Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

The SPX is climbing like a caffeinated squirrel… ok, maybe not. It’s more like a slightly confused sloth trying to find second gear!…, while DJX and RUT are stuck in the mud.

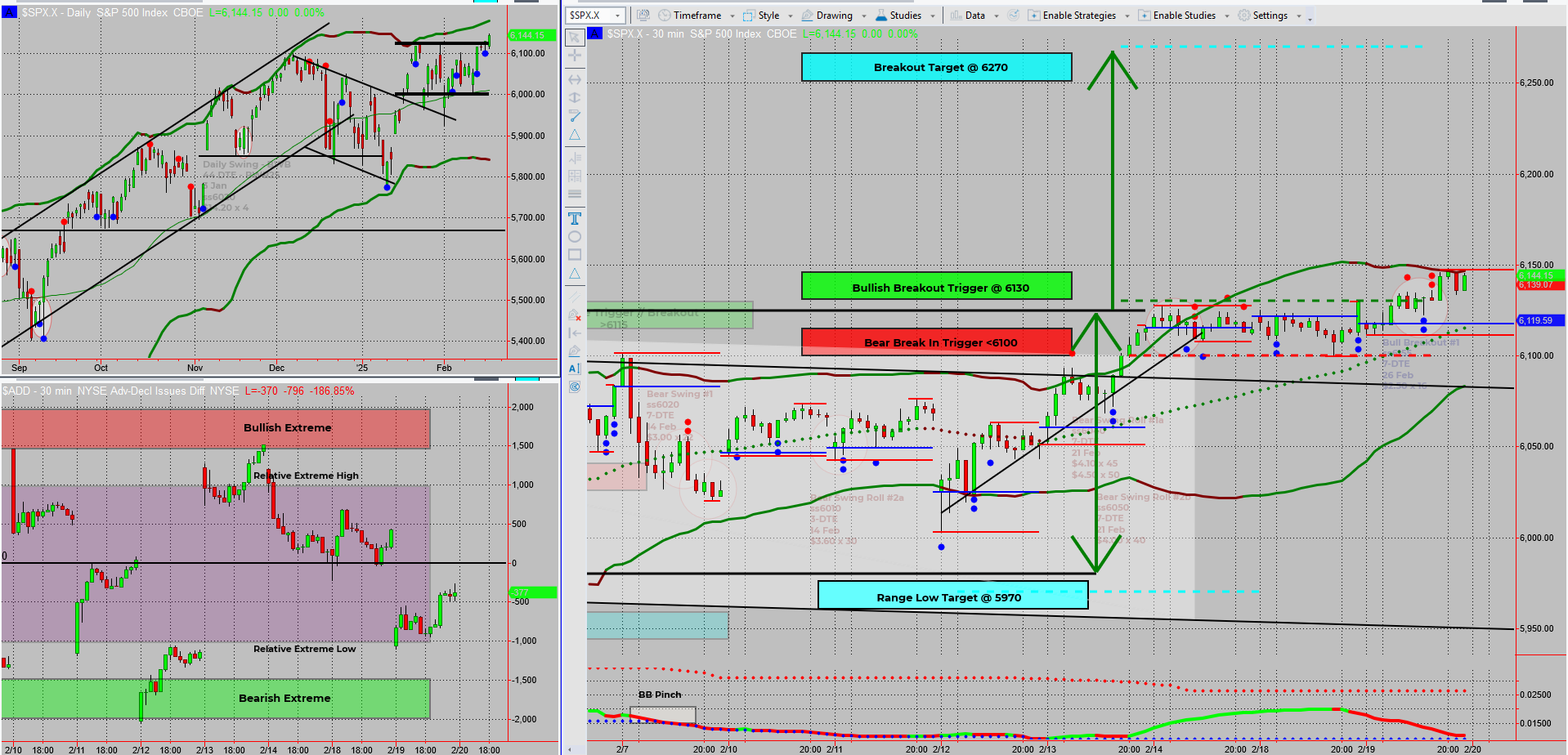

The breakout move we’ve been waiting for has arrived, and now the question is—does it have enough fuel to hit 6270, or will it stumble and trigger my hedge at 6100? Bollinger Bands are too tight for reliable setups, so I’m sticking with my 6 money-making patterns until volatility expands.

Let’s break it all down…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

SPX Deeper Dive Analysis:

SPX is Soaring (like a fat pigeon!) – But the Other Indexes Aren’t Joining the Party

While SPX is off making new highs, its friends DJX and RUT seem to have lost their invitations.

- DJX is struggling to gain meaningful ground

- RUT can’t even catch an uptick, making it the weakest of the bunch ❌

- Meanwhile, SPX is leading the way, with a clear breakout in play

- A closely following NDX is nipping at SPX’s heals

Breakout Confirmed – But Can It Hold?

Scenario #1 from our previous discussions has unfolded—the range has broken out.

- Target: 6270

- Hedge trigger: 6100 in case the move fails

- This is the good kind of waiting—waiting for profits to materialise

Why I’m Avoiding Tag ‘n Turn Setups Right Now

Normally, after a breakout, I’d shift back to Tag ‘n Turn setups. But there’s a problem…

- Bollinger Bandwidth is too tight, making moves too fast

- Price is flipping from one side of the bands to the other

- A Bollinger Band pinch is forming, indicating more compression before expansion

So, what’s the plan?

✅ I’ll continue to use my 6 money-making patterns

✅ I’ll wait for volatility to expand before returning to Bollinger setups

✅ No forced trades—only high-probability moves

Final Takeaway?

The breakout is here, the target is set, and the plan is clear. Now, it’s time to let the market do its thing and wait for the move to play out.

Fun Fact

Did you know? In 2018, Amazon briefly became a $1 trillion company—but it only stayed there for a few hours before dropping back below the threshold.

The Lesson? Even the biggest breakouts can be short-lived—just because a stock (or index) makes a new high doesn’t mean it will stay there forever. Always have a plan—targets and hedge triggers matter.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece