Futures Drift 30 Points Into Bear Trigger – Not Jumping Yet

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Another day, another dollar – even if the market was flatter than a deflated souffle on a gluten-free diet.

Yesterday gave us next to nothing in terms of direction, but that’s just fine when you’re running a premium system. We got paid anyway – a near max profit just before the closing bell, even as price moved against the entry.

That’s the beauty of edge.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX Market Briefing

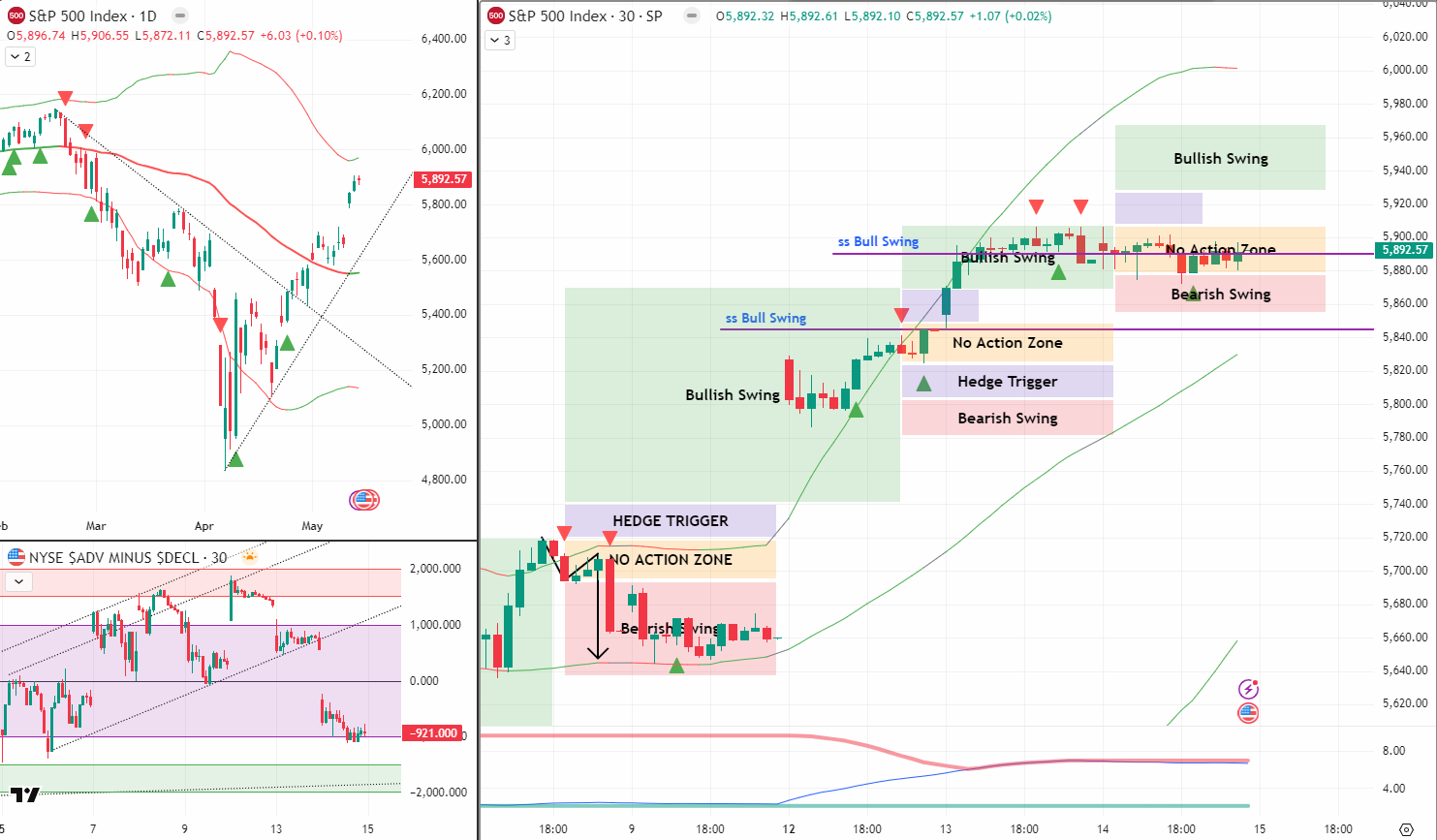

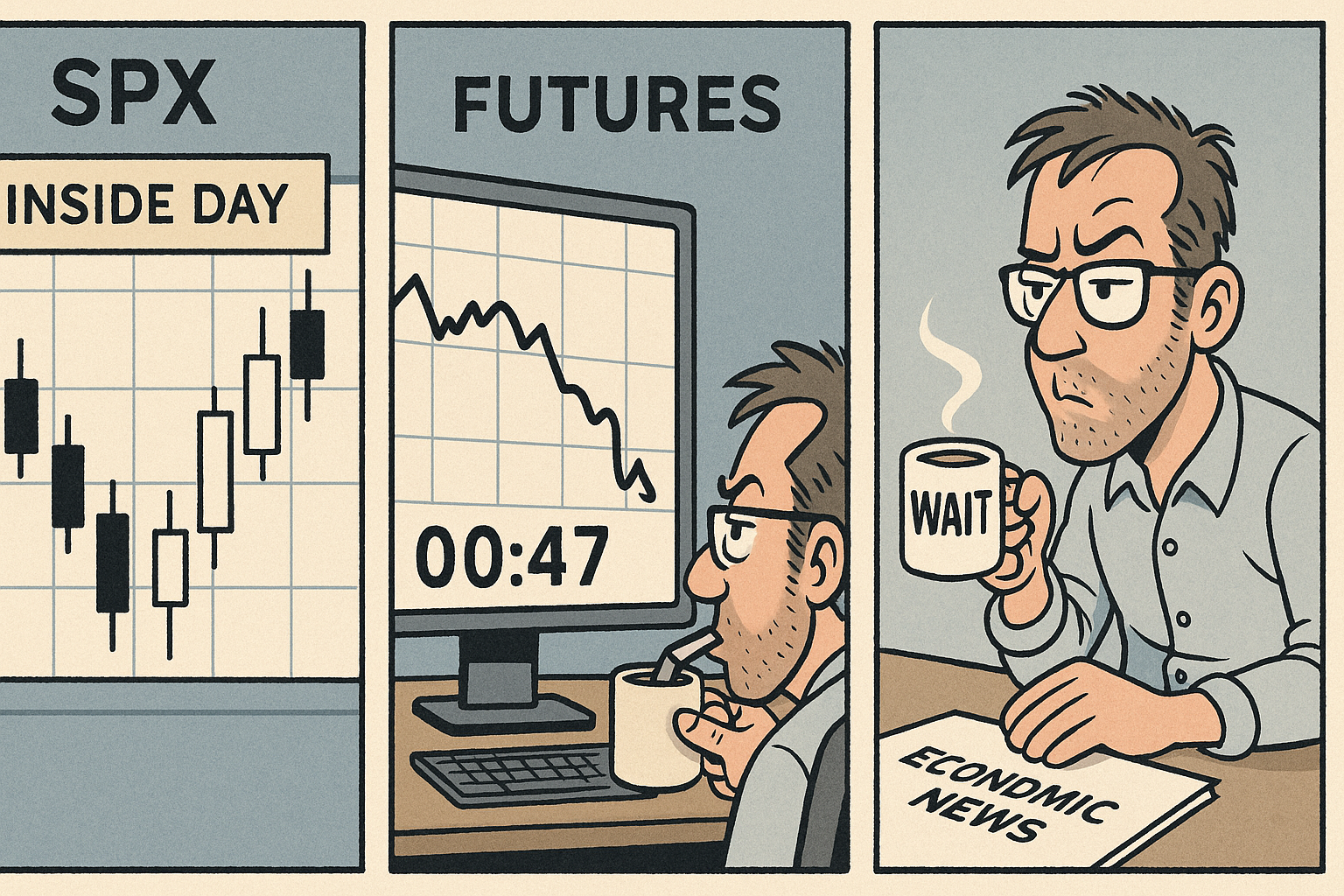

Yesterday wrapped with an inside bar on the daily chart – a clear sign of indecision, or more accurately, range compression.

Inside days often act like traps. They’ll break one side early, then flip hard in the opposite direction. On the 30-minute, that structure’s already showing. Today’s overnight futures? Drifted ~30 points lower – not a collapse, just a slow grind. And that grind will have us gapping into a bearish Tag ‘n Turn setup right at the open.

Technically bearish? Yes.

Emotionally confident? Not quite yet.

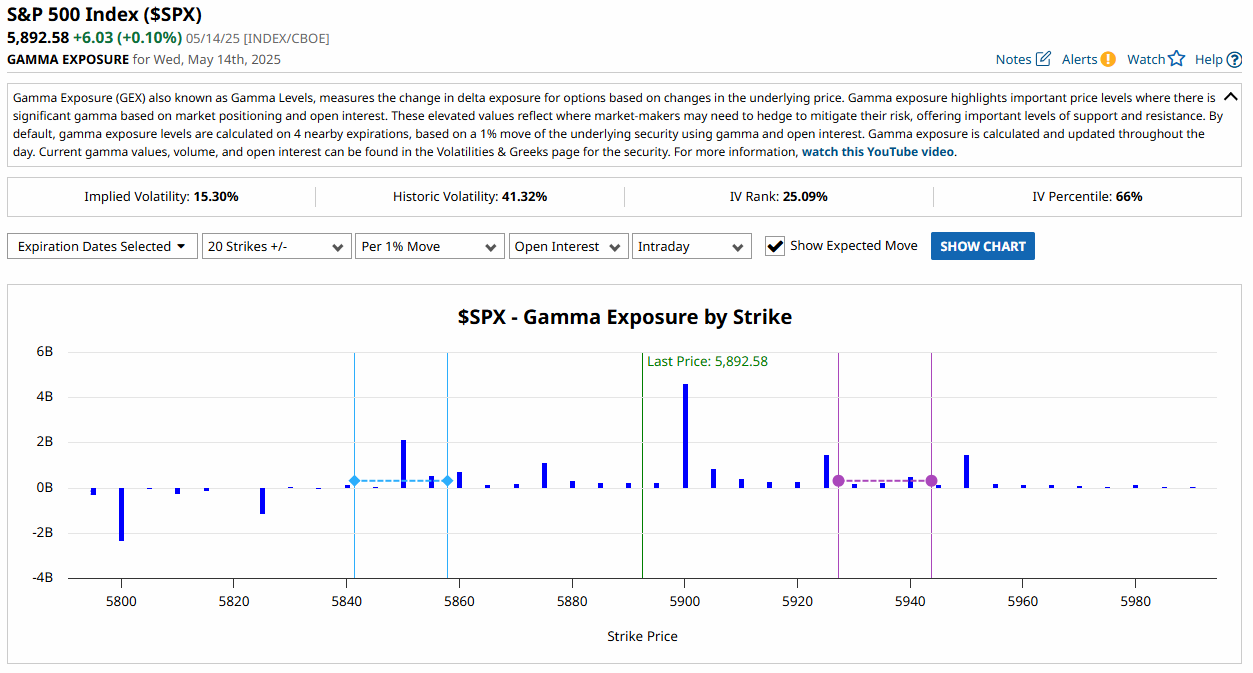

GEX is still showing 5900 as the positive gamma wall, and 5850 as the flip-to-negative level. If 5850 holds, we could see a snapback toward 6000 – not a technical prediction, just what the inner voice is whispering.

Add to that: we’ve got a round of news an hour before the open. That alone is enough to hold off – and if we do get a news pop, I’d rather be flat than trapped.

The plan?

No blind entries at the open.

Wait. Watch. Let price commit.

Trade decision likely by lunchtime once the market tips its hand.

GEX Analysis Update

- 5900/5850

Expert Insights:

Mistake: Acting on the first breakout from an inside day

Fix: Treat early breaks with caution – the first move is often the fake one

Mistake: Jumping into gap setups without futures confirmation

Fix: Wait for futures structure to align – especially after overnight drifts

Mistake: Ignoring gamma levels when timing entries

Fix: Know your walls – today’s 5900 cap and 5850 pivot zone could define the day

Rumour Has It…

Inside Day Breaks Market’s Will to Live

In a breaking report from the AntiVestor Chaos Desk, analysts confirmed the SPX officially moved “just enough to ruin everyone’s trades but not enough to actually do anything.”

Sources claim the inside bar was engineered by bored quants with “just a little spice left in the tank.”

One confessed: “We flipped a coin to choose direction. It landed sideways.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Most traders underestimate the power of non-directional income.

Inside bars, grindy sessions, and overnight flatness are usually dismissed as “wasted days.” But to a premium seller? That’s the good stuff.

The tighter the coil, the faster the decay – and that’s when we step in and collect.

Meme of the Day

“Let them fight. I got paid inside the range.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.