Dow Led Moon Shot Yesterday +1.25% Nearly 600 Points – While ES, NQ, RTY Took Crafty Smoke Break

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Yesterday the Dow decided to lead a moon shot.

+1.25%. Nearly 600 points. Stood tall and proud.

Meanwhile ES, NQ, and RTY enjoyed a crafty smoke break whilst Dow did all the heavy lifting.

Here’s what’s happening:

ES looking to follow during premarket. NQ lagging (surprise). RTY lagging (not a surprise).

Tomorrow we get CPI data. Could this be “buy the rumour sell the news” event? Or will we just see complete and utter mayhem?

My popcorn is ready.

SPX continues bullish from the lower TnT setup at 6660 and chugging nicely toward the upper BB. Nothing clever or fancy needed. Just keep collecting that premium.

RUT also still bullish from Friday’s TnT setup. Price grinding between bear and bull AVWAP. Bullish breaks above 2470, bearish breaks below 2440.

Technically RUT has reached the projected target from the daily chart. Firming in buy range lows. Targeting range highs at 2540 which could see the bigger move shoot towards a crack at new ATH.

Fun times.

Keep scrolling for the Dow moon shot breakdown…

Dow +600. Others Smoking. CPI Tomorrow. Premium Collection Continues.

SPX Market Briefing:

Wednesday November reviews collective stock market standing tall as Dow led moon shot charge (+1.25% nearly 600 points) whilst other indexes enjoyed crafty smoke break with ES looking to follow premarket (NQ lagging surprise, RTY lagging not surprise), CPI data tomorrow creating buy-rumour-sell-news or complete-mayhem question (popcorn ready), SPX continuing bull from 6660 TnT low chugging toward upper BB (just collect premium), RUT hitting projected target grinding between 2470/2440 AVWAPs whilst targeting 2540 range highs for potential new ATH crack.

Current Multi-Market Status:

- ES: 6895.75, following Dow’s lead in premarket

- RTY: 2463.4, lagging, grinding between AVWAPs

- YM: 48,106, moon shot leader +1.25% nearly 600 points

- NQ: 25,798.00, lagging (surprise)

- CL: $60.70, back above $60 level

- GC: $4134.6, consolidating recent gains

- VIX: 17.14, continuing decline from elevated levels

- 2yr Bonds: 3.566%

- NYSE Advance-Decline: 728,000 (positive breadth)

Dow Moon Shot – Others On Smoke Break

The collective stock market stood tall and proud yesterday and the Dow led the charge for a moon shot.

YM: +1.25%, nearly 600 points.

Ending the day up… all whilst the other indexes enjoyed a crafty smoke break whilst Dow did all the heavy lifting.

ES, NQ, RTY sitting on the bench: “You got this, Dow. Carry on.”

Different indexes lead at different times. Sometimes one does the work whilst others rest. What matters: Dow’s 600-point move shows buying conviction exists. But narrow leadership (one index working, three resting) means be careful assuming broad market strength.

Current Status: Dow +600 moon shot, others took smoke break, narrow leadership visible

ES Following, NQ/RTY Lagging

ES is looking like it’s making a push to follow during the premarket session.

ES: 6895.75 premarket – attempting to follow Dow’s lead.

Whilst NQ (surprise) along with RTY (not a surprise) is lagging.

NQ lagging = noteworthy. Tech usually leads. When Nasdaq lags whilst Dow leads, it’s role reversal worth noting.

RTY lagging = expected. Uncle Russell’s been wobbling for weeks. Small caps continue their separate story.

Current Status: ES following premarket, NQ lagging (surprise), RTY lagging (not surprise)

CPI Tomorrow – Popcorn Ready

With the potential for some news out later this week (tomorrow) could this be a “buy the rumour sell the news” event – or will we just see complete and utter mayhem?

Thursday 13 November: CPI data

- Core CPI m/m: 0.3% forecast

- CPI m/m: 0.2% forecast

- CPI y/y: 3.0% forecast

Two scenarios:

Buy the rumour, sell the news: Markets already positioned. Data as expected. Initial pop, then profit-taking.

Complete and utter mayhem: CPI hotter or cooler than expected. Markets panic or rally hard. Chaos either way.

My popcorn is ready.

Premium collection strategies love volatility. Higher IV around news events = bigger premiums to collect. Up or down doesn’t matter.

Current Status: CPI tomorrow, two scenarios possible, popcorn ready, Premium strategies positioned for volatility

SPX – Just Keep Collecting Premium

SPX continues to bull its way from the lower TnT setup at 6660 and chug nicely along the route towards the upper BB.

Current: 6846.40

Friday’s TnT flip: Bullish above 6640.93. Support at 6660 holding. Target: Upper Bollinger Band. Route: Chugging along nicely.

Nothing clever or fancy needed, just keep collecting that premium.

When trend is established and price is behaving: Don’t overcomplicate. Don’t predict reversals. Don’t fight the move. Just execute mechanical rules and collect premium.

Current Status: SPX bullish from 6660, chugging to upper BB, just collect premium

RUT – Grinding AVWAPs, Targeting ATH

RUT also still bullish from the recent TnT setup last Friday.

Current: 2458.28

Only price does seem to be grinding between the bear and bull AVWAP – bullish breaks above 2470 and bearish breaks below 2440.

Two AVWAP levels defining range:

- 2470: Bull AVWAP – break above confirms bullish

- 2440: Bear AVWAP – break below signals bearish

Price squeezed between. Grinding. Testing. Deciding.

Technically we have seen RUT reach the projected target from the daily chart.

Bearish breakdown target: Hit ✓. Bears got their downside.

So we are firming in buy range lows and target the range highs which could see the bigger move shoot towards 2540 level and have a crack at a new ATH.

The setup: Daily target reached. Support firming. Range highs at 2540. Potential new all-time high attempt.

If RUT breaks above 2470 and confirms bullish, path opens toward 2540. From there, new ATH levels come into view.

Fun times.

Current Status: RUT grinding 2470/2440 AVWAPs, daily target hit, targeting 2540 for ATH crack

In Other News…

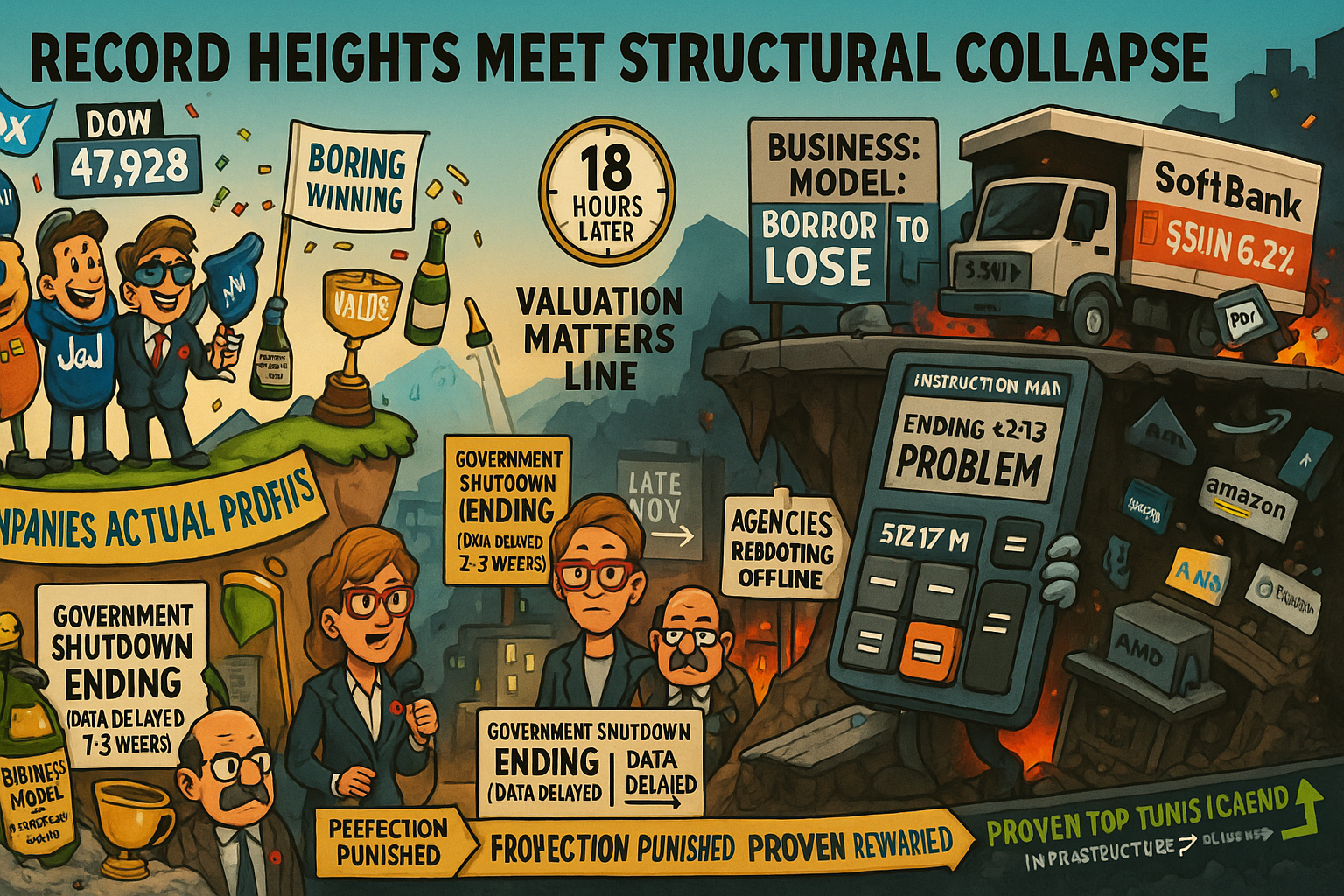

Dow Hits Record Whilst Everything Else Discovers Gravity

Old economy celebrates. Tech discovers CoreWeave’s business model is “borrow money, lose more money.”

Monday delivered peak market schizophrenia: Dow surged 559 points to record 47,928 celebrating industrials and healthcare whilst Nasdaq fell 0.25% as tech profit-taking revealed CoreWeave losing $94M annually after paying interest on borrowing to lose money operationally. SoftBank’s stock soared despite dumping $5.83B Nvidia stake because apparently selling winners whilst profit triples signals galaxy-brain investment strategy. Shutdown approaching resolution but CPI/PPI delayed 2-3 weeks as agencies need time to remember how counting works.

When Business Model Is “Borrow More Than You Earn”

CoreWeave crashed 16% cutting 2025 guidance after revealing operating income $217M trails interest expense $311M—corporate equivalent of celebrating salary raise whilst mortgage payment doubles. AMD beat every metric, showcased OpenAI partnership, guided higher for Q4, yet fell because Amazon disclosed exiting position proving perfect execution meaningless when big money leaves. Applied Materials and chip equipment names discovered nobody wants infrastructure for business models losing $94M annually.

Flight to Boring Achieves Record Heights

Dow industrials, Merck, Amgen, J&J led gains as investors rediscovered revolutionary concept that companies making actual profits trading at reasonable valuations might beat companies borrowing billions to subsidise unprofitable AI infrastructure. FedEx CFO calmed holiday fears sending stock up 5%, Warner Bros surged 15% on acquisition rumours—markets rewarding anything resembling traditional business rather than financing circularity schemes.

Shutdown “Resolution” Solves Absolutely Nothing

Government shutdown approaching end removes uncertainty premium except CPI/PPI delayed until late November as agencies need 2-3 weeks to restart basic counting functions. Data drought continues meaning Fed still flying blind, but apparently solving dysfunction that created information blackout counts as progress. Treasury curve steepening on easing path confidence despite nobody having actual economic data to justify confidence.

☕ Hazel’s Take

Markets celebrating Dow records whilst tech discovers borrowing $311M to lose $217M operationally isn’t sustainable business model. When flight-to-quality means fleeing companies losing money to companies making money, possibly admitting valuations occasionally matter after all.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Moon Shot Formation Flying Whilst Others Take Smoke Breaks” whilst analysing Dow’s 600-point solo charge and claiming they had mastered “CPI Event Popcorn Preparation Advanced Cooing With Buy-Rumour-Sell-News Recognition Discipline.”

Hazel updated her crisis management protocols to include “One Index Moon Shot Whilst Three Take Crafty Smoke Break Recognition Emergency Procedures” alongside contingency plans for “Complete And Utter Mayhem Versus Sell-News Event Integration With Premium Collection During CPI Volatility Protocols.”

Mac raised his Wednesday whisky and declared, “When Dow does all heavy lifting with 600-point moon shot whilst ES, NQ, RTY enjoy smoke break and CPI tomorrow creates mayhem or sell-news question, just-keep-collecting-premium becomes delightfully superior to prediction attempts!”

Kash attempted livestreaming about “buy the rumour being basically like DeFi pre-announcement positioning but with actual CPI data catalysts” but got distracted calculating whether popcorn-ready counts as risk management or just entertainment positioning.

Wallie grumbled that in his day, moon shots meant “all indexes moving together rather than this modern Dow-does-work-whilst-others-smoke behaviour with CPI mayhem speculation!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.