Here Comes SPX 7000, Maybe?

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well then. We didn’t just hit the breakout target – we practically kissed it.

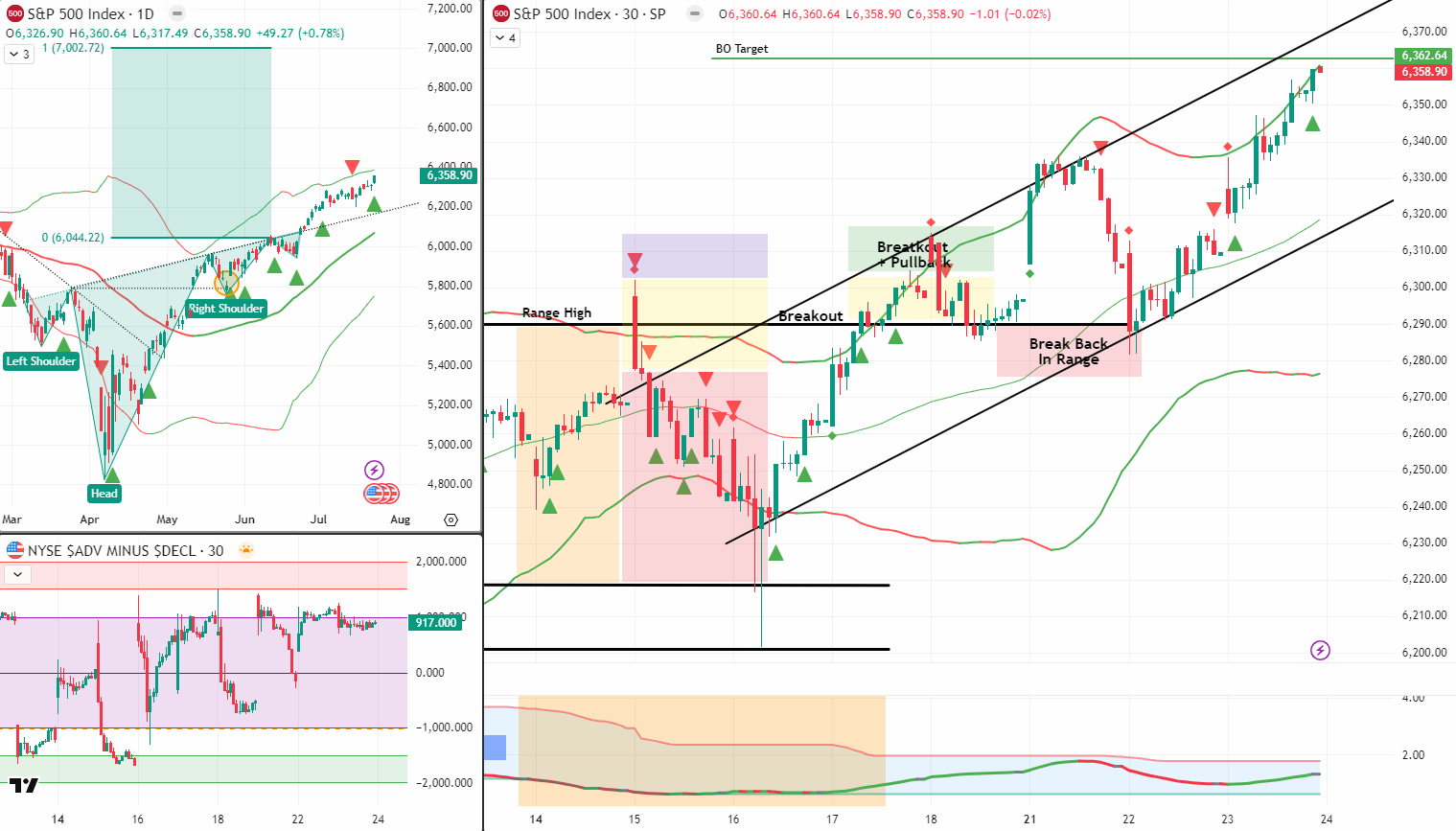

Yesterday’s close landed at 6,358.90, just shy of the 6,362 breakout target that’s been in play since the July 17 breakout move. That’s a textbook tag n’ run from the range low to the full extension target. If you caught it? Job done. Close the trade, walk away smug.

Let’s break it down.

Keep reading for trade anatomy.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing:

System Update – Where We Stand

-

The range defined by the BBW pinch on 14-15 July is still the foundational reference.

-

That range gave us the horizontal Range High and Range Low (fixed from that pinch – no updates).

-

We had:

-

✅ Bear Tag n’ Turn at Range High → Price dropped to Range Low.

-

✅ Bull Tag n’ Turn at Range Low → Triggered the 17 July breakout.

-

This breakout was clean:

-

Breakout

-

Pullback

-

✅ Break of pullback high = confirmed continuation

-

Target = Range Height added to Range High = 6,362

We’re now 5 points away from that target being fully hit – close enough to lock it in.

⚠️ Today’s Setup – 24 July

So… what now?

-

We are still bullish until we’re not – which means:

-

We do not short into this just because it’s “high”

-

We do not sell just because of the BB upper band

-

-

❌ Bear Tag n’ Turn trades are invalid until either:

-

Target is reached and we stall

-

We break back into the range (confirmed with break of pullback low) - New Tag ‘n Turn setup

-

Key Levels to Watch

-

✅ 6,362 – Breakout Target → Already touched. You can consider the breakout objective “complete”

-

6,290 – Range High → If we get a pullback that breaks below this, it’s a signal to reassess

-

6,280 – Break Back In Confirmation → Break + pullback + lower low = reversal in logic

Until then? Bulls are in charge.

Teaching Note for Students

“We are bullish until we are bearish – and that moment is defined by price action, not gut feel.”

-

Do not fade highs just because it “feels stretched”

-

Use the fixed range logic and breakout confirmation model

-

If you’re unsure whether it’s a new swing setup or an old trade finishing, ask:

“Are we at target, or are we breaking back in?”

In Other News…

Markets microwave popcorn and wait

Asia surges, India trips, and Powell hides behind the curtain

-

Asia threw a tariff party and forgot to invite panic.

Topix moonwalked 2% on the back of a U.S.-Japan tariff cuddlefest. The Aussie dollar flexed like it just got promoted. India showed up late, spilled chai on itself, and stumbled out with a limp Nifty. Meanwhile, oil and gold stood around awkwardly like divorced parents at a school play-civil, stable, and not making eye contact. -

Crude found its confidence under the bleachers.

Hovering just below $69, oil is back in its “maybe I am desirable” phase after a U.S. inventory diet. Gold, meanwhile, cosplayed as emotional support metal-refusing to drop even with the dollar stomping around like it owns the place. Apparently, demand is alive and well, just swiping left on inflation. -

India’s tech sector pulled a full Windows 98 crash.

Down 1.7%, IT stocks faceplanted while telecoms tried to pick up the slack with a paperclip and hope. The result? Nifty went wobbly. There’s optimism-but it’s the kind where you smile while eyeing the fire exit. -

U.S. futures hit the snooze button for the fourth time.

Powell’s upcoming speech and tech earnings have the market in full “don’t rock the boat” mode. The VIX is flatter than your uncle’s punchlines. Bulls and bears both benched, trading volume replaced with nervous pacing. Everyone’s waiting for a signal-but Powell’s still backstage doing vocal warm-ups.

Expert Insights:

“Don’t Let Expiration Trap You”

This market loves fast exits. Don’t get hypnotized by the expiration date-when you’ve banked the bulk of the premium, close the trade and move on. The best wins are often done before the crowd realises it.

[Source: AntiVestor.com – “SPX Income System Book” – Link]

Rumour Has It…

“Markets Breaking Out… Kinda”

FinNuts anchors are already celebrating a “confirmed” breakout complete while the chart still has 5 points to go. Hazel’s sipping coffee, Percy’s smashing his ATH clown horn again, and Wallie is re-running his model because he “doesn’t like being optimistic without a stress test.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Meme of the Day:

“Charge the Fakeout!”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.