Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Something for the weekend? Don’t mind if I do!

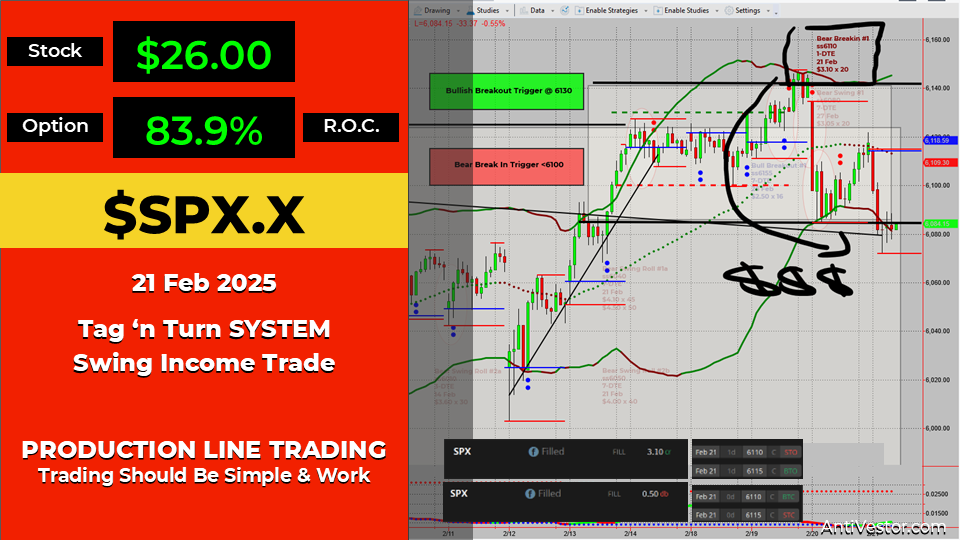

This quick-fire hedge trade was a perfect response to my bullish breakout trade suddenly changing its mind and doing a U-turn. Rather than dragging out a long adjustment, I took a 1-DTE trade, locked in a quick 83.9% return, and now I’m waiting to manage the original trade properly.

No stress, no drama—just smart trading. Let’s break it down…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

SPX Deeper Dive Analysis:

Why This Trade? A Hedge Against a U-Turn

This wasn’t just a random trade for the sake of trading—it was part of a larger plan.

- The original bullish breakout trade was valid but started showing signs of hesitation

- Instead of closing it outright, I opted for a short-term hedge

- A 1-DTE trade allowed me to offset potential losses while keeping my original trade alive

The Trade Setup

- Collected $3.10 in premium

- Closed the next day for $0.50

- Final return: 83.9%

Why a 1-DTE Trade?

If I had hedged in the same expiration, I’d be stuck managing both legs for too long.

✅ Short-term hedge → Quick resolution

✅ No unnecessary adjustments

✅ Kept the bullish trade alive while protecting against an outright loss

What’s Next?

- The bullish trade still has time—I’ll update once I manage it

- Profit is locked in, regardless of what happens next

- Broker statements are on the chart for full transparency

Final Takeaway? This is why having a strategy matters—even when the market decides to change direction.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece