Yesterday’s Premium Popper and Lazy Popper Deliver Beach Day Wins

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

At the risk of sounding repetitive – the swing is still bullish.

Sometimes the best trading updates are the boring ones.

No overnight drama, no system overhauls, no emergency pivots.

Just mechanical continuity from strategies that work.

The ADD has dropped to bearish extremes over the last day, but SPX barely flinched despite overnight futures reacting to reports. Cash markets dropped and recovered quite quickly – exactly what you’d expect from a market that’s found its rhythm.

Overnight futures are up around 15 points this morning.

Nothing to write home about, but enough to push us toward another new all-time high if that gap holds through the opening bell.

Yesterday’s trades once again smashed it for the traders.

Premium Popper delivered profits right out the gate with fast action.

Lazy Popper produced another win while I enjoyed penny arcades, food markets, and ice cream at the beach with my wife and friends.

A lovely day made all the better by not being chained to a desk while collecting premium.

Keep scrolling for the final plan before flower show Friday…

SPX. 30 Minutes. One Trade. Job Done.

Trade less. Profit more. This isn’t trading… it’s income engineering.

SPX Market Briefing:

The chart continues its bullish narrative with mechanical precision. Sometimes consistency beats complexity.

Current Market Pulse:

- Swing Bias: Still bullish (theta dripping in nicely)

- Overnight Action: +15 point gap toward new ATH

- ADD Status: Bearish extreme hit, but cash market resilient

- Gap Psychology: If it holds, fresh highs likely at open

The ADD dropping to bearish extremes while SPX holds steady tells a story of underlying strength.

Overnight futures reacted to reports, but cash markets proved more resilient – dropping and recovering quickly. That’s the behavior of a market that knows where it wants to go.

Today’s Systematic Plan:

Tag ‘n Turn – Sit back and enjoy that theta dripping in while we wait for a new setup. The bullish swing continues delivering passive income while we monitor for the next opportunity.

Premium Popper – Waiting for the opening bell to scalp some fresh theta. First 15-30 minutes often serve up the cleanest volatility for quick collection.

Lazy Popper – Also waiting for opening bell action. Post-open setup for 0-DTE collection while maintaining mobile flexibility.

The plan remains beautifully simple: let the current positions do their work while staying ready for new opportunities. No forcing, no chasing, just mechanical execution when conditions align.

Friday Finale Note: Let’s see if we can finish the week on a high note before I head off to enjoy a flower show.

Not a weird metaphor – an actual showing of flowers.

Should be fun and a perfect way to decompress after a profitable week.

In Other News…

FinNuts Market Flash

FUTURES PLAYING DEAD CONVINCINGLY

E-mini S&P managed a heroic +0.2% by 9:25 AM – enough excitement to power a small village for roughly three seconds. Nasdaq flatlining like Kash’s enthusiasm for budget meetings while Dow does its best impression of furniture. Thursday’s hot PPI print had everyone clutching their pearls, but the trend’s still chugging along like Percy’s ancient Ford – ugly but unstoppable.

QUALITY GROWTH STRUTS LIKE IT OWNS THE PLACE

Policy expectations narrowed to quarter-point cuts, so growth stocks are preening like peacocks at a beauty contest. Semiconductors and AI infrastructure leading the parade while software names follow yield curves like lovesick teenagers. Energy’s flatter than Wallie’s jokes thanks to crude oil’s commitment to absolute boredom – brilliant news for transport companies who can finally afford diesel without selling organs.

EARNINGS CALENDAR EMPTIER THAN MAC’S PROMISES

Corporate catalysts scarcer than unicorns this close to weekend, so everyone’s obsessing over guidance about tariffs and freight costs like they’re reading ancient prophecies. Multinationals eyeing that soft dollar like Christmas morning – weak greenback means their foreign earnings don’t look quite so pathetic when translated back home.

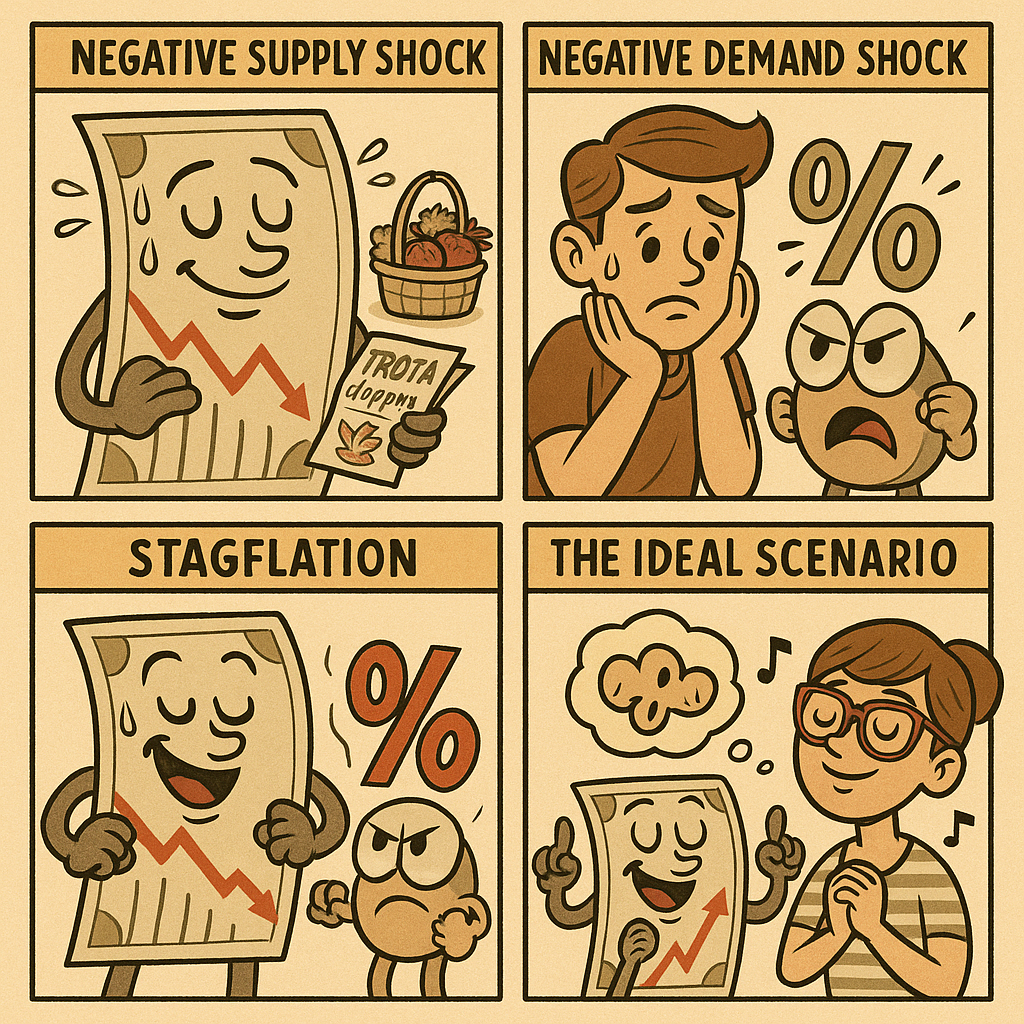

CROSS-ASSET FORTUNE TELLING SESSION

Jumbo Fed cuts died faster than office plants during August holidays after that PPI surprise, but 25 basis points in September still has everyone playing nice. Oil’s staying put like a well-trained dog, keeping inflation headlines from going mental. Credit markets behaving themselves while volatility naps peacefully. The roadmap: everything’s lovely unless Alaska summit decides to throw a proper tantrum or some rogue data point forces everyone to rethink their entire worldview.

-Hazel

Expert Insights:

When ADD hits bearish extremes while SPX maintains composure, it often indicates selective strength rather than broad weakness. The index is being carried by quality names while weaker stocks get shaken out.

Beach day trading success validates the core principle: when your system works mechanically, location and lifestyle enhancement become possible without sacrificing performance.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Mac was overheard planning his own “cultural enrichment trading tour,” starting with tomorrow’s flower show attendance.

“My dear chaps,” Mac declared while polishing his fedora, “if one can profit from penny arcades and ice cream parlors, surely flower exhibitions offer untapped market wisdom!”

Hazel immediately responded, “Absolutely not. We’re not turning botanical gardens into satellite trading floors.” She then blocked her calendar for “Flower Show Risk Assessment” while muttering about “systematic vacation policies.”

Percy claimed the flower show would provide “essential pollen-based market forecasting opportunities,” insisting that bloom patterns could predict volatility cycles.

Kash tried to explain how flower shows were “basically like yield farming but with actual flowers,” while Wallie just shook his head and muttered, “First beaches, now gardens. What’s next, trading from hot air balloons?”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Meme of the Day:

“When your swing trade is printing theta while you plan flower show attendance”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.