Ahoy there Trader! ☠️

Ahoy there Trader! ☠️

It’s Phil…

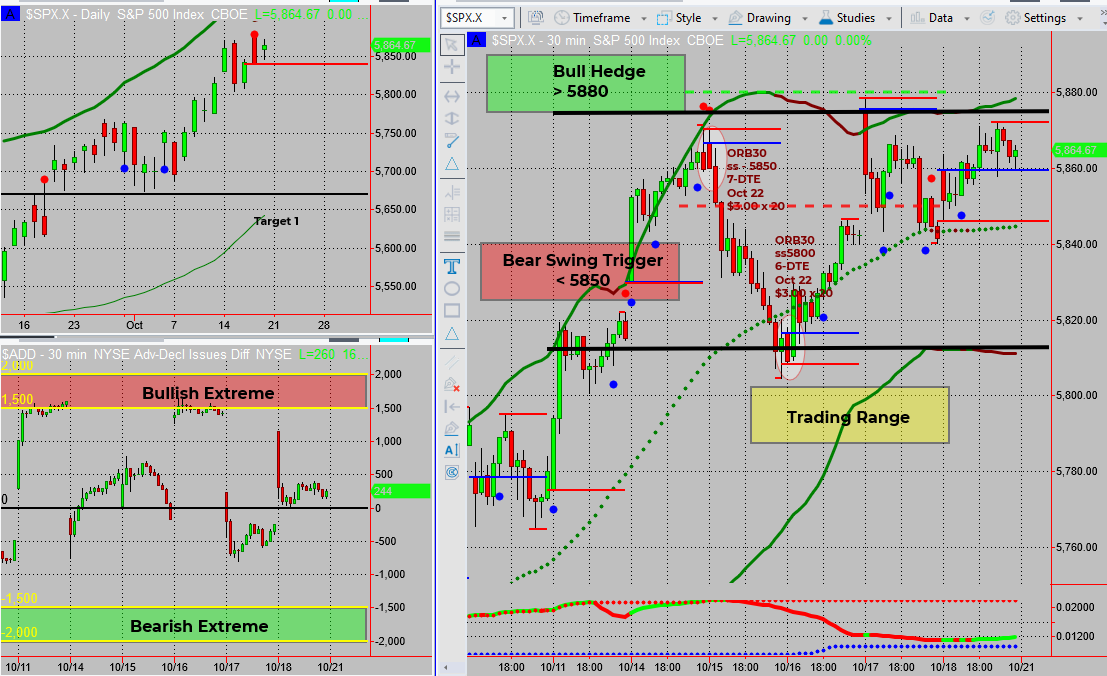

The SPX is back in a contraction phase, with Bollinger Bandwidth at its lowest in 150 bars. Traders now have the option to either wait for a breakout or engage in range trading. It’s a time to strategize and capitalize on market movements!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The market has contracted and expanded like a yo-yo, and here we are back in a sideways shuffle. The Bollinger Bandwidth is at one of its lowest points in the last 150 bars, signaling that a decision must be made.

As we navigate this familiar territory, we have two primary choices:

- Wait for the Breakout: Keep your eyes peeled for that magical moment when price decides to leap outside the range.

- Trade the Range: Embrace the classic back-and-forth dance, capitalizing on both bullish and bearish movements within the defined limits.

When the market behaves like a coiled spring, profits await those ready to act!

Fun Fact

Did you know? The SPX has had more than 30% of its trading days within a narrow range of just 1% since 2000! This highlights how often markets can consolidate before making significant moves.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece