Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

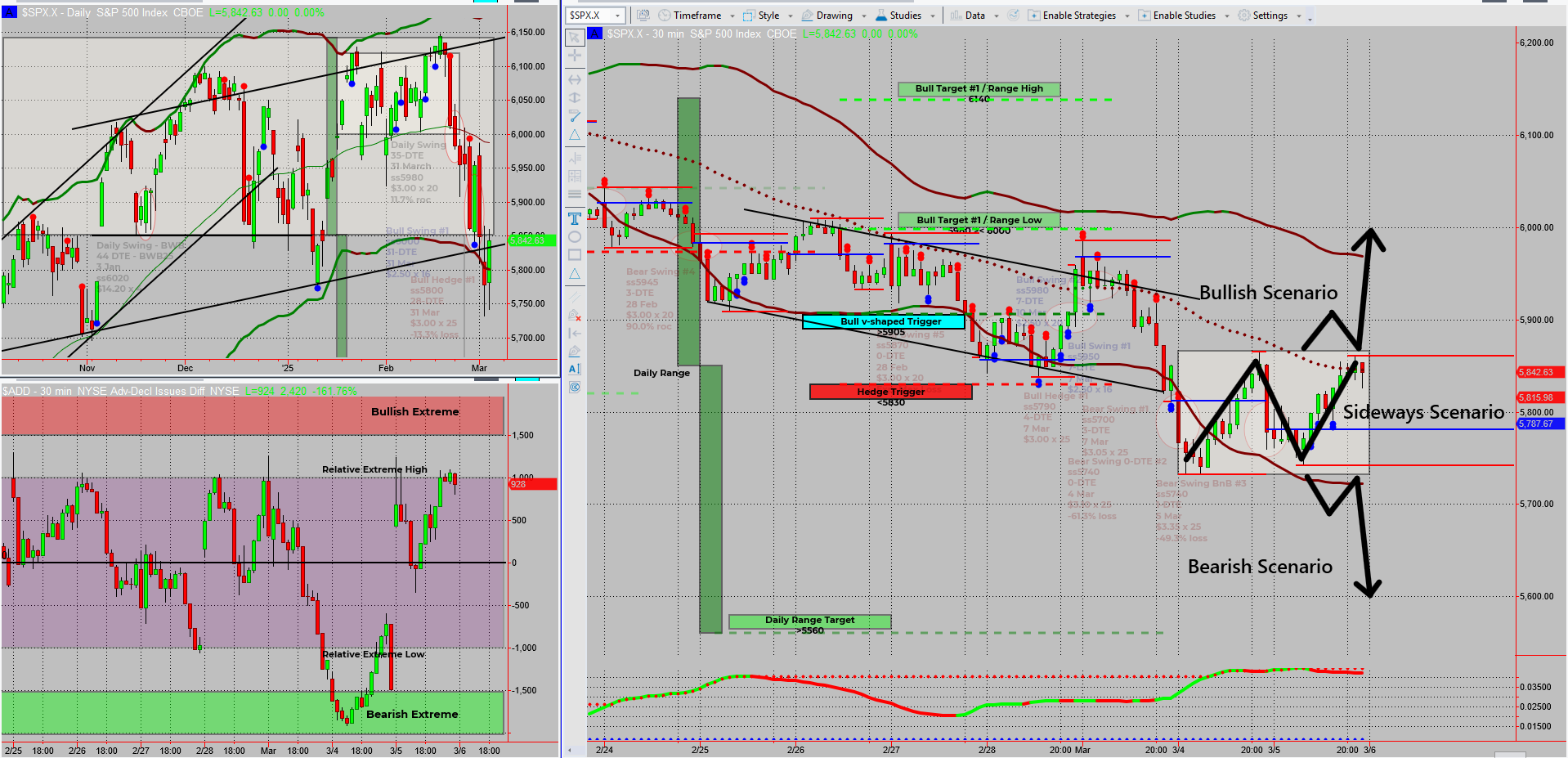

The market is bouncing around like a gummy bear on gummy juice—up one day, down the next, sometimes both in the same session. But now, a short-term price range is forming, making trade setups much clearer.

This new range, which is easier to see on ES futures, aligns perfectly with my 6 money-making patterns, guiding bullish, bearish, and neutral scenarios. ADD is at an upper extreme, overnight futures are selling off, and we have tariff wars & red flag news on deck—so patience continues to rule the day. The market is setting up for its next big move, and I’ll be ready when it fires.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

The markets continue to whipsaw traders, creating choppy and indecisive price action. But amidst the chaos, a short-term range is forming, providing clearer trade setups based on my 6 money-making patterns.

The Market Setup – A Tight Range is Emerging

- A short-term, well-defined price range is forming (visible on ES futures)

- This creates clear “what to do” signals based on my system

- Three possible scenarios:

- Bullish breakout – if buyers take control

- Bearish breakdown – if sellers push through support

- Neutral range-bound action – if price continues to chop around

Key Market Observations Today

- ADD is at an upper relative extreme – signalling a possible short-term pullback

- Price is near the upper boundary of the range – a natural resistance level

- Overnight futures are already selling off – adding to the bearish bias

What Could Trigger the Next Big Move?

- Tariff wars unfolding – potential for market-moving headlines

- Red flag news this month – major economic reports could act as a catalyst

- Markets at a tipping point – just waiting for the right push

How I’m Trading This:

✅ Hedged for movement in either direction—no need to predict, just react

✅ Waiting for confirmation before making a move—patience wins

✅ Watching for breakouts or failures at range extremes

This is a textbook setup—range-bound markets lead to breakouts, and I’ll be ready to capitalize on the move when it comes.

Fun Fact

Did you know? In 2009, a Twitter hoax claiming President Obama was injured caused the S&P 500 to drop 1% in minutes, wiping out billions in market value—before bouncing back when the truth came out.

The Lesson? The market reacts to headlines before verifying facts—a reminder that patience and confirmation matter in trading.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece