Everyone Hit Lifeboats – Rescued By Titanic’s Sister Ship “The Naughty Bear”

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

What a difference a day makes!

We’ve moved from Dow attempting its personal moon shot while S&P, Nasdaq, and Uncle Russ attempt to outwit each other in a backroom game of Cripple Mr Onion to Dow suddenly realising he, in typical red shirt Mr Scott fashion, who “just hasn’t got the power” and “I’m giving her all she’s got!” before blowing up the engine room of the good ship “Bull Run.”

Forcing everyone to hit the lifeboats only to be rescued by the Titanic’s little known sister ship “The Naughty Bear.”

Uncle Russ was leading the bear charge all along and finally we may see this pesky range low target. Will it totally tip over though and deliver a full on corrective move?

Mag7, AI, Quantum computing all seem to have stalled and the bubble that was propping up the markets seems to have lost some of its mojo.

The government is back like a new Voldemort plot in a Harry Potter spin off and he who must not be named is back at contradicting himself.

The crash oracle Michael Burry, in a double plot twist, has decided to throw the towel in and winding down his fund because he doesn’t understand this market. Are we looking at the top? Could this be a real time real world left turn in what will inevitably be “The Big Short 2.0” coming soon to a cinema near you? Stay tuned!

Anyway, back to my short term setups.

SPX reclaimed the bull AVWAP and as mentioned earlier in the week can be used to manage positions without needing to wait for TnT setups. I’ve also taken a speculative bear swing which is working out just fine at the moment.

I’ll be working on automating the signal setups for this old and reworked setup as I rebuild my software suite.

Over on RUT, the same setup can be seen with the AVWAP showing the range pinch before the eventual breakout, so a standard breakout entry can be taken for a bear swing and also used to manage the bulls in the same way as SPX.

All in all things are looking good. I just wonder if we will see a huge bull turnaround before the Friday finish again? Stay tuned.

Keep scrolling for the engine room explosion analysis…

Dow Blows Up. Naughty Bear Rescues Everyone. Uncle Russ Leads Charge. Burry Throws Towel.

SPX Market Briefing:

Friday November reviews what-a-difference-a-day-makes journey from Dow moon shot attempting personal space mission to red shirt Scotty engine room explosion “hasn’t got power” forcing lifeboat rescue by Titanic’s sister ship Naughty Bear,

Uncle Russ leading bear charge all along (range low target approaching, full corrective move question), Mag7/AI/quantum bubble lost mojo, government back like Voldemort plot contradicting himself,

Michael Burry plot twist winding down fund because doesn’t understand market (looking at top, Big Short 2.0 signal?),

SPX reclaimed bull AVWAP managing positions without TnT wait (speculative bear swing working fine, automating signals whilst rebuilding software), RUT same AVWAP setup showing range pinch before breakout (standard bear swing entry, manage bulls like SPX),

wondering if huge bull turnaround before Friday finish again.

Current Multi-Market Status:

- ES: 6743.00, engine room blown

- RTY: 2382.6, leading bear charge

- YM: 47,481, red shirt Scotty failure

- NQ: 24,972.00, quantum bubble deflating

- CL: $59.44, slight recovery

- GC: $4200.0, giving back gains

- VIX: 21.21, volatility spike from 17.70

- 2yr Bonds: 3.587%

Dow Blows Engine Room – Red Shirt Scotty Can’t Save It

What a difference a day makes!

Yesterday: Dow at 48,393 in outer space, NATHs baby.

Today: YM 47,481, nearly 1,000 points lower.

We’ve moved from Dow attempting its personal moon shot to Dow suddenly realising he, in typical red shirt Mr Scott fashion, who “just hasn’t got the power” and “I’m giving her all she’s got!” before blowing up the engine room of the good ship “Bull Run.”

Star Trek fans know: When Scotty says “I’m giving her all she’s got, Captain!” the engine room is about to explode. Classic red shirt moment.

Yesterday’s solo moon mission? Today’s catastrophic mechanical failure.

Current Status: Dow engine room exploded, Scotty couldn’t save it and a random red shirt took one for the team, 1,000 points lower

Rescued By The Naughty Bear

Forcing everyone to hit the lifeboats only to be rescued by the Titanic’s little known sister ship “The Naughty Bear.”

When Bull Run’s engine exploded, passengers abandoned ship. Lifeboats deployed. Chaos ensued.

Rescue ship arrives: The Naughty Bear. Titanic’s little known sister ship. Presumably learned from Titanic’s mistakes. Still not ideal rescue vehicle given family history.

Market participants fleeing into… bearish positioning. The irony.

Current Status: Everyone rescued by Naughty Bear after Bull Run explosion

Uncle Russ Leading Bear Charge All Along

Uncle Russ was leading the bear charge all along and finally we may see this pesky range low target.

RTY: 2382.6 – approaching that 2391 target zone from the daily chart setup.

Uncle Russell wasn’t wobbling. He was leading. While everyone watched Dow’s outer space adventure, Uncle Russ was quietly positioning for bear charge.

Will it totally tip over though and deliver a full on corrective move?

Range low target approaching. Question: Does it bounce here or break through for full corrective move?

Mag7, AI, Quantum computing all seem to have stalled and the bubble that was propping up the markets seems to have lost some of its mojo.

The narrative stocks stalling. NQ: 24,972 down from 25,605. Tech bubble deflating. Quantum computing hype paused. AI mojo lost.

Current Status: Uncle Russ leading bear charge, range low target approaching, tech bubble deflating

Burry Throws Towel – Big Short 2.0?

The crash oracle Michael Burry, in a double plot twist, has decided to throw the towel in and winding down his fund because he doesn’t understand this market.

Michael Burry – the guy who predicted 2008 crash, made famous by “The Big Short” – is winding down his fund. Reason: Doesn’t understand current market.

Are we looking at the top?

Historical irony: When legendary bear capitulates, is that the actual top signal?

Could this be a real time real world left turn in what will inevitably be “The Big Short 2.0” coming soon to a cinema near you?

Plot twist worthy of sequel: Burry throws in towel right before massive crash validates his entire thesis. Hollywood couldn’t write better script.

The government is back like a new Voldemort plot in a Harry Potter spin off and he who must not be named is back at contradicting himself.

Political chaos continuing. Policy contradictions mounting. Voldemort-level drama.

Current Status: Burry winding down fund, potential top signal, government contradicting itself

SPX AVWAP Management + Bear Swing

Anyway, back to my short term setups.

SPX: 6737.48 down from yesterday’s 6850.93.

SPX reclaimed the bull AVWAP and as mentioned earlier in the week can be used to manage positions without needing to wait for TnT setups.

Bull AVWAP reclaimed = management level active. Don’t need to wait for PFZ trip. Tighter control.

I’ve also taken a speculative bear swing which is working out just fine at the moment.

Bear swing entry taken. Working. No elaborate explanation needed.

I’ll be working on automating the signal setups for this old and reworked setup as I rebuild my software suite.

System improvement continues. Automating signals. Rebuilding suite.

Current Status: SPX bull AVWAP managing, speculative bear swing working, automating signals

RUT Same Setup – AVWAP Breakout Entry

Over on RUT, the same setup can be seen with the AVWAP showing the range pinch before the eventual breakout.

RUT: 2382.98 – AVWAP range pinch visible. Compression before expansion.

So a standard breakout entry can be taken for a bear swing and also used to manage the bulls in the same way as SPX.

Bear swing entry: Standard breakout below AVWAP support.

Bull management: Same AVWAP approach as SPX.

Current Status: RUT AVWAP pinch, bear breakout entry available, bull management active

Friday Turnaround Question

All in all things are looking good.

Despite market chaos: Setups working. Management in place. Systems functioning.

I just wonder if we will see a huge bull turnaround before the Friday finish again?

Markets have habit of Friday reversals. Big sell-off Thursday/Friday morning. Then magical turnaround into close.

Will it happen again? Stay tuned.

Current Status: Things looking good, wondering about Friday turnaround magic

In Other News…

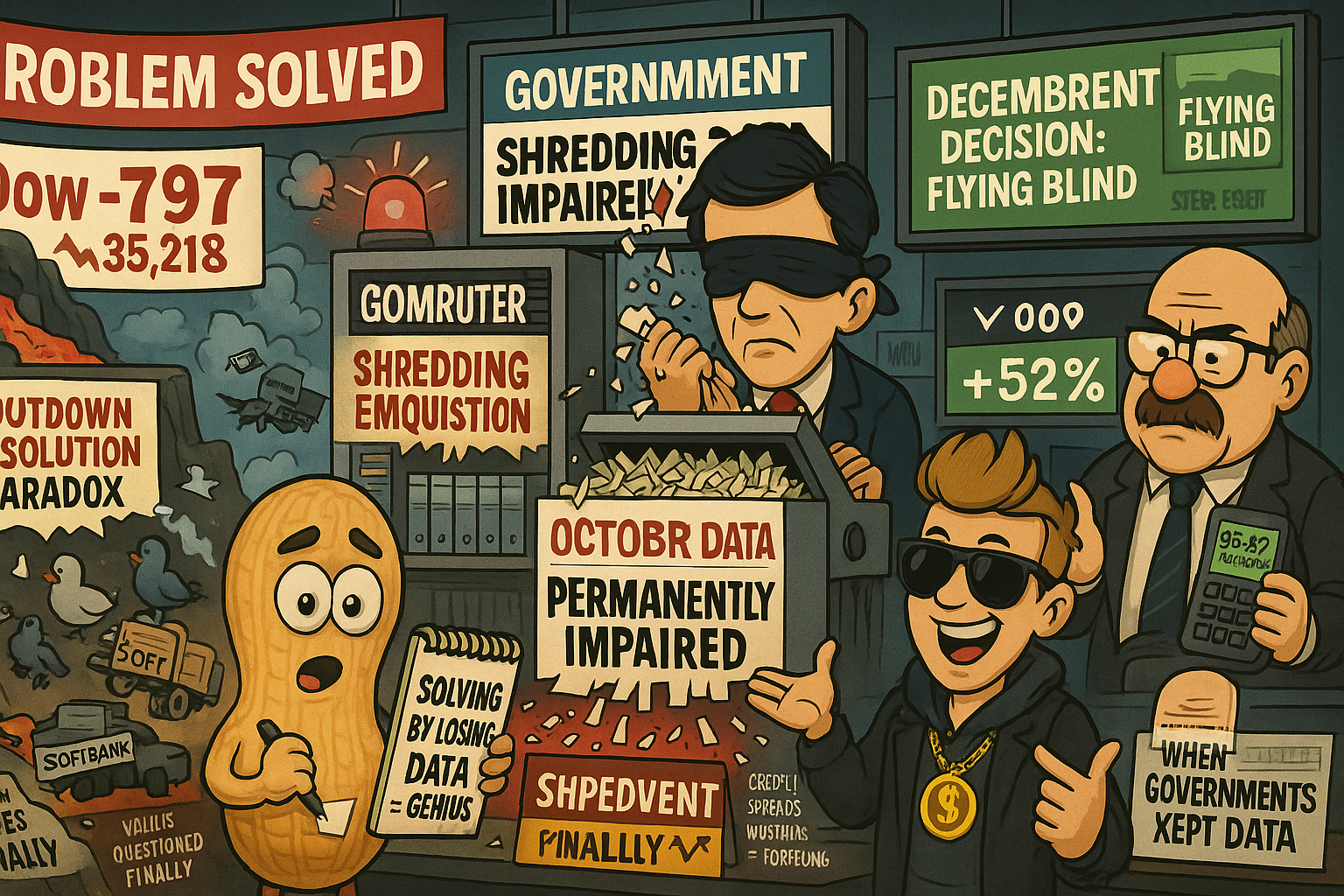

Markets Celebrate Shutdown Resolution By Crashing 797 Points

Government solves dysfunction by permanently losing October economic data. Markets respond logically.

Dow plunged 797 points Thursday (-1.65%) as shutdown ending paradoxically triggered risk-off whilst Fed cut odds collapsed from 95% to 52% in one month. VIX spiked to 21.20 as markets processed White House admission that October jobs/inflation data “permanently impaired”—government’s version of “we lost the homework.” Treasury yield jumped to 4.10% from 3.96% as investors realised Fed now flying blind with no economic data and no plans to get any.

AI Darlings Discover Gravity Simultaneously

Tech massacre led by Nvidia -3.6%, Tesla -6.6%, Palantir -6.6%, Super Micro -7.6% as AI euphoria fades into valuation reality. Disney crashed 8% despite beating EPS because revenue miss apparently matters now. Only winner: Cisco +4.9% on AI infrastructure guidance proving companies selling picks and shovels profit whilst gold miners bleed. SoftBank’s $5.8B Nvidia sale this week adds pressure because selling winners while ahead remains galaxy-brain strategy.

When Solving Crisis Creates Worse Crisis

Shutdown resolution removed uncertainty by creating unprecedented Fed uncertainty—October data permanently lost means Powell’s December decision happens without instruments, maps, or functioning sensors. Fed cut probability collapsed as Powell’s “not a foregone conclusion” warning finally registered. Treasury curve bear-flattened, dollar strengthened, credit spreads widened, risk-off dominates despite problem supposedly solved.

☕ Hazel’s Take

Government ended shutdown by permanently losing economic data. Markets celebrated resolution by crashing hardest in month. When solving dysfunction requires admitting data irretrievably lost, probably questioning whether anything solved at all.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Engine Room Explosion Emergency Evacuation Flying Whilst Boarding Naughty Bear” whilst analysing Dow’s red shirt Scotty failure and claiming they had mastered “Michael Burry Capitulation Recognition Advanced Cooing With AVWAP Management Without TnT Wait Discipline.”

Hazel updated her crisis management protocols to include “Bull Run Engine Room Explosion Forcing Lifeboat Deployment Recognition Emergency Procedures” alongside contingency plans for “Titanic Sister Ship Naughty Bear Rescue Integration With Uncle Russ Bear Charge Leadership And Big-Short-2.0-Top-Signal Analysis Protocols.”

Mac raised his Friday whisky and declared, “When Dow blows engine room forcing Naughty Bear rescue whilst Uncle Russ leads charge and Burry throws towel not understanding market, managing with AVWAP without TnT wait becomes delightfully superior to waiting for Friday turnaround magic!”

Kash attempted livestreaming about “Naughty Bear being basically like DeFi insurance protocol but with actual Titanic family history” but got distracted calculating whether Burry capitulation counts as contrarian buy signal or legitimate top warning.

Wallie grumbled that in his day, market corrections meant “proper understanding of conditions rather than this modern legend-throws-towel-whilst-automating-signal-setups behaviour with Big Short sequel speculation!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.