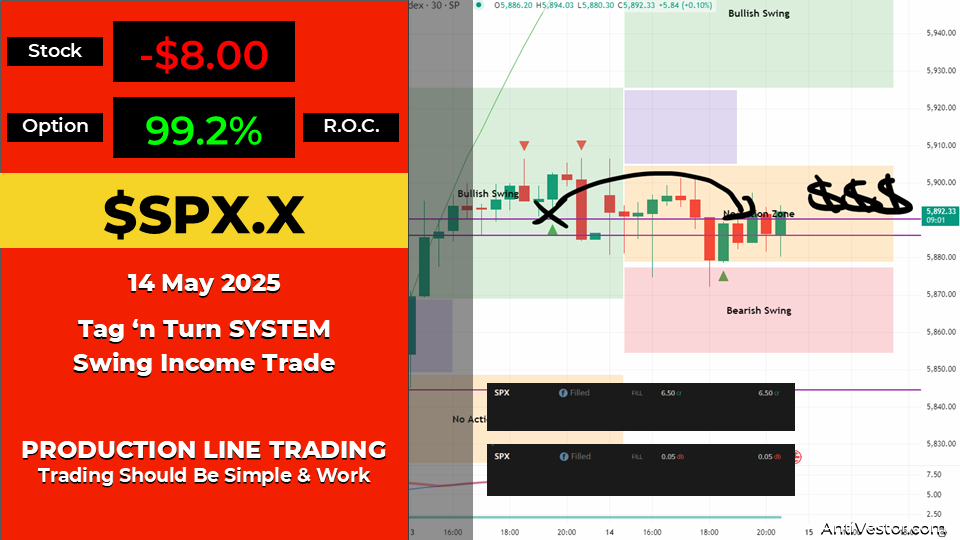

Setup Voided, Bias Flipped – $6.50 In, $0.05 Out

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Another day, another win – and this one was all about staying mechanical, reading the signal, and letting the market do the work.

We started the day expecting to flip bearish… but the system had other plans.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX De-Briefing

The original game plan was to follow a late-day bearish Tag ‘n Turn setup from yesterday – and flip accordingly.

But the market said “not today.”

The setup voided through the hedge trigger – and since I had nothing to hedge, the next move was simple: get bullish.

With my prior positions closed profitably, I opened a new 7-DTE income swing, following the usual playbook. A bit later, a clean bullish pulse bar gave me the green light to add a 1-DTE overnight swing.

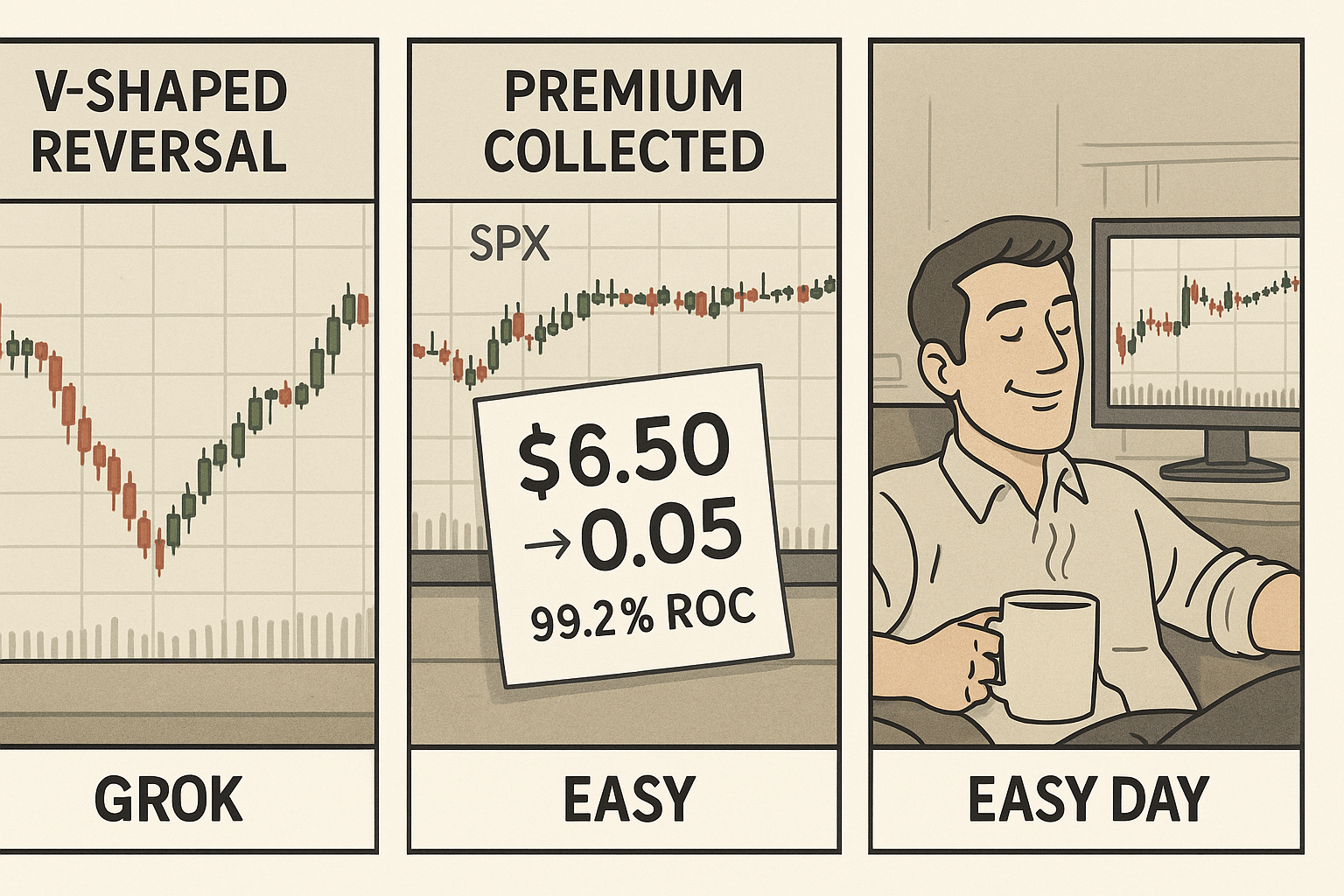

And then… price did nothing.

Which, as any premium seller knows, is exactly what you want.

No panic. No run. Just a flatline drift while the clock did the heavy lifting. By morning, both trades were in the money and the 1-DTE was closed. $6.50 in, $0.05 out, a 99.2% ROC, and zero drama.

That’s the beauty of the system – mechanical setups, stacked probabilities, and strategic re-entries.

Viva the income trade.

Expert Insights:

Mistake: Sticking with a bias after the market flips

Fix: Let the hedge trigger speak – if the setup voids, reposition

Mistake: Forcing action when price goes flat

Fix: Premium sellers don’t need movement – they need no breakdown

Mistake: Overthinking multi-day setups

Fix: Clock works in your favor – rules, time, and patience print profits

Rumour Has It…

SPX Sideways Drift Declared National Holiday by Premium Sellers

The United Federation of Income Traders has declared “National Drift Day” after SPX flatlined for hours, leading to a record-high payout rate for 1-DTE sellers.

“Nothing happened and we all got paid,” said one trader while sipping celebratory coffee. “Honestly, it’s the dream.”

Volatility was unavailable for comment.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Traders chase big moves. Premium sellers? We chase stillness.

The irony? The less the market does, the more we get paid – especially when we’re correctly positioned.

Flat price. No fear. Just decay working for you.

Meme of the Day

“Flat all day – 99.2% paid anyway.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.