We Just Entered January’s Weakest Stretch – Trading Days 7-13

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

With the first full week of the new year under our belt, a Venezuelan bid for freedom, and now eyes once again pointing to Greenland… NFP was such a flop that people questioned if it were even released. What about those pesky Epstein files?

And then Sunday night happened.

The Justice Department served the Federal Reserve with grand jury subpoenas on Friday. Criminal indictment threatened against Fed Chair Powell. The pretext? His June testimony about a $2.5 billion headquarters renovation.

Powell released a video statement Sunday evening. His words: “This unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure.”

He added: “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Fed independence is under attack. Gold’s hitting new all-time highs. VIX jumped. Markets are reacting.

Whatever happens – gonna be interesting.

[Source: Federal Reserve Statement, Bloomberg, NBC News]

Gold screams. Bears wake. Seasonal weakness arrives on schedule. Scroll down.

When the world goes mad, systematic traders still execute.

Market Briefing:

Monday brings the kind of news that makes you wonder if you’re watching a late night comedy sketch. Except it’s real. And markets are reacting.

Current Multi-Market Status:

- ES: 6,962.25 – selling off NATHs (7,014)

- YM: 49,379 – selling off NATHs (49,876)

- NQ: 25,718.75 – weakest, lagging

- RTY: 2,628.5 – selling off NATHs (2,650)

- GC: 4,594.8 – NEW ATH, flight to safety

- CL: 58.57 – bouncing around

- VIX: 16.33 – jumped sharply overnight

SPX – Bear TnT Triggered

SPX tipped over literally at the final bell on Friday. New Bear Tag n Turn active.

| TnT Status | Level |

|---|---|

| Bearish Below | 6965.68 |

| PFZ Level | 6978.36 |

| Target | 6904.3 |

| Current | ~6,966 |

I spent some time adding and removing trend lines on the daily charts. Whilst it’s very rough around the edges and more about being the line of best fit, there’s an ample touch-point trend line to be seen – which we’re now reacting off. You can see it clearly on the usual 30-min charts.

Assuming this range holds, we can presume that the previous expanding triangle pattern has evolved and mutated a little. That gives a target down towards 6800.

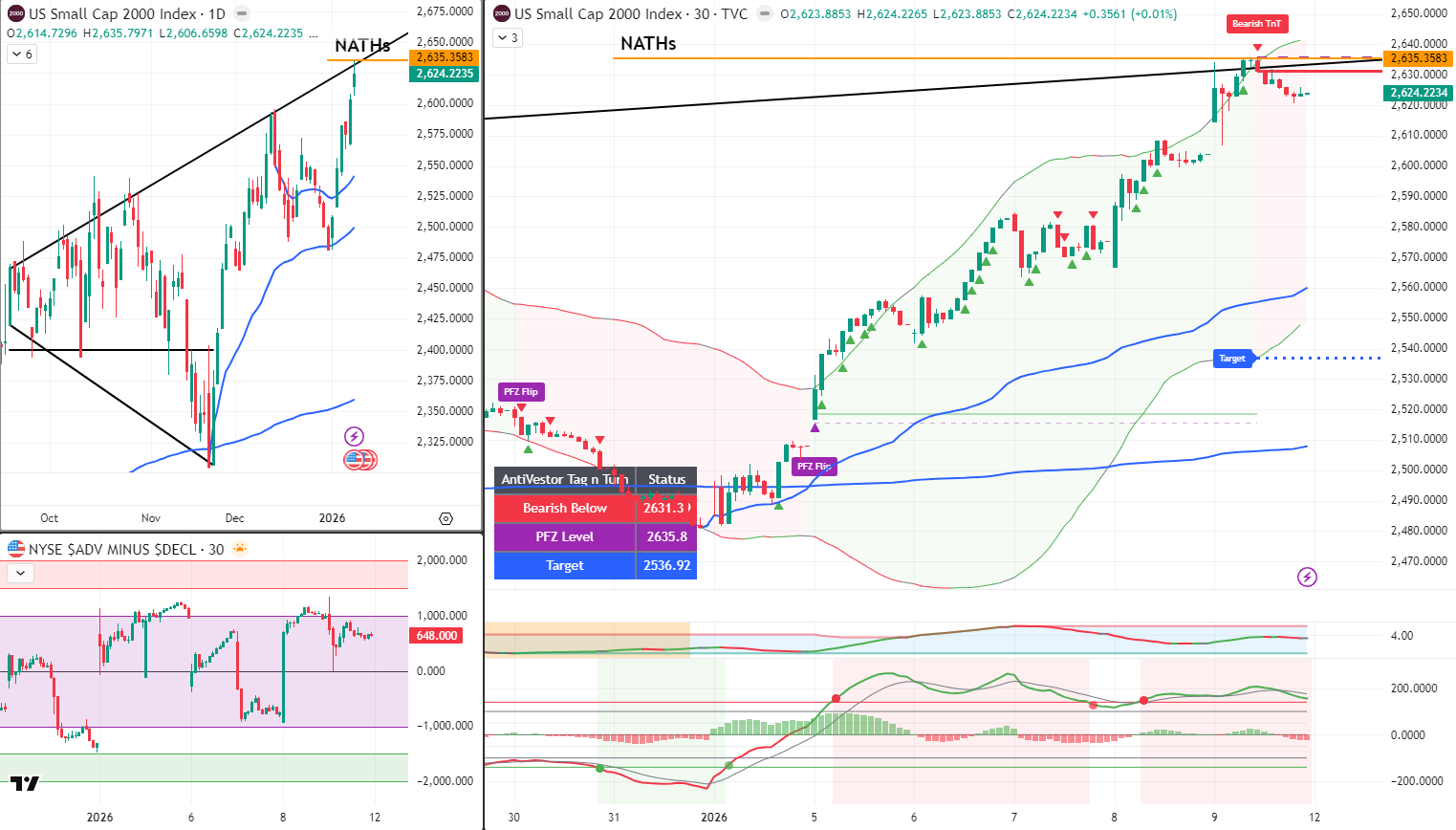

RUT – Already Turned Lower

Uncle Russell has already turned lower on a Tag n Turn. Similar patterns can be seen.

| TnT Status | Level |

|---|---|

| Bearish Below | 2631.31 |

| PFZ Level | 2635.8 |

| Target | 2536.92 |

| Current | ~2,624 |

A larger target could be down to 2500 for the same reasons mentioned for SPX.

It’s been a while where the moves have been in lockstep. Let’s see how long this continues.

Gold – Flight to Safety

Gold has leapt to new all-time highs at 4,594.8. When the DOJ subpoenas the Fed Chair and threatens criminal indictment, yes – gold moves. VIX has also jumped sharply compared to the overnight futures moves. 16.33 and climbing.

The safe havens are waking up.

The Week Ahead

| Day | Event | Time (ET) |

|---|---|---|

| Mon 12 | Markets digest Powell/DOJ news | All day |

| Tue 13 | CPI (December) | 8:30am |

| Tue 13 | Bank earnings begin | Various |

| Wed 14 | PPI | 8:30am |

| Thu 15 | Retail Sales, Claims | 8:30am |

| Fri 16 | Housing Starts | 8:30am |

CPI Tuesday forecast: 0.3% MoM, 2.7% YoY (headline). Core: 0.3% MoM, 2.7% YoY.

[Source: BLS, Bloomberg]

As usual, just waiting for the open to take action and see what Poppers develop for a little scalping love at the open.

Expert Insights:

The Federal Reserve is designed to be independent from political pressure so policymakers can make sometimes unpopular decisions – like raising interest rates to keep inflation in check.

Powell’s term as chairman expires in May. Trump has been outspoken about wanting lower rates. The administration has also tried to remove another Fed board member, Lisa Cook.

Senator Thom Tillis (R-NC) responded: “If there were any remaining doubt whether advisers within the Trump Administration are actively pushing to end the independence of the Federal Reserve, there should now be none.”

Markets don’t like uncertainty about monetary policy independence. Hence gold’s move. Hence the VIX jump.

[Source: Federal Reserve Statement, NPR, NBC News]

In Other News…

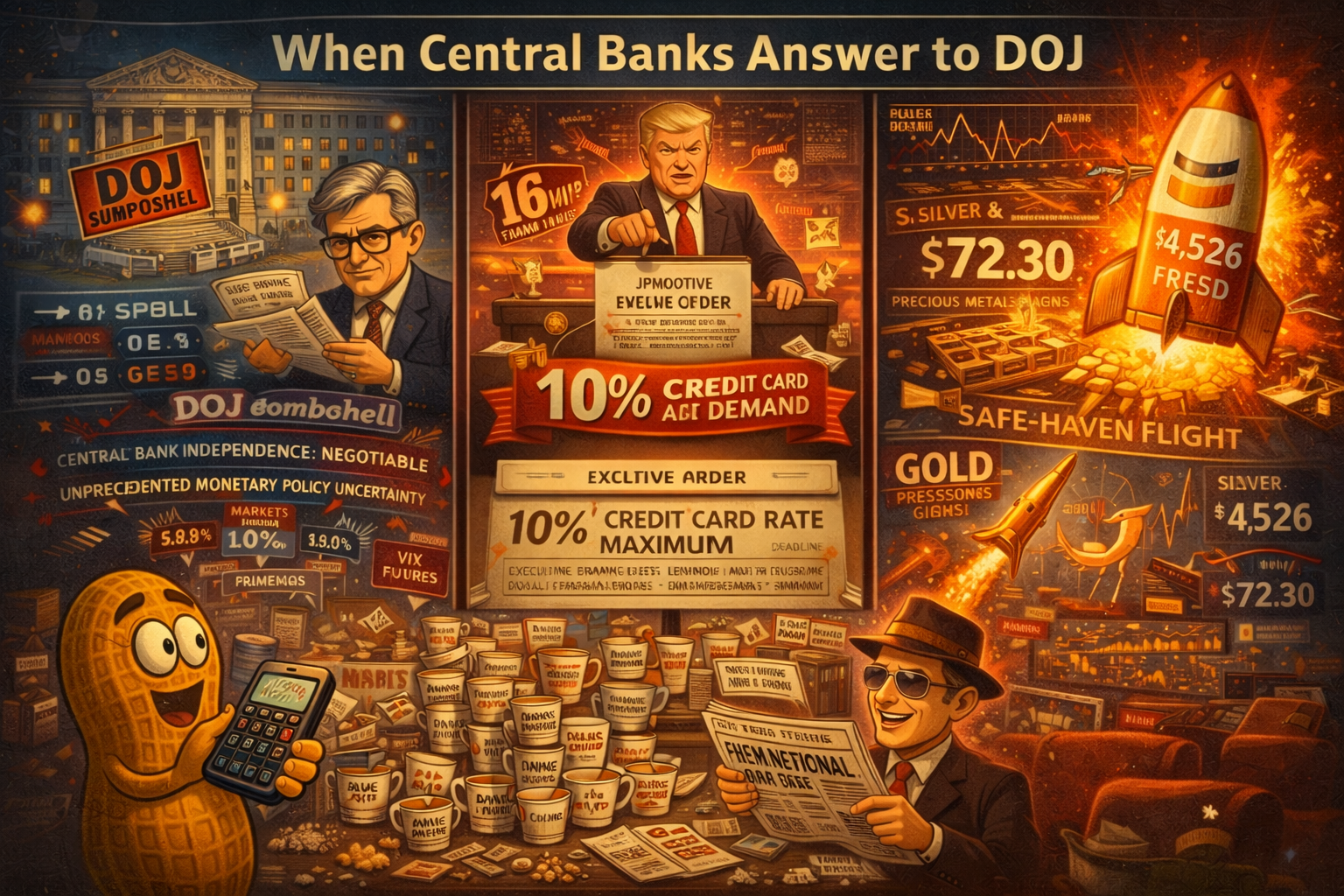

DOJ Subpoenas Fed Chair: Markets Discover Independence Optional

Powell probe rattles institutions. Trump demands 10% credit cards. Gold hits record $4,526. Defence stocks whipsaw on threats.

Futures tumbled as weekend’s DOJ subpoena revelation against Powell created unprecedented monetary policy uncertainty—markets discovering central bank independence apparently negotiable concept. S&P -0.8%, Nasdaq -1.1% processing bombshell whilst gold hit fresh record $4,526 and silver $72.30 proving safe-haven flows dominate when institutions questioned. Trump’s 10% credit card rate demand with January 20 deadline adds pressure on financials already facing Powell probe uncertainty because apparently executive branch now sets consumer lending rates.

Bank Earnings Face “Dual Pressure” (Understatement)

JPMorgan reports Tuesday before CPI data whilst navigating Trump’s 10% credit card ultimatum and Fed chair investigation—dual pressure being financial euphemism for “unprecedented institutional chaos.” Wells Fargo, Citi Wednesday, Goldman and Morgan Stanley Thursday all face questions about net interest margins, loan provisions, consumer credit whilst pretending monetary policy framework intact. Watch CEOs carefully avoid mentioning DOJ probe during earnings calls.

Defence Stocks: Thursday Threat, Friday Promise

Defence sector plunged 5% Thursday when Trump threatened dividend/buyback blocks then rallied Friday on $1.5T spending pledge—24-hour whipsaw proving presidential announcements create algorithmic trading opportunities. Markets treating defence as coin flip based on daily pronouncements rather than analysing actual procurement budgets or geopolitical realities.

Rate Uncertainty “Clouds Valuation Models”

Tech vulnerable as rate uncertainty clouds valuation models—analyst-speak for “how do we discount cash flows when Fed independence questioned.” Bond market pricing limited January cut odds, roughly even for March proving markets simultaneously expecting cuts whilst acknowledging political pressure removes certainty. CPI Tuesday crucial with +0.3% MoM expected but any surprise irrelevant if policy framework compromised.

☕ Hazel’s Take

DOJ subpoenas Powell, Trump demands 10% cards, defence whipsaws, gold records. When central bank independence becomes negotiable and executive branch sets lending rates, probably acknowledging Tuesday’s bank earnings and CPI data matter less than institutional framework survival.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: The team arrived Monday morning to absolute chaos. Every screen showed the same thing. Powell. DOJ. Subpoenas.

Mac looked up from his newspaper. “So the administration is threatening to criminally indict the Fed Chair over a building renovation.”

“That’s the pretext,” Hazel corrected, already six coffees in. “Powell’s statement was pretty clear about what it’s actually about. Interest rates.”

Percy was watching gold. “New all-time highs. 4,594. Flight to safety, they’re calling it.”

“Flight to sanity,” Mac muttered.

Wallie pointed at the TnT indicators. “Both indexes bearish. SPX flipped at Friday’s close. RUT already turned. Targets lower.”

Kash attempted to explain the constitutional implications of Fed independence but got distracted when his calculator displayed “?!?!” for the third time.

“The system doesn’t care about constitutional crises,” Wallie reminded everyone. “Bear TnT triggered. Target 6904. Poppers at the open. Same as always.”

Percy nodded solemnly. “PopPop?”

Everyone stared at him.

“Maybe save it for after we see if democracy survives the week, Percy.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

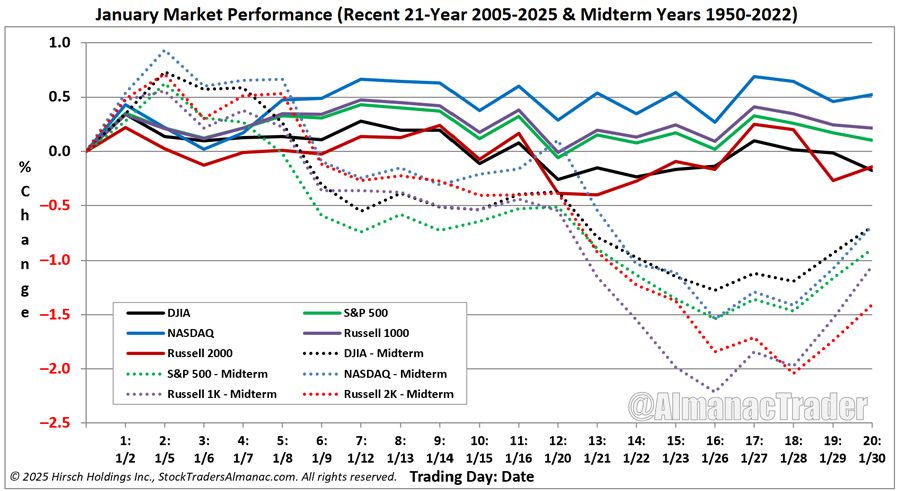

Fun Fact: January’s Weakest Stretch: Trading Days 7-13

We just entered it. Jeffrey Hirsch from Stock Trader’s Almanac flagged the pattern last week – January opens strong then fades, with the weakest stretch historically running from around the seventh trading day through the twelfth or thirteenth.

Here’s the thing about seasonal patterns – they don’t care about your feelings OR about DOJ subpoenas!

Jeffrey Hirsch, the man who literally wrote the book on market seasonality (Stock Trader’s Almanac, look it up), dropped this chart showing 21 years of January data.

The pattern? January starts strong with all major indexes – DJIA, S&P 500, NASDAQ, Russell 1000 and 2000 – logging gains through around mid-month. Then weakness creeps in with sideways and choppy trading through month end. The weakest stretch? Trading days 7 through 13. Today is trading day 7.

We’re literally entering the danger zone right as the DOJ decides to subpoena the Fed Chair. Coincidence? Probably. But seasonal patterns plus political chaos plus Bear TnT triggers equals the kind of confluence that makes systematic traders pay attention.

The chart shows solid lines for recent 21-year performance (2005-2025) and dotted lines for midterm years (1950-2022) – and both show the same mid-month weakness pattern. Sometimes the market just does what it does, regardless of headlines. And right now, what it does is weaken mid-January. Bears armed with seasonal data AND TnT triggers AND flight to safety in gold?

That’s not prediction – that’s pattern recognition meeting systematic execution!

[Source: Stock Trader’s Almanac – Jeffrey Hirsch, Hirsch Holdings Inc.]

Meme of the Day:

“When the DOJ subpoenas the Fed Chair but your Bear TnT triggered Friday and you were already positioned”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.