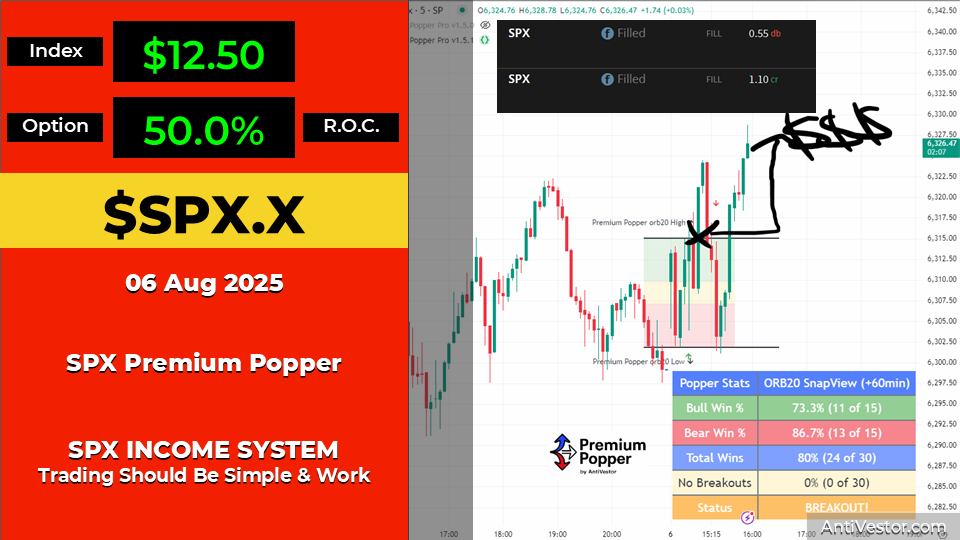

Live Trade. Fast Exit. $1.10 In, $0.55 Out. That’s a Popper.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

If you tuned in for the software demo this morning, you also got a front-row seat to a real-time income trade execution – textbook Premium Popper style.

This wasn’t a hypothetical backtest, a maybe-trade, or some guru’s hindsight hallucination.

This was live. Real money. Real rules. Real result.

Right after the bell, we got our Premium Popper pulse bar break.

Entered a credit spread at $1.10.

Then waited.

No chasing.

No wiggling.

Just execution.

Roughly 60 minutes later, price pushed +$12.50 from the range low, tagged our automation levels, and hit the pre-defined exit at $0.55.

That’s a clean 50% return-on-risk – without needing to sit in front of the screen all day.

The trade was over before most traders think about starting their day.

Because “popping premium” might just be your new favourite hobby.

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX Market Briefing:

Today’s Premium Popper trade is the kind of setup that makes the AntiVestor approach look deceptively simple – because it is.

Here’s the breakdown:

-

Strategy: Premium Popper (opening scalp), designed to capture option premium at the open

-

Chart timeframe: 5-min

-

Tool Used: The new Popper Software (demoed live)

-

Setup: Pulse bar breakout of 15-min opening range

-

Trade Trigger: Break above Premium Popper ORB high

-

Spread Sold: Put credit spread, 0-DTE

-

Credit Collected: $1.10

-

Exit Trigger: Price pushed (eventually) +$12.50 in our favour – exited at $0.55

This was not some wild YOLO option play. It was a defined-risk, rule-based, data-driven trade with a clear process behind it.

We’ve built the system around speed, simplicity, and statistical advantage. When you know the odds are in your favour, your only job is to pull the lever when the setup appears.

And today, it appeared right on cue.

The mechanical exit took care of the rest.

No guesswork. No stress. Just premium, popped.

And if you missed it?

You’ll get another one. Maybe tomorrow. That’s the point of a repeatable edge.

FUN FACT

The SPX was created in 1957 and originally included just 500 industrial stocks – tech was barely a blip back then. Today, it’s 80% tech, but the ticker remains: SPX.

[Source: S&P Global – “History of the S&P 500”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.