Snaps Fingers And Just Like That, The Crash Never Happened.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

…and just like that snaps fingers – crash cancelled.

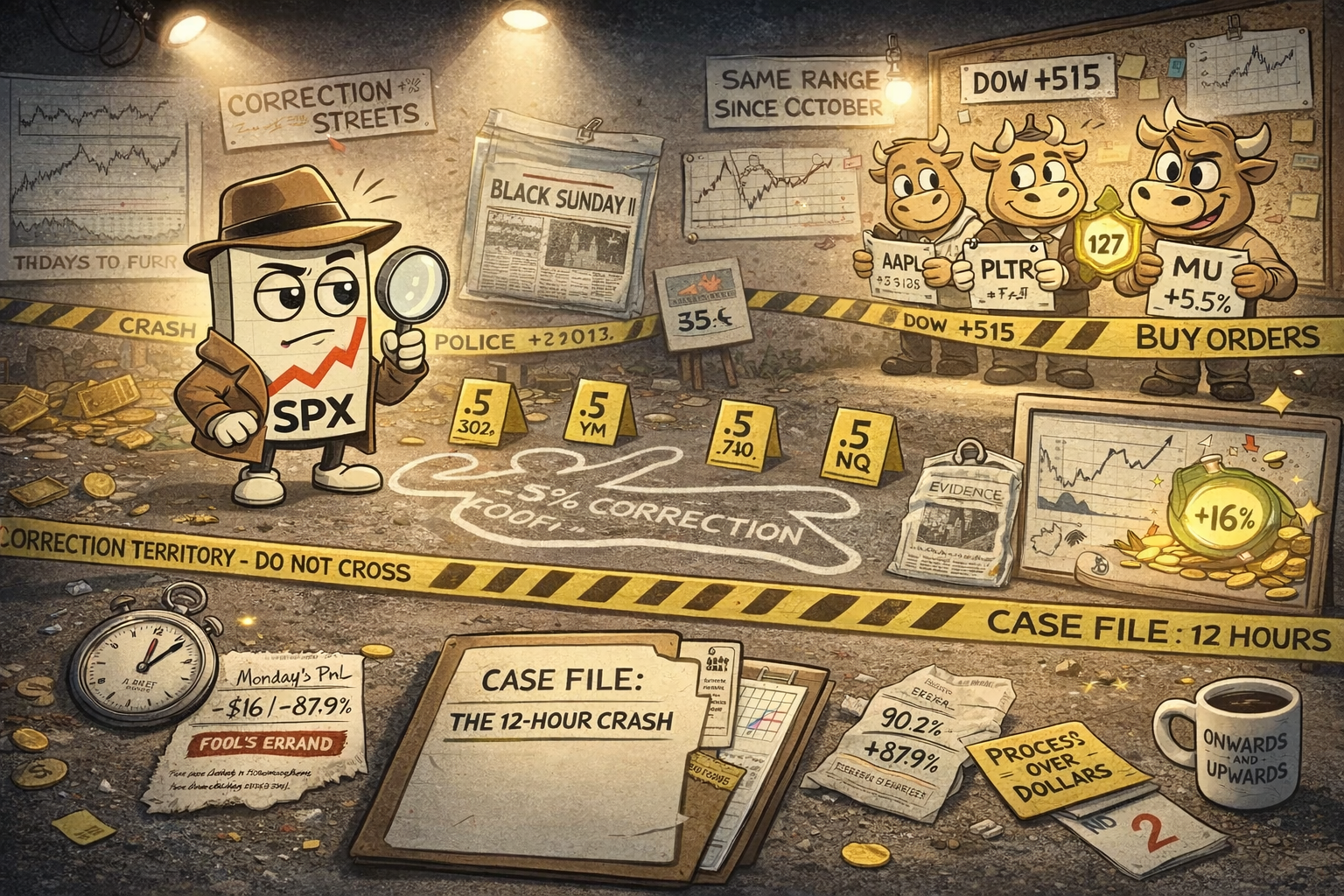

Remember yesterday’s briefing? Blood in the streets? Gold crashing 20%? “Almost Black Monday”?

Well. Futures dropped hard in the Sunday premarket. Recovered before Monday’s open. And then it was poof – as if it had never happened. Rallied hard into the early morning and basically stayed bullish for the rest of the day. Dow surged 515 points. S&P up half a percent. NATHs back in play.

This narrative is grinding my axe. I was telling my Fast Forward insiders that I’ve been keeping an eye on that 5% down from recent highs to potential lows – for most of last year that was the line in the sand considered “correction territory.” The snap charts tell the story: ES -5.01%, YM -5.02%, NQ -5.02%, and RTY? A whopping -10.03%.

Turns out just being a Monday sends the bulls into a frenzy.

I remained bearish – that’s the pattern I see. So I’ll be keeping with that for the SPX and RUT swings. Time is my friend as we bobble around, so no harm, no foul.

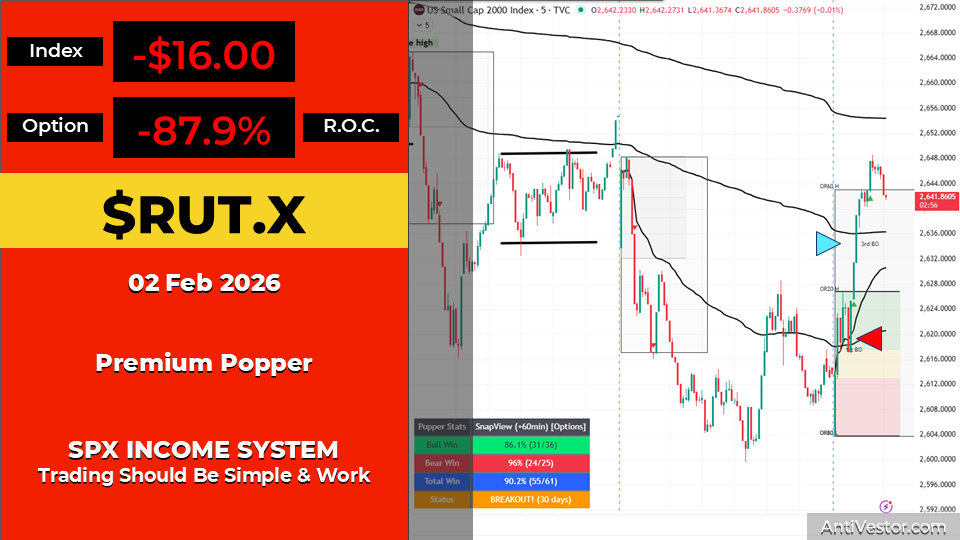

The same bearish bias for the Premium Poppers kicked me in the shins though. Started February with a gong on RUT: -$16 / -87.9% ROC. The 2-day VWAP bias failed me and a straight up ORB20 breakout would have been a winner all day long.

But here’s the thing I was explaining to my insiders: just because I lost money doesn’t make it a losing trade. I followed the same plan as last week. And all of January. And all of December. Worked like gangbusters. Looking at 1 trade in isolation because of the dollars it made or lost is a fool’s errand.

Onwards and upwards for the next setups.

Scroll down for what’s moving, what’s not, and why Palantir just changed the AI conversation…

Market Briefing:

Multi-Market Status

SPX: Bearish at Upper Range. Current 6,976.45 (30min: 6,985). Still targeting Range Lows around 6,840. Price bounced Monday but remains at the upper range boundary. The bearish structure hasn’t changed – we’re just bobbling around up here. Time is on our side.

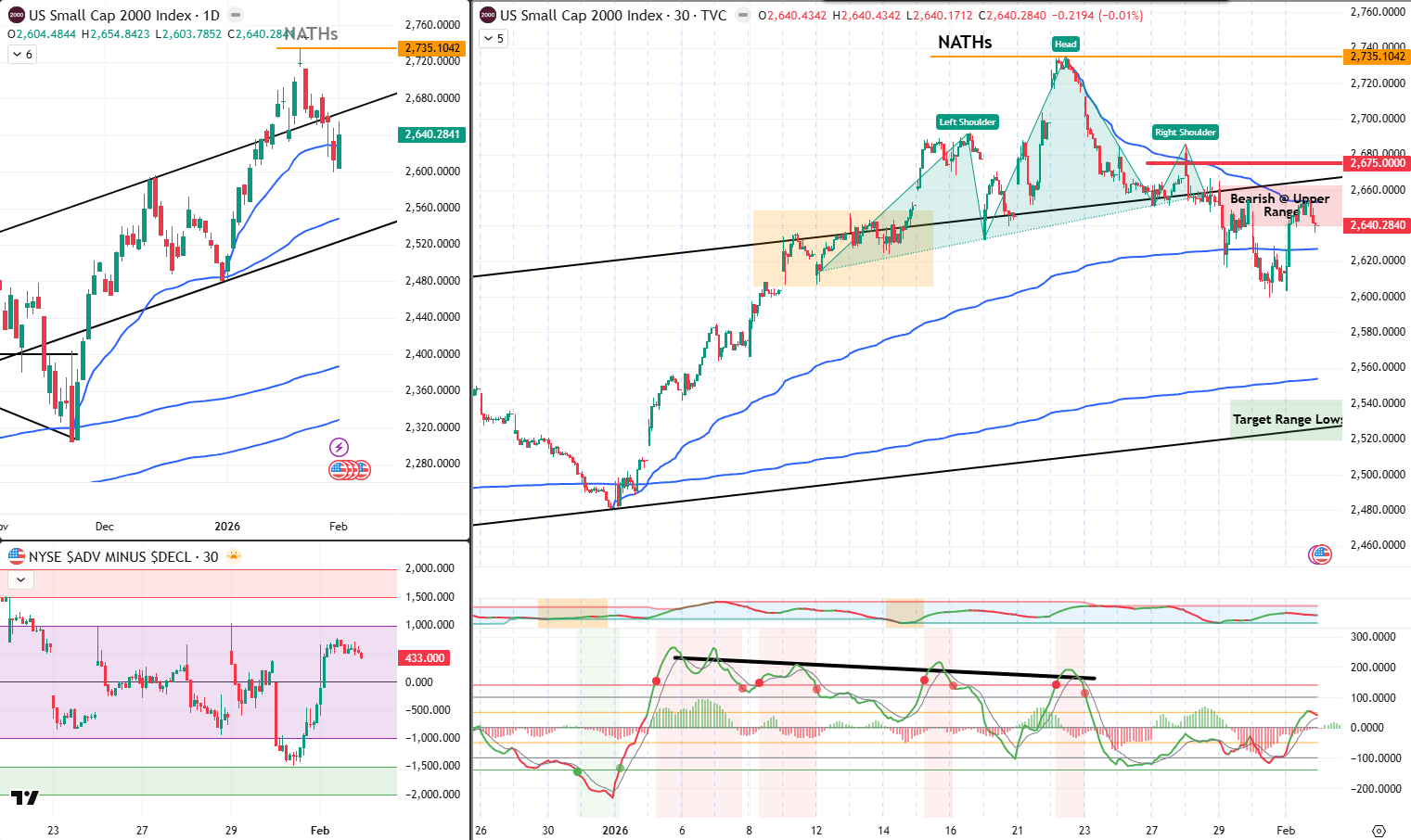

RUT: Bearish at Upper Range. Current 2,640.28. Target Range Lows around 2,520. The head and shoulders remains clearly visible – left shoulder, head at NATH (2,735), right shoulder complete. Price bounced to 2,653 on futures but the pattern is intact. Still bearish, still patient.

ES Futures: 7,002.75 – back above 7,000 after Monday’s bounce. The -5.01% high-to-low measurement tells the story of the range.

NQ Futures: 25,972.25 – tech rallying on Palantir momentum. -5.02% high-to-low.

YM Futures: 49,520 – surged after Monday’s 515-point rally. -5.02% measured move.

RTY Futures: 2,653.7 – small caps bounced hard but the -10.03% decline from highs dwarfs everything else.

Gold: $4,941.1 – bounced 6% from crash lows. Silver +10%. Deutsche Bank says positioning not fundamental. JPMorgan maintains $6,000 target.

VIX: 16.17 – dropped 7% Monday. Fear evaporating. Classic V-shaped volatility crush.

Bitcoin: $78,305 – stabilised after crashing to $74,876 weekend low. ETF inflows snapped back $562M Monday.

The “Correction” That Wasn’t

I’ve been marking off the 5% levels from recent highs on the snap charts – those light blue arrows you can see. Why? Because for most of last year, 5% down was the line in the sand. The level where “pullback” becomes “correction” and the headlines start screaming about bear markets.

Here’s where those 5% levels sit:

- ES: -352.75 points (-5.01%) from highs

- YM: -2,504 points (-5.02%) from highs

- NQ: -1,322.25 points (-5.02%) from highs

- RTY: -275.8 points (-10.03%) from highs

The thing is – we never even got there.

Price dropped hard on Sunday. Looked ugly. Felt ugly. But it turned around before reaching those levels and bounced back like nothing happened. Didn’t even need to touch “correction territory” before the bulls came charging in.

RTY’s measurement is the interesting one. At -10.03% from NATH to the 5% marker, small caps have the longest way to fall – and they’re already leading the decline thanks to the H&S breakdown. That’s the instrument to watch if this ever does become a real correction.

The lesson: The market didn’t even need to reach the levels I was watching before bouncing. That tells you everything about the buy-the-dip muscle memory in this market. Every dip is being bought faster and more aggressively. Crashes are getting shorter before they even become crashes.

Monday’s Popper: The Gong

Let’s be transparent about Monday.

RUT Premium Popper: -$16 / -87.9% ROC ❌

The bearish VWAP bias from the 2-day filter pointed lower. Made sense given Sunday’s carnage. But the market had other ideas. Rallied straight out of the gate. A straight ORB20 breakout would have been a winner all day long.

But here’s what I told my Fast Forward group:

Losing money doesn’t make it a losing trade. That sounds counterintuitive, so let me explain.

I followed the exact same process on Monday as I did last week. The same process that delivered 16 wins from 17 trades. The same process that worked all through January and December.

The 2-day VWAP filter said bear. I went bear. Price went bull. That’s a single data point in a system with a 90.2% total win rate (55/61 on the 30-day stats).

Looking at 1 trade in isolation because of the dollars it made or lost? That’s a fool’s errand.

The system is the system. Some days it gives. Some days it takes. The edge is in the aggregate, not the individual trade.

Popper Stats (30-day rolling):

- Bull Win: 86.1% (31/36)

- Bear Win: 96% (24/25)

- Total Win: 90.2% (55/61)

Those numbers don’t lie. One gong doesn’t erase them.

Palantir’s 127 Changes Everything

Now let’s talk about the number everyone’s discussing.

Palantir reported after Monday’s close and absolutely blew the doors off:

The Numbers:

- Q4 Revenue: $1.41B (+70% YoY) – crushed estimates

- EPS: $0.25 vs $0.23 expected

- FY2026 Guidance: $7.19B vs $6.22B consensus – a 15% beat on forward revenue

- U.S. Commercial Revenue: +137%

- Rule of 40: 127%

Why 127 Matters:

The “Rule of 40” is a SaaS metric – your revenue growth rate plus profit margin should exceed 40%. It’s the benchmark for healthy tech companies. Most struggle to stay above 40. Elite companies hit 60-70.

Palantir just hit 127. That’s not just good. That’s unprecedented for a company of this size.

Stock jumped 12% premarket. And the broader message? AI spending is untouchable. Companies aren’t pulling back – they’re doubling down.

The Bigger Picture

Monday was a day of whiplash:

The Rally: Dow +515 (+1.05%), S&P +0.54%, Nasdaq +0.56%. Tech reclaimed leadership. Apple +4.1%, Micron +5.5%, AMD +4%, SanDisk +15.4%.

The Crash Recovery: Gold bounced 6% to $4,938. Silver +10%. Bitcoin stabilised at $78,477 after hitting $74,876.

The India Deal: Trump slashed tariffs to 18% from 50%. Modi halts Russian oil purchases. $500B in U.S. goods pledged. Indian stocks surged.

The Shutdown: Day 4. House vote expected today. Johnson has 218-214, can lose one vote.

The Mega-Merger: SpaceX-xAI at $1.25 trillion would be the largest M&A deal in history. Musk consolidating his AI empire.

Tonight’s Earnings: AMD, Pfizer, PepsiCo, PayPal, Chipotle. Alphabet Wednesday. Amazon Thursday.

And NFP? Postponed indefinitely due to the shutdown. Flying blind on jobs data.

Expert Insights

The “V-Shaped Recovery” Problem

Monday’s instant bounce from Sunday’s crash reveals something important about modern markets: corrections are getting shorter.

In 2020, the COVID crash took 33 days to reach the bottom. In 2022, the bear market lasted months. In 2025, the August AI selloff took about 3 weeks to resolve.

Sunday’s “crash”? Resolved in hours. Futures touched -5% territory and immediately bounced.

This creates a problem for bears (including us). The market’s muscle memory is conditioned to buy dips aggressively. Every dip since October 2022 has been a buying opportunity. Every crash has been a V-shaped recovery.

For our bear swings, this means patience. The range is still the range. Upper boundary to lower boundary. But the bounces within that range are getting faster and more aggressive. Time decay remains our friend. The swings will work – we just need to let them breathe.

In Other News…

Healthcare Insurers Lose $50B After Government Offers 0.09% Instead of 4-6%

CMS delivers pay rise equivalent to finding 9p in the sofa cushions.

Wall Street discovered Tuesday that government maths and Street expectations inhabit entirely different realities. CMS proposed a 0.09% Medicare Advantage payment increase for 2027—the market expected 4-6%. The resulting healthcare massacre erased $50 billion before breakfast whilst gold quietly crossed $5,102.

The 0.09% Catastrophe

UnitedHealth crashed 8.5%, Humana plunged 12%, CVS dropped 9.5%—all because someone in Washington decided “near-zero” counted as a pay increase. Street analysts expecting 4-6% growth now face the awkward task of explaining how they missed by roughly 5,900%. Rising utilisation and coding restrictions apparently weren’t priced in.

Gold’s Quiet Victory Lap

Record $5,102 whilst everything burns. When precious metals rally during Fed meetings, tariff escalations, and 70%+ shutdown odds, the message isn’t subtle. Small caps outperforming the S&P by 7 percentage points suggests investors prefer companies too small for Washington to notice.

✈️ The Earnings Confessional

Boeing reports expecting -$0.37 EPS because nothing says “recovery” like negative earnings. GM and American Airlines join the confessional today. Three-quarters of companies beating estimates so far, though “beating lowered expectations” remains the participation trophy of corporate achievement.

☕ Hazel’s Take

When the government’s idea of support is 0.09% and gold’s response is record highs, probably worth noting who’s reading the room correctly. Fed decides Wednesday; shutdown odds above 70%. At least someone’s buying something—it’s just all shiny and doesn’t require congressional approval.

—Hazel, FinNuts

Rumour Has It…

The Financial Nuts Newsroom has emotional whiplash…

Percy looks confused. “Wasn’t everything crashing yesterday? I distinctly remember blood in the streets. Seven trillion wiped out. Black Sunday II.” He checks his calendar. “That was literally yesterday.”

Hazel snaps her fingers. “And just like that – crash cancelled. Dow up five hundred. Gold bouncing. Bitcoin stabilising. It’s like Sunday never happened.”

Mac is nursing his glass from yesterday. “I’ve seen some fast reversals in my time. But Sunday to Monday? That’s a new record.” He pauses. “The bulls didn’t even wait for the opening bell.”

Kash shrugs at his Popper loss. “Gong. Bear bias. Market went bull. It happens. Same process as last week. Same process that delivered sixteen wins.” He pulls up the 30-day stats. “Ninety point two percent. One loss doesn’t change that.”

Wallie hasn’t moved. “H&S still intact on RUT. Bear swing still working. SPX still at upper range. Everyone’s celebrating but we’re exactly where we were – at resistance.” He underlines “TARGET RANGE LOWS” on his whiteboard. “Patience.”

The team nods. Yesterday was chaos. Today is process. Tomorrow might be chaos again. The system doesn’t care.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Palantir’s Rule of 40 at 127 – What That Actually Means

The “Rule of 40” is tech’s most important health metric: add your revenue growth rate to your profit margin. If the total exceeds 40, you’re a healthy tech company.

For context on how remarkable 127 is:

Most publicly traded SaaS companies average around 20-30. The median S&P 500 tech company sits around 35-45. Companies like Salesforce, considered elite operators, typically score 50-60.

Palantir at 127 means their revenue is growing so fast AND their margins are so high that they’re essentially operating at triple the benchmark. Revenue growing 70% year-over-year whilst maintaining substantial profitability.

The only comparable historical moments: early Zoom during COVID (Rule of 40 briefly exceeded 100) and early Snowflake (touched 90+). Neither sustained those levels.

Whether Palantir can maintain 127 is another question entirely. But for one quarter, they produced a number that redefines what’s possible in enterprise AI.

Meme of the Day:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.