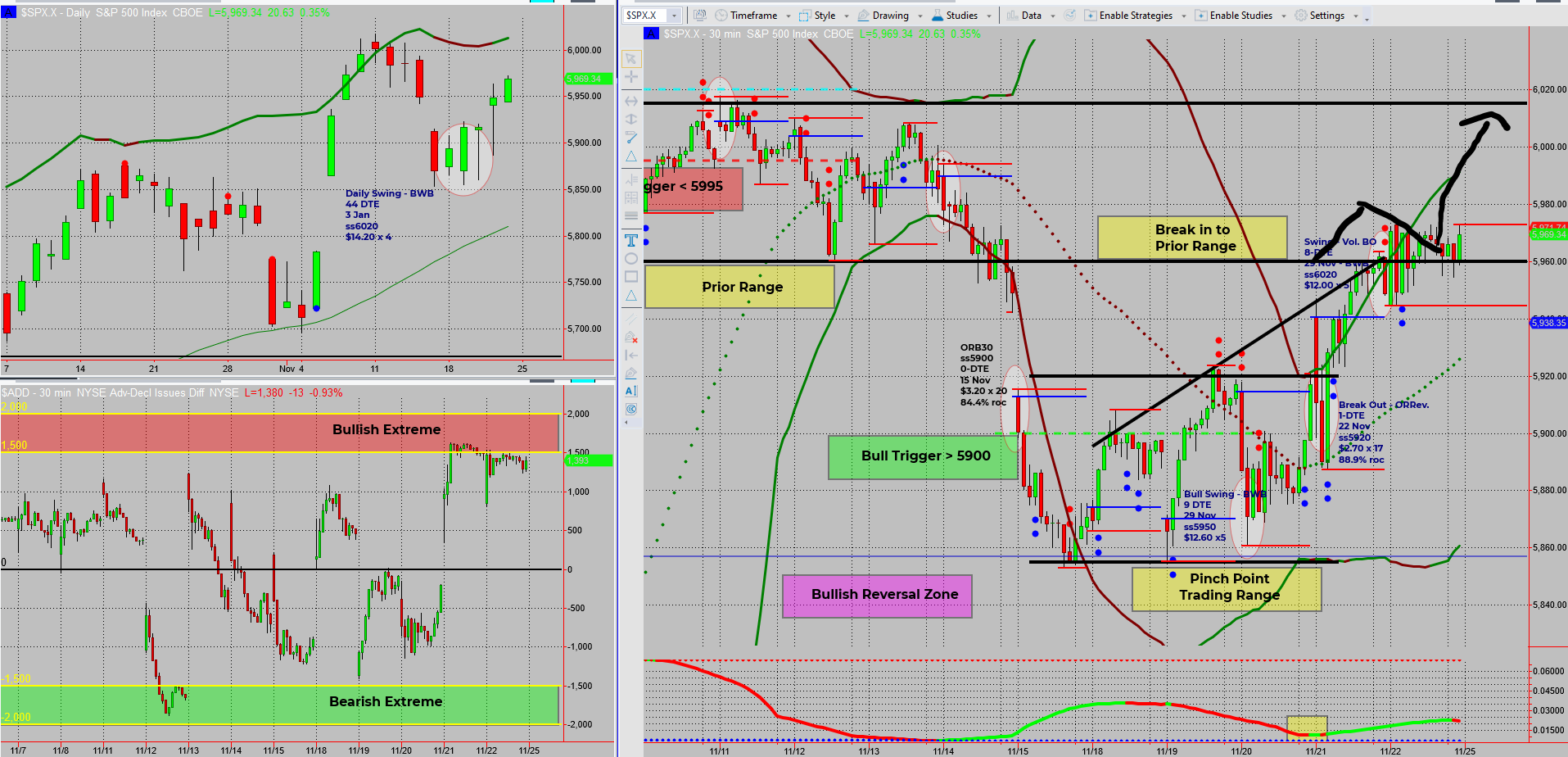

SPX keeps sailing higher, breaking patterns, and proving why mechanical systems trump gut feelings. As the market inches toward new highs, let’s dive into why emotional and unproven trading trading leaves bears stranded, and why the “Tag ‘n Turn” setup keeps cashing in.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

Last week’s breakout didn’t just push higher—it completely negated the much-hyped island reversal pattern. For many bears, it’s been a frustrating ride, caught off guard by the reversal and trapped in a market turning against them.

- The Lesson? Don’t rely on old, untested patterns from “that book” everyone loves quoting.

- Mechanical routines, like the SPX Income System, keep emotions & opinions out while the profits keep profits flowing.

Why do these patterns fail? Because trading isn’t about blindly trusting decades-old theories—it’s about finding and proving what works today.

Enter the “Tag ‘n Turn” setup.

This mechanical, proven system thrives in volatile markets, delivering multiple steady wins per week. Instead of reacting emotionally, it focuses on the data and the edge.

- Last week’s stats:

- Steady profits on breakout moves.

- Bullish momentum continues toward new all-time highs.

As SPX inches closer to record levels, the takeaway is clear: Stick to what works. Don’t get caught chasing unproven setups.

Fun Fact

The SPX (S&P 500) wasn’t always 500 stocks! In fact, when it launched in 1957, it was one of the first indices to use computers to calculate its value.

While it’s called the S&P 500 today, its predecessor, the Standard & Poor’s Composite Index, began in 1923 with only 90 stocks. The leap to 500 in 1957 was a groundbreaking move, making it one of the most comprehensive measures of the U.S. economy at the time. Today, it’s rebalanced quarterly, ensuring it reflects the most significant companies in the market.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece