Futures Punch Bears in the Plums After Overnight Gap

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Markets flirted with follow-through yesterday, breaking down from the range just as FOMC rolled through. The playbook was working… until the futures market grabbed a hammer.

Blame Meta. Or Microsoft. Either way, earnings gave tech traders the sugar high they needed – and now the bears are waking up to a 60+ point gap in the wrong direction.

“Atlas didn’t shrug – he just bought more Tech.”

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX Market Briefing:

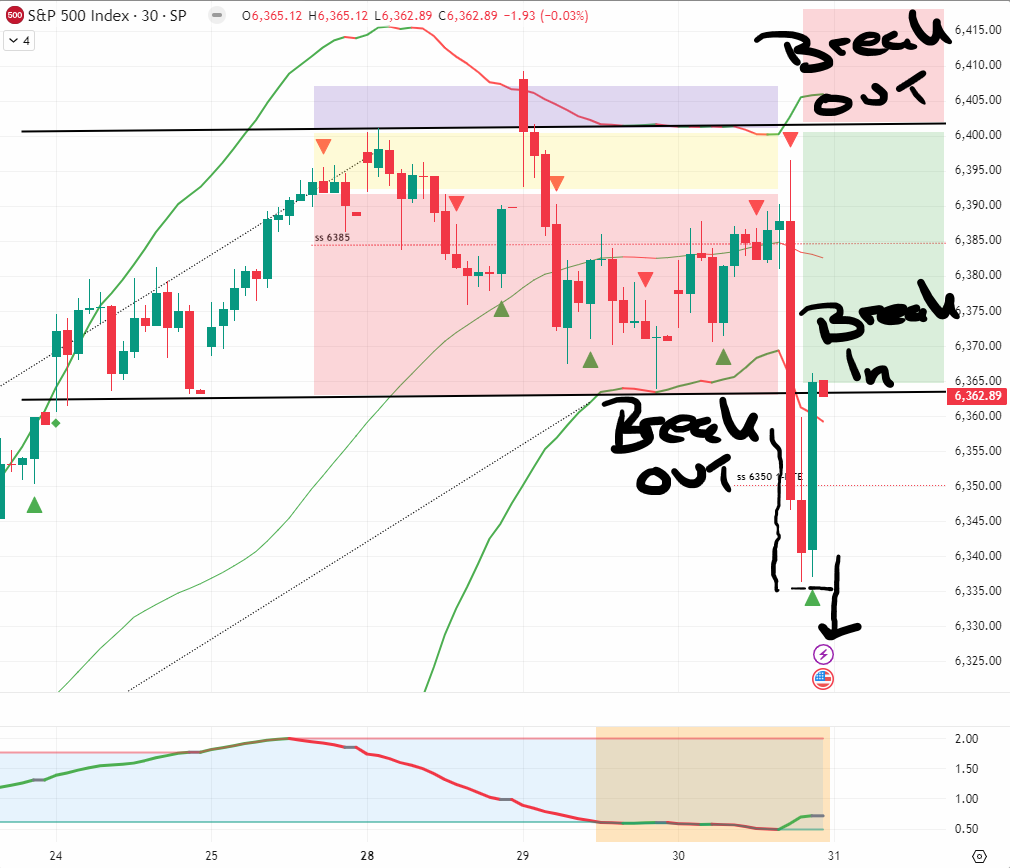

✅ Context Check

• We had a clean breakout through the range lows yesterday (6365).

• The pullback zone was in play for continuation shorts.

• Momentum confirmed the direction – bear swing still active.

• Everything was lining up.

Then came the after hours earnings… and the futures market decided to yeet the plan.

What Now?

Overnight, SPX futures launched over 1% on the back of tech earnings. That puts us in dangerous territory for bearish continuation – and right back in “range fakeout” land.

At time of writing:

• Futures suggest a gap above 6400/6420

• Likely to be opening outside the entire range

That’s not a bearish continuation. That’s a potential bull reset.

Current Tactical Map

-

Range Low: 6365 (confirmed broken intraday)

-

Range High: 6402.50

-

PFZ: Still ~6400 – acting as the gatekeeper – until the markets open!

Today’s Plan

Option 1 – Bullish Breakout above 6400

-

Wait for open. Let 30-60 mins shake out

-

If price holds above 6402.5 → Setup for breakout continuation (bull)

Option 2 – Break Back Into Range

-

Gap opens above but fails → reversal back into range

-

Look for breakback into range (bearish)

In Other News…

Markets Jitter Like a Caffeine Addict at a Meditation Retreat

Flat tape, twitchy hands, and one foot on the panic button

Wall Street woke up this morning like a hungover tightrope walker-wobbling between anticipation and existential dread.

Asia tried, kinda. MSCI Asia-Pacific squeaked out a 0.3% gain, led by Taiwan and Australia. Nikkei wandered off like it forgot what it was supposed to do. Traders there mostly just watched clouds and prayed Powell wouldn’t use the word “hawkish” in a sentence.

Futures played dead. Until they didn’t. S&P ticked down a humble 0.1%, the market equivalent of sighing loudly in a meeting. Energy and consumer staples took the day off-possibly to review their résumés.

But then-META and MSFT dropped the mic.

SPX futures suddenly jolted awake, vaulting 1% after Meta and Microsoft walked in like the cool kids at earnings prom. Zuckerberg handed out AI revenue like party favours, and Satya Nadella casually tossed a $3 trillion cloud around like a beach ball. Traders immediately unpaused their FOMO.

Meanwhile, the dollar hit beast mode.

The euro closed out July with a fat L, dropping into its first red month of the year. European exporters whimpered. Commodities mumbled something about “FX headwinds” and rolled over.

Sector rotation? More like sector stagnation.

Industrials, materials, and financials sat on the fence like they were waiting for Powell to send a carrier pigeon with instructions. Nobody wants to be the first to move-just the first to say “told you so” if it all implodes.

Bottom line: The market is strapped to a Fed-shaped heart monitor while big tech tries to play DJ. If Powell blinks, sneezes, or raises an eyebrow the wrong way-expect a full-volume asset class tantrum.

Rumour Has It…

FinNuts Hazel was last seen shouting “TECH TO THE MOON!” while stuffing diamond hands stickers into her Meta headset. When questioned about valuation, she said:

“My P/E is infinity, baby.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Meme of the Day:

“Right in the Plums”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.