Messy Market, Mechanical Process, Maximum Results

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Remember this morning’s battle plan? Premium Popper scalps, Lazy Popper endgame, and Tag ‘n Turn patience?

Well, the market served up a masterclass in why having multiple strategies beats trying to predict which way the wind will blow.

Today was messy. Sloppy. The kind of day where price action looks like it was drawn by a caffeinated toddler with commitment issues.

But here’s the beautiful thing about mechanical systems – they don’t care if the market’s having an identity crisis. They just execute when the conditions align.

And today? Both the Premium Popper and Lazy Popper conditions aligned perfectly.

Result? We profited both coming and going.

Keep scrolling for the trade-by-trade breakdown…

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

SPX DeBriefing:

This morning’s plan wasn’t wishful thinking – it was a roadmap. And the Fast Forward mentorship call executed it in real-time, step by mechanical step.

Trade 1: Premium Popper (Bullish Scalp)

- Strategy: ORB15 breakout scalp

- Direction: Bullish (opening pop)

- Premium Collected: $1.10

- Bought Back At: $0.55

- Execution: Right after opening bell

- Result: 50% ROC in opening minutes

- Logic: Quick premium capture on early volatility burst

The Premium Popper did exactly what it’s designed to do – grab fast premium when the market decides which way it wants to go first.

Clean entry, clean exit, clean profit.

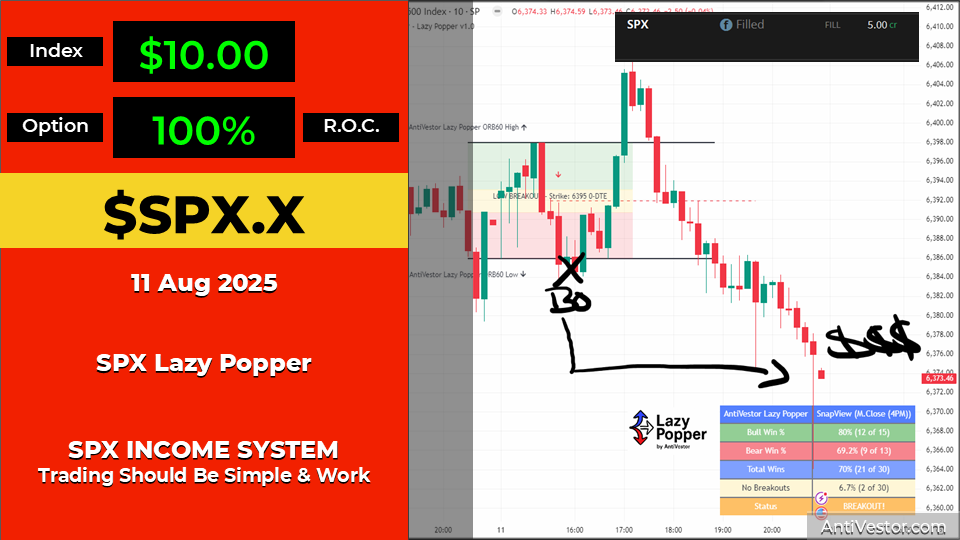

Trade 2: Lazy Popper (Bearish 0-Day Swing)

- Strategy: ORB60 directional play

- Direction: Bearish (0-DTE premium collection)

- Premium Collected: $5.00

- Exit: Expired worthless (fully out of the money)

- Execution: Set and forget

- Result: 100% ROC by closing bell

- Logic: Let time decay work while price moved in our favor

The Lazy Popper proved why patience pays.

While the market chopped around all day looking confused, our spread quietly marched toward maximum profit.

New Position: Bearish Swing Trade

- Setup: Fresh 7-day opportunity

- Status: Position locked, results TBC

- Context: Market structure shifted bearish into close

From flat positions this morning to a full bearish swing setup by close – that’s how you adapt to what the market gives you rather than forcing what you want it to give you.

The Bottom Line: Sloppy, messy trading days are exactly where systematic approaches shine.

While discretionary traders get whipsawed by the noise, rule-based strategies just execute when their conditions are met.

Today proved the morning plan wasn’t hope – it was preparation meeting opportunity.

Expert Insights:

The beauty of running multiple strategies isn’t complexity – it’s coverage.

Premium Popper captures opening volatility pop.

Lazy Popper harvests 0-DTE premium collection.

Tag ‘n Turn waits for multi day swing opportunities.

Different strategies, same principle: let the market come to you rather than chasing the market around.

When your system has multiple ways to profit, messy days become opportunity days.

[Source: AntiVestor SPX Income System]

Rumour Has It…

Breaking from the Financial Nuts newsroom: Hazel was spotted doing a victory lap around the trading floor after the Lazy Popper hit 100% ROC.

“Two trades, two wins, one sloppy market,” she announced to the newsroom. “That’s not luck – that’s having a system that works when everything else doesn’t.”

Percy immediately claimed credit for the wins, insisting his morning pigeon count had “predicted the exact directional reversals.” He’s now demanding the office install a pigeon feeding station for “enhanced market intelligence.”

Kash tried to explain how the trades were “basically like diamond hands but with actual profits,” while Mac raised his whisky glass and declared, “My dear chaps, mechanical brilliance deserves a mechanical toast!”

Wallie just muttered something about “finally, someone trades with proper risk management” and went back to polishing his broken calculator.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

IMAGE HERE

Fun Fact:

The S&P 500’s average daily range during August historically expands by 23% compared to July, making it one of the most volatile months for intraday trading strategies. Premium sellers often feast during high-volatility, low-conviction market environments.

[Source: CBOE – “Seasonal Volatility Patterns in Equity Markets”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.