Still At Upper Edge Of Larger Range – Same View Different Day Number RUT Pushed

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Groundhog day again. We are still at the upper edge of the larger range on the indexes. Gold is grinding but not yet lost its shine. Oil slid back into its range. VIX is starting to nudge higher along with the index.

What do we do?

Follow the process and bank some profits.

Which is exactly what I did yesterday with a RUT Premium Popper on my mobile – between the pinots and salmon thingies at a charity event. Full debrief here – [LINK]

Oh, and it’s FOMC day. Powell and friends make their presence felt at 2pm. Stay nimble.

Keep scrolling for why the software settings matter more than you think…

Market Briefing:

FOMC day. The Fed announces their rate decision at 2pm ET, followed by economic projections, the statement, and Powell’s press conference at 2:30pm. Markets tend to get twitchy around these events, so stay aware.

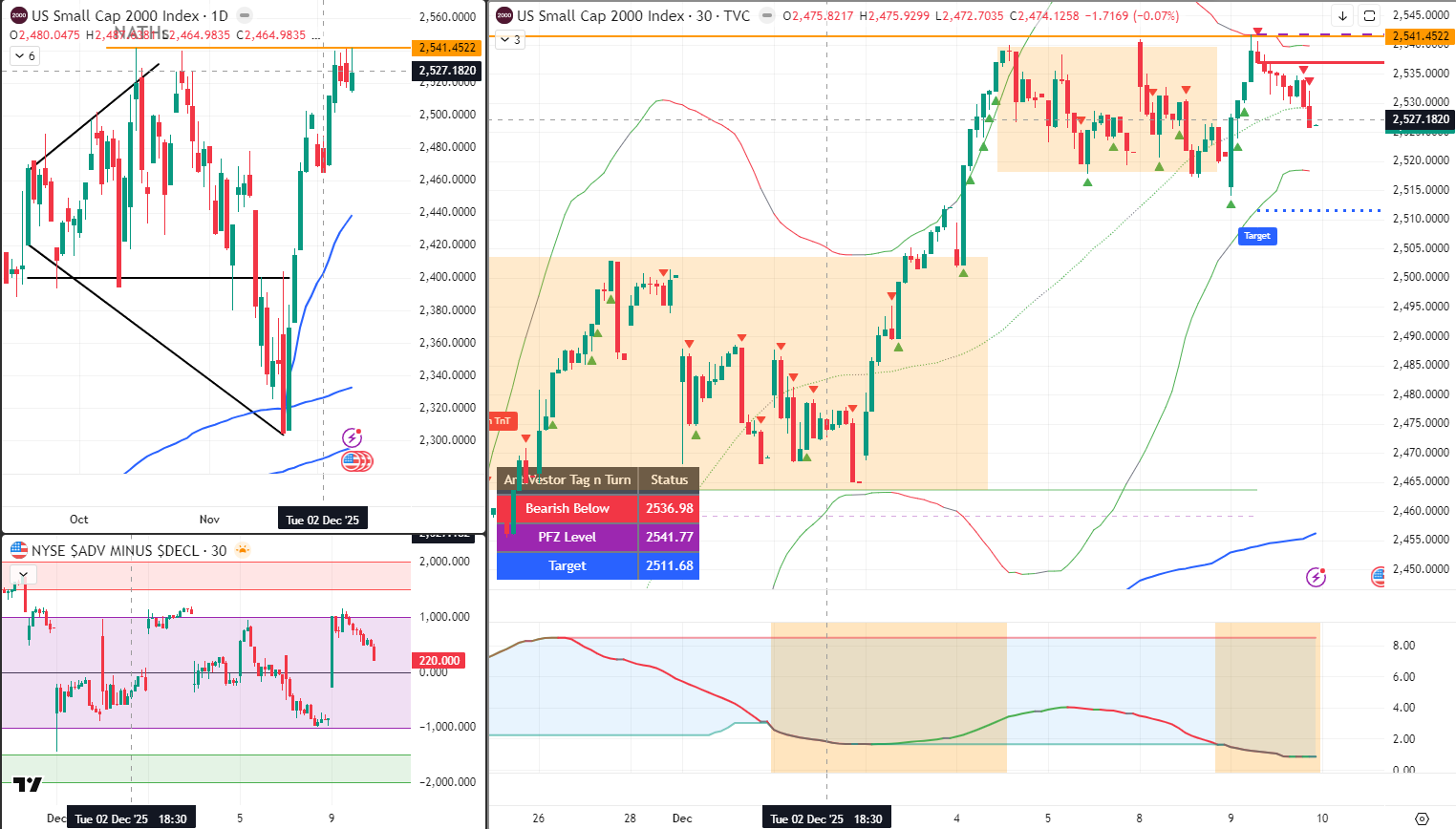

Current Multi-Market Status:

- SPX: Bull TnT active – Bullish Above 6847.97, PFZ 6827.19, Target 6883.96

- RUT: Bear TnT active – Bearish Below 2536.98, PFZ 2541.77, Target 2511.68

- VIX: 17.37 – nudging higher

- GC: 4,219 – grinding but hasn’t lost its shine

- CL: 58.57 – slid back into range

SPX – Software Settings Matter

SPX didn’t get the bear setup in a suitable time window. This is one of the variable settings you can choose in the software settings.

I’ve currently got mine set quite strict. Others have it set more relaxed – which will explain why some are seeing no setup earlier in the week and some are seeing a bear flip to bull setup.

Right now – we are bullish with the flip point below 6830.

The software handles the assessment. No guessing required.

RUT – The Interesting One

RUT pushed to a NATH by a few pennies, tagged the upper Bollinger Band, and turned bearish.

Interestingly, this all happened at the range high which I’ve manually marked off. The target is the range lows.

Key Level: A drop below 2515 and I will consider that a breakout and use the breakout targets manually – just like we did last week on the bullish breakout.

As a reminder – the update hopefully coming in the new year will have this part of the process done for you. Until then, we have 2 minutes of work to do when/if there is a BBW pinch point.

The Streak

And lastly – let’s see if we get some more Poppers at the opening bell.

I’m 7 for 7 this month so far.

Let’s hope I’ve not just jinxed it. Fingers crossed.

Calendar Today – FOMC Day

- 8:30am: Employment Cost Index

- 2:00pm: Federal Funds Rate Decision (Forecast 3.75% vs Previous 4.00%)

- 2:00pm: FOMC Economic Projections

- 2:00pm: FOMC Statement

- 2:30pm: FOMC Press Conference (Powell speaks)

Big day. Stay nimble around the 2pm announcement.

In Other News…

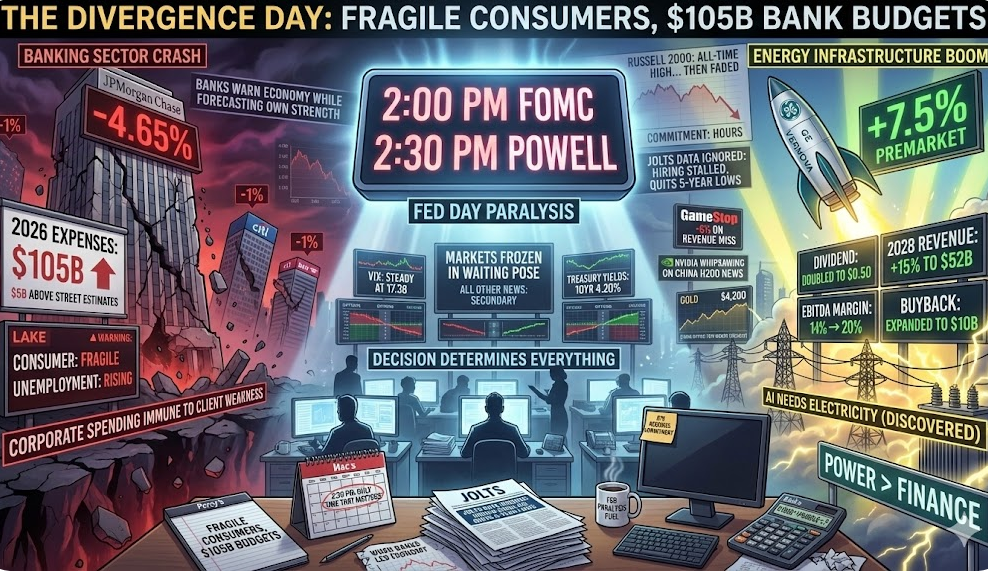

Fed Day Paralyzes Everything Except JPMorgan’s Expense Projections

Bank warns consumers fragile whilst projecting $105B costs. GE Vernova doubles dividend on AI power demand. Markets wait.

Markets froze awaiting 2 PM FOMC decision as JPMorgan crashed 4.65% projecting $105B 2026 expenses $5B above Street whilst simultaneously warning consumers “fragile” and unemployment rising—apparently bank can afford massive spending consumers cannot. GE Vernova surged 7.5% premarket doubling dividend and raising 2028 revenue target 15% to $52B proving AI power infrastructure pays better than financing it. Russell 2000 hit all-time high Tuesday before immediately fading because apparently record highs require commitment.

When Bank Projects $105B Costs Warning Consumers Broke

JPMorgan’s Lake warned 2026 expenses $5B above estimates, consumer “fragile,” unemployment rising—corporate spending immune to consumer weakness bank itself predicting. Triggered financial sector contagion as Citi and BofA fell 1% absorbing message that banking profitable enough for massive expenses whilst clients struggle. Markets processing paradox: banks warning economy weak whilst forecasting own strength.

⚡ GE Vernova Discovers AI Needs Electricity

GE Vernova raised 2028 targets dramatically: revenue +15% to $52B, EBITDA margin from 14% to 20%, doubled quarterly dividend to $0.50, expanded buyback to $10B. Energy infrastructure benefiting from revolutionary discovery that AI data centers require power. While JPMorgan warns consumers fragile, GE Vernova rewarding shareholders because apparently electricity more reliable than finance.

Russell 2000’s Brief Flirtation With Records

Russell 2000 hit all-time high Tuesday before fading—commitment to records lasting approximately hours. Small caps discovered new peaks then immediately reconsidered proving even historic milestones require sustained conviction. JOLTS showed hiring stalled, quits at 5-year lows whilst everyone ignoring for Fed decision at 2 PM.

☕ Hazel’s Take

JPMorgan warns consumers whilst projecting $105B expenses, GE Vernova doubles dividend on AI power, Russell 2000 hits record then fades. When bank forecasting own strength whilst predicting client weakness = strategy, probably acknowledging Fed’s 2:30 presser only number mattering.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Groundhog Day Formation Flying” whilst claiming they had mastered “Repetitive Range Boundary Hovering With FOMC Alert Integration Procedures.”

Hazel updated her crisis management protocols to include “Trading During Federal Reserve Announcement Procedures” alongside emergency plans for “Powell Press Conference Volatility Spike Management Processes.”

Mac raised his Wednesday morning whisky and declared, “When you’re 7 for 7 and FOMC day arrives, the proper response is obviously fingers crossed and another dram for luck!”

Kash attempted livestreaming about “Fed rate decisions being basically like smart contract governance votes but with actual monetary policy instead of imaginary tokenomics affecting real markets” but got distracted calculating jinx probabilities.

Wallie grumbled that in his day, FOMC days meant “proper market panic, not this systematic Premium Popper nonsense with 7 for 7 streaks and salmon thingies!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The Streak Reality: What 7 For 7 Actually Means

Research shows even with a 70% win rate strategy, there’s a 93% chance of hitting 3 consecutive losses at some point – streaks are statistical certainties, not magic!

Here’s the uncomfortable truth about winning streaks that nobody wants to hear: they don’t mean you’re suddenly a genius, and they don’t mean they’ll continue forever!

Research from Edgeful shows that even with a 70% win rate – which is exceptional – you’ve got a 93% chance of experiencing 3 consecutive losses and a 55% chance of hitting 4 in a row at some point.

The “law of large numbers” means winning and losing streaks are completely normal over any meaningful sample size. The biggest mistake traders make? Changing their system after a few losses (thinking it’s “broken”) or getting cocky after a few wins (thinking they’ve found the Holy Grail).

The 7 for 7 streak is lovely, but it’s just statistics doing what statistics do. The process stays the same whether you’re 7 for 7 or 0 for 7 – that’s the entire point of systematic trading. Now fingers crossed I haven’t jinxed it by talking about it!

[Source: Tradeciety – “Why Your Trading Strategy Is Still Good After 10 Losing Trades”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.