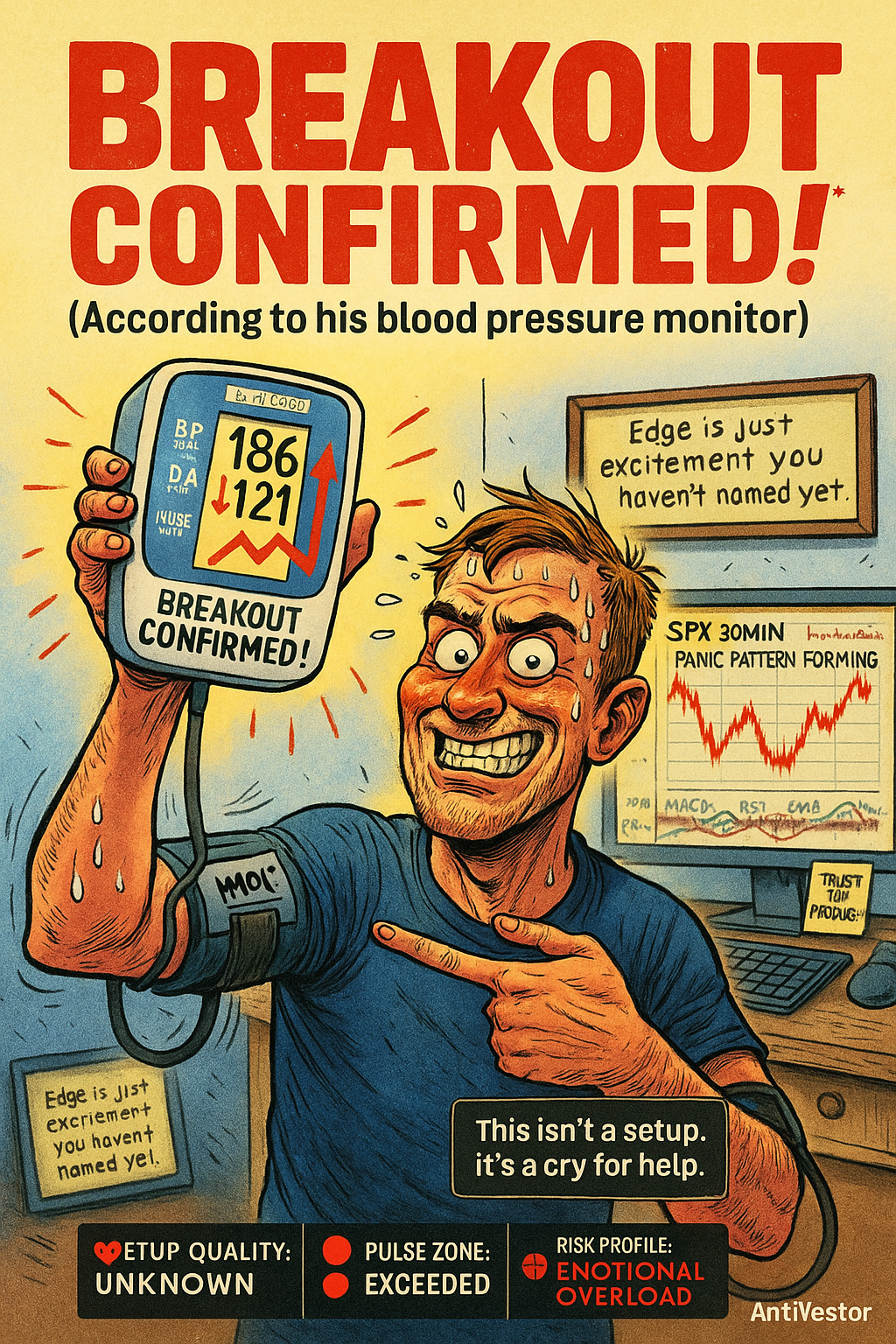

If your blood pressure’s making a new high score – you’re not trading.

You’re just panicking with a brokerage account.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The New High Score No One Brags About

You know the feeling – clammy hands, racing heart, tunnel vision locked on a flickering chart that just blew past your stop… again.

But this time you “just know” it’s going to bounce.

Your body says war.

Your brain says logic.

Your mouse says revenge.

This isn’t trading. It’s nervous system roulette.

And here’s the truth no one wants to say out loud:

Trader stress is usually just unstructured guessing disguised as decision-making.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

The Biology of a Bad Trade

Let’s call it what it is: your body is betraying you.

When you don’t have a system – when you’re relying on “feel” – your nervous system flips the emergency switch:

-

Cortisol spikes

-

Adrenaline floods

-

Your prefrontal cortex (the part that thinks) shuts down

-

Your fight-or-flight reflex grabs the wheel

That means instead of calmly executing a strategy, you’re:

-

Overtrading

-

Second-guessing

-

Cutting winners short

-

Holding losers long

-

Burning energy on decisions that should already be made

You’re not using your trading brain. You’re using your survival brain.

The Myth of “Good Stress”

Wall Street worships hustle. Twitter glorifies adrenaline. Traders wear stress like a badge.

But here’s the AntiVestor truth:

If you’re excited, you’re probably doing it wrong.

The best traders are bored. Focused. Methodical. Confident – not because they “feel it,” but because they’ve run the playbook 1,000 times.

Stress doesn’t make you sharper. It makes you stupid.

Stress says:

-

“Maybe it’s a breakout”

-

“Maybe I can scalp this reversal”

-

“Maybe I’ll just add a little more size”

A system says:

-

Yes

-

No

-

Next

Why Most Traders Are Stressed: No System, No Process

Let’s strip this down.

If you’re stressed while trading, you’re probably:

-

Making decisions on the fly

-

Trading setups you haven’t defined

-

Managing risk based on “feel”

-

Letting emotions override exits

Translation?

You’re trading without a system. You’re guessing. Reacting. Chasing. Surviving.

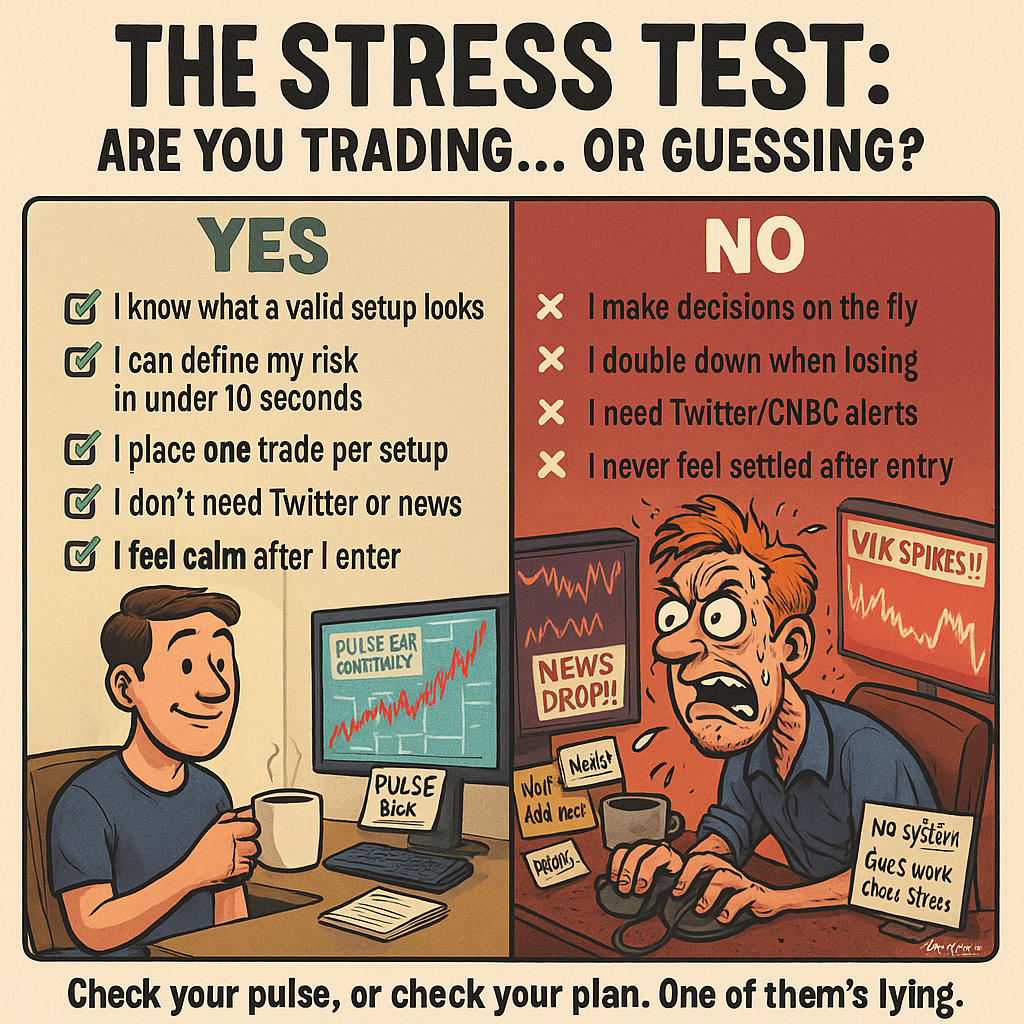

Compare this:

The Stress Desk

-

6 monitors

-

CNBC shouting

-

Twitter open

-

4 open trades

-

1 blown fuse

✅ The System Desk

-

1 chart

-

1 alert

-

1 setup

-

1 clean execution

The difference isn’t just the desk.

It’s the emotional cost of guessing.

The Cure Is Boring: Rule-Based Trading

If that sounds like punishment, good. Because the cure is boring.

But boring prints money.

A proper system is like a checklist for a fighter pilot:

-

Clear entry criteria

-

Defined risk

-

Pre-set target or time-based exit

-

No need for decision-making mid-air

That’s what the SPX Income System was built for:

-

✅ Pulse bar confirmation

-

✅ Credit spread placement

-

✅ Premium decay collection

-

✅ Optional early exit

-

✅ No stress, no mess

The boring trader wins – because the rules already did the thinking.

Case Study: “The Guy Who Quit the Heart Monitor”

One student (we’ll call him Dan) used to monitor two things:

-

His trades

-

His blood pressure

Dan came in hot:

-

20+ trades/week

-

Intraday scalp alerts

-

Overnight options gambles

-

And a drawer full of stress meds

Fast forward 6 weeks into the SPX Income System:

-

3-5 high-probability setups/month

-

Defined entries

-

Pulse bar filter

-

Calm exits

-

And – his words, not mine –

“I haven’t seen a blood pressure spike since April.”

“Now I trade like a surgeon, not a slot machine.”

The Trader Stress Checklist

Ask yourself these 5:

✅ I know what a valid setup looks like

✅ I can define my risk in under 10 seconds

✅ I place one trade per setup – no doubling down

✅ I don’t need Twitter, SquawkBox, or news feeds

✅ I feel calm after I enter a trade

If you said “no” to 3 or more – you’re not trading a system. You’re reacting to chaos.

Your Heart Rate Shouldn’t Be a Chart Indicator

Let’s bring it full circle:

-

You’re not a better trader when you’re sweating.

-

You’re not sharper when you’re panicking.

-

And your heart rate is not an edge.

You don’t need another setup.

You need a system.

The AntiVestor Truth

If you’re stressing, you’re guessing.

If you’re calm, you’re trading.

Want to fix the real problem?

Start with a system that:

-

Defines risk

-

Removes emotion

-

Pays you with time, not tension

It’s not supposed to feel like a fight.

Unless you’re fighting for your capital – or your sanity.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.