Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

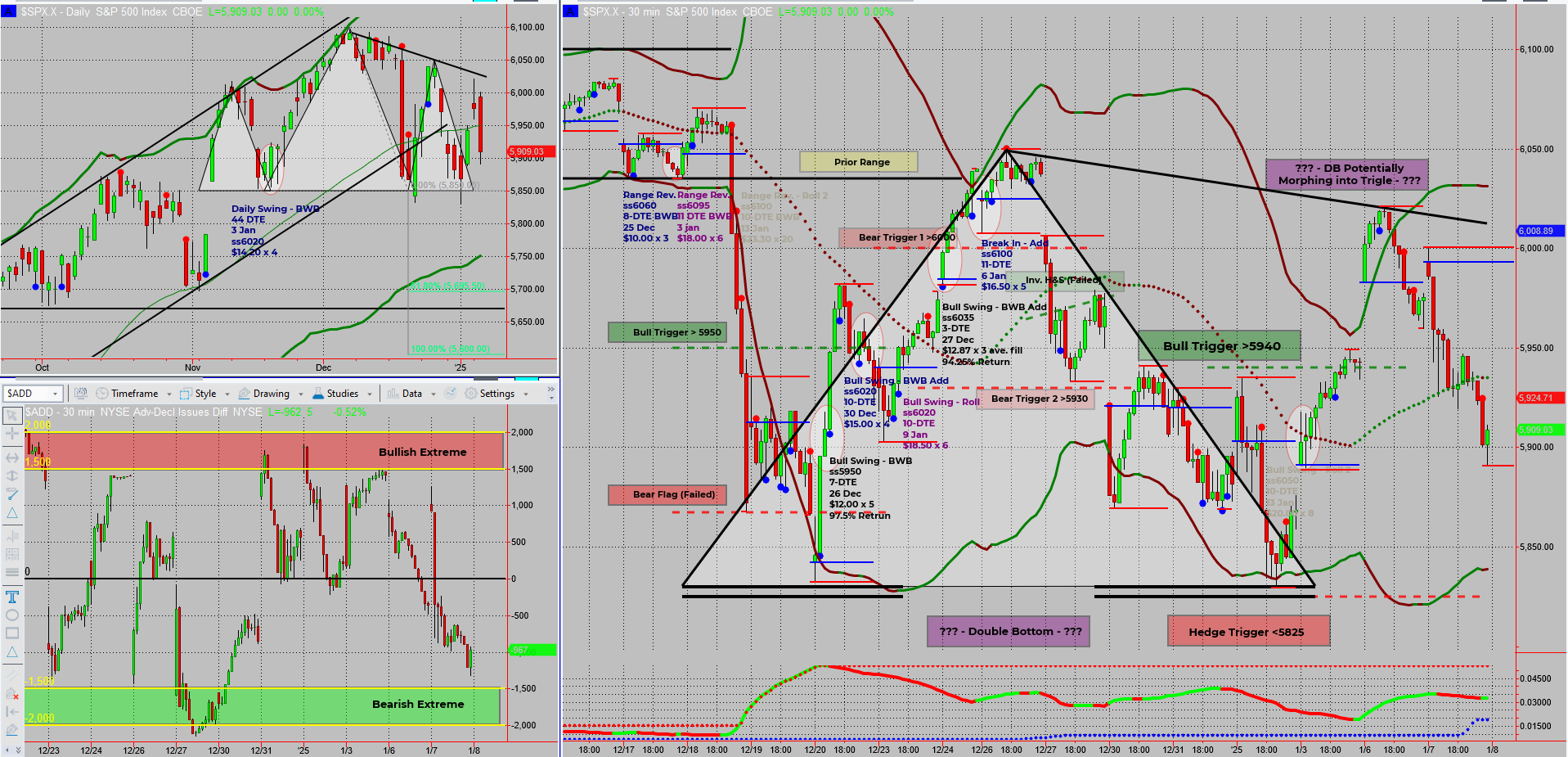

Chart patterns in real-time aren’t as clear-cut as those picture-perfect textbook examples. They mutate, evolve, and sometimes defy expectations. Today, we dive into why adaptability and patience are your ultimate trading tools – especially when the market sends mixed signals.

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

The challenge with identifying chart patterns in real-time lies in their unpredictability. Unlike textbook examples that analyze patterns in hindsight, trading in the moment requires recognizing their potential to evolve or morph entirely into something completely different.

As W.D. Gann wisely said,

“Always be prepared to change your mind.” I would also add, “with new information,” a lesson every trader must embrace.

The previously noted double bottom on SPX seems to be shifting. With a lower high formed, it hints at the early stages of a triangle pattern. Whether this becomes a descending or symmetrical triangle depends on retesting the 5830 level, which has yet to happen.

- SPX System Highlights:

- Monday: Conservative entry and pulse bar entries identified

- Tuesday: No actionable pulse bars for trades

Unfortunately, a hospital trip on Monday meant I missed the bear SPX Income Swing opportunity with a “Tag ‘n Turn” setup. It’s a stark reminder that missed trades shouldn’t lead to revenge trading. Chasing losses often blows accounts faster than an SAS sabotage mission.

On the $ADD front, the bearish extreme suggests a possible higher low, leaning towards a short-term bullish move. With Thursday’s market closure looming and this stop-start trading week, I’m opting for patience.

I’ll wait for a decisive breakout before committing to new trades.

Fun Fact

Did you know? The term “double bottom” was inspired by the W-pattern resembling two mountain peaks. While widely discussed, less than 15% of these patterns lead to a significant breakout according to modern studies!

Despite their popularity, double bottoms don’t always guarantee a clear outcome. They’re better understood as potential setups rather than certainties. A vital trading lesson: Never rely on a single pattern without confirmation.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece