Wednesday Reset: Stay Mechanical, Stay Profitable, Fresh Outlook

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Wednesday hump day, hopefully more premium day!

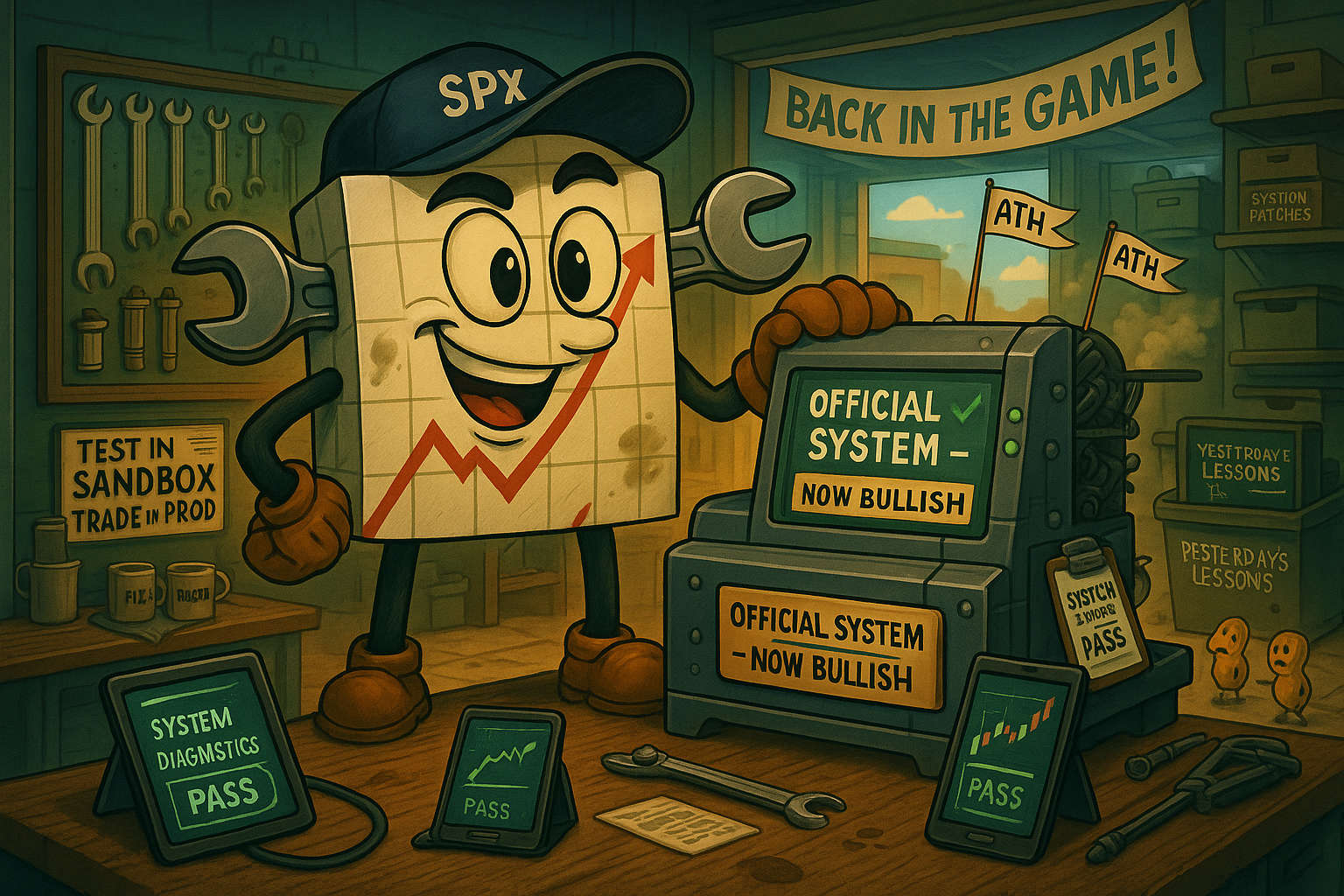

After yesterday’s cock-up and mixed results (full debrief here), we step into Wednesday with a fresh outlook and properly functioning software.

The official system has me bullish – and the tools are finally marking this off correctly. No more test software blunders. No more buggy entries. Just clean signals from debugged systems.

Fresh all-time highs just got dinged, which could mean we’re setting up for that end-of-week push pattern I’ve mentioned in earlier monthly briefings. When SPX hits new heights mid-week, it often likes to keep the party going into Friday.

The new and correct software is displaying the bullish state accurately with visual indicators working as designed. Those colored boxes you see are manually placed for reference while I work on getting them coded up properly.

Keep scrolling for today’s mechanical game plan…

Trade SPX Like a Machine. Get Paid Like a Boss.

Rule-based spreads. Defined risk. Cash-settled. Welcome to trader freedom.

SPX Market Briefing:

The chart tells a much cleaner story today than yesterday’s debugging disaster.

Current System Status:

- Tag ‘n Turn: Officially bullish after flip from bearish reversal

- ATH Status: Fresh all-time highs just hit

- Pattern Watch: Potential end-of-week push developing

- Software Status: Debugged and displaying correctly

We’re bullish until we’re bearish – and waiting for a brand new tag (✓) and turn (pending) for the next fresh bear setup. The system caught yesterday’s mistake and corrected course exactly as designed.

The fresh all-time highs could trigger that observed pattern where mid-week ATH breaks often push hard into the end of the week before seeing any pause or retracements. Not a guarantee, but a pattern worth watching.

Today’s Mechanical Plan:

Tag ‘n Turn – Bullish state, nothing to do yet. The system will signal when the next bear setup develops. Patience pays while the current bias plays out.

Premium Popper – On pause today due to desk absence. This strategy needs active monitoring during opening volatility, so better to skip than force it from mobile.

Lazy Popper – Mobile-ready and likely active. This setup works beautifully on mobile since it’s more of a “set and forget” 0-DTE collection strategy. Less screen time required, more theta decay harvesting.

The beauty of having multiple strategies is knowing when to deploy them and when to hold back. Today’s mobile trading reality means focusing on what works best remotely.

Wednesday Reset Mentality: Yesterday taught valuable lessons about keeping development separate from live trading. Today we apply those lessons with properly functioning software and mechanical discipline.

Stay mechanical. Stay profitable. Wednesday, here we come!

In Other News…

FinNuts Market Flash

FUTURES WHISPER SWEET NOTHINGS

E-mini S&P tiptoeing at +0.1% like it’s sneaking past sleeping parents at 3:10 AM. Nasdaq doing the same cautious shuffle while Dow pretends to be awake. Monday hit record highs after CPI came in milder than Percy’s curry tolerance. Overnight ranges tighter than Wallie’s budget spreadsheet.

DOLLAR GOES SOFT, TECH GETS FRISKY

Greenback’s having a weak moment while real yields take a nap, sending quality growth stocks into full peacock mode. Tech and communication services preening like they just discovered hair gel. Energy’s flat as yesterday’s champagne thanks to crude oil doing absolutely nothing, which means transports can actually afford to fill their tanks.

EARNINGS CALENDAR LIGHTER THAN MAC’S WORKLOAD

Mega-caps taking midweek off, so everyone’s staring at rate sensitivity like it holds the secrets of the universe. Asia’s corporate cheerleading squad hitting record highs, which U.S. quants are desperately trying to translate into “buy everything with a screen and a silicon chip.”

CROSS-ASSET TEA LEAF READING

Softer dollar plus firmer gold equals “Fed might actually cut rates without the world ending.” Oil’s sitting still like a well-behaved pet, keeping inflation fears in their cage. If this cozy setup continues, expect dips to get bought faster than Kash’s morning pastries. Only threat: Alaska deciding to mess with crude supplies because apparently even oil needs drama.

-Hazel

Expert Insights:

The difference between successful systematic traders and everyone else often comes down to how quickly they recover from setbacks. Yesterday’s losses provided valuable debugging data for both software and process improvements.

Fresh all-time highs mid-week often create momentum that carries into Friday before any meaningful retracements.

Mobile trading works best for strategies that require minimal real-time management. Lazy Popper’s “set and forget” nature makes it ideal for remote execution.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Hazel was spotted doing victory laps around the office after the software finally displayed bullish signals correctly.

“From debugging disaster to bullish bliss in 24 hours,” she announced while updating her status to “CFO of Functional Software Solutions.” She then raised her Wednesday coffee mug in a toast to “properly separated development environments.”

Percy immediately claimed credit for the ATH breakthrough, insisting his “Tuesday evening pigeon meditation session” had channeled positive energy into the markets.

Kash tried to explain how the new highs were “basically like diamond hands but for entire indices,” while Mac raised his morning whisky and declared, “My dear chaps, there’s nothing quite like fresh peaks to start the hump day properly!”

Wallie just muttered, “Finally, software that works as advertised. Maybe there’s hope for this digital generation after all.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Meme of the Day:

“When your software finally works correctly and the market hits new highs on the same day”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.