25 Traders. One Systematic Approach Delivering Wins Across Every Strategy.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

This week’s Wall of Wins hits different.

25 traders. 48 screenshots. Every single one proving the same point: Systematic frameworks work better than prediction attempts.

Zach made his old job’s weekly salary in 4 hours this morning. Roy just signed up for the book-only tier last week – ran it Friday and Monday for his first 2 trades ever. Both wins. $1,800 day.

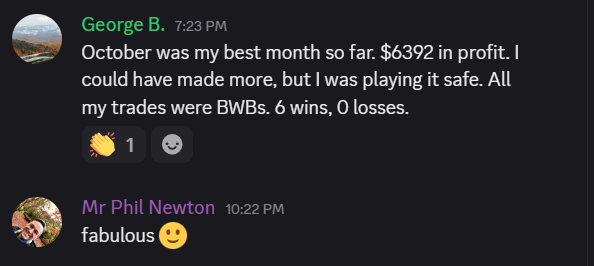

George posted his best month: $6,392 profit. 6 wins, 0 losses. All BWBs.

Michael traded Lazy Poppers from a beach in the Bahamas. Then from Cuba. Three wins whilst on cruise.

This is what systematic trading delivers. Not prediction. Not guru calls. Not “trust my signals.” Just: Learn framework. Execute mechanical rules. Collect results.

Andrea was down $900 yesterday after breaking her rules. Reversal saved her. Up $400 by close. She didn’t let it expire, got out after being down so much. That’s systematic risk management in action.

Kevin stacked multiple 90%+ TnT wins. Closed RUT false range break for 953% ROC. /GC overnight for 329%. Bulls and bears both paying when setups confirm.

The proof is in the screenshots. Let’s celebrate them.

Keep scrolling for the complete Wall of Wins breakdown…

25 Systematic Traders. 48 Winning Screenshots. Proof Not Promises.

Wall Of Wins – Week Ending 15 November 2025

Milestone Moments That Matter

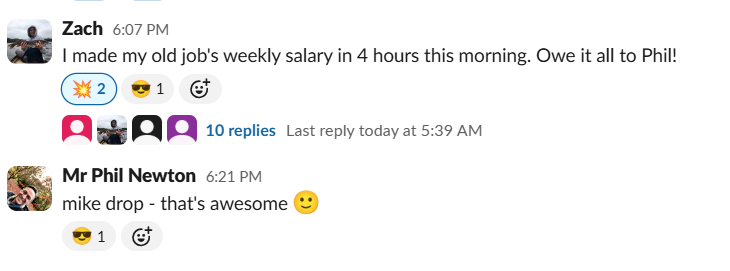

Zach: “I made my old job’s weekly salary in 4 hours this morning. Owe it all to Phil!”

Former weekly salary achieved in single morning session. Fast RUT ORB20 execution. 50% ROC. This is lifestyle change documented in real time.

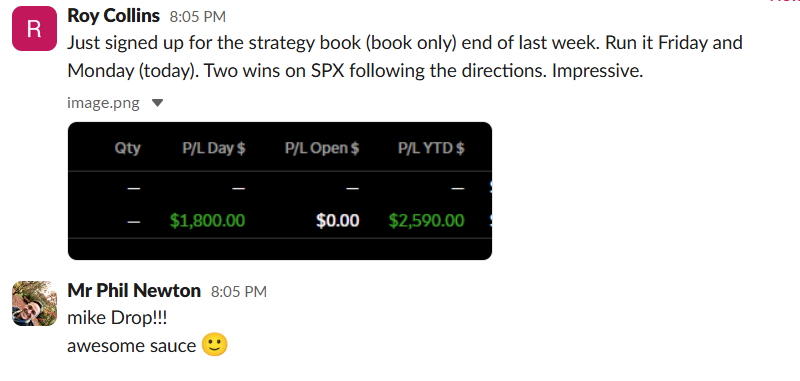

Roy C.: New book-only student – First 2 trades, both wins, $1,800 day

“Just signed up for the strategy book (book only) end of last week. Run it Friday and Monday (today). Two wins on SPX following the directions. Impressive.”

P/L Day: $1,800. YTD: $2,590. New student. Following directions. Winning immediately.

George B.: Best month ever – $6,392, 6-0 record on BWBs

“October was my best month so far. $6392 in profit. I could have made more, but I was playing it safe. All my trades were BWBs. 6 wins, 0 losses.”

Perfect win streak. Conservative approach still delivering $6k+ month. Systematic execution.

Vacation Trading Wins

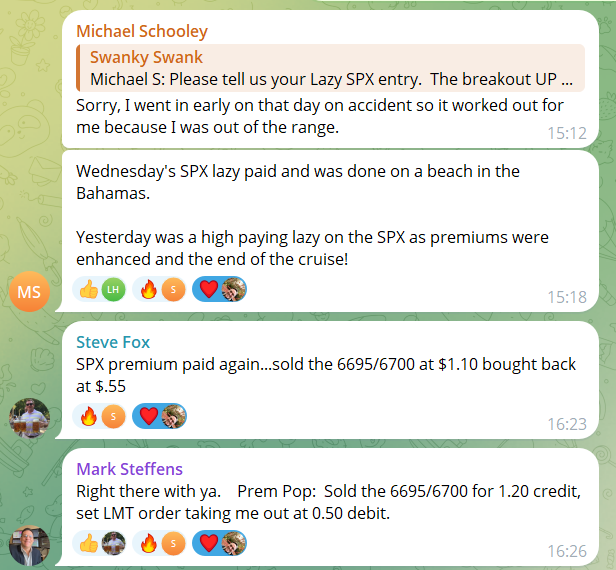

Michael S.: Three Lazy Popper wins from cruise ship

- “Lazy SPX paid again today! This time sailing past Cuba”

- “Wednesday’s SPX lazy paid and was done on a beach in the Bahamas ️”

- “Yesterday was a high paying lazy on the SPX as premiums were enhanced and the end of the cruise!”

100% win rate. Trading from beaches. No monitoring required. This is Lazy Popper design delivering exactly as intended.

Strategy Performance Proof

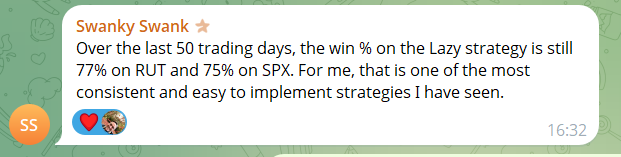

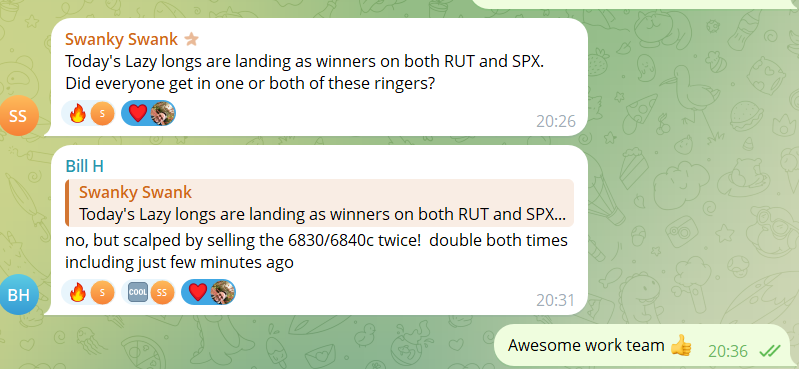

Swanky S.: 77% RUT, 75% SPX over 50 trading days on Lazy Popper

“Over the last 50 trading days, the win % on the Lazy strategy is still 77% on RUT and 75% on SPX. For me, that is one of the most consistent and easy to implement strategies I have seen.”

50-day sample size. Documented win rates. Most consistent strategy claim backed by data.

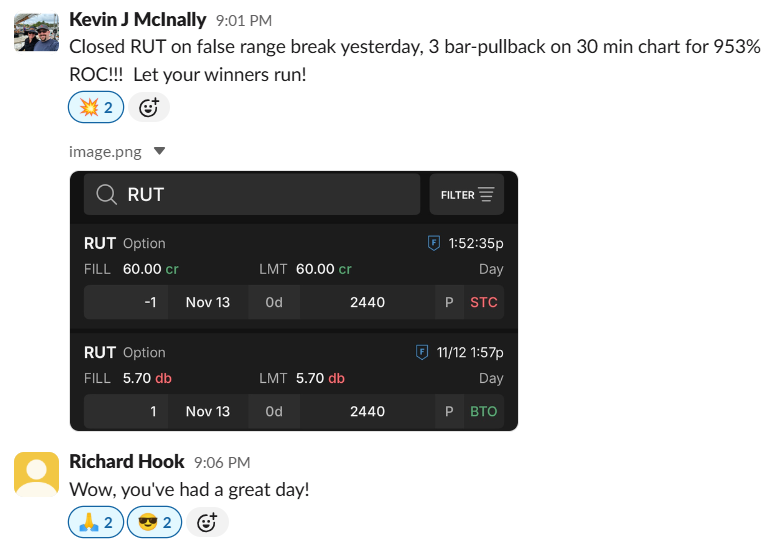

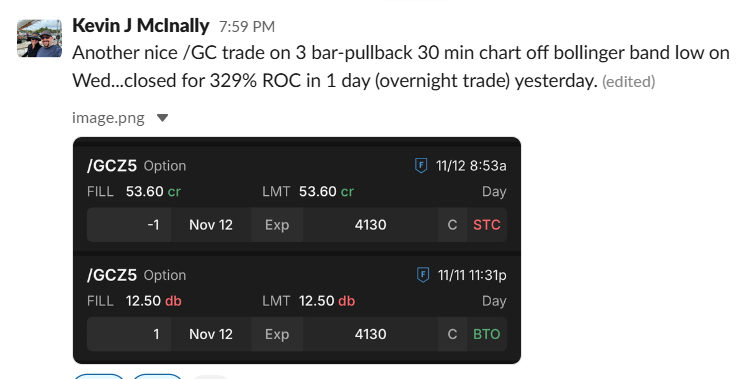

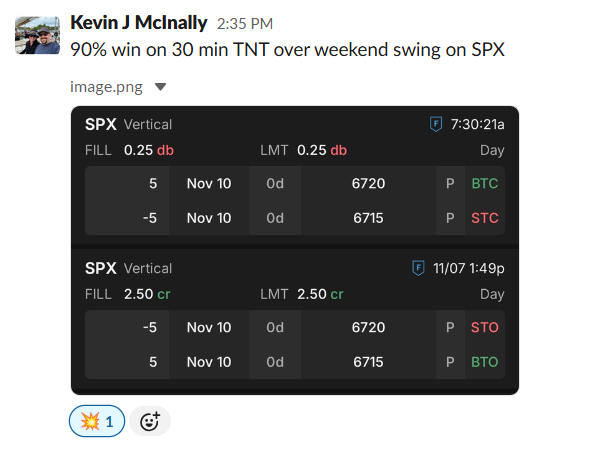

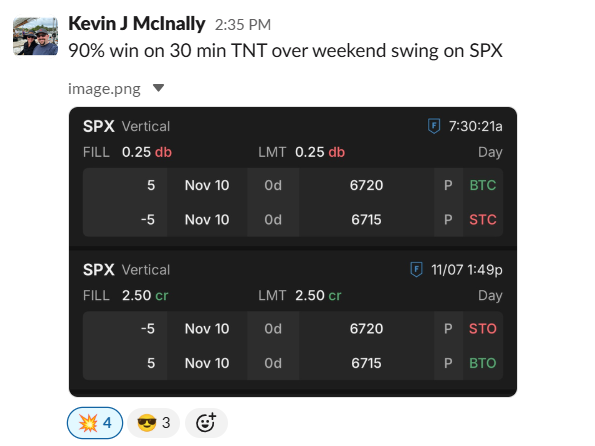

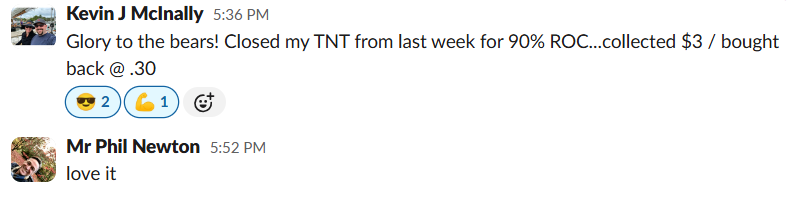

Kevin J M.: Multiple 90%+ TnT wins, 953% ROC on single trade

- “Glory to the bears! Closed my TNT from last week for 90% ROC…collected $3 / bought back @ .30”

- “Closed RUT on false range break yesterday, 3 bar-pullback on 30 min chart for 953% ROC!!! Let your winners run!”

- “/GC trade on 3 bar-pullback 30 min chart off bollinger band low Wed…closed for 329% ROC in 1 day”

TnT delivering both reliable 90% wins and occasional 900%+ runners when price cooperates. Same framework. Different outcomes. Both systematic.

Recovery Stories

Andrea R.: Down $900 → Up $400 through systematic management

“Up 1200 since one week ago all on rut doing 15 wide actually totally broke my rules yesterday and was down 900 and then the turn around saved me and was up 400 didn’t let expire got out after being down so much.”

Broke rules. Got punished. Managed position systematically. Recovered. Learning documented in P/L.

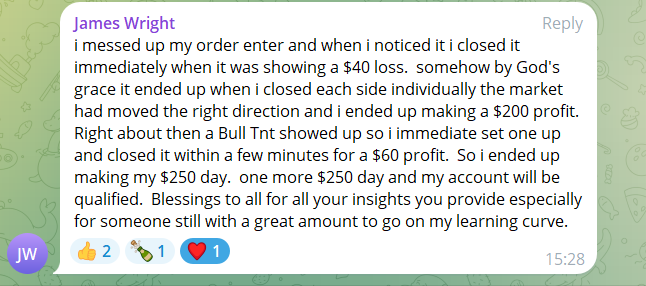

James W.: $40 loss → $200 profit through careful management, approaching qualification

“I messed up my order enter and when i noticed it i closed it immediately when it was showing a $40 loss. Somehow by God’s grace it ended up when I closed each side individually the market had moved the right direction and i ended up making a $200 profit. Right about then a Bull TnT showed up so I immediate set one up and closed it within a few minutes for a $60 profit. So i ended up making my $250 day. One more $250 day and my account will be qualified “

Mistake recovery. Systematic position management. TnT opportunity seized. $250 day target hit. One day from qualification.

High-Volume Systematic Execution

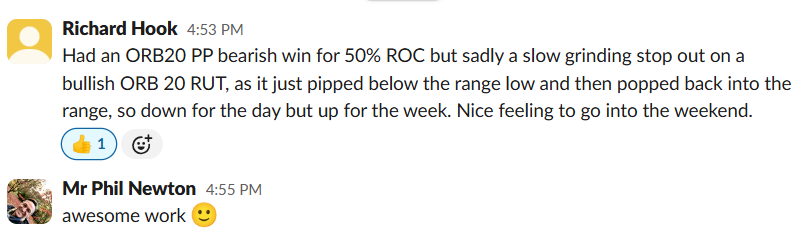

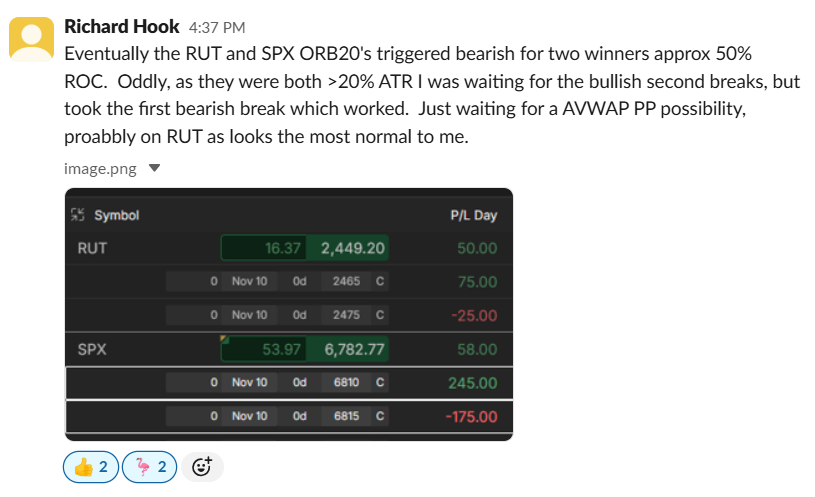

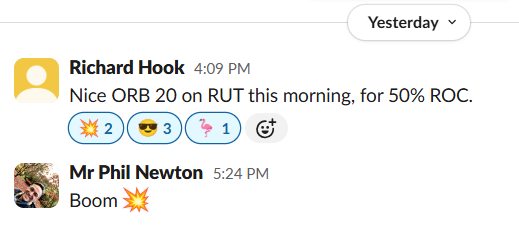

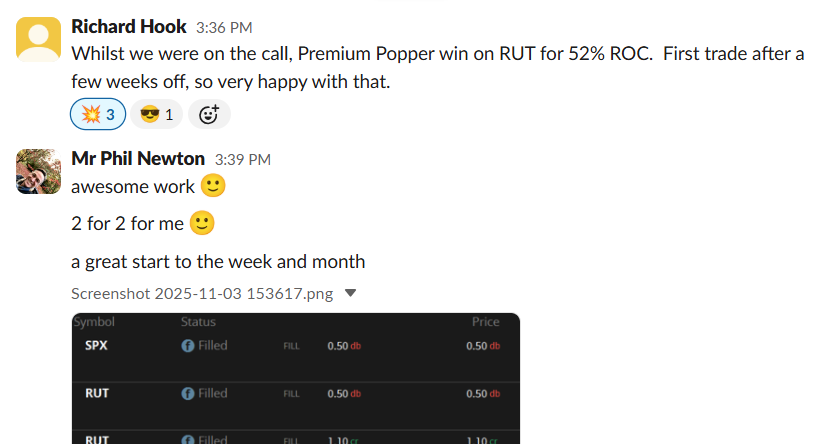

Richard H.: 7 separate trade reports across week

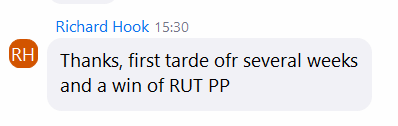

- Premium Popper RUT: 52% ROC (first trade after weeks off)

- ORB20 bearish win 50% ROC, bullish stop out (up for week)

- RUT ORB20: 50% ROC

- SPX ORB20: 50% ROC (moved strike from 6825 to 6835)

- RUT + SPX ORB20 both triggered bearish: ~50% ROC each ($2,449.20 + $6,782.77)

- Two Premium Poppers RUT + SPX: ~50% ROC (waited for second range breakout, >20% ATR)

Active trader executing multiple setups. Some wins, some losses, up for week. Systematic approach across different conditions.

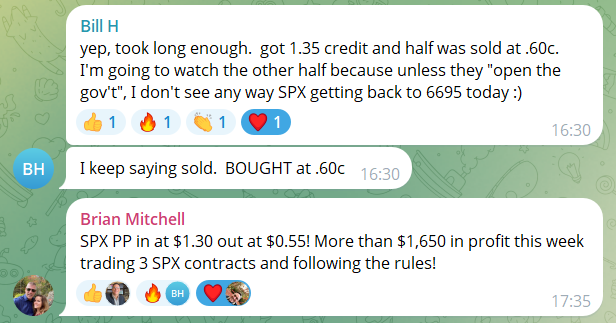

Brian M.: $1,650+ profit this week trading 3 SPX contracts

“SPX PP in at $1.30 out at $0.55! More than $1,650 in profit this week trading 3 SPX contracts and following the rules!”

Three contracts. Following rules. $1,650 week. Rules work.

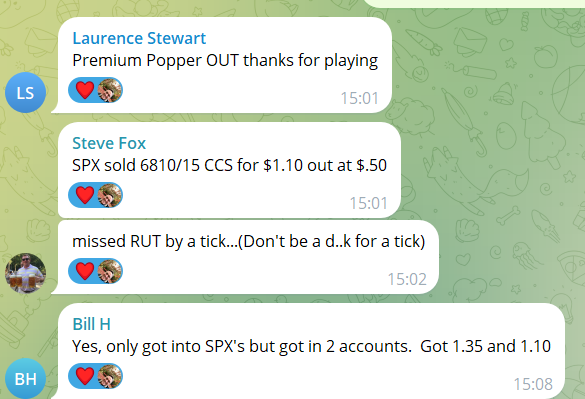

Premium Popper Default Performance

50% ROC standard across multiple traders:

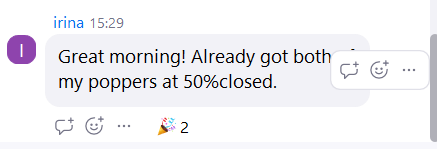

- irina: “Great morning! Already got both my poppers at 50% closed”

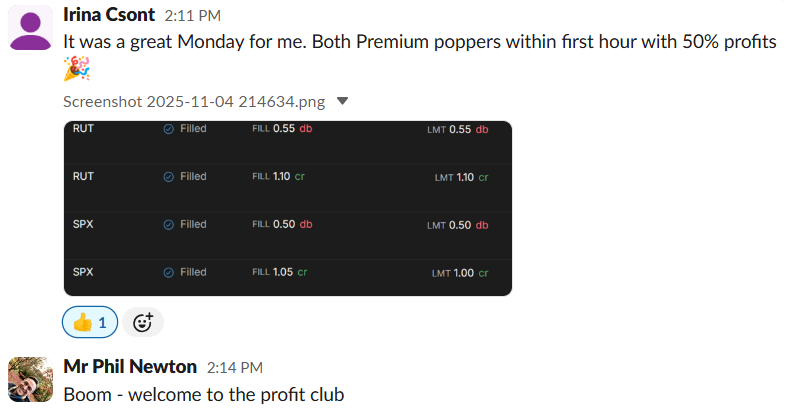

- Irina C.: “It was a great Monday for me. Both Premium poppers within first hour with 50% profits “

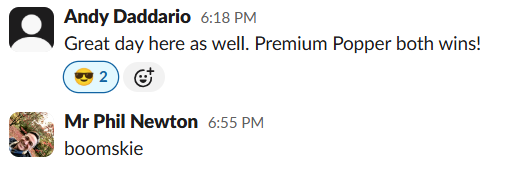

- Andy D.: “Great day here as well. Premium Popper both wins!”

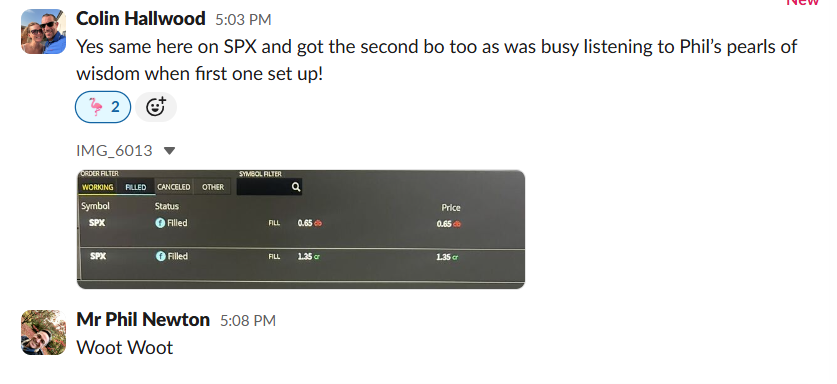

- Colin H.: Got second breakout whilst listening to Phil’s teaching

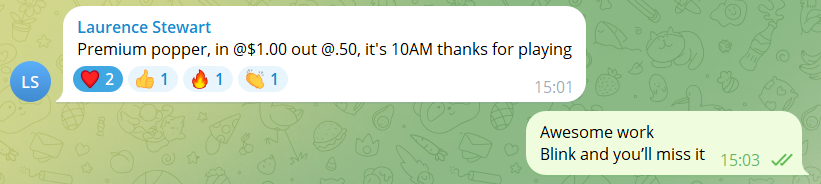

- Laurence S.: “Premium poper, in @$1.00 out @.50, it’s 10AM thanks for playing”

Default 50% target hitting consistently. First hour exits common. Mechanical execution delivering.

| Name | Results | Highlights |

|---|---|---|

| Daisy | 78.5% · 75% | [ORB] “11/14 real money trades successful (78.5%) – traded various DTEs and couple of 60ORBs in SPX/RUT/NDX” [ORB] “I’m loving the markets this week! Yesterday 2/2 successful, today 4/6 – had to hedge NDX-60 ORB. Put RUT-60ORB turned and failed. I often have this issue with RUT ORBs – they bite me by turning late in the day I’m at 75% success this week so far” |

| Richard H. | 52% · 50% · Loss · 50% · 50% · 50% · $2,449 · $6,783 | [Popper] “Premium Popper win on RUT for 52% ROC. First trade after a few weeks off, so very happy with that” [ORB] “Had an ORB20 PP bearish win for 50% ROC but sadly a slow grinding stop out on a bullish ORB 20 RUT, as it just pipped below the range low and then popped back into the range, so down for the day but up for the week” [ORB] “Nice ORB 20 on RUT this morning, for 50% ROC” [ORB] “Finally my SPX ORB 20 hit 50% ROC. As the premiums were better, I moved the short strike up from suggested 6825 to 6835 and glad I did as it moved straight back up there before heading back down. Now in an ORB 60 PP” [ORB] “Eventually the RUT and SPX ORB20’s triggered bearish for two winners approx 50% ROC. Oddly, as they were both >20% ATR I was waiting for the bullish second breaks, but took the first bearish break which worked” (RUT: $2,449.20, SPX: $6,782.77) [Popper] “Two nice Premium Poppers on RUT and SPX for approx. 50% ROC. I waited for the second range breakout as the ORB 20 was over 20% ATR. Worked a treat on RUT and saved me a loss. Also used Phil’s reduce the premium you want and it made for swift fills. Got filled at better than I asked for as well” |

| Roy C. | $1,800 · $2,590 YTD | [Milestone] “Just signed up for the strategy book (book only) end of last week. Run it Friday and Monday (today). Two wins on SPX following the directions. Impressive” (P/L Day $1,800, YTD $2,590) |

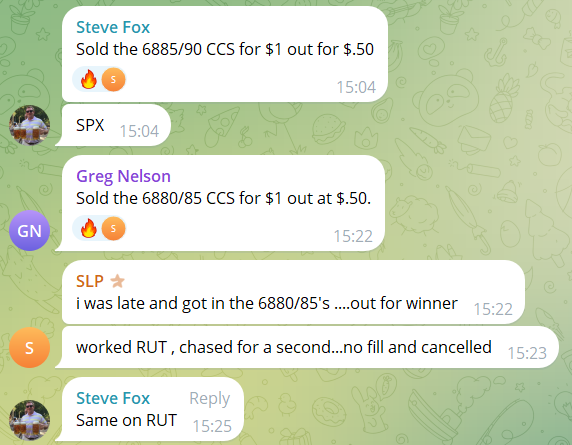

| Steve F. | $1/$5.50 · $1.10/$0.50 · $1.10/$0.55 · $1.10/$0.55 | [Spread] “Sold the 6885/90 CCS for $1 out for $5.50” [Spread] “SPX sold 6810/15 CCS for $1.10 out at $.50” [Popper] “SPX premium paid again…sold the 6695/6700 at $1.10 bought back at $.55” [BWB] “Just closed the broken wing from Friday afternoon $$$. Left a few bucks on the table but I’ll take it” [Comment] “Have traded options for years…the system Silas and Phil have provided is priceless!!! And I know there is more coming this week. I have made multiples of what this program has cost, if your on the fence don’t be this is way worth it…and I am not an attorney paid spokesperson!!! ” [Spread] “Just closed my 6795/90 PCS sold for $1.10/ covered at $.55” |

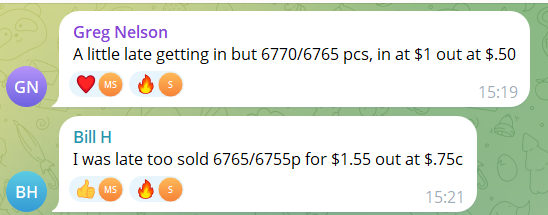

| Greg N. | $1/$0.50 · $1/$0.50 | [Spread] “Sold the 6880/85 CCS for $1 out at $0.50” [Spread] “A little late getting in but 6770/6765 pcs, in at $1 out at $.50” |

| SLP | — | [Spread] “I was late and got in the 6880/85’s….out for winner. Worked RUT, chased for a second…no fill and cancelled” |

| irina | 50% | [Popper] “Great morning! Already got both my poppers at 50% closed” |

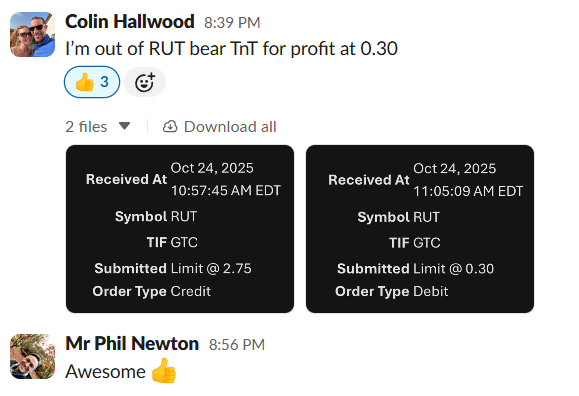

| Colin H. | $2.75/$0.30 · 50% | [TnT] “I’m out of RUT bear TnT for profit at 0.30” (Entry at 2.75 credit) [ORB] “Yes same hardly time to bracket it ” (responding to Zach’s fast RUT ORB20) [Popper] “Yes same here on SPX and got the second bo too as was busy listening to Phil’s pearls of wisdom when first one set up!” |

| Daniella | — | [Comment] “Thank you very much for enlightening me, I learnt a lot. You are genius ” [Comment] “Thank You, Phil. You are a great teacher. My target is to earn enough so I can purchase your other courses. Thank you for guiding me and helping me towards achieving it, though this is just a beginning. Cheers!!” |

| John G. | 2/3 · $1,200 | [Popper] “2/3 on premium poppers this week, lost today as it turned on me – closed early not to lose max which ended up being a good decision” [Pulse] “I was also 2/2 today on the morning pulse raking in $1200 which puts me back to break even for the month hahahaha. I did well with a couple trades in crypto over the weekend about 25k trading the SPX, the RSI pressure checker helped me close a trade before it retraced” |

| George B. | $6,392 · 6-0 | [BWB] [Milestone] “October was my best month so far. $6392 in profit. I could have made more, but I was playing it safe. All my trades were BWBs. 6 wins, 0 losses” |

| Laurence S. | 50% · $1.00/$0.50 | [Popper] “Premium Popper OUT thanks for playing” [Popper] “Premium poper, in @$1.00 out @.50, it’s 10AM thanks for playing” |

| Bill H. | $1.35 · $1.10 · $0.95/$0.45 · $1.55/$0.75 · $1.35/$0.60 | [Popper] “Yes, only got into SPX’s but got in 2 accounts. Got 1.35 and 1.10” [Scalp] “Scalped by selling the 6830/6840c twice! double both times including just few minutes ago” [Scalp] “Winner winner, chicken dinner. Just sold that rally and fail at 6820. Sold 6850/6860c for .95 BTC at .45! Took 5 mins”<br>[Spread] “I was late too sold 6765/6755p for $1.55 out at $.75c” [Popper] “Yep took long enough. Got 1.35 credit and half was sold at .60c. I’m going to watch the other half because unless they ‘open the gov’t’, I don’t see any way SPX getting back to 6695 today” |

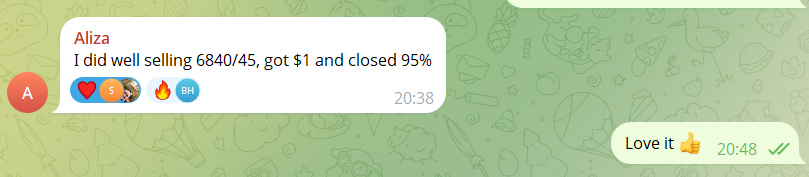

| Aliza | 95% · $1.35/$0.50 · 90% | [Spread] “I did well selling 6840/45, got $1 and closed 95%” [Spread] “Dido Swanky. Sold 6825/30 at $1.35 in early a.m. & bought back at .50c” [Lazy] “If I’m around most of the day near a computer I’ll mange the trade. I issued a stop 2:1on lazy popper bear call 6830 yesterday, and at the same time sold bull put 6810/05 for next day. This worked out to even my loss. As the day progressed around 2pm I sold 6855/60 for $1.35 and closed 90%” |

| Swanky S. | 77% · 75% | [Lazy] “Today’s Lazy longs are landing as winners on both RUT and SPX. Did everyone get in one or both of these ringers?” [Lazy] “Over the last 50 trading days, the win % on the Lazy strategy is still 77% on RUT and 75% on SPX. For me, that is one of the most consistent and easy to implement strategies I have seen” |

| Michael S. | 100% · 100% · 100% | [Lazy] “Lazy SPX paid again today! This time sailing past Cuba” [Lazy] “Wednesday’s SPX lazy paid and was done on a beach in the Bahamas ️” [Lazy] “Yesterday was a high paying lazy on the SPX as premiums were enhanced and the end of the cruise!” |

| Mark S. | $1.20/$0.50 | [Popper] “Right there with ya. Prem Pop: Sold the 6695/6700 for 1.20 credit, set LMT order taking me out at 0.50 debit” |

| Irina C. | 50% | [Popper] “It was a great Monday for me. Both Premium poppers within first hour with 50% profits “ |

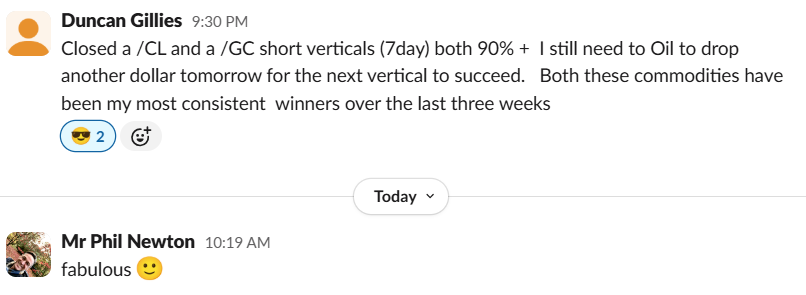

| Duncan G. | 90%+ · 90%+ | [Spread] “Closed a /CL and a /GC short verticals (7day) both 90%+ I still need to Oil to drop another dollar tomorrow for the next vertical to succeed. Both these commodities have been my most consistent winners over the last three weeks” |

| James W. | $200 · $60 | [Recovery] “I messed up my order enter and when i noticed it i closed it immediately when it was showing a $40 loss. Somehow by God’s grace it ended up when I closed each side individually the market had moved the right direction and i ended up making a $200 profit” [TnT] “Right about then a Bull TnT showed up so I immediate set one up and closed it within a few minutes for a $60 profit. So i ended up making my $250 day. One more $250 day and my account will be qualified “ |

| Brian M. | $1,650+ · $1.30/$0.55 | [Popper] “SPX PP in at $1.30 out at $0.55! More than $1,650 in profit this week trading 3 SPX contracts and following the rules!” |

| Andy D. | 2-0 | [Popper] “Great day here as well. Premium Popper both wins!” |

| Kevin J M. | 90% · $3/$0.30 · 90% · $2.50/$0.25 · 953% · 329% | [TnT] “Glory to the bears! Closed my TNT from last week for 90% ROC…collected $3 / bought back @ .30” [TnT] “90% win on 30 min TNT over weekend swing on SPX” [TnT] “Closed RUT on false range break yesterday, 3 bar-pullback on 30 min chart for 953% ROC!!! Let your winners run!” [TnT] “Another nice /GC trade on 3 bar-pullback 30 min chart off bollinger band low on Wed…closed for 329% ROC in 1 day (overnight trade) yesterday” |

| Zach | 50% | [ORB] “A fast RUT 20orb!”<br>[Milestone] “I made my old job’s weekly salary in 4 hours this morning. Owe it all to Phil!” |

| Andrea R. | $1,200 | [Recovery] “Up 1200 since one week ago all on rut doing 15 wide actually totally broke my rules yesterday and was down 900 and then the turn around saved me and was up 400 didn’t let expire got out after being down so much” |

| Kerry D. | $315 · $330 | [Spread] “Momentum starting in, up $315” → “I closed mine at $330” |

| Rodger V. | — | [Lazy] “2 good lazy poppers and a nice pulse bar trade. It paid me to bother Phil yesterday to get on the right page!! Thanks Phil” |

KEY STATISTICS

- Total Traders Featured: 25

- Total Screenshots Processed: 48

- Perfect Win Streaks: George B. (6-0 BWBs)

- Highest Single ROC: Kevin J M. (953% on RUT false range break)

- Biggest Monthly Profit: George B. ($6,392)

- Most Active Trader: Richard H. (7 separate trade reports)

- Vacation Trading: Michael S. (trading from cruise ship – Bahamas & Cuba)

NOTABLE HIGHLIGHTS

Milestones & Transformations:

- Zach: Made old job’s weekly salary in 4 hours

- Roy C.: New book-only student – first 2 trades, both wins ($1,800 day)

- George B.: Best month ever – $6,392, 100% win rate on BWBs

- James W.: One more $250 day away from account qualification

Recovery Stories:

- Andrea R.: Down $900 → reversal saved position → up $400

- James W.: $40 loss turned into $200 profit through careful management

- Richard H.: Loss on RUT ORB but up for the week overall

Learning Wins:

- Daniella: Progressing toward earning enough to buy more courses

- Rodger V.: “It paid me to bother Phil yesterday to get on the right page”

- Steve F.: “Made multiples of what this program has cost”

Lifestyle Trading:

- Michael S.: Three Lazy SPX wins from cruise ship (Bahamas beach & Cuba)

- Daisy: 78.5% win rate across real money trades in multiple DTEs

STRATEGY BREAKDOWN

| Strategy | Traders Using | Notable Results |

|---|---|---|

| Premium Popper / ORB | 15 | Default 50% ROC – Richard H. (multiple), Brian M. ($1,650 week), Laurence S., Andy D., irina, Irina C. |

| Lazy Popper | 6 | Default 100% – Swanky S. (77% RUT, 75% SPX over 50 days), Michael S. (3 wins from cruise), Rodger V., Aliza |

| TnT / Swings | 3 | Kevin J M. (953% RUT, 329% /GC, multiple 90%+ wins), Colin H., James W. |

| BWB | 2 | George B. (6-0, $6,392 month), Steve F. |

| Credit Spreads | 7 | Steve F. (multiple), Greg N., SLP, Bill H., Aliza, Kerry D., Duncan G. |

| Scalps | 1 | Bill H. (6830/6840c doubled twice) |

| Pulse | 2 | John G. ($1,200), Rodger V. |

| Commodities | 2 | Duncan G. (/CL, /GC both 90%+), Kevin J M. (/GC 329%) |

What This Proves

Systematic frameworks work across:

- New students (Roy’s first 2 trades)

- Veterans (George’s best month)

- Beaches (Michael’s cruise)

- Recoveries (Andrea, James)

- High volume (Richard’s 7 reports)

- Low maintenance (Lazy Poppers set and forget)

Not predictions. Not guru calls. Just: Framework + mechanical execution = documented results.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.