Remembrance Day – Honouring The Fallen And Those Who Serve

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Let’s take a minute to bow our heads and remember the fallen and for those that serve on a day of remembrance.

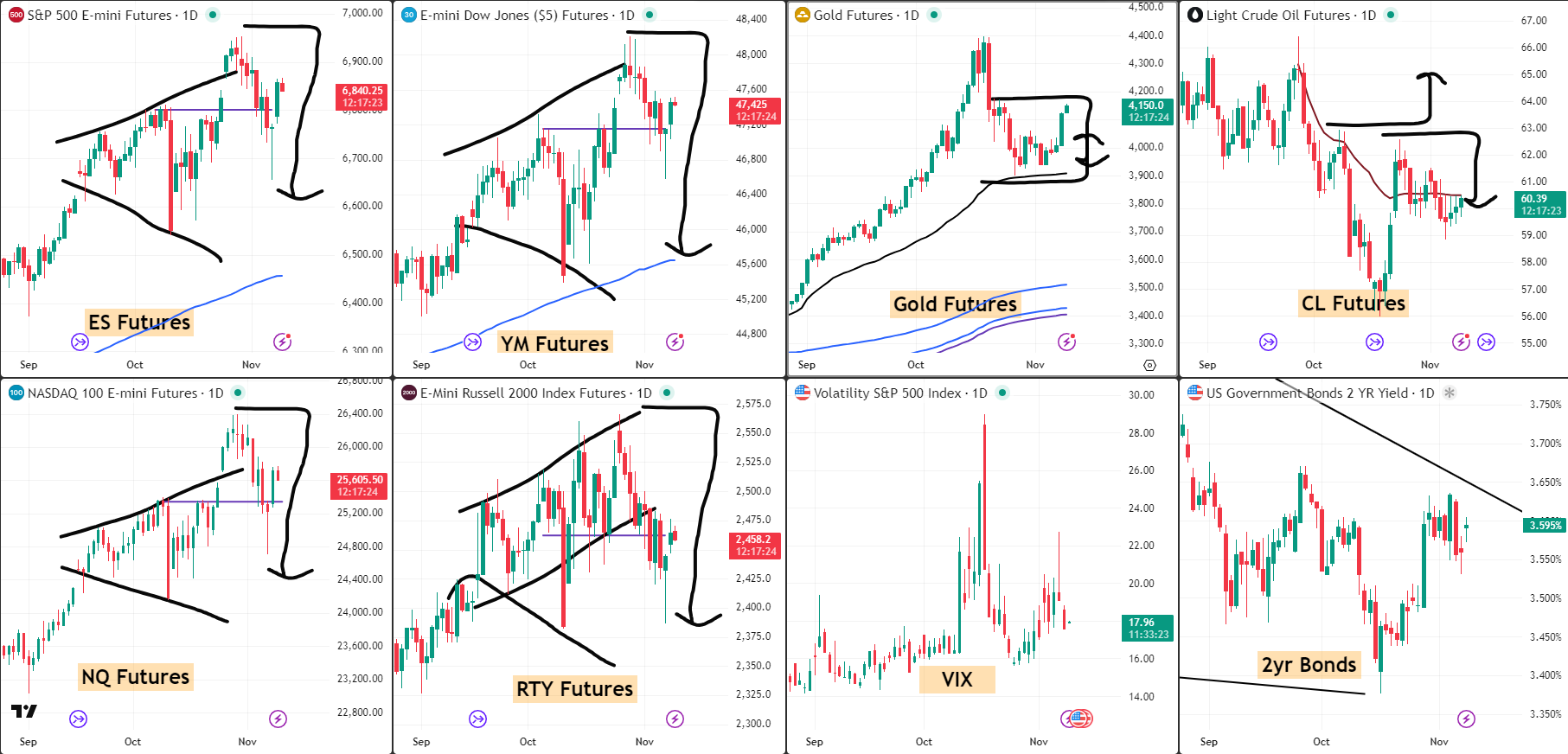

Today’s markets seem just like yesterday’s and last week’s in that we are grinding sideways with no new ground being won or lost.

The daily charts look like nothing serious has happened – and yet yesterday did see a 100+ point move on the ES and comparative moves on NQ and YM. RTY was the only wobble, which again may offer clues as to the real moves unfolding behind the exuberance of the blue chip leaders.

Gold is already leading the charge to reclaim some ground, and I’m already seeing this move being talked about in terms of this being a bull trap and further capitulation moves.

I’m not in the forecasting or crystal ball game. I respond to what my system is saying, and I always have firm over/under lines – so as to not get caught in a trap… with no way out.

SPX has pushed firmly off Friday’s lows and is near the upper Bollinger Band. Should we not reach it, I will use the AVWAP from the TnT low as a moving level I can manage my bull swing as needed.

RUT also behaving in a similar way off Friday’s low – but struggling to push higher to the same magnitude. It is finding overhead resistance at the AVWAP from the TnT high, again using the AVWAP off TnT low as line to manage the bull positions without waiting for the PFZ level to be tripped.

As I was away from desk yesterday due to a family emergency, I will be sitting down properly for the first time this week to look for some Premium Popper action.

Keep scrolling for the systematic grinding sideways analysis…

100+ ES Move Looks Like Nothing On Daily. RTY Wobble Tells Different Story.

SPX Market Briefing:

Tuesday November observes Remembrance Day honouring the fallen whilst markets grind sideways (no new ground won/lost despite yesterday’s 100+ ES move looking uneventful on daily charts), RTY wobble offering clues to real moves behind blue chip exuberance as gold leads reclaim with bull trap talk emerging, Phil responding to system not forecasts using firm over/under lines and AVWAP from TnT levels for management rather than waiting for PFZ trips.

Current Multi-Market Status:

- ES: 6840.25, near upper Bollinger Band off Friday lows

- RTY: 2458.2, struggling vs blue chips, wobbling

- YM: 47,425, comparative move to ES yesterday

- NQ: 25,605.50, blue chip exuberance continuing

- CL: $60.39, reclaimed $60 level

- GC: $4150.0, leading charge to reclaim ground

- VIX: 17.96, declining from elevated levels

- 2yr Bonds: 3.595%

Remembrance Day – A Minute To Honour

Let’s take a minute to bow our heads and remember the fallen and for those that serve on a day of remembrance.

11 November – Remembrance Day in the UK. A moment to pause from markets and trading to honour those who gave their lives and those who continue to serve.

The systematic approach to trading provides freedom and flexibility – including the freedom to step away, honour what matters, and return to mechanical execution when appropriate.

Today we remember.

Grinding Sideways – 100+ ES Move Looks Like Nothing

Today’s markets seem just like yesterday’s and last week’s in that we are grinding sideways with no new ground being won or lost.

The daily charts look like nothing serious has happened. Pull up SPX, ES, NQ, YM – they all show ranging, grinding, sideways consolidation. No decisive breakouts. No confirmed reversals.

And yet yesterday did see a 100+ point move on the ES and comparative moves on NQ and YM.

Timeframe perspective:

Intraday traders: “Massive 100+ point move! Volatility! Action!”

Daily chart observers: “Meh. Another inside bar. Still ranging.”

For systematic traders, daily charts matter more than intraday volatility when assessing directional conviction. If daily charts aren’t confirming moves, intraday drama is just noise.

Current Status: Grinding sideways with no new ground won/lost, 100+ ES move looks uneventful on daily timeframes

RTY Wobble – Blue Chip Exuberance Lacks Foundation

RTY was the only wobble, which again may offer clues as to the real moves unfolding behind the exuberance of the blue chip leaders.

ES, YM, NQ: All pushing off Friday lows. Blue chip exuberance. Grinding higher.

RTY: Wobbling. Not keeping pace. Struggling with same magnitude.

When blue chips are exuberant but small caps are wobbling, this suggests surface-level strength without broad-based conviction. Blue chip names can rally on their own momentum, but if small caps aren’t participating, the move lacks foundation.

RUT finding overhead resistance at AVWAP from TnT high whilst SPX approaches upper Bollinger Band. Divided market behaviour.

Current Status: RTY wobbling whilst blue chips exuberant, small cap weakness suggesting surface-level strength

System Response Not Forecasting

Gold is already leading the charge to reclaim some ground. GC: $4150.0 – pushing higher after recent weakness.

And I’m already seeing this move being talked about in terms of this being a bull trap and further capitulation moves.

I’m not in the forecasting or crystal ball game. I respond to what my system is saying.

And I always have firm over/under lines – so as to not get caught in a trap… with no way out.

Firm over/under lines = mechanical levels:

- Above = bullish positioning appropriate

- Below = bearish positioning appropriate

- Price moves, positioning adjusts, never trapped

Current Status: Gold leading with competing narratives, responding to system with firm lines preventing traps

AVWAP Management – Tighter Control Without PFZ Wait

SPX has pushed firmly off Friday’s lows and is near the upper Bollinger Band.

Should we not reach it, I will use the AVWAP from the TnT low as a moving level I can manage my bull swing as needed.

Enhanced approach: Use AVWAP from TnT low as dynamic management level. Don’t wait for PFZ trip. AVWAP provides dynamic support that moves with price. Break below signals weakness before PFZ level trips. Tighter management in uncertain environment.

RUT also behaving in a similar way off Friday’s low – but struggling to push higher to the same magnitude.

It is finding overhead resistance at the AVWAP from the TnT high, again using the AVWAP off TnT low as line to manage the bull positions without waiting for the PFZ level to be tripped.

Two AVWAP levels on RUT:

- AVWAP from TnT high: Overhead resistance (price struggling)

- AVWAP from TnT low: Support/management level (exit if breaks)

Price squeezed between two AVWAPs creates defined risk zone. Tighter management than waiting for PFZ trip.

Current Status: SPX near upper BB using AVWAP from TnT low for management, RUT squeezed between two AVWAP levels

Back At Desk – Looking For Premium Poppers

As I was away from desk yesterday due to a family emergency, I will be sitting down properly for the first time this week to look for some Premium Popper action.

Personal note acknowledging: Life happens. Family emergencies take priority. Systematic trading provides flexibility to step away when needed.

First time sitting down properly this week: Monday was weekend, today (Tuesday) is first proper desk session. Looking for Premium Popper opportunities after being away.

The advantage of systematic frameworks: They don’t require constant monitoring. Premium Poppers have mechanical entry triggers. When setups appear, execution happens. When they don’t, patience continues.

Being away from desk doesn’t create FOMO or anxiety when systems are mechanical. Just return, scan for setups, execute if triggered, continue if not.

Current Status: Back at desk after family emergency, scanning for Premium Popper opportunities, systematic patience no FOMO

In Other News…

xxx

CHART HERE

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Grinding Sideways Despite 100-Point Moves Formation Flying” whilst analysing RTY wobble patterns and claiming they had mastered “AVWAP From TnT Levels Advanced Management Cooing With Firm Over-Under Lines Discipline” – all whilst wearing commemorative poppy badges in honour of Remembrance Day.

Hazel updated her crisis management protocols to include “Blue Chip Exuberance Whilst Small Caps Wobble Recognition Emergency Procedures” alongside contingency plans for “Bull Trap Narrative Integration With Gold Reclaim Monitoring And Daily-Chart-Looking-Calm-Despite-Intraday-Drama Analysis Protocols.”

Mac raised his Tuesday whisky (with poppy pin on lapel) and declared, “When 100-point ES moves look like nothing on daily charts whilst RTY wobbles behind blue chip exuberance and gold leads reclaim with bull trap talk, responding to system with firm over-under lines becomes delightfully superior to crystal ball forecasting!”

Kash attempted livestreaming about “grinding sideways being basically like DeFi range-bound liquidity but with actual AVWAP management levels” but got distracted calculating whether bull trap narratives count as alpha or just mainstream FUD.

Wallie grumbled (poppy on his vintage jacket) that in his day, Remembrance Day meant “proper market pause rather than this modern grinding-sideways-whilst-honouring-the-fallen multitasking with AVWAP terminology!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.