Why the System Still Pays Even When You’re Away

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Not every day goes to plan. And today?

Well, let’s just say the Wolfe was ready… but I wasn’t.

The charts gave us the setup we wanted: bear bias under 5400, a pulse bar within the opening 30 minutes, and a textbook opportunity to rejoin the swing move toward 5000.

But instead of placing a trade, I was in a hospital waiting room with Mrs. N, getting her checked over for something that couldn’t wait. (She’s okay for now – just part of an ongoing issue.)

It’s a stark reminder that even with mechanical setups, trading lives inside the real world. And that’s exactly why I always carry swing exposure – because sometimes, you just can’t show up for the day trade.

The trade didn’t happen. The system didn’t fail.

Life just had other plans today.

Now let’s look at the setup that unfolded… and what’s still on deck.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Isn’t Random. It’s a Paycheque Waiting to Be Claimed.

Zero-day options + pulse bar = fast cash, low stress.

Wolfe Still in Play

Today’s setup couldn’t have been clearer.

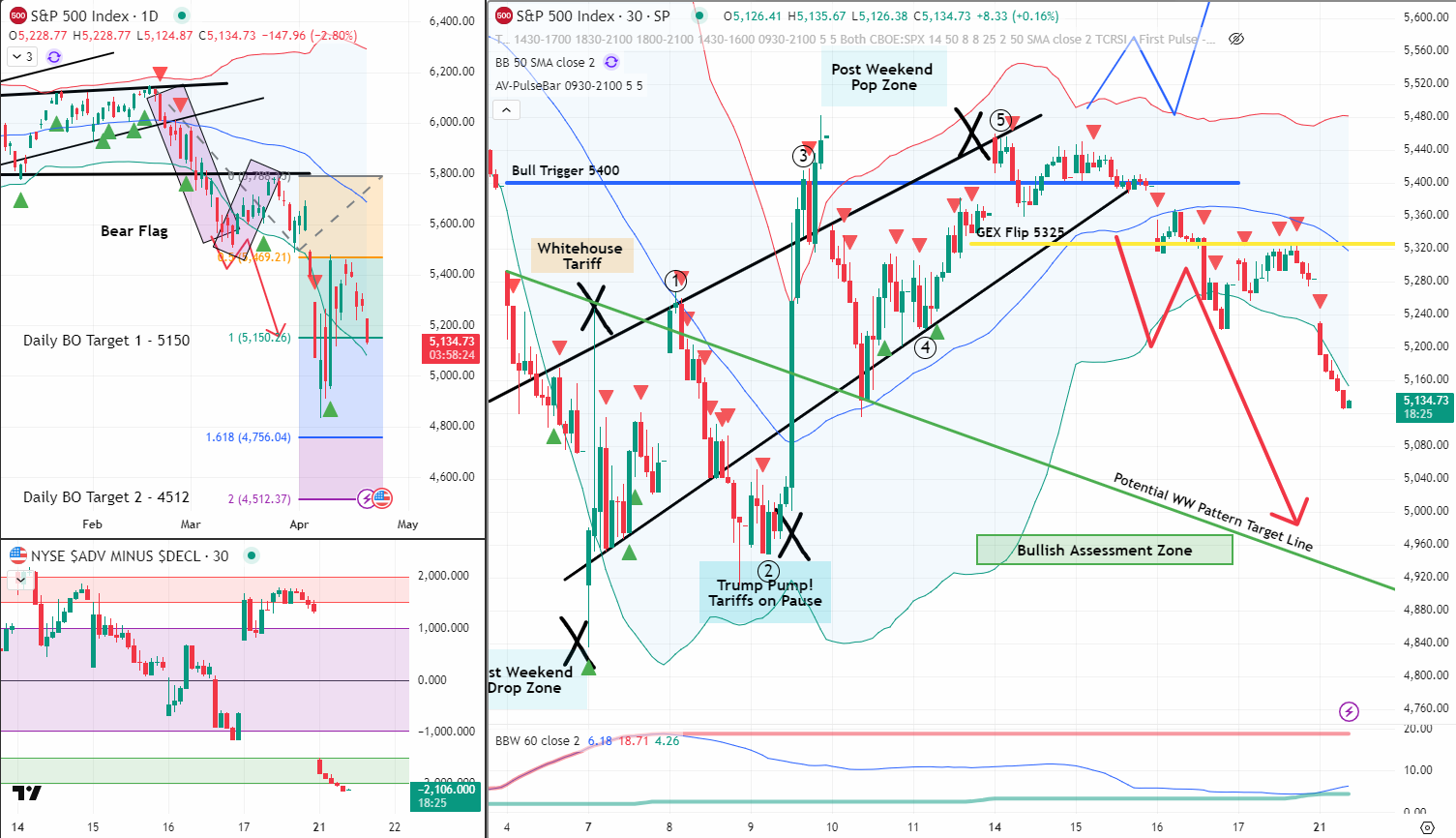

As laid out in the morning plan, we maintained a bearish bias below 5400 with a Wolfe Wave still in motion toward the 5000 target. Price confirmed that view beautifully with a textbook pulse bar during the opening 30 minutes, forming just beneath 5200.

That was the trigger.

The kind of clean entry that typically lets us lock in a premium around $3.00, with the usual exit resting comfortably near $0.30 – a near 90% ROC.

But even without the intraday entry, the system bias hasn’t changed:

-

GEX remains negative – confirming resistance

-

5400 = flip level – still firmly acting as a ceiling

-

5250 = gamma magnet – a potential price attractor mid-week

-

5000 = Wolfe Wave target – and we’re inching closer by the hour

So even if the day trade didn’t happen, the bearish swing exposure is still working in the background.

And if price keeps pushing, those open positions will do the talking… with or without me clicking the button.

Expert Insights: Common Trading Mistake & How to Avoid It

❌ Thinking missed trades = missed opportunity

It’s easy to fall into the trap of thinking, “I missed the move… now I’ve lost the edge.”

✅ Let the swing do the heavy lifting

This is why we use directional swing exposure alongside day trades.

It gives us coverage, continuity, and confidence — even when life interrupts the plan.

The system keeps paying when you’re not at the desk.

That’s not a luxury. That’s the point.

Fun Market Fact – Markets Don’t Care About Your Schedule

Did you know… the S&P has never once paused to let a trader grab a coffee, settle a family emergency, or reschedule an entry?

Shocking, I know.

Markets don’t slow down. They don’t care if you’re on holiday, in the hospital, or stuck on the motorway. But here’s the twist: systematic traders don’t care either.

Because the system was built to run without constant supervision.

The setup doesn’t need your opinion.

The swing doesn’t need your presence.

The edge doesn’t vanish just because you missed one trigger.

So yes, price might run without you today.

But you’ll still get paid – just a little later.

Rumour Has It…

-

Trump was spotted holding a sign saying “5400 is fake news” before retreating into a golf cart powered by negative gamma.

-

Reports suggest GEX levels tried to send an SOS signal over the weekend… but were drowned out by Easter brunch noise.

-

Some traders were seen attempting to short the chocolate supply chain after mistaking “bunny run” for a bullish breakout.

(This section is entirely made-up satire. Probably.)

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.