Chicken Soup, Bruised Ego, and a Bullish Setup?

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning traders – the markets fell hard and so did I!

A badly twisted ankle, knee, hip, wrist, one of those scrapes that only maternal-grade sympathy can fix – and of course, my pride took the biggest hit.

After that unscheduled stairwell liquidity sweep, I did what any disciplined trader would do: sat out, iced everything, and watched the Powell-Trump circus unfold from the comfort of my couch.

⬇️⬇️⬇️ – keep scrolling for today’s full breakdown – ⬇️⬇️⬇️

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

SPX Market Briefing:

The market remains rangebound, despite the theatrics. Yes, we saw a bullish setup off the range lows, but I was too busy being pampered and told what a brave little boy I was while sipping imaginary tea and rethinking my entire mobility strategy.

Today’s a fresh start. My mouse hand and clicking finger are battle-ready. But as I always say – I don’t love new trades in the middle of a range. That’s usually where good trades go to die slowly.

So I’m leaning bearish until something forces a rethink. Either my hedge trigger flips me bullish, or we tag those range lows cleanly again. Until then? It’s chicken soup and mild complaining on repeat.

Same gameplan holds.

-

Reversals at range highs and lows

-

Breakouts through the same

-

Sit tight in the mushy middle

Until then… I wait.

Expert Insights:

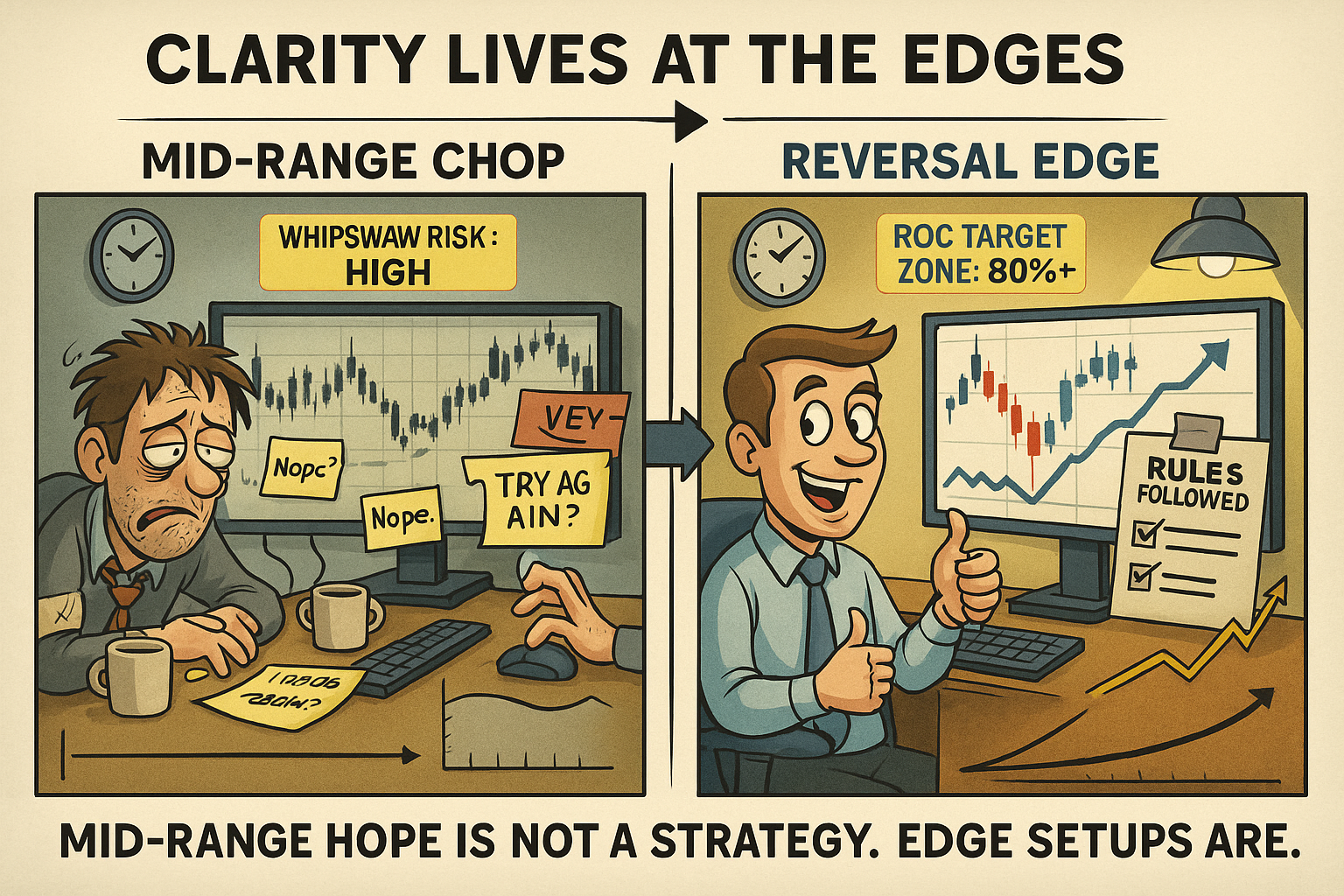

Mid-range trades are where hope goes to die.

According to trading stats from Thomas Bulkowski’s pattern research, breakout and reversal setups at key levels outperform mid-range drift entries by over 2:1 in risk-adjusted return profiles

[Source: ThePatternSite.com – “Performance Rank of Chart Patterns”].

The AntiVestor Truth?

If you need to squint to see a setup, it’s probably not there. Range edges offer clarity. The middle offers confusion with extra slippage. Don’t mistake motion for opportunity.

Rumour Has It…

Trump apparently re-fired Jerome Powell before un-firing him five minutes later.

“Powell, you’re fired. Just kidding. Got you good. The good’est anyone’s been got.”

Satire Alert: Markets shouldn’t be a reality show – yet here we are.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

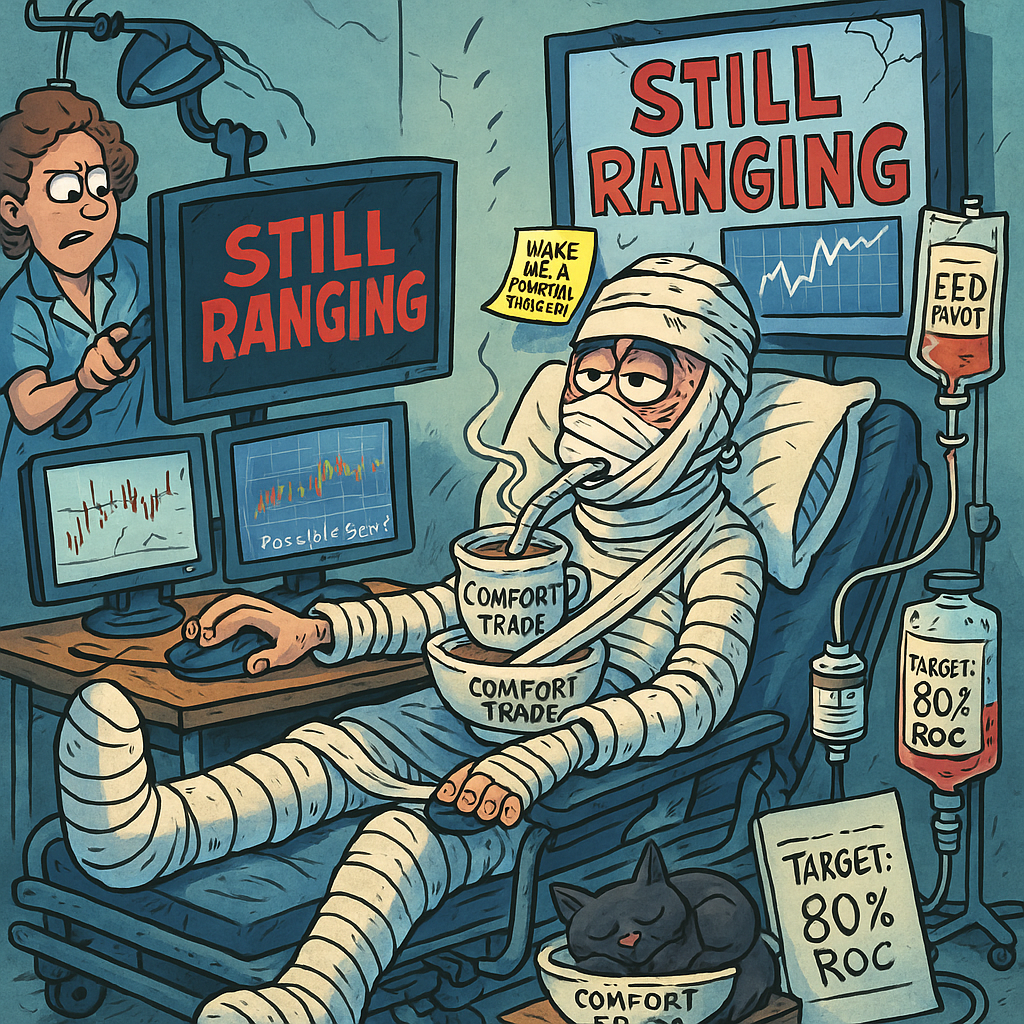

Meme of the Day:

“When you’re bandaged head-to-toe but still stalking the reversal trigger.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.