Management Rules Prove Their Worth When Markets Test Your Resolve

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Some days you learn more from the losses than the wins. Today was one of those days.

The Tag ‘n Turn swing kicked me square in the shins with a -32.1% loss after SPX decided to march $25 higher. The Premium Popper got stopped out on the opening bear setup. Back-to-back win streak? Well, that’s broke’ed.

But here’s the thing about systematic trading – it’s not about being right every time. It’s about having rules that keep you sane when you’re wrong.

And today proved why management rules aren’t suggestions – they’re survival tools.

Time for a vibe coder confession and a lesson in why process beats perfection…

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX Debrief:

Let me start with the uncomfortable truth: I buggered up the Tag ‘n Turn entry.

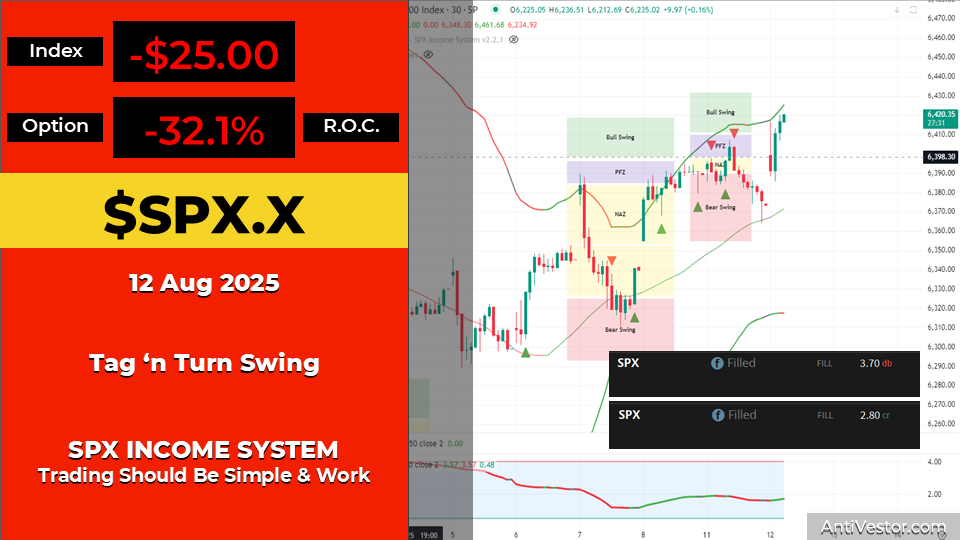

Trade 1: Tag ‘n Turn Swing (The Shin-Kicker)

- Strategy: Multi-day bearish swing

- Premium Collected: $2.80

- Closed At: $3.70

- Loss: -32.1% ROC

- SPX Move: +$25 against position

- The Mistake: Used test software with bugs instead of official release

Here’s the vibe coder confession: I’m elbow-deep in development, testing ideas to ensure the 2025 SPX software is the best ever. Problem is, I was using buggy test software that had errors. The official release actually had us bullish – not bearish.

Classic case of the cobbler’s children having no shoes.

Trade 2: Premium Popper (Opening Stumble)

- Strategy: ORB15 bear setup

- Direction: Bearish (wrong read of opening momentum)

- Result: Stopped out

- Lesson: Even correct rule-based entries can fail when market shifts quickly

The Premium Popper fired on the bear side at the opening bell, then swiftly turned and stopped out. This trade was technically correct based on the setup rules – sometimes the market just changes its mind faster than your stop loss.

Trade 3: Lazy Popper (The Day Saver)

- Strategy: 0-DTE premium collection

- Premium Collected: $5.00

- Result: 100% ROC – expired worthless

- Timing: Perfect end-of-day victory during family meal

While nursing my wounded pride over dinner with the family, the Lazy Popper quietly did its thing and delivered 100% ROC by day’s end. Sometimes the best trades are the ones you barely notice happening.

The Real Win: Management Rules When the PFZ level triggered and flipped back to bullish, the system worked exactly as designed. Quick flip, clean signal, lovely run for the rest of the day. The rules caught my mistake and corrected course.

Monthly Context Check: Today felt rough, but we’re 11 for 12 this month. That’s a 91.7% win rate, and we’re not even halfway through August yet. One bad day doesn’t erase a glorious month of systematic success.

Expert Insights:

The difference between successful systematic traders and everyone else isn’t avoiding mistakes – it’s having management rules that catch mistakes before they become disasters.

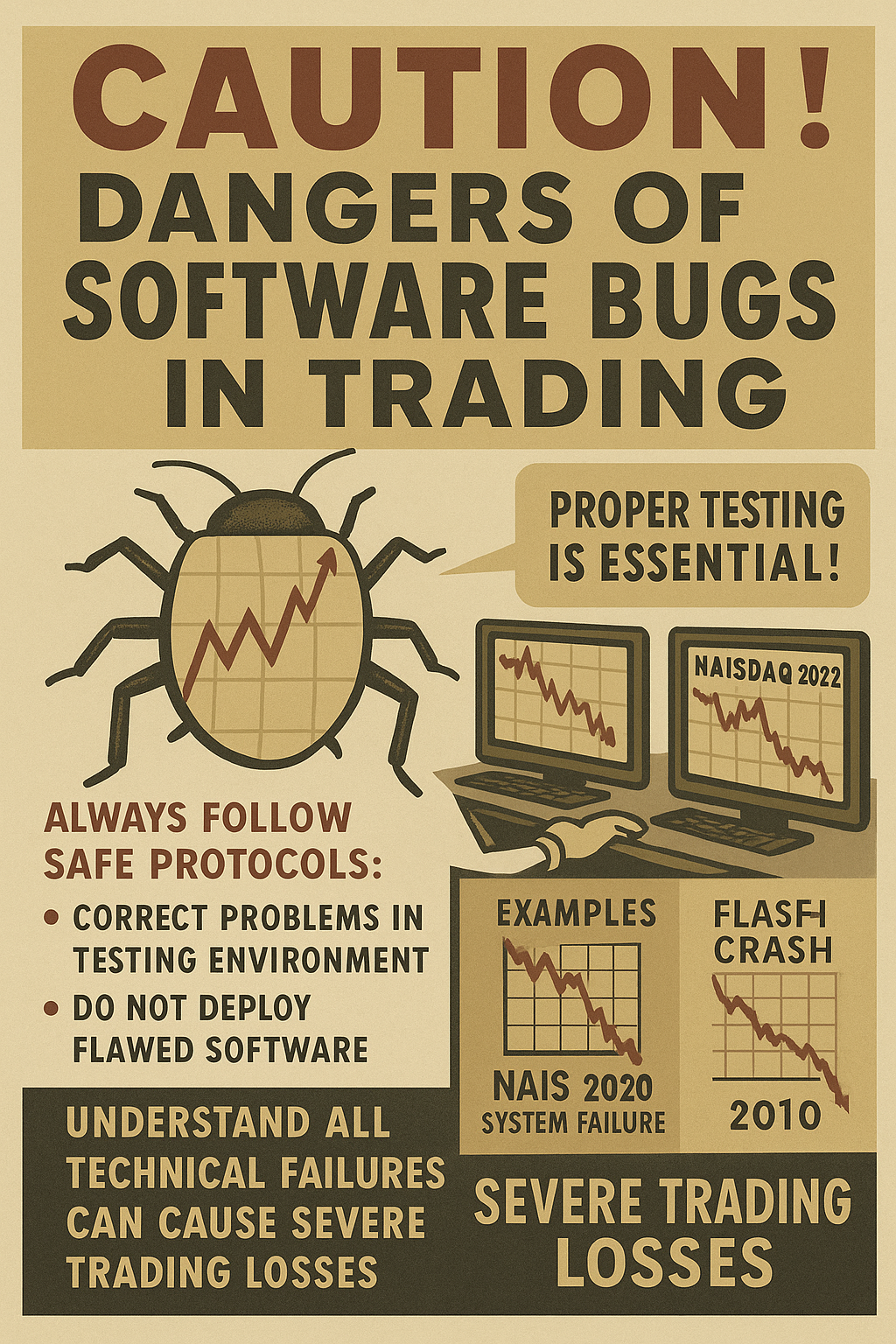

Test software belongs in testing environments, not live trading accounts. When you’re developing systems, maintain strict separation between experimental code and production trading tools.

Context always beats single-day drama. Monthly performance matters more than daily perfection.

[Source: AntiVestor SPX Income System – Risk Management Protocols]

Rumour Has It…

Breaking from the Financial Nuts newsroom: Hazel was spotted shaking her head at the Tag ‘n Turn loss while simultaneously toasting the Lazy Popper win.

“Losing money on test software while making money on production systems,” she announced to the newsroom. “That’s not trading – that’s a very expensive debugging session.”

Percy immediately claimed the losses were due to “insufficient pigeon consultation” and demanded all future trades require his bird-based approval process.

Kash tried to spin the day as “diamond hands stress testing,” while Mac raised his whisky glass and declared, “My dear boy, every great trader needs a good shin-kicking to keep them humble!”

Wallie just muttered, “This is why I stick to calculators from 1985. They might be broken, but at least they’re consistently broken.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Software bugs have caused some of the most expensive trading losses in history. Knight Capital lost $440 million in 45 minutes in 2012 due to faulty trading software deployment. The lesson: always test in sandbox environments, not live accounts.

[Source: SEC – “Knight Capital Group Trading Error Investigation”]

Meme of the Day:

“When you’re coding the perfect trading system but accidentally trade with the buggy test version”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.