Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

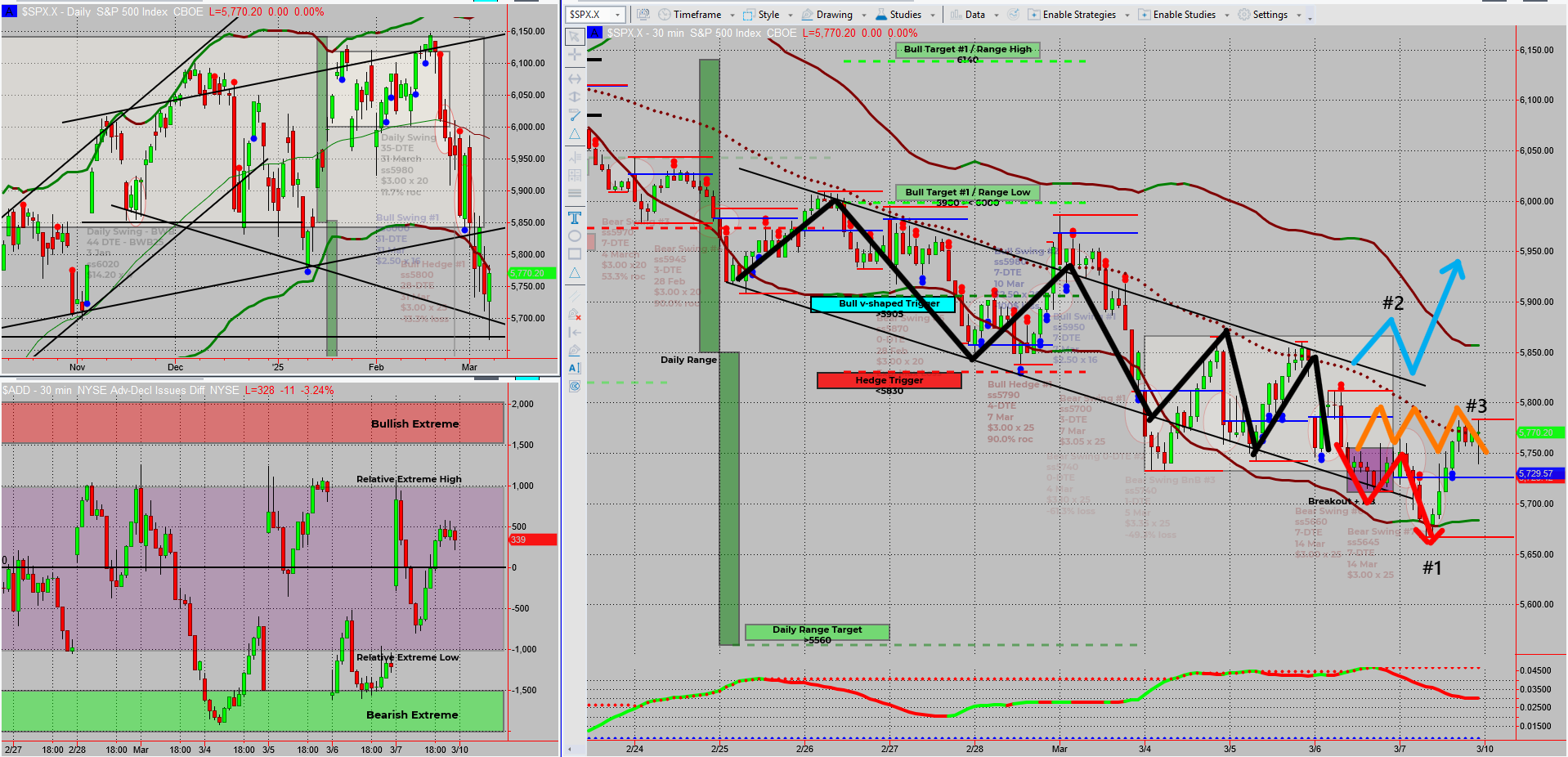

Another week, another grinding bearish move—but are we truly breaking down, or is this just another market head-fake?

Friday gave us a tease of a breakdown, only to bounce right back into the range by the close. The overnight futures are dipping slightly, but we’re not yet below last week’s lows, meaning the bears haven’t fully taken control—yet.

The scenarios remain unchanged, the bias is still bearish, and patience remains the best strategy. We’re watching for confirmation—because in this kind of slow-motion market, forcing a trade only leads to frustration.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

The market is playing the ultimate waiting game, and traders are getting impatient. It’s been grinding lower, teasing a real breakdown, only to snap back into the range by the week’s end. It’s like watching a boxer throw a knockout punch—only for the opponent to wobble, but never hit the canvas.

The bearish move is still intact, but it’s moving in slow motion. It’s not a dramatic crash, but a controlled decline, inching lower each day.

Friday’s Tease – The Breakdown That Wasn’t

- The market attempted a decisive break lower but failed to hold.

- By the close, price had bounced back into the range, leaving traders confused.

- This type of fake breakdown is what traps emotional traders, forcing them to chase moves that never materialize.

Overnight Futures – More of the Same?

- Futures dipped slightly, but last week’s lows remain unbroken.

- A real downside continuation requires price to actually commit below key levels.

- For now, it’s just more of the same slow-motion grind.

The Bearish Bias is Still in Play – But It Needs Confirmation

- The larger descending channel is still guiding price lower.

- The bias remains bearish, but conviction is lacking.

- If the market doesn’t break soon, we could see another bounce-back-to-nowhere scenario.

The Plan – Stay Hedged, Stay Patient

- No need to force a position—the market hasn’t fully committed.

- Let the range confirm a direction before taking on new risk.

- Stay ready—because once the move happens, it could be fast.

Right now, the market is whispering, not shouting. The traders who listen to what price is actually doing, rather than what they want it to do, will be the ones who capitalize when the next real move arrives.

Fun Fact

Did you know? In 1986, a trader at the Chicago Mercantile Exchange accidentally placed a $7 billion order instead of $7 million, causing a massive market spike before it was caught and reversed.

The Lesson? Even the smallest trading mistake can have enormous consequences—which is why having a structured system like the SPX Income System can help avoid costly errors and keep your trades under control.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece