Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

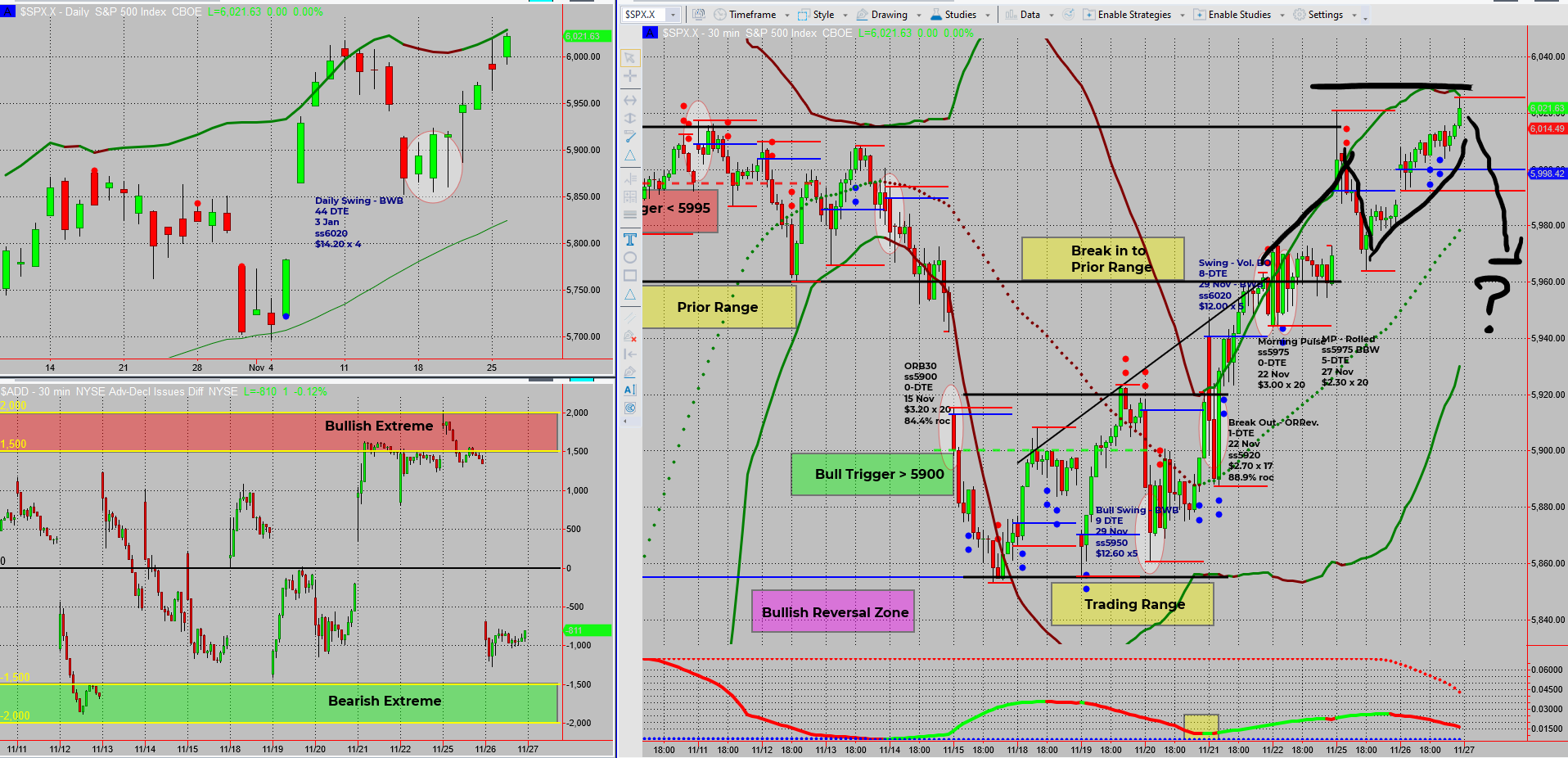

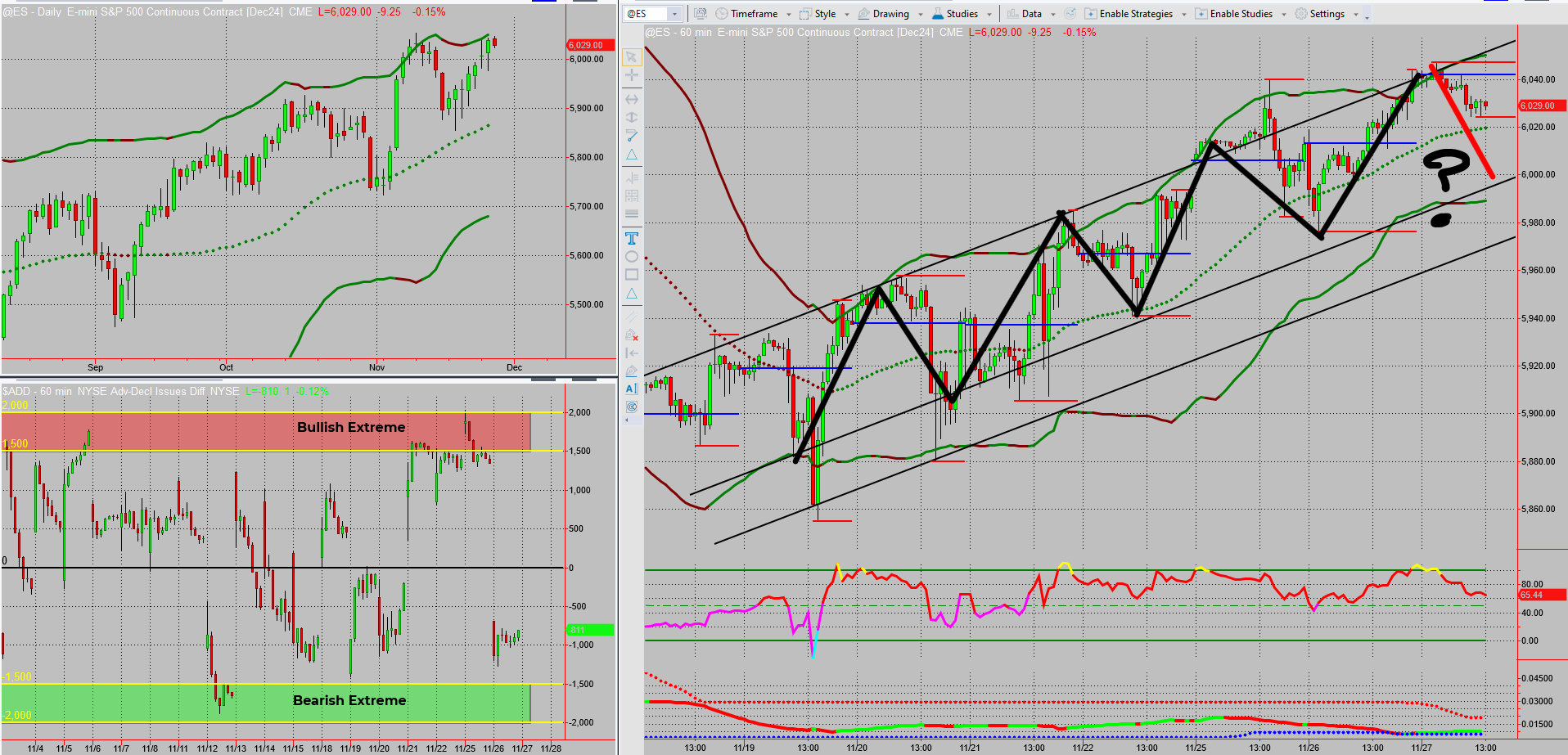

The SPX continues to dance within its range, teasing both bears and bulls alike. With ES futures suggesting a rising range, the next move could take us to lower boundaries before any breakout sparks new opportunities. Let’s dive into today’s market landscape!

Rising Channel is more clearly seen on ES futures.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX remains stuck in its prior range, as expected. For now, I’m eyeing moves toward the lower boundary before we see any breakout attempt in either direction.

What’s unfolding:

- ES futures reveal a rising range.

- Price currently hovers near the upper boundary.

- A move to the lower boundary seems most likely in the short term.

Friday’s “fix-it” trade wrapped up with a small but satisfying net gain. The details will follow separately, but it’s a great example of managing risk smartly.

The bigger picture:

- My overall bias remains bullish, focusing on reversals at range lows and breakouts at range highs.

- Any bearish movements are likely to be short-lived, consistent with market behaviour post-election.

Patience is key, and I’m ready to take action when the next clear setup presents itself.

Fun Fact

The S&P 500’s ticker, SPX, wasn’t always its name. Before 1982, it was referred to as the “Composite Index,” and it had only 90 companies!

Expansion to 500 companies gave the index its name and the breadth it’s known for today. This diversification turned it into the market barometer we rely on.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece