Sitting And Waiting For Theta Decay – Continuing To Watch AVWAP From Swing Low (Served Well Last Week)

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

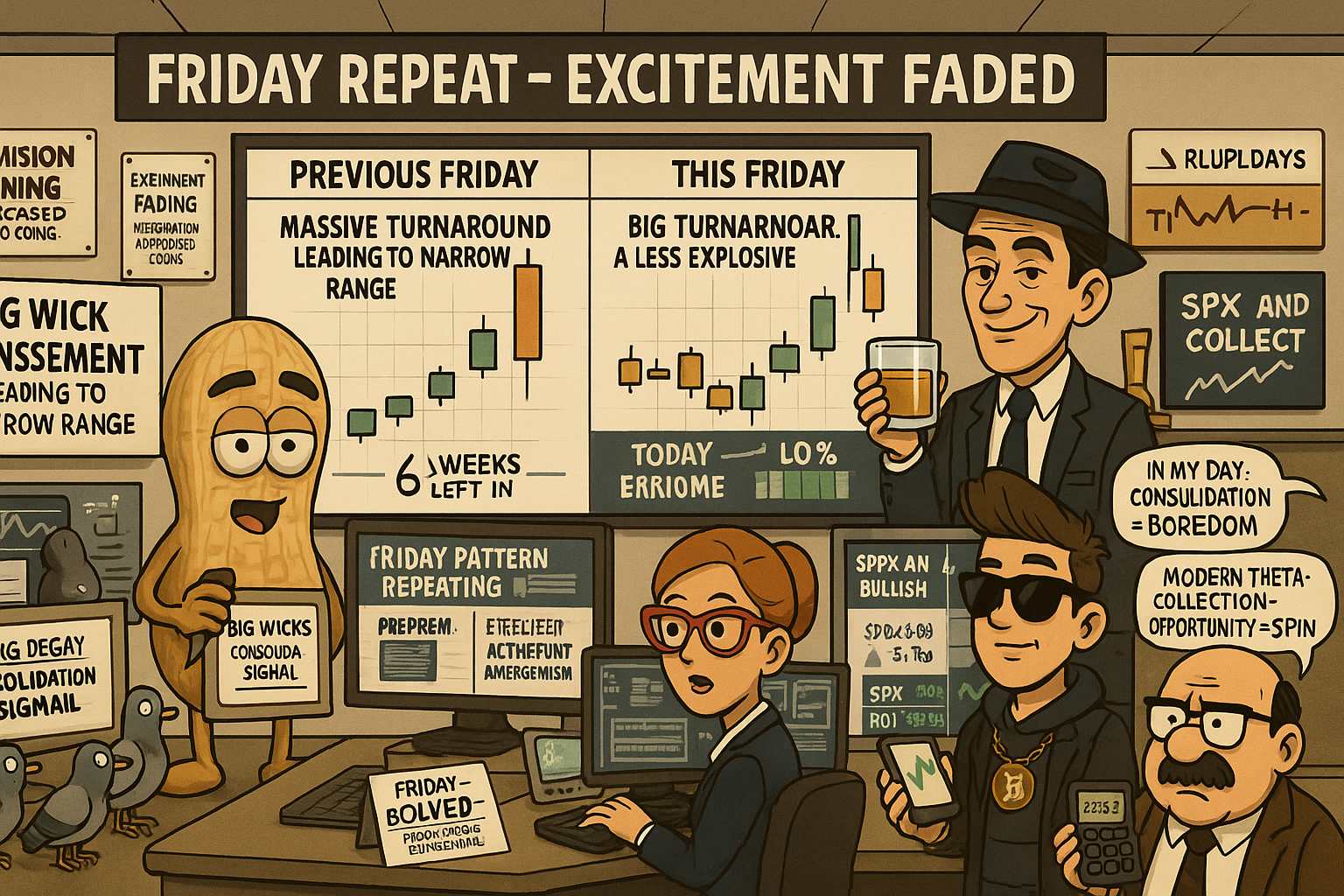

Last Friday saw a similar reaction to the end of the previous week.

Big sell off. Bigger turnaround move.

What I’m seeing as different this time: The lack of a huge bull reaction.

Friday’s recovery was significant but not explosive. The follow-through isn’t materialising with the same force.

There is very little activity in the premarket futures. I suspect the excitement is over at least for the moment.

My usual big wick assessment can potentially complete – in that we see a narrow ranging day today.

Big wicks on charts often lead to consolidation. The extremes have been tested. Now markets digest and range.

On my usual entry timeframes: SPX and RUT are bullish. So it’s again just a case of sitting and waiting for the theta decay.

I will again continue to keep an eye on the Anchored VWAP from the swing low as that served me very well last week.

AVWAP from lows = management level. Tighter than waiting for PFZ trips. Last week proved value. Continuing this week.

Keep scrolling for the consolidation analysis…

Friday Turnaround Repeats. Excitement Fades. Narrow Range Expected. Theta Collection Active.

SPX Market Briefing:

Friday pattern repeating (big sell off, bigger turnaround move) with difference being lack of huge bull reaction and very little premarket futures activity suggesting excitement over for moment, big wick assessment potentially completing (narrow ranging day expected today as extremes tested markets digest), SPX and RUT both bullish on usual entry timeframes (sitting waiting theta decay mode), continuing watch Anchored VWAP from swing low (served well last week for management without PFZ wait).

Current Multi-Market Status:

- ES: 6766.00, consolidating after Friday turnaround

- RTY: 2392.6, bullish but quiet

- YM: 47,196, stable post-recovery

- NQ: 25,182.75, lacking follow-through

- CL: $60.06, back at $60 level

- GC: $4100.0, pulling back from highs

- VIX: 20.54, declining from spike

- 2yr Bonds: 3.598%

Friday Pattern Repeats – Less Dramatic

Last Friday saw a similar reaction to the end of the previous week. Big sell off. Bigger turnaround move.

Previous Friday: Massive sell off, massive recovery.

This Friday: Big sell off, big recovery.

Pattern repeating. Markets testing lows. Then reversing hard.

What I’m seeing as different this time: The lack of a huge bull reaction.

Friday’s turnaround was significant but not explosive. The buying conviction lower. Recovery happened but without same force as previous week.

ES: 6766.00. Recovering but not rocketing. Consolidating instead.

Current Status: Friday pattern repeated, bull reaction less dramatic

Excitement Faded – Premarket Quiet

There is very little activity in the premarket futures.

ES, RTY, YM, NQ: All showing minimal movement premarket. Low volume. Quiet action.

I suspect the excitement is over at least for the moment.

Last week’s volatility spike = excitement. VIX hit 21.21. Now: 20.54 declining. Markets calming. Drama fading.

When premarket is this quiet after big moves, it suggests consolidation incoming rather than continuation.

Current Status: Premarket quiet, excitement faded, consolidation likely

Big Wick Assessment – Narrow Range Expected

My usual big wick assessment can potentially complete – in that we see a narrow ranging day today.

Big wick = large candle with long upper and lower shadows. Shows extremes tested. Both bulls and bears pushed hard. Neither won decisively.

When big wicks form after volatile moves, they often lead to consolidation. Markets pause. Digest. Range forms whilst participants decide direction.

Today: Expecting narrow range. Big wicks completing their pattern. Extremes tested Friday. Now time to consolidate.

Current Status: Big wick assessment suggests narrow range today

SPX/RUT Bullish – Theta Collection Mode

On my usual entry timeframes: SPX and RUT are bullish.

SPX: 6846.75. Bullish on 30min setup.

RUT: 2418.82. Bullish on 30min setup.

Both showing bull structure on entry timeframes.

So it’s again just a case of sitting and waiting for the theta decay.

Bull setups intact. No action required. Just: Sit. Wait. Collect theta.

Narrow range expectation = perfect for theta collection. Time passes. Premiums decay. No dramatic moves needed.

Current Status: SPX/RUT bullish, sitting waiting theta decay

AVWAP Management Continues

I will again continue to keep an eye on the Anchored VWAP from the swing low as that served me very well last week.

AVWAP from swing low = dynamic management level. Tighter than waiting for PFZ mechanical trips.

Last week: AVWAP management worked excellently. Provided earlier signals. Better position control.

This week: Continuing same approach. AVWAP from lows watching. Managing without needing to wait for full PFZ trips.

Systematic approach evolving. Not abandoning mechanical rules. Adding tighter management layer using AVWAP.

Current Status: AVWAP from swing low management continuing, served well last week

In Other News…

93-Year-Old Validates Tech, Markets Celebrate

Buffett buys Google after decade of avoidance. Nvidia earnings Wednesday determines if anyone’s right.

Alphabet surged 5.5% premarket after Berkshire disclosed $4.9B stake—markets treating 93-year-old’s belated tech adoption as bullish signal despite Buffett’s famous timing on technology investments. Nasdaq attempting recovery after last week’s carnage when rotation questioned AI valuations, CoreWeave guidance crashed -16%, and Thursday massacre saw Dow fall 797 points. Nvidia earnings Wednesday represent “true test” with perfection priced in and whisper numbers creating setup for disappointment.

When Oracle of Omaha Becomes Oracle of “Finally”

Buffett’s 17.9M share Alphabet purchase validates tech sector through advanced strategy of buying decade after everyone else discovered search advertising. Markets celebrating validation from investor who famously avoided Microsoft, Amazon, and Google during their growth phases. Nvidia earnings Wednesday with Street expecting $54.8B revenue, $1.25 EPS—Goldman warning whisper numbers create perfection pricing whilst China H20 ban means zero revenue from advanced chips in world’s second-largest economy.

September Data Arrives, October Lost Forever

Thursday brings September jobs report breaking data blackout but October figures “lost forever” creating unprecedented Fed uncertainty. Rate cut odds collapsed from 95% to 47% in one month as Powell’s “not foregone conclusion” combined with 3% sticky inflation. Markets recalibrating expectations whilst government admits permanent data impairment—solving dysfunction by admitting incompetence.

☕ Hazel’s Take

Markets celebrating Buffett’s tech validation despite timing track record whilst Nvidia faces perfection pricing and Fed operates without October data. When 93-year-old buying Google counts as catalyst, probably acknowledging hope replacing analysis.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Big Wick Assessment Leading To Narrow Range Consolidation Flying” whilst analysing Friday’s turnaround pattern repeat and claiming they had mastered “Excitement Fading Recognition Advanced Cooing With AVWAP Management From Swing Low Discipline.”

Hazel updated her crisis management protocols to include “Friday Pattern Repeating But Less Dramatic Bull Reaction Recognition Emergency Procedures” alongside contingency plans for “Very Little Premarket Activity Integration With Big-Wick-Potentially-Completing Analysis And Theta-Collection-During-Narrow-Range Protocols.”

Mac raised his Monday whisky and declared, “When Friday turnaround pattern repeats but excitement fades with quiet premarket suggesting narrow range ahead, sitting-and-waiting-for-theta-decay becomes delightfully superior to chasing faded follow-through!”

Kash attempted livestreaming about “big wick assessment being basically like DeFi consolidation phase identification but with actual candle pattern recognition” but got distracted calculating whether AVWAP-from-swing-low counts as management innovation or just tighter mechanical execution.

Wallie grumbled that in his day, consolidation meant “actual boredom rather than this modern theta-collection-opportunity framing with AVWAP management terminology!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.