Swing Income Trade Hits Sweet Spot – Exit, Reload

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Some trades don’t need to surprise you to pay you.

This swing was methodical from the start:

Inverted head and shoulders on the daily.

Neckline breakout. Clear projection.

Enter. Sit. Let the market grind upward.

And that’s what it did – until it started to wobble.

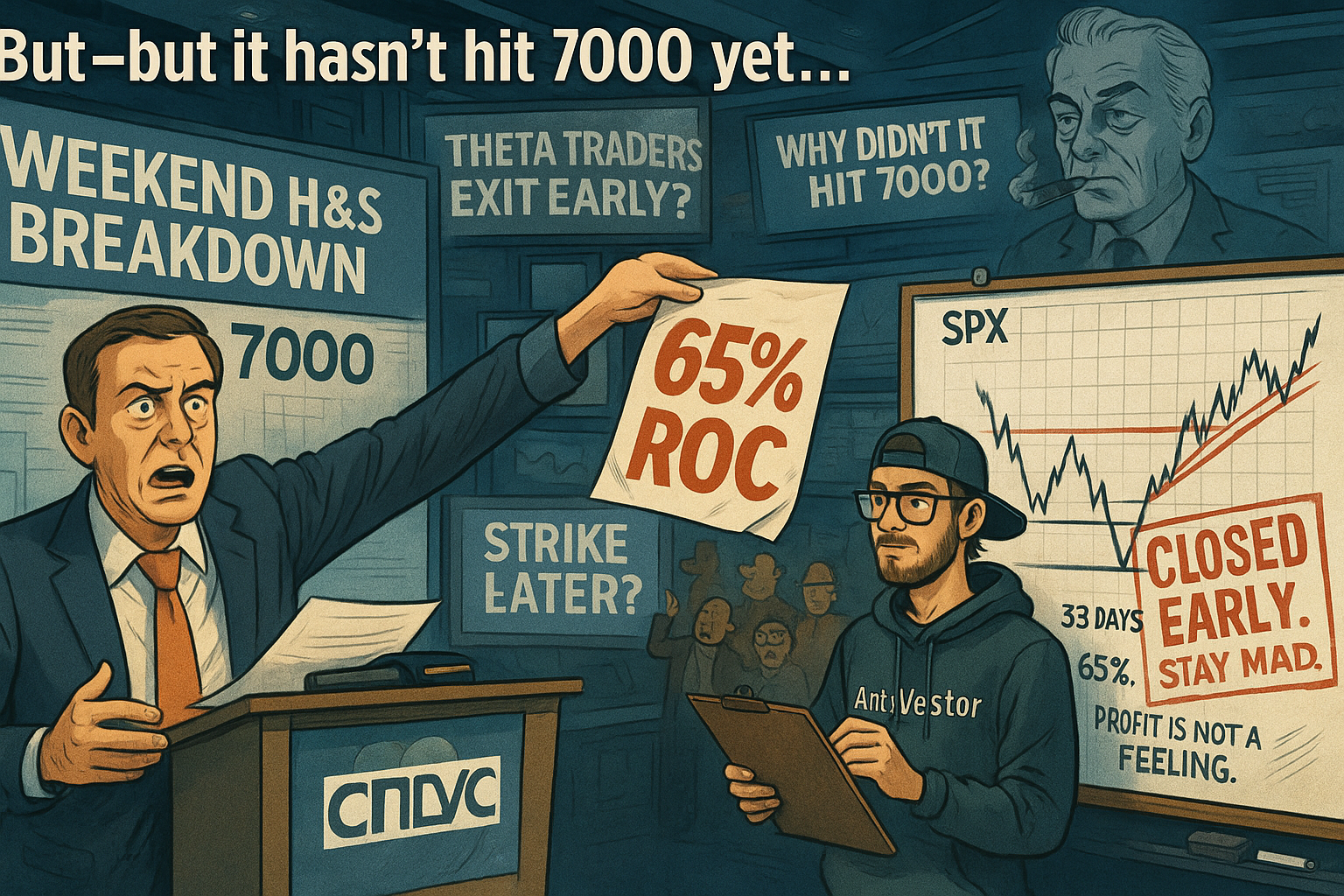

With 65% ROC in the bank and short-term exhaustion blinking on the dashboard…

I didn’t wait for the full 7000 target.

I cashed it.

And now I wait to reload.

✅ Pattern confirmed. Premium locked. Watchlist active.

SPX Isn’t Random. It’s a Paycheque Waiting to Be Claimed.

Zero-day options + pulse bar = fast cash, low stress.

SPX Market Briefing:

This setup started over a month ago – and it wasn’t subtle.

The inverted head and shoulders on the daily chart was wide, clean, and textbook.

Not some micro-pattern on a 5-min frame. This one demanded patience and premium.

Once price broke the neckline, the projected move gave us a target near 7000, measured from the depth of the shoulder to the neckline.

But that’s theoretical target distance.

What’s more valuable?

-

A solid 65% return on capital

-

On a fully formed, high-conviction swing

-

With signs of short-term exhaustion flashing after 33 days

Answer: the ROC.

Take the win. Manage the reentry. Stay system-aligned.

The projection remains – but I won’t force the fill.

Expert Insights:

What Makes Inverted Head and Shoulders Work?

According to technical studies across S&P 500 components:

“Inverted head and shoulders patterns with a duration of 20+ sessions and breakout volume confirmation have a 71% follow-through rate to their projected target.”

– https://thepatternsite.com/hst.html

This one had both:

-

Clean structure

-

Daily timeframe

-

Breakout confirmation

But the real edge?

Using options income to monetize time before target hits.

Rumour Has It…

SPX’s left shoulder reportedly filed a lawsuit against the right, accusing it of “breaking symmetry with intent to reverse.” The neckline refused to testify, citing a pending retracement.

Meanwhile, the trader who exited early was spotted on a beach, sipping from a “65% ROC” mug, reading Reload Monthly.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Inverted head and shoulders on the S&P 500 daily chart have reached their projected price target only 62% of the time over the past 10 years — but trades that exited at 60-70% of the measured move outperformed in terms of average risk-adjusted return.

Sometimes, “close enough” is the win.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.