Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

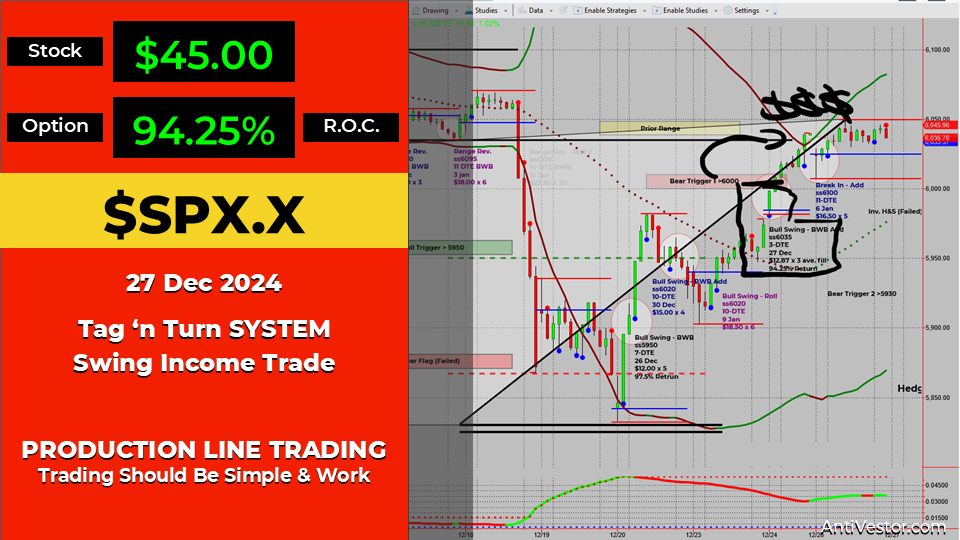

✨ The holiday cheer spilt over into the markets with a quick and profitable SPX trade. Following our bullish swing strategy, this trade was set up on Christmas Eve and closed post-holiday for a hefty 94.25% return. Let’s break it down!

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

The festive season didn’t slow down our trading momentum. Here’s the scoop:

- The Setup: Placed on Christmas Eve, this was the third bullish trade in the swing. Using a broken wing butterfly, it complemented the ongoing bull strategy.

- The Details:

- Credit Collected: $12.87 (average fill after split fill).

- Plan: Enter on Tuesday, and aim to close by Friday.

- The Result:

- Exit Price: $0.74, locking in a 94.25% return.

- Timing: Closed early on December 26th for a quick post-holiday win.

- The Strategy: This setup, part of the SPX Income System, showcased the power of timing, precision, and strategy in capitalizing on seasonal market movements.

As we head toward the end of the year, the bullish swing remains strong, with plenty of potential for continued gains.

Fun Fact

Historically, December tends to be one of the strongest months for the stock market, but January often takes the crown for small-cap stocks. This “January Effect” sees smaller companies outperforming as investors reposition portfolios for the new year.

The January Effect is fueled by tax-loss harvesting and reinvestment strategies, often driving a surge in small-cap stocks as traders and investors allocate funds for the year ahead. It’s a phenomenon that savvy traders watch closely, aligning their strategies with these seasonal biases to maximize returns.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece