SUB HEADLINE

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

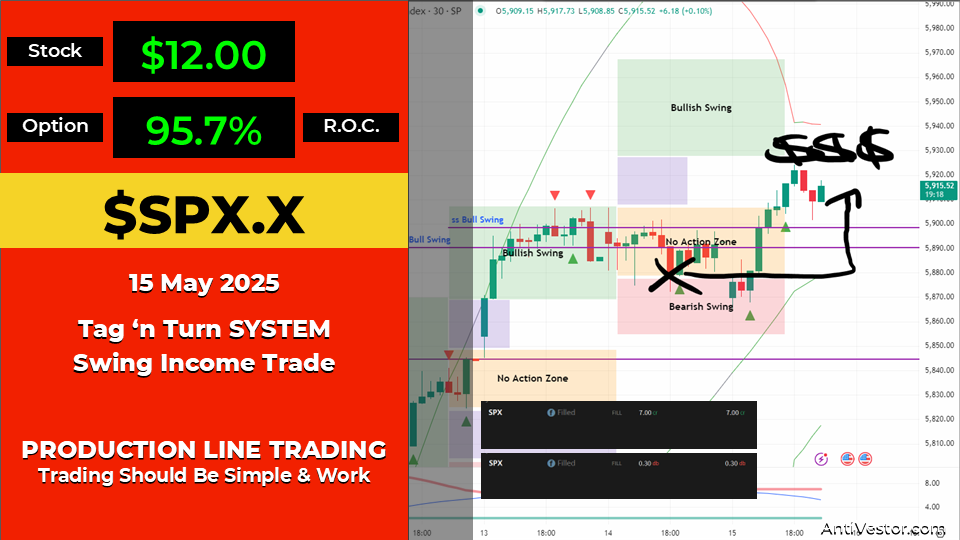

Another day, another overnight win – this time a clean 95.7% return on capital while most traders were still undecided about direction.

Yesterday’s premarket read was simple but powerful: SPX stayed firm above the bear trigger, and with end-of-month expirations approaching, we suspected a likely pin around 5900. That gave us the confidence to fire off another overnight credit spread.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX De-Briefing

We collected $7 in premium on the trade and closed it out mechanically this morning for just $0.30 – a textbook exit with 95.7% ROC.

What’s interesting is that the SPX barely moved. A modest $12 push higher was all it took to keep the trade safe. No big breakout, no violent reversal – just a sideways lean that played perfectly into our setup.

This trade was never about prediction. It was about positioning. We respected the data, followed the plan, and let the system do its thing. And just like that, we added another notch to this week’s win streak.

And let’s not forget – no losses this month using the updated overnight process. That’s what staying mechanical gets you: quiet confidence and reliable results.

Long live the profits.

Expert Insights:

Mistake: Chasing momentum on indecision days.

Many traders saw SPX hesitate yesterday and assumed a big move was coming. The result? Impulsive trades, emotional decisions, and inconsistent results.

Fix: Follow the system, not the suspense.

The real edge came from recognising the range-bound behaviour and leaning on a conservative credit spread that capitalised on time decay – not direction. That’s where consistency lives.

Rumour Has It…

“CBOE Traders Report Mysterious Noise at 5900 – ‘It’s Just Premiums Dying'”

In a strange turn of events, floor traders at the CBOE reported a faint “sizzling” sound around the 5900 strike. One veteran market-maker described it as “like bacon… but more expensive.”

Authorities confirmed it was just another wave of premium decay vaporising under the weight of zero movement. Experts warn the pinning effect could intensify if traders continue trying to “will” SPX into a direction.

Retail traders, meanwhile, have been told to “just sell the range and go outside.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Option Decay Doesn’t Sleep – Especially in Ranges

Even when SPX moves just $12, as we saw overnight, time decay continues doing its quiet work. This is what makes overnight income trades so powerful – especially when your strike selection aligns with a high-probability range.

In this case, a $7 credit collected and a next-day close at $0.30 might seem like a small win – but with a defined risk profile, it becomes a 95.7% ROC example of how non-directional profits are just as valid.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.