No Fireworks, Just Fades – Trader Slips Into Maintenance Mode

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Sometimes doing less… does more.

The market gave us one last hoorah into the 4th of July – then promptly reversed it in the overnight session. No follow-through. No fireworks. Just fade.

I chose not to hedge into that Thursday gap. And I’m glad I didn’t. The system had already turned bearish. A bit of patience let the trade breathe, and now I can adjust on my terms – not the market’s.

Swing positions from the daily chart are still chugging. Premium is almost cooked. And with no new trades planned, I’m slipping into maintenance mode for the week.

There’s nothing to chase.

But there may be a reentry coming soon.

Fade confirmed. Swing profit alive. Maintenance mode: engaged.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

Thursday’s action was textbook bait.

Push to new highs, holiday liquidity, short-lived squeeze.

But as expected, the real reaction came after hours.

And by Monday morning, all of Thursday’s gains had vanished.

This isn’t about surprise. It’s about structure.

-

The system model flipped bearish heading into the weekend

-

That Thursday pop didn’t warrant a hedge

-

Waiting through the long weekend has preserved flexibility

-

Swing trade from the daily chart is still working

-

No new directional play needed – we’re in monitor mode

For now:

Manage theta.

Protect gains.

Don’t overdo it.

In Other News…

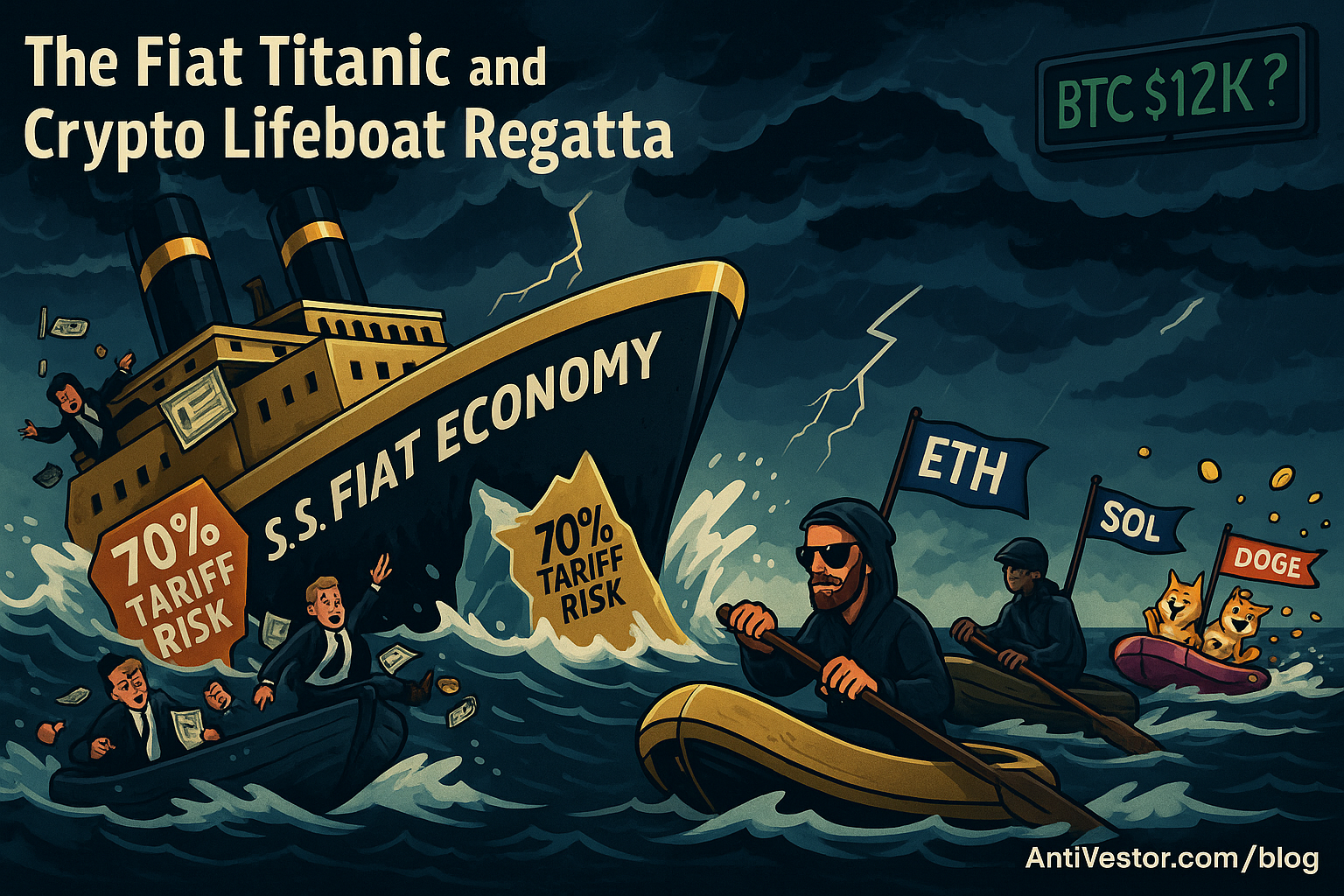

Tariffs Tease, Tech Squeezes, T-Bills Wheeze

Cheap dollar masks supply-side tremors

Opening note – Asia’s exporters rallied on the FX tailwind, nudging S&P futures up 0.2 % before U.S. dawn.

But wait – Energy’s early bounce fizzled as traders digested OPEC+’s outsized hike; XLE slipped from +0.7 % to flat by coffee time. Industrials outperformed on weaker-dollar hopes, while Materials caught a copper pop from Chilean strike chatter.

Next twist – Tech staggered. Nvidia’s tariff warning, Apple’s EU antitrust rumble, and AMD sympathy selling dragged SOX -1.3 %. Yet megacap levitation kept the composite green until Tesla’s 6 % plunge yanked consumer-discretionary red.

Closing setup – Front-end funding markets blinked: four-week bills cleared at 4.22 %, widest tail since April, scorching swap spreads. Dealers eye the 5 650 SPX gamma ceiling – break it and vol-sellers chase higher; drop through 5 600 and month-opening flows could flip risk-off.

Expert Insights:

Why Post-Holiday Gaps Often Reverse

It’s easy to overreact to a bullish pop before a holiday. But history suggests those moves rarely hold.

“The S&P 500 averages a daily return of just +0.09% on the trading day after July 4, with positive closes only 58% of the time”

– MarketWatch

Translation?

That Thursday rally wasn’t built to last – and it didn’t.

Rumour Has It…

The AntiVestor maintenance crew was spotted at SPX 6200 over the weekend with a “DO NOT CHASE” road sign and a coffee cart labeled “Premium Only – No Directionals.”

Meanwhile, a rogue trader tried launching his July 4 calls via bottle rocket – only to have the wick fizzle and the market send him a theta invoice.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The day after July 4 tends to underwhelm.

According to historical analysis:

“Over the last 15 years, the S&P 500 has posted an average return of +0.09% on the post-holiday session, closing green just 58% of the time.”

– MarketWatch

That makes Monday’s fade less surprising – and more statistically aligned.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.