Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

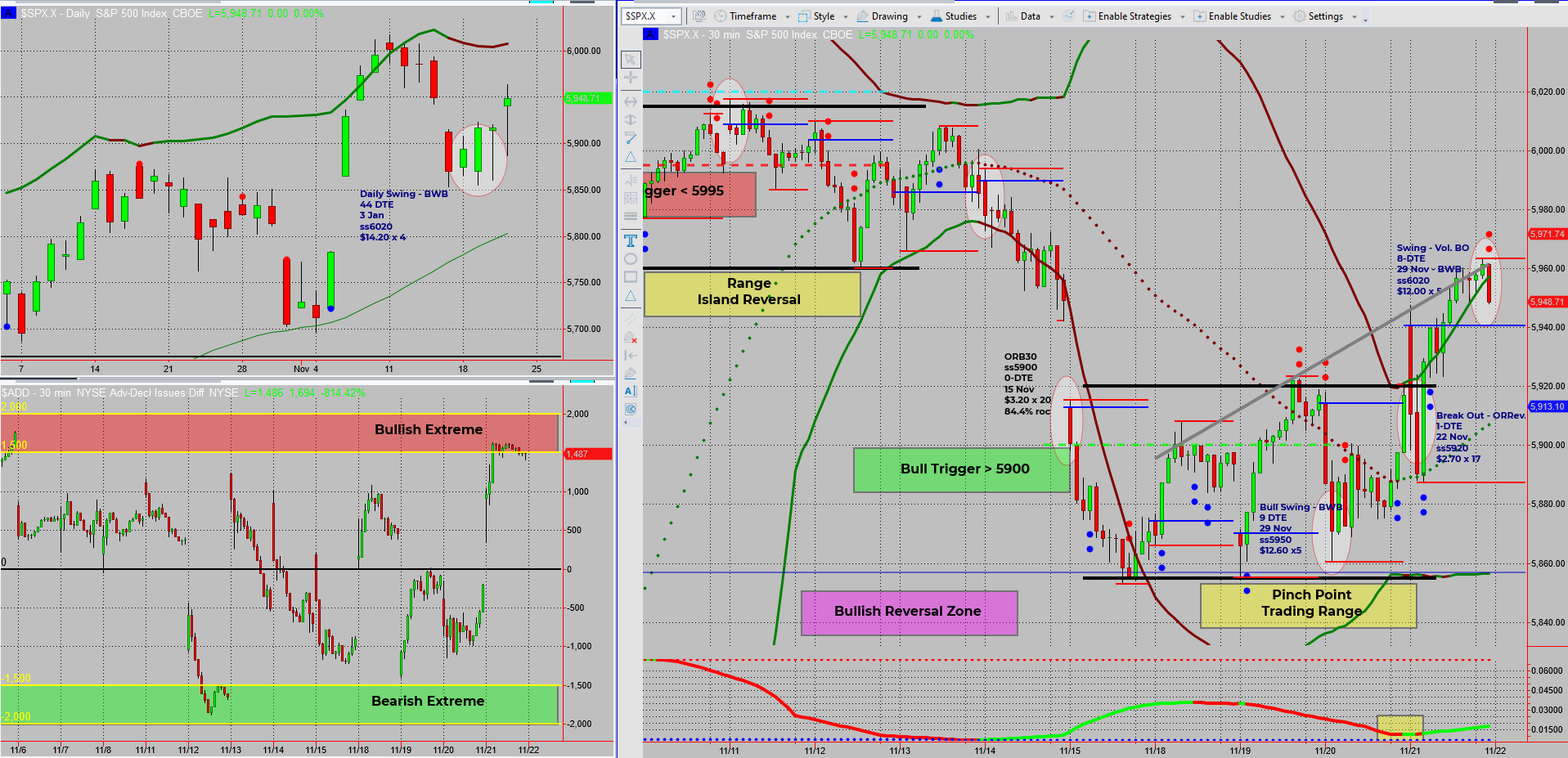

As SPX transitions from sideways to what looks like a rising channel, the bullish bias remains strong. Today’s market moves may dip before rising, setting the stage for exciting new opportunities. Let’s dive in!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The sideways range on SPX didn’t stick around for long. Just as expected, we’re seeing early signs of a shift into an upsloping angled range or a rising channel. While it’s still too soon to confirm this on SPX, ES futures are making this pattern clearer.

Here’s what’s on my radar:

- Bullish Bias Remains: My income system stays focused on long trades.

- Market Internals Say Pullback First: $ADD is at an extreme, hinting at a brief dip before continuation.

- Overnight Futures Action: A 20-point dip could lead to a gap lower at the open, but signs point to a climb higher into the session’s end.

As always, patience is key. Targets are waiting to be hit, and new entry setups will soon reveal themselves.

For now, I’m wrapping up early this week. Tonight’s plan? Good company, a stellar meal, and a dance floor dominated by 80s anthems. Maybe I’ll snag another profit while moonwalking my way into the weekend.

Fun Fact

Did you know? The SPX has been more likely to hit all-time highs in the final quarter of the year than any other! Historical data shows Q4 rallies are fueled by optimism, holiday spending, and institutional positioning for the new year.

Q4 is often nicknamed the “Santa Claus Rally” season. Analysts attribute this to a mix of seasonal cheer and portfolio reshuffling before the fiscal year ends. While it’s not guaranteed, these conditions make it an exciting time to trade.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece