Patience Pays: Another Theta-Soaked Quiet Thursday

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Dare I say… it’s going exactly to plan.

What we speculated on during Monday’s Fast Forward call?

It’s now reality. SFA. Sweet. Fanny. Adams.

The wedge has narrowed. The BBW has contracted. The ADD flirted with bullish extreme. And the market? It just… drifted.

The plan has not changed. NFP drops soon. Then we’ll see if any fireworks come before the fireworks. Half-day session. Holiday volume. Heat, smoke, and maybe some real movement next week. Maybe.

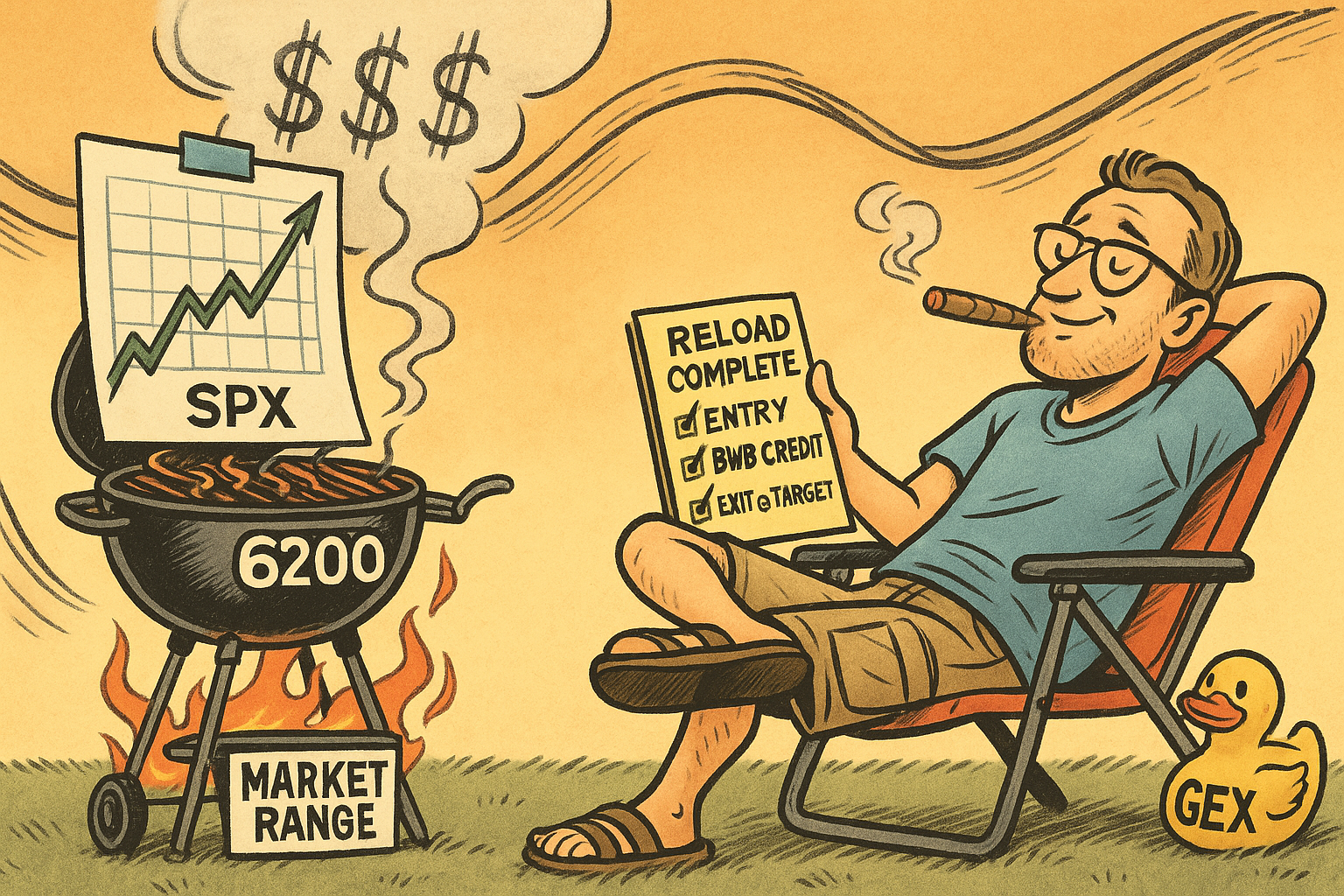

For now? The theta still drips. The premiums still decay. And I’ll be lighting the grill with untraded deltas.

Viva La Theta Profits.

Have fun everyone.

Market paused. Premium flowing. NFP ahead. Scroll in for final prep.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing:

Let’s be honest – not a single thing has changed since Monday.

The range-bound grind we forecast? Happening.

The 6200 pin? Still in play.

The divergences on %B and BBW? Still showing.

The speculative scenario we laughed about – “What if literally nothing happens until the jobs number?” – yeah, we’re living in it.

So the plan remains the same:

-

Continue to hold your theta-positive positions

-

Only adjust if price decisively breaks structure

-

Don’t chase anything on NFP day during a holiday half-session

-

Use time decay as your edge, not price action

Most traders will be hoping the report creates a catalyst.

We don’t need hope – we have premium.

In Other News…

Dollar Dip, Tesla Trip, Crypto Flip

FX quake meets auto wobble, tokens gain lift

Opening note – The greenback’s lurch to a 3½-year low followed Donald Trump’s eye-watering $3.3 trillion tax-and-spend tease and Jerome Powell’s soothing chat in Portugal. Exporters cheered, importers flinched, and bond desks recalculated every CPI pathway.

But wait – Brent barely budged. OPEC+ dangled a modest August output add while U.S. tanks filled unexpectedly, trapping crude near $67. With energy muted, equity bulls stretched the tape again: futures pointed to fresh highs, capping tech’s best half-year since meme-mania.

Twist – Tesla stands on the banana peel. Analysts expect Q2 deliveries down double digits as Chinese EV rivals undercut prices and Musk’s political detours dent brand mojo. A three-percent pre-market gap could test the index’s narrow breadth.

Meanwhile – Crypto hijacked the policy mic. Germany green-lit the first euro-stablecoin under MiCA, and Ripple revealed a bid for a full U.S. bank charter. Bitcoin drifted north of $109k, eyeing the well-watched $114k trigger. Institutionals keep opening doors even as retail chases meme charts.

Will a sagging dollar fuel the party, or does a Tesla skid mark July’s first stumble? Scroll for sector-by-sector side-eyes.

Expert Insights:

Why Theta Weeks Reward Discipline

When realized volatility compresses into a holiday week – especially with NFP ahead – the most common outcome is a contained range followed by delayed expansion.

According to CBOE studies:

“SPX options held through holiday-adjusted sessions see a consistent decline in implied volatility, favoring credit-based positioning 72% of the time in non-breakout weeks.”

Translation?

If price doesn’t break, you win.

That’s why you don’t adjust. That’s why you collect.

Rumour Has It…

In a surprise appearance, the spirit of Benjamin Graham reportedly rose from the options pit at 4:44 a.m. and whispered, “Thou shalt not trade on half-days, ye degenerate.”

Meanwhile, GEX interns taped a bottle rocket to the 6200 level, claiming “we just wanna see if it does anything.” Theta traders responded by turning down the volume on CNBC and slow-cooking ribs over a volatility index.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The 3 trading days before July 4 have averaged +0.52% SPX gains, while the day after the holiday often underperforms.

But in years where SPX fails to move >0.5% into July 4, the following week has produced downside mean reversion 63% of the time according to archived data from the Stock Trader’s Almanac and Bespoke.

This year’s setup fits the profile. Stay patient.

Meme of the Day:

“Theta Pays, BBQ Slays”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.