Business Mindset vs New Trader Psychology: The Apple Tree Reality

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Playing a little catch-up with post-trade debriefings today as I’ve been mostly elbows deep in code, updating the SPX Income System’s algo suite.

Sometimes the best trading happens when you’re not watching every tick – systematic approaches work whether you’re coding improvements or watching charts.

Since my last update, we’ve had mixed results but thankfully ended net profitable by week’s end. That’s exactly what positive expectancy trading looks like in real life – not every trade wins, but the system delivers over time.

Here’s the brutal honesty of systematic trading: some weeks test your discipline more than your market analysis. This week was one of those character builders that separate systematic traders from emotional reactors.

Keep scrolling for the trade-by-trade breakdown and business reality check…

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX Trade Debrief:

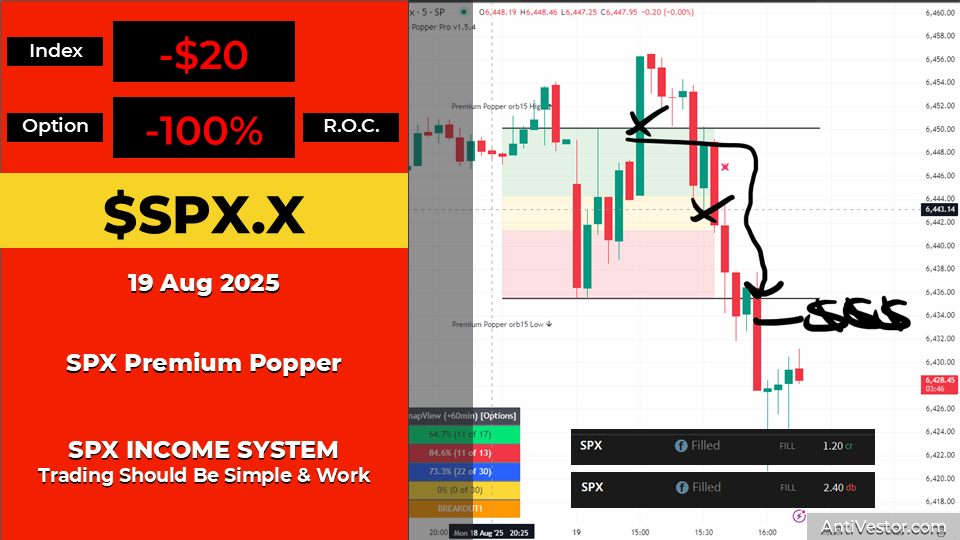

19th August – The Mixed Tuesday:

- Premium Popper: -100% loss (of credit received) – full stop out

- Lazy Popper: 100% ROC – perfect expiration at max profit

- Daily Result: Net positive despite Premium Popper setback

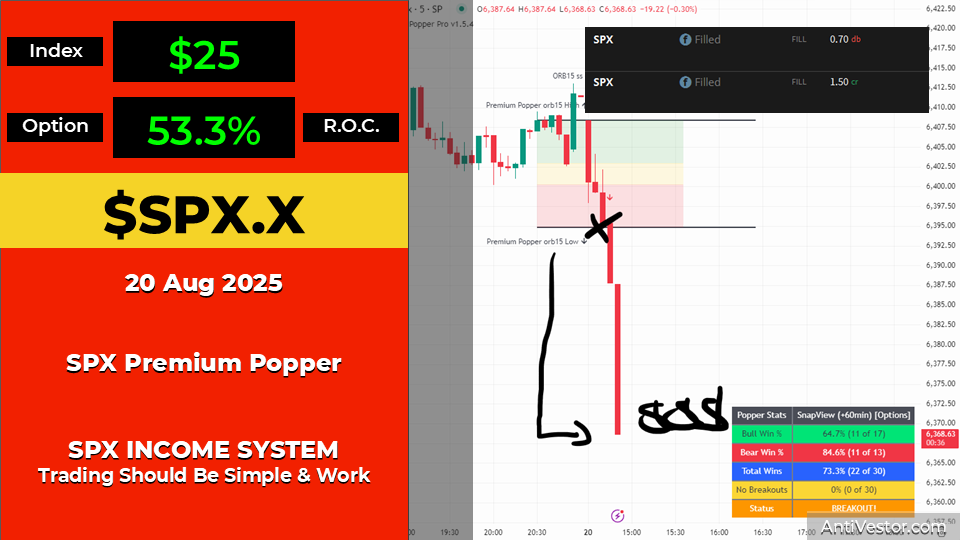

20th August – Strike Selection Reality Check:

- Lazy Popper: -66% loss (not quite max loss)

- Premium Popper: -53.3% ROC

- The Lesson: Many students reported wins on the Lazy Popper while I took a loss – all down to strike selection preferences. Literally one strike separation created the difference between profit and loss. My preference for more aggressive positioning bit me this time.

- Daily Result: Red ink day with valuable lessons

21st August – Speed Kills Theta:

- Premium Popper: -100% loss (of credit received)

- Tag ‘n Turn Exit: 33.3% ROC

- The Reality: This swing trade moved exceptionally fast to a small range target, so we didn’t get to see theta decay pull in lazy profits. Speed proves the system works but limits premium collection.

- Daily Result: Small positive from systematic discipline

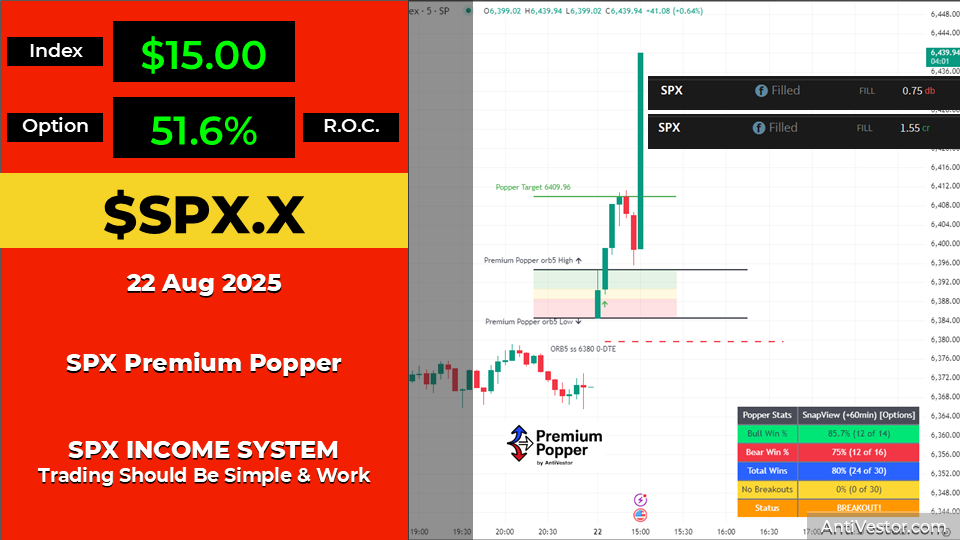

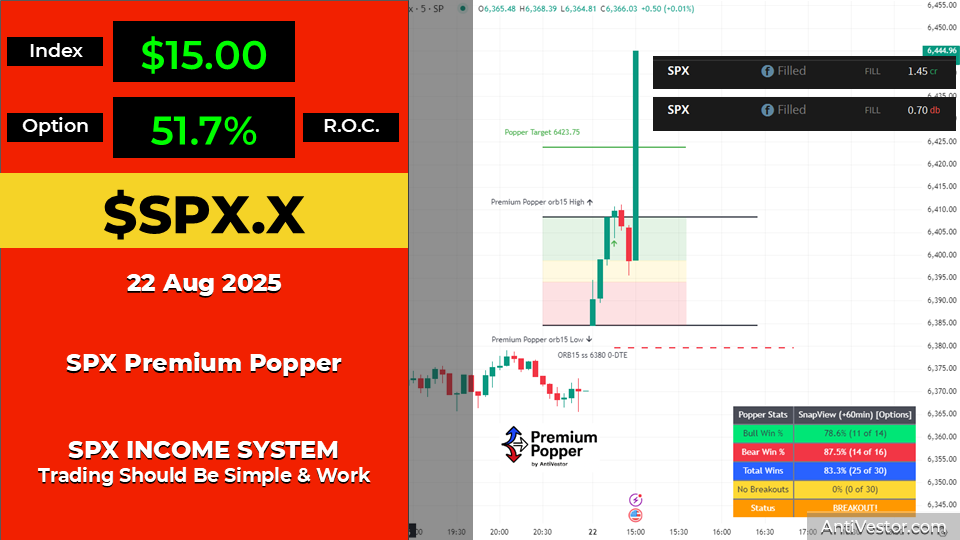

22nd August – Jackson’s Hole Jackpot:

- Tag ‘n Turn: 71.3% ROC bull swing popped dramatically higher on Jackson’s Hole news

- Premium Popper ORB5: 51.6% ROC

- Premium Popper ORB15: 51.7% ROC

- The Victory: When external drama meets systematic setups, beautiful things happen

- Daily Result: Strong finish validates the systematic approach

The Business Reality Check:

Overall, this was a mixed week with an eventual profitable end. Sometimes you’ll get weeks like this, and the hard part with any trading method is riding through mixed results or 1-2 losses.

Most new traders’ confidence drops out the apple tree and hits every branch on the way down to end up battered and bruised.

The reality? This is part of the game we play.

I am not smarter than the system – the research says quite definitively that I have to survive to place the next trade, and the next, and the one after that.

Compare the same attitude if you had a regular bricks and mortar business:

You have a week where you get more customers coming in asking for refunds on items you can’t resell, or theft of items you have to write off.

The new trader mindset would close the business and try something new because;

“this is clearly a scam and doesn’t work.”

Whereas a logical, sensible mindset realizes the week is a mess – likely showing a net loss for the day, possibly the week. But your month or quarter is showing record profits because you stayed open for business, followed your business plan, and didn’t get scared because you had to issue a refund.

Makes you think, doesn’t it?

Expert Insights:

Strike selection consistency matters more than individual trade optimization. Aggressive positioning can create different outcomes from the same systematic setup – discipline means accepting both the enhanced returns and occasional enhanced losses.

Systematic trading success requires surviving individual setbacks to capture long-term positive expectancy. The research is clear: traders who quit after short-term losses miss the profitable cycles that make the approach work.

Speed in directional moves validates systematic signals but limits theta collection opportunities. Fast winners prove the system works; slow grinders provide better premium harvesting.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Hazel was spotted updating her “Mixed Week Management Protocols” while simultaneously celebrating the net profitable outcome with a tactical coffee mug refill.

“Some weeks test your systematic resolve,” she announced to the newsroom while reviewing the strike selection lesson reports. “But profitable finishes after mixed results prove the business plan works better than emotional reactions.”

Percy immediately claimed credit for the Jackson’s Hole rally through his “enhanced Federal Reserve pigeon communication network,” while Mac raised his whisky glass declaring, “My dear chaps, mixed weeks separate the systematic traders from the panic merchants!”

Kash tried to explain how mixed trading weeks were “basically like DeFi farming with actual business cycle management,” while Wallie nodded approvingly at the business mindset comparison, muttering, “Finally, someone understands that trading is business, not gambling.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.