Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

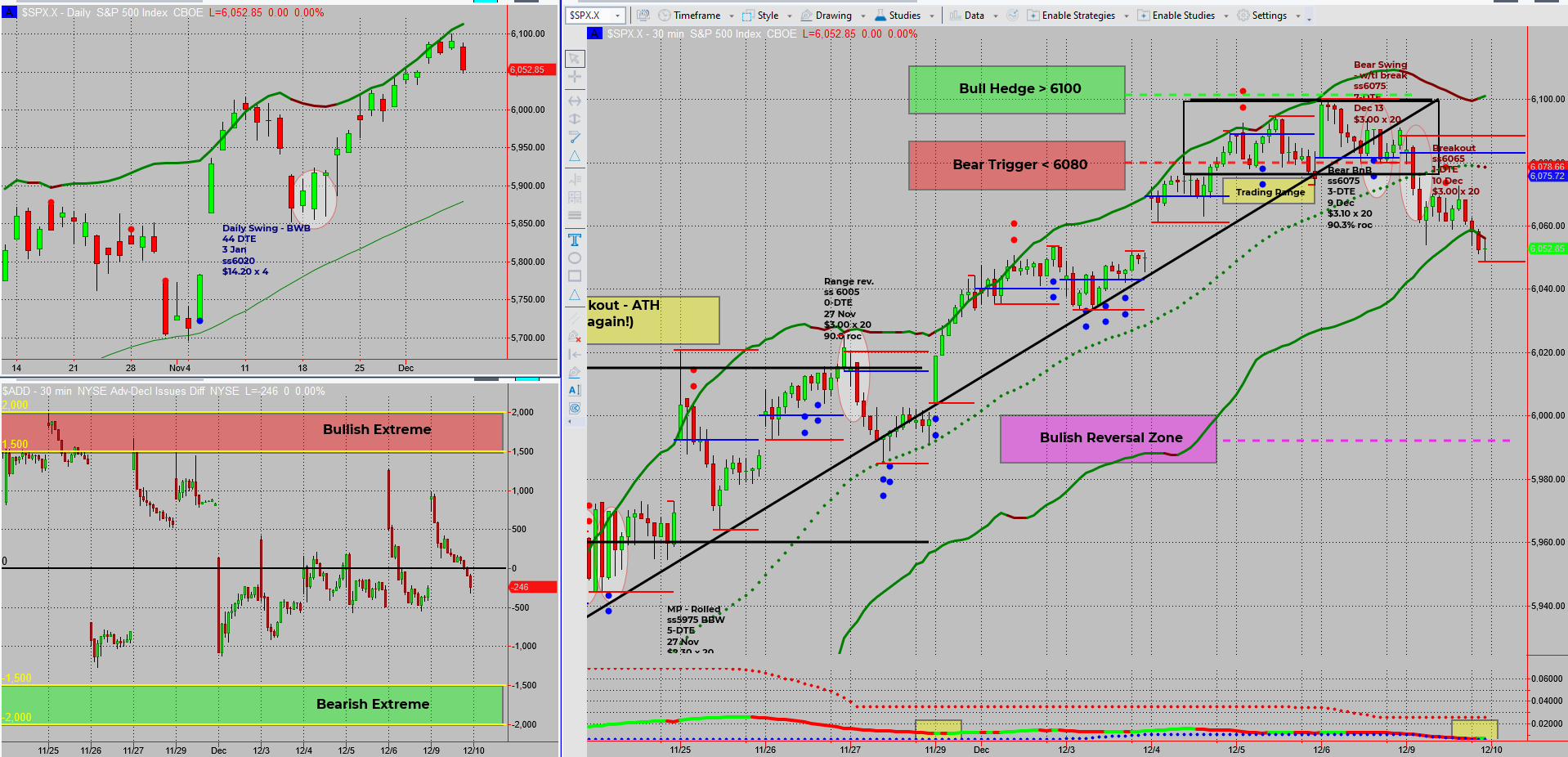

SPX has reached the anticipated $6,050 level, filling a previous gap from early December. Bearish income trades performed well, but could there be more room to drop? Let’s dive in!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX followed the expected path, breaking last week’s trend line and yesterday’s range. Price pushed lower to around $6,050, filling the gap left from December 4th-5th.

- This level was my initial target for short-term bearish swings.

- Profitable bear income trades were achieved as the market dropped.

- If the bearish momentum continues, I’m eyeing $6,000-$6,020 as the next potential stop.

Despite the recent bearish moves, my overall bias remains bullish.

- The SPX Income System continues to guide my trades effectively.

- I’m watching for signs of reversals and bullish entries near these levels.

In the meantime, patience rules the day as I wait for additional target exits and opportunities to align with the longer-term uptrend.

Fun Fact:

Did you know December is famous for the “Santa Claus Rally”?

The last five trading days of December and the first two of January often bring positive market returns. The rally is attributed to holiday optimism, year-end bonuses, and institutional portfolio adjustments. While not guaranteed, it’s a trend many traders keep an eye on for potential gains.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece