Follow-On Swing Nails Exit For $7.20 Premium Gain

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Let’s break down a prime example of how you don’t need a new system – you need a new setup.

This trade wasn’t new. It was a reload – an elegant follow-on swing built directly on top of the breakout that closed out our prior reversal trade. You saw the original entry. You saw the measured move begin. And you likely saw the new setup coming – because we talked through it in real time during the morning brief.

So when price triggered that continuation, I reloaded. Same system, new position. No guesswork.

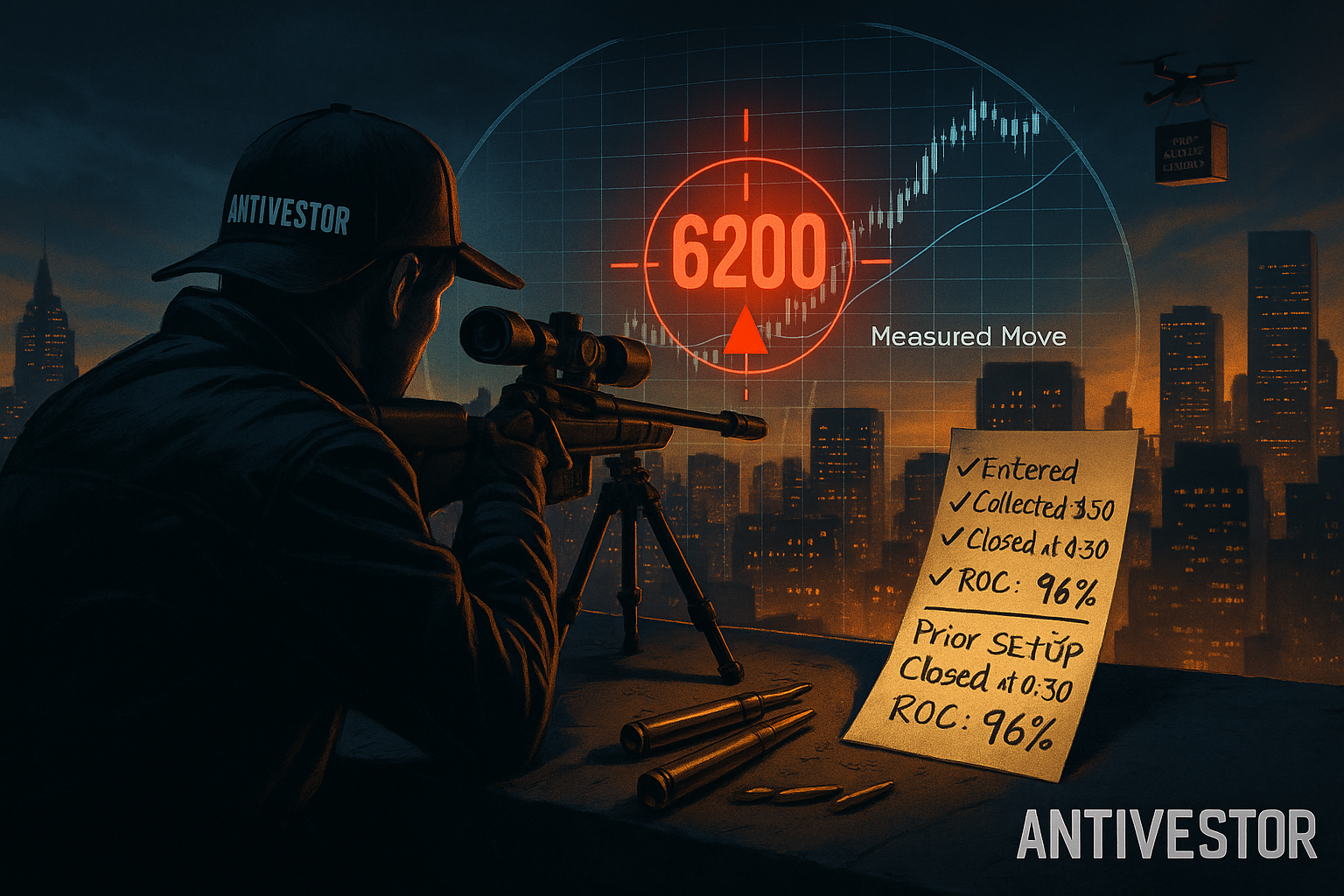

The target was clear: 6180/6200, measured from the range. The trade? A smartly priced BWB that pulled in $7.50 credit and exited at just $0.30. That’s a 96% ROC with next to no management. Just watch for add-ins, let the premium work, and let structure do its job.

Let’s walk through it.

Same system. Reloaded. Collected. Keep reading for trade anatomy.

SPX Isn’t Random. It’s a Paycheque Waiting to Be Claimed.

Zero-day options + pulse bar = fast cash, low stress.

SPX De-Briefing

This swing wasn’t flashy – and that’s what made it flawless.

After closing the range reversal trade on the previous measured move, we turned attention to the breakout continuation setup. It was classic: a breakout with structure, volume validation, and a projected target derived from the height of the previous range.

That target was 6200 – clean, mechanical, and visual.

The trade structure was a Broken Wing Butterfly (BWB) with an aggressive $7.50 credit. Positioned for range continuation, but with zero dependency on a directional sprint.

Key points:

-

✅ Entry triggered from breakout structure, not hope

-

✅ Target clearly defined using measured move math

-

✅ Premium collected upfront – $7.50

-

✅ Exit hit with minimal drama – $0.30 close, 96% ROC

-

✅ No complex management – just stalked for add-in setups

And when it played out?

Price tagged 6200. The trade closed shortly afterwards on the theta decay. The system paid.

This is how reloading works – not by guessing what’s next, but by knowing when to re-enter the same logic with a new window.

Expert Insights:

The Real Edge In Follow-On Swings

Reload trades work because structure repeats. You’re not inventing a new edge – you’re exploiting a continuation of the same market logic that just paid you.

-

When a range breaks cleanly with volume and clarity, you often get a second leg

-

The measured move projection gives you a realistic, actionable target

-

A BWB allows you to collect premium with a directional tailwind, but still profit if the market drifts

And when you’ve just exited a trade – you’re mentally prepared.

The chart’s familiar. The risk is contextual. That’s real edge.

IMAGE HERE

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.