Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

The markets are grappling with uncertainty, and the charts are no less conflicted. The markets are sinking and thankfully not crashing in the light of the two horrendous terror attacks. Our thoughts and prayers go to all those impacted by these atrocities.

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

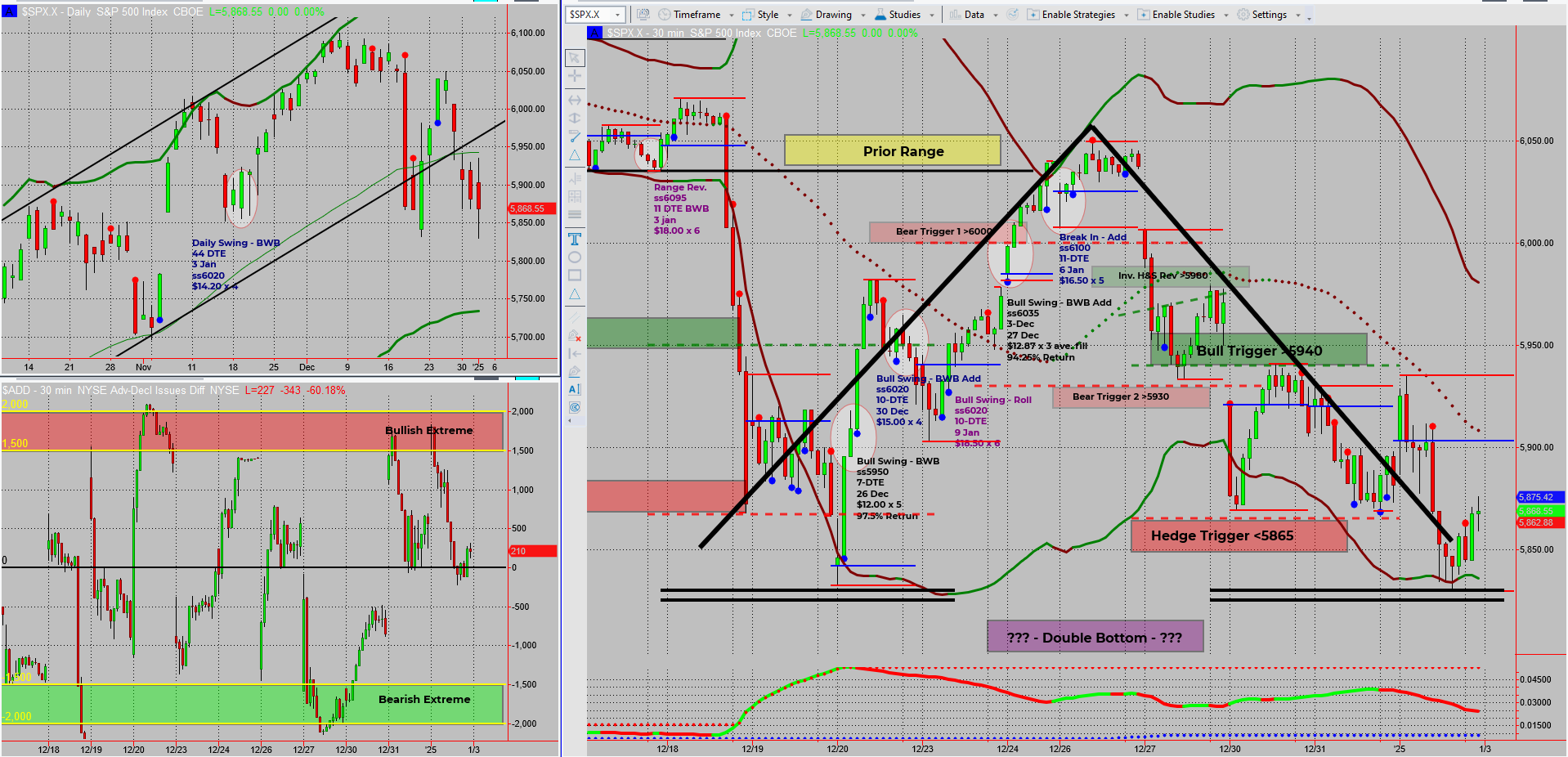

The SPX daily chart paints a picture of indecision with another long lower wick. Bears are clearly struggling to make a meaningful impact, hinting that we could see a pause before any major moves unfold.

Zooming into the 30-minute charts, a double bottom appears to be forming around the pivotal 5850 level. This level has held the line several times before, giving traders reason to pay close attention. However, it also aligns with what could be a neckline for a head-and-shoulders pattern on the daily chart.

Such conflicting signals between time frames are why I stick to single-time-frame trading 99.9% of the time – it keeps things clean and straightforward.

Here’s where things stand:

- The bear/hedge trigger at 5865 has been breached, but bear pulse bars remain absent.

- Until bear pulse bars confirm the trend, my bullish trades stay intact.

- Seasonal trends suggest a lacklustre Santa Rally may lead to a weak start for 2025.

Despite the noise, patience will be rewarded as we await the next clear signal. Whether bulls or bears take the lead, our SPX Income System is ready to pounce.

Fun Fact

Did you know? Historically, years following a weak Santa Rally often underperform, with the S&P 500 gaining just 1.2% on average versus 7.6% after strong rallies.

While not a guarantee, this data has held true in many cases since the “Santa Rally” concept was coined in the 1970s. It’s a reminder that even the most festive trends can carry sobering implications.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece