Smoke Break Somehow Turned Into Competitive Cripple Mr Onion Tournament

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Dow is currently in outer space on its own NATHs baby!

While Nasdaq, S&P, and Uncle Russell continue their extended smoke break which has somehow turned into a competitive Cripple Mr Onion tournament. (STP would approve of this level of absurdity.)

Gold’s breakout charge continues making the bull trap party speechless as they wave goodbye from the sidelines.

Oil finally gets some life back into it (or death in this case) as Trump tweets torpedo it down to sensible prices.

Apart from that, everything is normal, nothing to see here, move along, no droids here! No news either! (still).

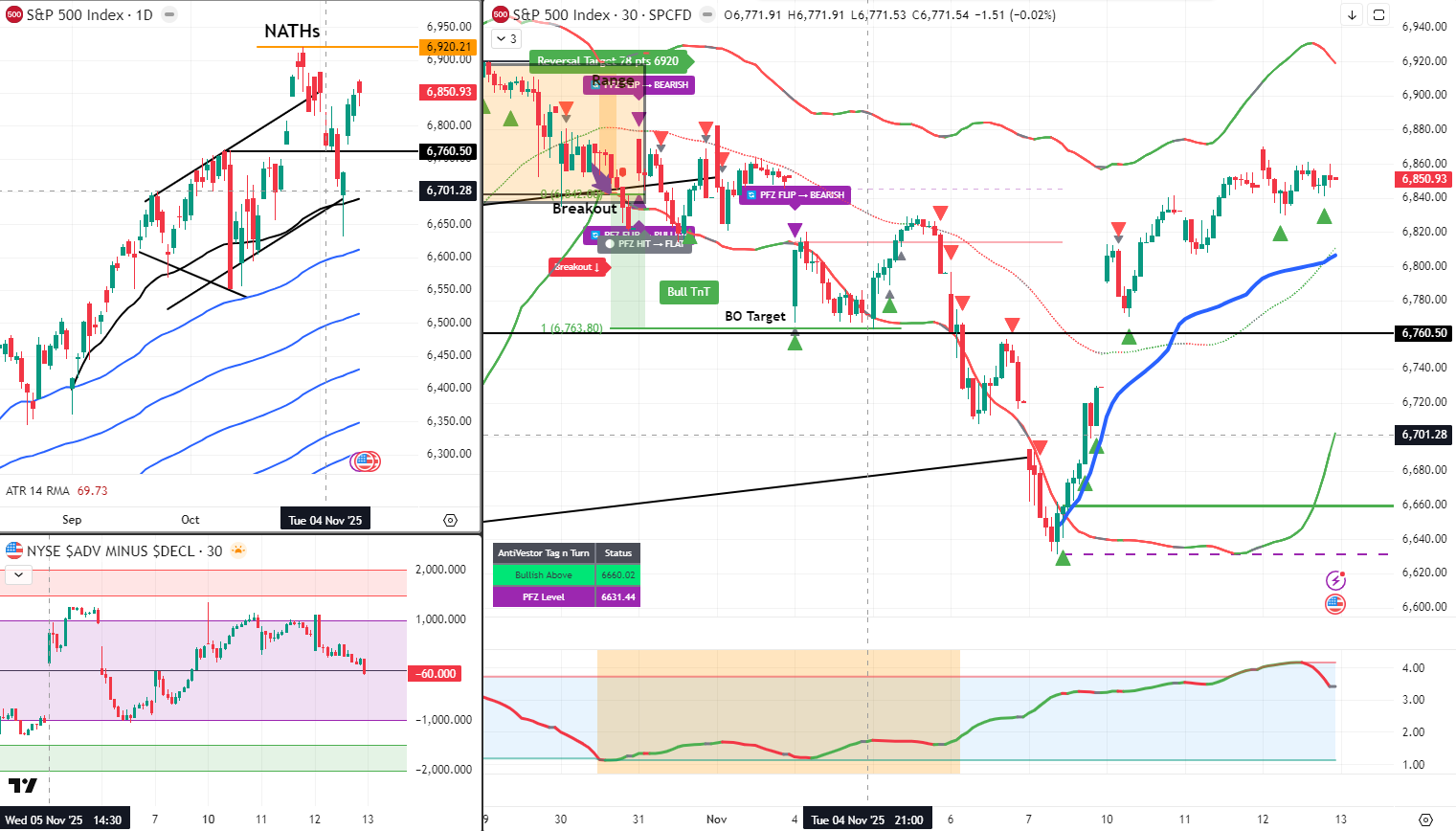

SPX bull swing on my usual 30 min setup continues to bull – and this sideways move does nothing but help “Collect ‘dat theta! As sung by 50 Cent or ‘Fiddy as the kids call him.

RUT is in a rut and has pinched between the upper and lower AVWAPs which could be a precursor to an official Bollinger band pinch point – other than that the bull swing is fine and collecting that theta.

The Premium Poppers were fun yesterday. I was a little late starting my own trading activities as I was busy coding up some improvements – eventually saw a nice VWAP flop on RUT for a quick scalp around lunch time.

The Lazy Poppers also did well yesterday – once again proving that you don’t need a trend to make the Benjamin’s.

Keep scrolling for the outer space Dow analysis…

Dow At NATHs Solo. Others Playing Card Games. Gold Breakout Continues. Theta Collection Supreme.

SPX Market Briefing:

Thursday November reviews Dow currently in outer space at own NATHs whilst Naz/S&P/Uncle Russ extended smoke break turned competitive Cripple Mr Onion tournament (Terry Pratchett absurdity), gold’s breakout charge continuing making bull trap party speechless waving goodbye from sidelines, oil getting life/death as Trump tweets torpedo to sensible prices, everything normal nothing-to-see-here-no-droids-no-news status, SPX bull swing on 30min collecting theta, RUT in rut pinched between AVWAPs (Bollinger pinch precursor whilst bull swing fine collecting theta), Premium Poppers fun yesterday (late start coding improvements, VWAP flop RUT scalp lunch), Lazy Poppers proving trend unnecessary for making Benjamin’s.

Current Multi-Market Status:

- ES: 6672.00, sideways whilst Dow solos outer space

- RTY: 2455.1, in a rut between AVWAPs

- YM: 48,393, outer space NATHs baby

- NQ: 25,605.50, competitive Cripple Mr Onion participant

- CL: $58.70, Trump tweet torpedoed to sensible prices

- GC: $4237.8, breakout charge silencing bull trap party

- VIX: 17.70, calm during absurdity

- 2yr Bonds: 3.583%

Dow In Outer Space – Others Playing Cripple Mr Onion

Dow is currently in outer space on its own NATHs baby!

YM: 48,393 – new all-time highs, solo mission.

While Nasdaq, S&P, and Uncle Russell continue their extended smoke break which has somehow turned into a competitive Cripple Mr Onion tournament.

Cripple Mr Onion = Terry Pratchett’s absurdly complex Discworld card game. Nobody understands the rules. Perfect description of what NQ, ES, and RTY are doing whilst Dow reaches new highs alone.

Current Status: Dow at NATHs solo, others playing incomprehensible card games

Gold Silences Bull Trap Party

Gold’s breakout charge continues making the bull trap party speechless as they wave goodbye from the sidelines.

GC: $4237.8 – continuing breakout charge.

The “bull trap” bears from earlier this week? Speechless. Watching from sidelines whilst move continues without them. Called trap at start, now trapped out of move.

Current Status: Gold breakout continuing, bull trap callers sidelined

Oil Torpedoed, Everything Normal, No Droids

Oil finally gets some life back into it (or death in this case) as Trump tweets torpedo it down to sensible prices.

CL: $58.70 – Trump tweets achieving “sensible prices.”

Apart from that, everything is normal, nothing to see here, move along, no droids here! No news either (still).

Star Wars energy: “These aren’t the droids you’re looking for.” Yesterday’s CPI anticipation led to… nothing particularly interesting. Back to normal programming.

Current Status: Oil torpedoed via tweets, everything normal, no news

SPX – Collecting Fiddy Theta

SPX bull swing on my usual 30 min setup continues to bull – and this sideways move does nothing but help collect ‘dat theta!

SPX: 6850.93 – bull swing from 6660 continuing.

As sung by 50 Cent or ‘Fiddy as the kids call him.

Sideways grind = perfect for theta collection. “Get Theta Or Die Tryin’.” Bull swing intact, collecting along the way.

Current Status: SPX bull swing collecting Fiddy theta, sideways helping

RUT In A Rut – AVWAP Pinch

RUT is in a rut and has pinched between the upper and lower AVWAPs which could be a precursor to an official Bollinger band pinch point.

RUT: 2450.67 – squeezed between AVWAP levels. Compression building. Could precede Bollinger squeeze.

Other than that the bull swing is fine and collecting that theta.

Despite compression, bull swing from Friday valid. Collecting theta whilst setup develops.

Current Status: RUT pinched between AVWAPs, Bollinger pinch precursor, bull swing collecting

Premium/Lazy Poppers – Making Benjamins

The Premium Poppers were fun yesterday. I was a little late starting my own trading activities as I was busy coding up some improvements – eventually saw a nice VWAP flop on RUT for a quick scalp around lunch time.

Late start coding. VWAP flop RUT. Lunch scalp. Done.

The Lazy Poppers also did well yesterday – once again proving that you don’t need a trend to make the Benjamins.

Lazy Poppers = 0-DTE strategies profiting from time decay. Sideways grind frustrates directional traders. Perfect for Lazy Poppers collecting Benjamins.

Current Status: Premium Poppers VWAP scalp, Lazy Poppers proving trend unnecessary

In Other News…

Dow Hits Record Nobody’s Watching

Blue-chips celebrate profitability. Tech discovers margins matter. Disney prepares final subscriber confession.

Dow surged to record 48,254 Wednesday whilst Nasdaq fell 0.26% as markets rediscovered revolutionary concept that companies making money trading at reasonable valuations occasionally outperform companies subsidising unprofitable infrastructure. CoreWeave extended Tuesday’s 16% crash as operating margin collapsed from 20.1% to 3.8%—corporate equivalent of celebrating revenue growth whilst profit margins evaporate. Disney reports 8:30 AM with final subscriber count before discontinuing metric, admitting defeat on transparency through strategic amnesia.

When Boring Equals Winning Again

Old economy dominated second straight session as materials, healthcare, financials led whilst Magnificent Seven fell 1.2% on valuation concerns. Flight-to-quality rewarding proven business models because investors finally questioning whether borrowing billions to lose money operationally constitutes sustainable strategy. CoreWeave’s margin collapse from 20.1% to 3.8% proved data center delays don’t just postpone revenue—they obliterate profitability whilst costs compound.

Disney’s Strategic Metric Discontinuation

Disney expected to post $1.03 EPS (down 9.6% YoY) with theme park attendance requiring discounting—classic sign of pricing power evaporating. Final subscriber count before metric discontinued tomorrow represents corporate transparency reaching logical conclusion: if numbers embarrassing, simply stop reporting them. Street expecting soft guidance as parks discount, streaming matures, and investors wonder whether magic kingdom operates on magic or margins.

Shutdown Resolution Sets Impressively Low Bar

Markets celebrating shutdown resolution removing tail risk whilst ignoring Fed December uncertainty, Treasury curve flattening reversing, and 82% earnings beats mattering to precisely nobody. Gold off recent $4,400 peak despite 63% YoY gains as dollar strength caps safe-haven bid. Oil struggling below $60 proving even commodities unconvinced by recovery narrative.

☕ Hazel’s Take

Dow celebrating records whilst tech discovers margins, Disney prepares final subscriber confession, and markets treat government remembering basic functionality as risk removal. When celebration requires discontinuing embarrassing metrics, probably time questioning sustainability.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Outer Space NATHs Solo Formation Flying Whilst Others Play Cripple Mr Onion” whilst analysing Dow’s solitary achievement and claiming they had mastered “Terry Pratchett Absurdity Recognition Advanced Cooing With Fiddy Theta Collection Discipline.”

Hazel updated her crisis management protocols to include “One Index In Outer Space Whilst Three Play Card Games Recognition Emergency Procedures” alongside contingency plans for “Gold Breakout Silencing Bull Trap Party Integration With Trump Tweet Oil Torpedo Monitoring And Everything-Normal-No-Droids-Here Analysis Protocols.”

Mac raised his Thursday whisky and declared, “When Dow reaches outer space NATHs solo whilst others compete at Cripple Mr Onion and gold silences bull trap party from sidelines, collecting Fiddy theta during sideways grind becomes delightfully superior to trend dependency!”

Kash attempted livestreaming about “Cripple Mr Onion being basically like DeFi yield farming complexity but with actual card game rules nobody understands” but got distracted calculating whether VWAP flop scalps count as alpha or just lunch money.

Wallie grumbled that in his day, new all-time highs meant “all indexes participating together rather than this modern solo-Dow-outer-space behaviour with Terry Pratchett card game terminology!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.